10 Glimpses Into What Middle-Class Life Looked Like Without Credit Scores

This is a peek into how everyday families managed money, housing, and trust before credit scores took over.

- Daisy Montero

- 3 min read

Before credit scores became the gatekeepers of financial life, middle-class families had a very different way of managing money. This listicle dives into the habits, hurdles, and workarounds people used to build lives, buy things, and earn trust. Some methods were surprisingly practical, while others feel downright foreign today.

1. Bankers Knew Your Face, Not Your Score

Alena Darmel on Pexels

Alena Darmel on Pexels

Getting a loan meant walking into your local bank where the teller knew your parents and probably your high school GPA. Personal trust and long-standing relationships carried more weight than paperwork. Your handshake often mattered more than a credit report.

2. Your Reputation Traveled Faster Than Your Wallet

PICHA on Pexels

PICHA on Pexels

In smaller communities, word got around if you were late on payments or dodged your debts. A bad reputation could keep you from buying on credit at local shops. Your character often acted as your unofficial credit report.

3. Store Credit Was Personal and Hand Written

Kenneth Surillo on Pexels

Kenneth Surillo on Pexels

General stores often let regulars take home groceries or supplies on credit, recording balances in a little notebook. This was a mutual understanding built on years of doing business. There were no interest rates, just expectations.

4. Layaway Was the Middle-Class Installment Plan

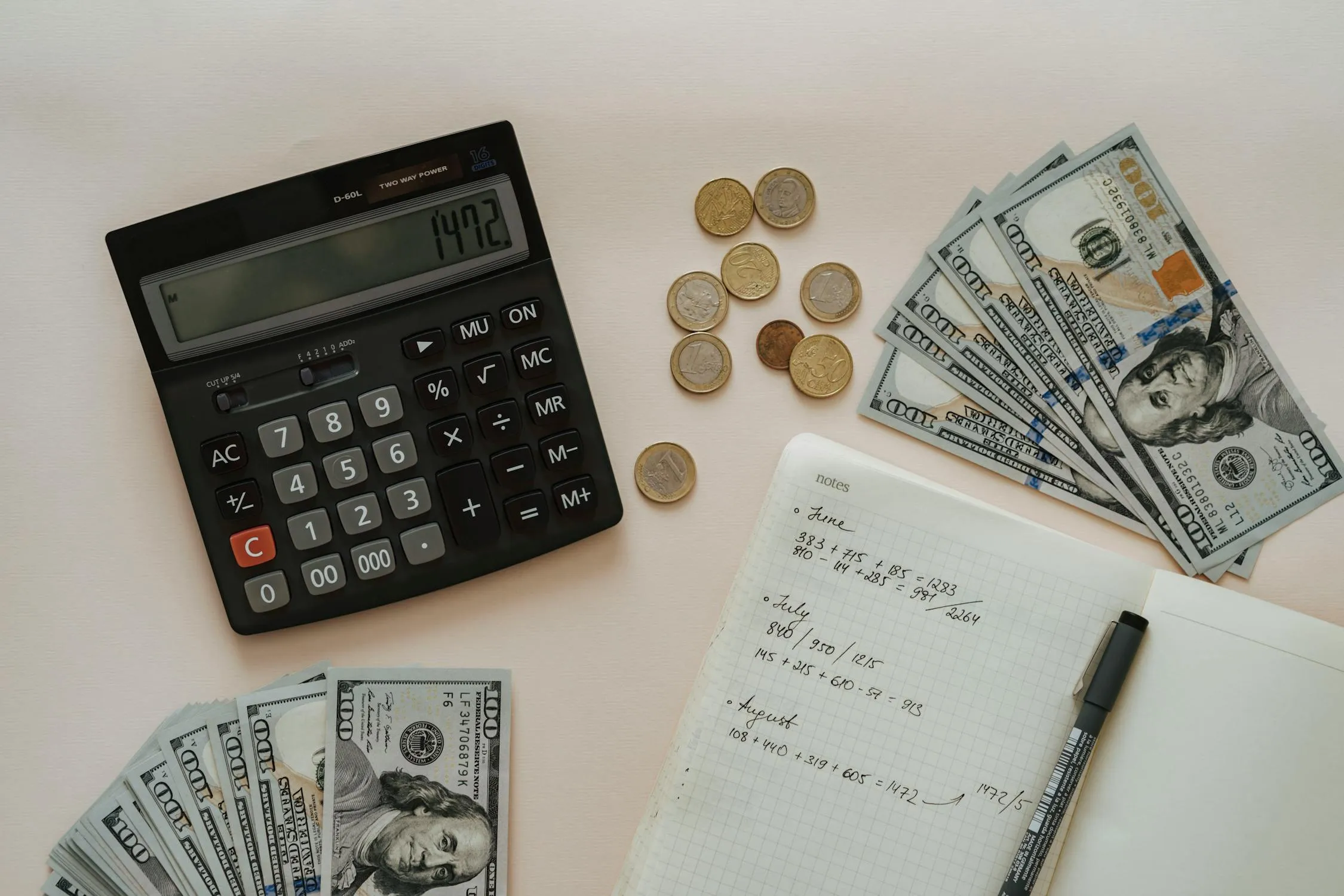

Photo By: Kaboompics.com on Pexels

Photo By: Kaboompics.com on Pexels

Before swiping plastic, layaway allowed families to pay in chunks until the full price was covered. It meant planning ahead for birthdays and Christmas—no debt, just delayed gratification.

5. Mortgages Were About Who You Knew

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Buying a home involved more face time with loan officers and fewer algorithm checks. Many folks relied on community banks or even employer-backed loans. Your family name and job history often sealed the deal.

6. Cash Was King and the Only Option

RDNE Stock project on Pexels

RDNE Stock project on Pexels

If you did not have the cash, you waited. Families budgeted carefully and used envelopes to divide the money for rent, food, and fun. This made impulse buying rare.

7. Loan Co-Signers Were Common and Sometimes Reluctant

Andrea Piacquadio on Pexels

Andrea Piacquadio on Pexels

Without scores, lenders often required a friend or family member to vouch for you. It could strain relationships if things went south. Saying yes meant taking a financial risk for something you loved.

8. Utilities Sometimes Asked for Personal References

Jakub Zerdzicki on Pexels

Jakub Zerdzicki on Pexels

Turning on the lights could require names of people who could require names of people who could vouch for you. Companies wanted to know your reliability, even if they could not check your credit. It felt more like applying for a job than setting up electricity.

9. Car Loans Were Often Done In-House

Antoni Shkraba Studio on Pexels

Antoni Shkraba Studio on Pexels

Car dealerships sometimes handled financing directly, skipping banks altogether. If they trusted you, they handed over the keys. If not, you were walking.

10. Trust-Based Lending Clubs Were a Lifeline

Photo By: Kaboompics.com on Pexels

Photo By: Kaboompics.com on Pexels

Some communities formed rotating savings clubs, pooling money and taking turns borrowing it. These informal systems ran on trust and community ties. Miss a payment, and you were out for good.