12 Financial Scams from the ’80s That Shook America

A deep dive into the most notorious financial scams of the 1980s that left an indelible mark on America's economic landscape.

- Daisy Montero

- 3 min read

The 1980s were a tumultuous decade for the American financial sector, marked by a series of high-profile scams and fraudulent activities. This listicle explores 12 of the most impactful financial scams from that era, shedding light on the individuals involved and lasting consequences of their actions. Understanding these events is crucial to appreciating the importance of transparency and regulation in today’s financial markets.

1. Ivan Boesky’s Insider Trading Scandal

Donald Tong on Wikimedia Commons

Donald Tong on Wikimedia Commons

Ivan Boesky became synonymous with insider trading in the 1980s. His illegal activities, involving the use of confidential information for stock trading, led to a $100 million fine and a prison sentence. Boesky’s case was pivotal in highlighting the need for stricter enforcement of securities laws.

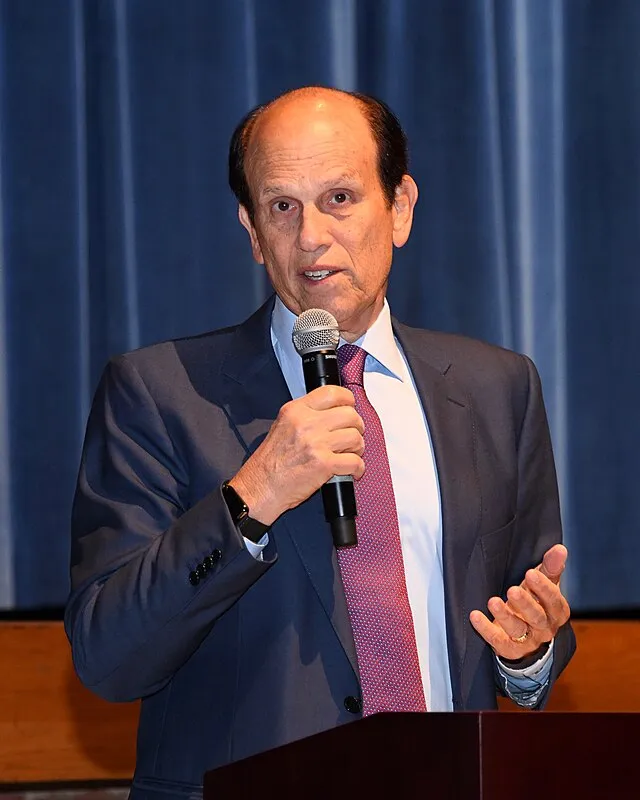

2. Michael Milken and the Junk Bond Debacle

Maryland GovPics on Wikimedia Commons

Maryland GovPics on Wikimedia Commons

Dubbed the “Junk Bond King,” Michael Milken revolutionized corporate finance but at a great cost. His manipulation of high-yield bonds led to significant market instability, culminating in charges of securities fraud and a $600 million fine.

3. The Savings and Loan Crisis

Nicola Barts on Pexels

Nicola Barts on Pexels

The deregulation of the savings and loan industry led to risky investments and widespread fraud. The crisis resulted in the failure of over a thousand institutions and cost taxpayers billions, prompting significant regulatory changes.

4. Dennis Levine’s Insider Trading Network

Ken Rutkowski on Wikimedia Commons

Ken Rutkowski on Wikimedia Commons

Dennis Levine’s extensive insider trading network unraveled in the mid-1980s, leading to his arrest and cooperation with authorities. His case exposed the depth of corruption on Wall Street and led to further high-profile convictions.

5. ZZZZ Best Carpet Cleaning Scam

Tara Winstead on Pexels

Tara Winstead on Pexels

Barry Minkow’s company, ZZZZ Best, was a front for a massive Ponzi scheme. He fabricated contracts and revenue, defrauding investors out of millions before the scheme collapsed.

6. E.F. Hutton’s Check-Kiting Scheme

Colerumbough on Wikimedia Commons

Colerumbough on Wikimedia Commons

E.F. Hutton engaged in a check-kiting scheme, manipulating bank floats to access interest-free loans. The scandal led to criminal charges and irreparably damaged the film’s reputation.

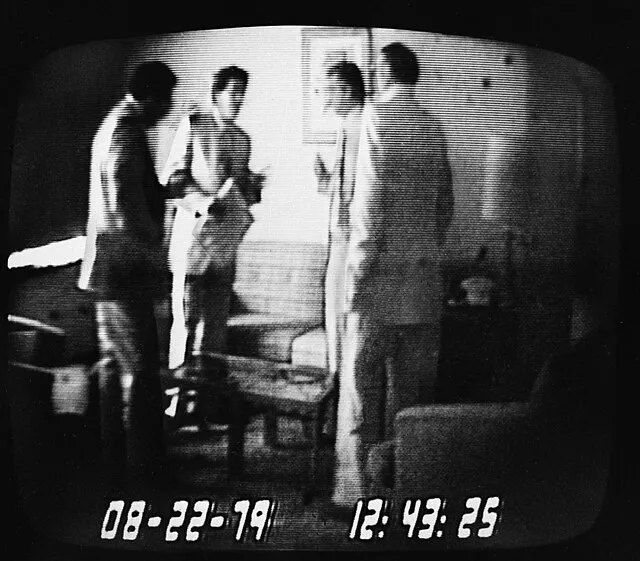

7. Abscam Political Scandal

FBI on Wikimedia Commons

FBI on Wikimedia Commons

Abscam was an FBI sting operation that exposed political corruption. It led to the conviction of several public officials and highlighted politicians’ susceptibility to financial bribery.

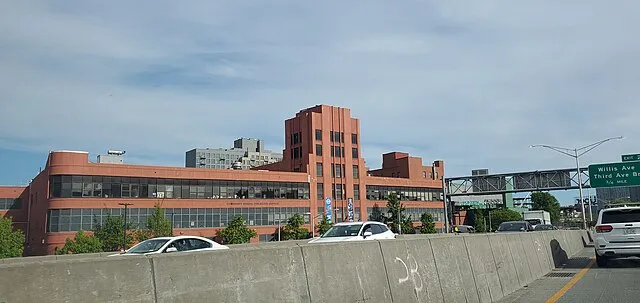

8. The Wedtech Scandal

Tdorante10 on Wikimedia Commons

Tdorante10 on Wikimedia Commons

Wedtech Corporation secured government contracts through bribery and political connections. The scandal led to multiple convictions and underscored the need for transparency in government contracting.

9. Princeton/Newport Partners Insider Trading

Mike Peel (www.mikepeel.net) on Wikimedia Commons

Mike Peel (www.mikepeel.net) on Wikimedia Commons

This investment firm was involved in a complex insider trading scheme, which led to significant legal repercussions and highlighted the need for stricter oversight in financial markets.

10. The Guinness Share-Trading Fraud

Ridiculopathy on Wikimedia Commons

Ridiculopathy on Wikimedia Commons

Executives at Guinness PLC manipulated share prices during a takeover bid, leading to convictions and emphasizing the importance of ethical practices in corporate finance.

11. The Bank of Credit and Commerce International (BCCI) Scandal

Anwar Ahmed on Wikimedia Commons

Anwar Ahmed on Wikimedia Commons

BCCI was involved in money laundering, bribery, and support of terrorism. Its collapse was one of the largest bank frauds in history, prompting international regulatory reforms.

12. Charles Keating and the Lincoln Savings Collapse

U.S. District Court for the Southern District of New York. 1814 in Wikimedia Commons

U.S. District Court for the Southern District of New York. 1814 in Wikimedia Commons

Charles Keating used Lincoln Savings and Loan to finance risky ventures and personal interests. When the company collapsed, thousands of investors lost their life savings. His actions symbolized the greed at the heart of the savings and loan crisis.