12 Times Bad Press Crashed a Company’s Stock Overnight

When news turns negative, the stock market can react in a flash and not in a good way. Just one headline, leak, or scandal has the power to wipe billions from a company’s value in a matter of hours. These real-life examples show how fast things can fall when public trust breaks.

- Tricia Quitales

- 3 min read

In the world of business, reputation can be as valuable as profits. A single news story, whistleblower account, or viral moment can cause panic among investors and send stock prices plummeting overnight. Whether due to fraud, safety concerns, or controversial behavior, the damage from bad press can be immediate and severe. This article looks at 12 striking moments when companies saw their market value crash in response to sudden negative publicity.

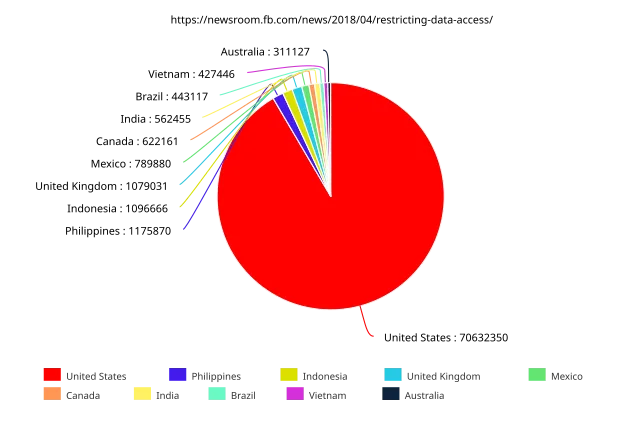

1. Facebook & Cambridge Analytica (2018)

FallingGravity on Wikimedia

FallingGravity on Wikimedia

A report revealed that millions of Facebook users had their data harvested without permission for political use. The public backlash was intense, and lawmakers demanded answers. Facebook’s stock lost over $36 billion in value in just two days.

2. Volkswagen Emissions Scandal (2015)

Volkswagen on Wikimedia

Volkswagen on Wikimedia

It came out that Volkswagen had installed software to cheat emissions tests in diesel cars. The news triggered outrage and led to billions in fines. Investors panicked, and the company’s stock dropped more than 30% in a week.

3. Peloton Tread+ Safety Issues (2021)

Unknown author on wikimedia

Unknown author on wikimedia

After reports of child injuries and a tragic death, Peloton faced harsh criticism over its treadmill safety. The company initially resisted a recall, which made things worse. Shares fell sharply as trust in the brand declined.

4. United Airlines Passenger Dragging Incident (2017)

https://1000logos.net/united-airlines-logo/ on Wikimedia

https://1000logos.net/united-airlines-logo/ on Wikimedia

A video of a passenger being violently dragged off a United flight went viral. The company’s response was widely viewed as tone-deaf and dismissive. The next day, United lost nearly $1 billion in market value.

5. Tesla’s Elon Musk “Funding Secured” Tweet (2018)

Solen Feyissa on Pexels

Solen Feyissa on Pexels

Elon Musk tweeted about taking Tesla private at $420 per share with “funding secured.” The tweet triggered an SEC investigation and raised doubts about leadership. Tesla’s stock fell sharply as confusion and mistrust spread.

6. Blue Apron IPO Backlash (2017)

Blue Apron on Wikimedia

Blue Apron on Wikimedia

Just before its IPO, news broke that Amazon was buying Whole Foods, raising doubts about Blue Apron’s future. Investors questioned its ability to compete. The stock dropped nearly 70% in the following months.

7. Chipotle E. coli Outbreak (2015)

Raysonho @ Open Grid Scheduler / Scalable Grid Engine on Wikimedia

Raysonho @ Open Grid Scheduler / Scalable Grid Engine on Wikimedia

An outbreak of E. coli linked to Chipotle restaurants sickened dozens and made headlines. The news scared off customers and hurt the brand’s clean-food image. The stock fell 44% over several weeks and took years to recover.

8. Robinhood GameStop Trading Limits (2021)

Public domain on Wikimedia

Public domain on Wikimedia

Robinhood stopped users from buying certain popular stocks, including GameStop, during a massive short squeeze. Outrage followed, with users accusing the platform of protecting hedge funds. The backlash caused Robinhood’s reputation and value to take a hit.

9. Boeing 737 MAX Crashes (2018–2019)

Jonathan Borba on Pexels

Jonathan Borba on Pexels

Two deadly crashes involving Boeing’s 737 MAX jets raised serious safety concerns. Investigations pointed to software problems and poor oversight. Boeing’s stock plunged and lost tens of billions in market value.

10. Facebook Whistleblower Testimony (2021)

Pixabay on Pexels

Pixabay on Pexels

A former employee testified before Congress, claiming Facebook put profits over safety. The news sparked global headlines and renewed scrutiny of the company. Its stock dropped over 5% in one day, wiping out billions.

11. Luckin Coffee Accounting Fraud (2020)

BuSea BaSze Mi HKer on Wikimedia

BuSea BaSze Mi HKer on Wikimedia

China’s Luckin Coffee admitted that it had faked hundreds of millions in sales. The news destroyed investor confidence almost instantly. Shares plunged by more than 75%, and the company was later delisted from the NASDAQ.

12. Netflix Subscriber Loss Report (2022)

Netflix Inc. on Wikimedia

Netflix Inc. on Wikimedia

Netflix announced it had lost subscribers for the first time in a decade, sparking concern over its future growth. The media quickly ran stories questioning the streaming giant’s business model. Investors reacted fast, and the stock sank over 35% in a single day.