12 Financial Scams That Fooled Millions Before Being Exposed

These financial scams tricked millions before the truth came out, costing people their savings, trust, and sometimes even their freedom.

- Daisy Montero

- 3 min read

Financial scams have plagued societies for decades, often leaving devastation in their wake. This listicle delves into 12 notorious financial scams that managed to fool millions before being uncovered, highlighting the importance of vigilance and awareness in the financial world.

1. Bernie Madoff’s $64.8 Billion Ponzi Scheme

U.S. Department of Justice on Wikimedia Commons

U.S. Department of Justice on Wikimedia Commons

Bernie Madoff orchestrated the largest Ponzi scheme in history, defrauding investors of approximately $64.8 billion. Promising consistent returns, Madoff’s firm attracted a vast clientele, including charities and celebrities, before collapsing in 2008. His arrest sent shockwaves through the financial world, highlighting the dangers of unchecked trust in investment advisors.

2. Theranos: The $9 Billion Health Tech Deception

Theranos on Wikimedia Commons

Theranos on Wikimedia Commons

Theranos, founded by Elizabeth Holmes, claimed to revolutionize blood testing with just a finger prick. Valued at $9 billion, the company’s technology was later exposed as ineffective, leading to criminal charges against its executives. The scandal underscored the importance of scientific validation in healthcare innovations.

3. OneCoin: The $4 Billion Cryptocurrency Scam

Ronny Martin Junnilainen on Wikimedia Commons

Ronny Martin Junnilainen on Wikimedia Commons

Marketed as a revolutionary cryptocurrency, OneCoin was a Ponzi scheme that defrauded investors worldwide of over $4 billion. Founder Ruja Ignatova disappeared in 2017, earning the nickname “Cryptoqueen.” The scam highlighted the risks associated with unregulated digital currencies.

4. Enron: The Energy Giant’s Accounting Fraud

Tilemahos Efthimiadis on Wikimedia Commons

Tilemahos Efthimiadis on Wikimedia Commons

Once a leading energy company, Enron used accounting loopholes to hide debt and inflate profits. Its 2001 bankruptcy led to significant financial losses for employees and investors, prompting reforms in corporate governance and accounting practices.

5. FTX: The Cryptocurrency Exchange Collapse

FTX on Wikimedia Commons

FTX on Wikimedia Commons

FTX, a prominent cryptocurrency exchange, collapsed in 2022 due to alleged mismanagement and misuse of customer funds. Founder Sam Bankman-Fried faced legal scrutiny, and the incident raised concerns about the stability and regulation of crypto platforms.

6. Bre-X: The $6 Billion Gold Mining Fraud

David Hawgood on Wikimedia Commons

David Hawgood on Wikimedia Commons

Canadian company Bre-X Minerals falsely claimed a massive gold discovery in Indonesia, inflating its stock value. The 1997 hoax revelation led to significant investor losses and highlighted the need for due diligence in mining ventures.

7. Wirecard: The $2 Billion Accounting Scandal

Renardo la vulpo on Wikimedia Commons

Renardo la vulpo on Wikimedia Commons

German fintech company Wirecard was exposed in 2020 for a $2 billion accounting fraud. The scandal led to the arrest of top executives and raised questions about regulatory oversight in the fintech industry.

8. Satyam: India’s $1.5 Billion Corporate Fraud

SatyamTiwari002 on Wikimedia Commons

SatyamTiwari002 on Wikimedia Commons

In 2009, Satyam Computer Services admitted to inflating its financial statements by $1.5 billion. The scandal shook India’s IT sector and led to increased scrutiny of corporate governance practices.

9. Lehman Brothers: The 2008 Financial Crisis Catalyst

Johannes Geiger on Wikimedia Commons

Johannes Geiger on Wikimedia Commons

Lehman Brothers’ bankruptcy in 2008, due to risky investments and accounting practices, triggered a global financial crisis. The collapse emphasized the dangers of excessive leverage and lack of transparency in financial institutions.

10. Deepfake Scams: AI-Powered Financial Deceptions

Ministerie van Buitenlandse Zaken on Wikimedia Commons

Ministerie van Buitenlandse Zaken on Wikimedia Commons

Advancements in AI have led to deepfake scams, where synthetic media is used to impersonate individuals for financial gain. These scams pose new challenges for verification and trust in digital communications.

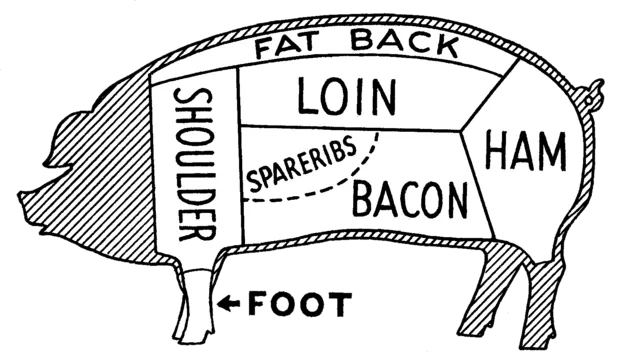

11. Pig Butchering: The Romance Investment Scam

Pearson Scott Foresman on Wikimedia Commons

Pearson Scott Foresman on Wikimedia Commons

“Pig butchering” scams involve fraudsters building romantic relationships online to manipulate victims into fraudulent investments. These scams have led to significant financial losses and emotional trauma for victims.

12. Fake Lottery Winnings and Advance-Fee Fraud

Eyüpcan Timur on Pexels

Eyüpcan Timur on Pexels

Scammers often pose as lottery officials, claiming the victim has won a prize, but must first pay taxes or fees to claim it. Many fall for it, lured by the excitement of sudden wealth and urgency. These schemes have drained life savings and remain prevalent through emails, calls, and even physical mail.