13 Times Prices Skyrocketed Overnight in American History

These jaw-dropping price jumps caught Americans off guard and changed how people shopped, traveled, and lived — almost overnight.

- Daisy Montero

- 3 min read

Throughout American history, certain events have triggered sudden and significant price hikes, leaving lasting impacts on the economy and society. This listicle delves into 13 such moments, offering insights into the causes and consequences of these rapid price escalations. Understanding these events provides valuable lessons for navigating future economic challenges.

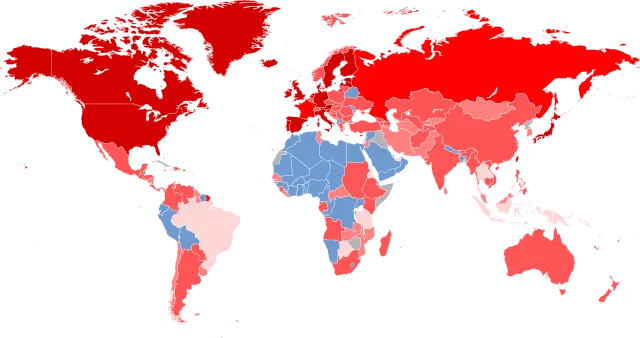

1. The 1973 Oil Crisis

Chainwit. NASA (Crew of Skylab 4) Israel Defense Forces David Falconer Koen Wessing Bengt Nyman Knudsen, Robert L. (Robert LeRoy) Unknown author on Wikimedia Commons

Chainwit. NASA (Crew of Skylab 4) Israel Defense Forces David Falconer Koen Wessing Bengt Nyman Knudsen, Robert L. (Robert LeRoy) Unknown author on Wikimedia Commons

In 1973, OPEC’s oil embargo led to a quadrupling of oil prices, causing widespread economic turmoil in the U.S. Gas shortages, long lines at stations, and soaring energy costs marked this period, highlighting America’s dependence on foreign oil.

2. Gold Prices Soar in 1980

Pixabay on Pexels

Pixabay on Pexels

On January 14, 1980, gold prices reached a record $850 per ounce, driven by high inflation and geopolitical tensions. Investors flocked to gold as a safe haven, reflecting fears of economic instability.

3. COVID-19 Pandemic Price

Tima Miroshnichenko on Pexels

Tima Miroshnichenko on Pexels

The onset of the COVID-19 pandemic in 2020 led to panic buying and supply chain disruptions, causing prices of essentials like toilet paper and sanitizers to skyrocket overnight. This period underscored the fragility of global supply networks.

4. 2012 Drought and Food Prices

Oxfam East Africa on Wikimedia Commons

Oxfam East Africa on Wikimedia Commons

The severe drought in 2012 devastated crops across the U.S., leading to a sharp increase in food prices. Staples like corn and soybeans saw significant price hikes, impacting domestic and global markets.

5. Bitcoin’s 2017 Surge

Crypto Crow on Pexels

Crypto Crow on Pexels

In December 2017, Bitcoin’s value soared to nearly $20,000, a dramatic increase from just $1,000 at the year’s start. This rapid rise highlighted the volatile nature of cryptocurrencies and speculative investments.

6. Hurricane Katrina’s Impact on Gas Prices

Lee chinyama on Pexels

Lee chinyama on Pexels

In 2005, Hurricane Katrina disrupted oil production in the Gulf of Mexico, causing gas prices to spike overnight. The disaster emphasized the vulnerability of energy infrastructure to natural disasters.

7. The 1973 Wheat Deal

Flip Schulke on Wikimedia Commons

Flip Schulke on Wikimedia Commons

The U.S.-Soviet wheat deal in 1973 led to a sudden surge in wheat prices, as the USSR purchased large quantities of American grain. This unexpected demand caused domestic shortages and price hikes.

8. Post-WWII Housing Boom

George Anton Groeschl on Wikimedia Commons

George Anton Groeschl on Wikimedia Commons

After World War II, returning veterans and a booming economy led to a housing shortage, causing home prices to rise rapidly. The demand outpaced the supply, reshaping urban and suburban landscapes.

9. 1980s Inflation Surge

FRED, Federal Reserve Bank of St. Louis on Wikimedia Commons

FRED, Federal Reserve Bank of St. Louis on Wikimedia Commons

The early 1980s saw inflation rates soar, with consumer prices increasing rapidly. This period led to high interest rates and significant economic adjustments.

10. 2008 Financial Crisis

Felipe Menegaz on Wikimedia Commons

Felipe Menegaz on Wikimedia Commons

The collapse of major financial institutions in 2008 led to a global economic downturn. Stock markets plummeted, and commodity prices experienced extreme volatility.

11. Airfare Price Spikes

Andrew Cutajar on Pexels

Andrew Cutajar on Pexels

Airline ticket prices can fluctuate dramatically overnight due to demand, fuel costs, and algorithmic pricing. Travelers often find prices doubling within hours, reflecting the dynamic nature of the industry.

12. 2022 Inflation Peak

Photo By: Kaboompics.com on Pexels

Photo By: Kaboompics.com on Pexels

In 2022, the U.S. experienced its highest inflation rate in decades, with prices for goods and services increasing sharply. Factors included supply chain issues and increased consumer demand post-pandemic.

13. The 2021 Lumber Surge

Stephen Ondich on Wikimedia Commons

Stephen Ondich on Wikimedia Commons

Lumber prices tripled in early 2021 as home renovation boomed and supply chains strained. The cost of building materials rose so fast that some construction projects stalled. It became one of the most visible signs of post-pandemic inflation.