10 Signs You’re Overspending Without Realizing It

Many people don’t notice their financial habits are draining their accounts until it’s too late—here’s how to spot the warning signs.

- Chris Graciano

- 3 min read

Overspending often happens gradually, making it difficult to recognize until finances become strained. Small, frequent purchases and unnoticed fees can quietly eat away at your budget. Identifying these ten red flags early can help you regain control and avoid financial trouble.

1. You Struggle to Save Consistently

maitree rimthong on Pexels

maitree rimthong on Pexels

If you find yourself with little to no savings each month, it’s a strong sign that spending is outpacing your income. Saving should be a priority, not an afterthought.

2. You Rely on Credit Cards for Everyday Purchases

Tima Miroshnichenko on Pexels

Tima Miroshnichenko on Pexels

Using credit for necessities like groceries or gas instead of paying with cash or a debit card is a red flag. Carrying a balance month after month means you’re spending more than you earn.

3. You Don’t Track Your Expenses

Kiersten Williams on Pexels

Kiersten Williams on Pexels

Without a clear picture of where your money goes, it’s easy to overspend. Many people assume they’re in control but end up surprised by their monthly totals.

4. You Live Paycheck to Paycheck

olia danilevich on Pexels

olia danilevich on Pexels

If your income barely covers your expenses, even with a decent salary, overspending could be the culprit. A budget should leave room for savings and unexpected costs.

5. Impulse Purchases Are a Habit

Cup of Couple on Pexels

Cup of Couple on Pexels

Grabbing random items at checkout, clicking “buy now” without thinking, or constantly upgrading gadgets can quickly drain funds. While occasional splurges are fine, frequent impulse buying often leads to regret.

6. Your Monthly Bills Keep Increasing

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

Subscription services, streaming platforms, and premium memberships can silently add up. If your fixed expenses keep growing without a change in income, it’s time to reassess.

7. You Frequently Dine Out or Order Takeout

Norma Mortenson on Pexels

Norma Mortenson on Pexels

Restaurant meals and food delivery may feel convenient, but they cost significantly more than cooking at home. If dining out is a regular habit rather than an occasional treat, it’s a major money leak.

8. You Don’t Have an Emergency Fund

Josh Appel on Unsplash

Josh Appel on Unsplash

If an unexpected car repair, medical bill, or job loss would send you into financial panic, it’s a clear sign of overspending. A healthy budget includes building an emergency fund.

9. Your Home is Full of Unused Items

Ron Lach on Pexels

Ron Lach on Pexels

Clothing with tags still attached, gadgets collecting dust, and cluttered shelves suggest a pattern of unnecessary spending. Buying things that don’t get used is essentially throwing money away.

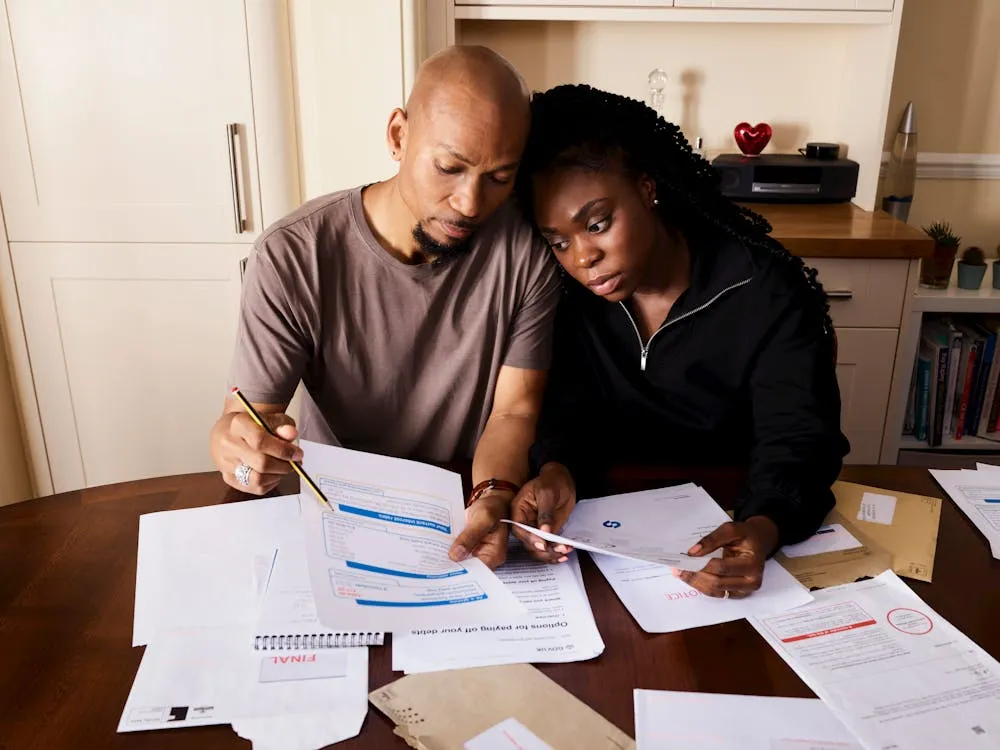

10. You Avoid Looking at Your Bank Statements

Vodafone x Rankin everyone.connected on Pexels

Vodafone x Rankin everyone.connected on Pexels

If checking your account balance or opening credit card statements fills you with anxiety, you might be spending more than you should. Avoiding financial reality only makes matters worse.