10 Ways Americans Paid Their Bills Before the Internet (and the Risks Involved)

A look back at how Americans handled bill payments in the pre-internet era—and the hidden dangers that came with each method.

- Chris Graciano

- 3 min read

Before online banking simplified life, paying bills was a manual, time-consuming task. Americans relied on checks, money orders, and even in-person visits to settle their accounts. Each method had its own set of hassles—and surprisingly risky consequences.

1. Mailing a Check

cottonbro studio on Pexels

cottonbro studio on Pexels

People wrote physical checks, sealed them in stamped envelopes, and dropped them in the mailbox. This was the go-to method for decades, but checks could get lost, stolen, or delayed in transit, risking late fees or fraud.

2. Visiting the Utility Office

energepic.com on Pexels

energepic.com on Pexels

Many paid electricity, gas, or water bills by walking into the local utility office. At the counter, payments were accepted in cash, check, or money order. While this ensured same-day payment, it also meant taking time off work or traveling across town.

3. Using a Bank’s Bill Pay Service (Pre-Digital)

POURIA 🦋 on Unsplash

POURIA 🦋 on Unsplash

Some banks offered manual bill payments, where customers submitted payment instructions, and the bank mailed checks on their behalf. This added convenience but took several days to process. If the timing was off, payments arrived late.

4. Paying by Phone

MART PRODUCTION on Pexels

MART PRODUCTION on Pexels

Customers could call a billing department and give their card number or bank information to a representative. It was faster than mail, but it was risky—sensitive data was shared verbally. There was no confirmation screen, and mistakes were hard to fix.

5. Dropping Payments in Night Deposit Boxes

Elliott R. Plack on Wikimedia Commons

Elliott R. Plack on Wikimedia Commons

Banks and some businesses had secure drop boxes where customers could leave payments after hours. It allowed flexibility, but there were no receipts unless you followed up. Items left overnight risked tampering or theft before retrieval.

6. Using Western Union or Telegraph Services

ChickenFalls on Wikimedia Commons

ChickenFalls on Wikimedia Commons

People used Western Union to send money quickly, especially for urgent bills. It cost extra and required a trip to a branch. Mistakes in recipient info could delay things.

7. Mailing Money Orders

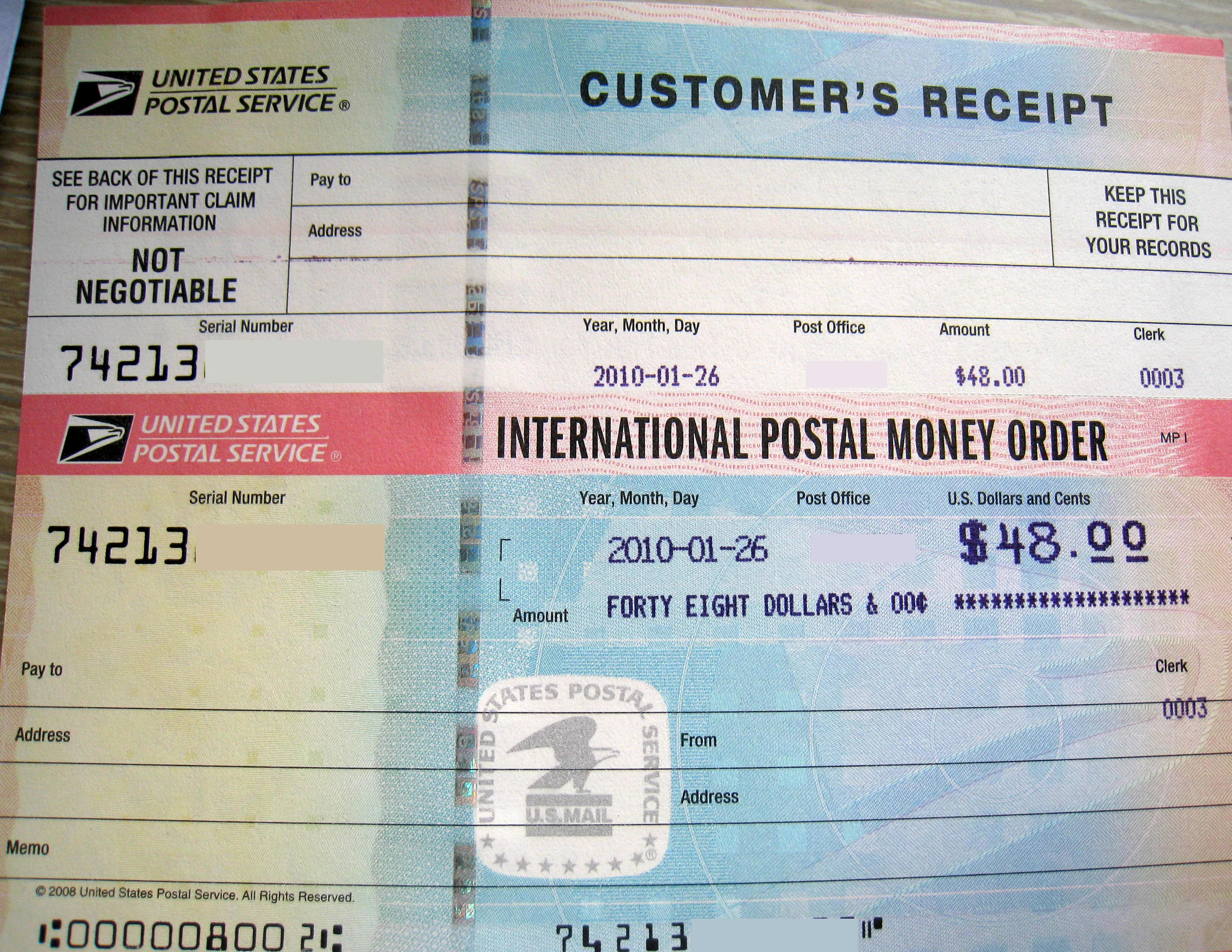

Dvortygirl on Flickr

Dvortygirl on Flickr

Money orders were safer than cash and often used by those without checking accounts. You’d buy one at a post office or store, fill it out, and mail it in. However, unlike modern payments, money orders weren’t traceable. If lost, replacing them was a slow, frustrating process.

8. Paying In Person at Retail Stores

Kampus Production on Pexels

Kampus Production on Pexels

Places like grocery stores or big-box retailers let you pay utility bills at customer service counters. It was a convenient one-stop errand. However, store clerks weren’t billing experts—errors weren’t uncommon.

9. Auto-Debit via Bank Agreement

Cytonn Photography on Pexels

Cytonn Photography on Pexels

Before apps, customers could fill out a paper form allowing a company to pull payments directly from their account. It removed the hassle but required serious trust. Canceling was a headache if you switched banks or had billing disputes.

10. Third-Party Payment Agents

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Some people used independent services or neighborhood agents who collected payments for a fee. These middlemen were common in some communities, but scams were a real risk. Once you handed over your money, you hoped they paid the bill.