13 Unexpected Lessons from Living Without Credit Cards

Living without credit cards is less “financial freedom” and more like a daily budgeting boot camp that accidentally teaches you about life.

- Sophia Zapanta

- 4 min read

Going credit-card-free sounds brave until your car breaks down or a surprise pizza craving hits at midnight. However, skipping plastic forces you to rethink how you spend, save, and survive. It’s uncomfortable at first—but oddly eye-opening.

1. You Actually Feel Your Spending

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Paying in cash or debit hits different. You physically see the money disappear, and it stings in a good way. Suddenly, a $6 coffee feels like a decision, not a reflex. It’s like your wallet whispers, “Are you sure?” before every purchase.

2. Impulse Buys Drop Hard

MART PRODUCTION on Pexels

MART PRODUCTION on Pexels

Without a credit card, there’s no fake buffer. If you don’t have the money, the purchase doesn’t happen. That five-second Amazon thrill? Gone. Weirdly enough, you start enjoying the freedom of not buying stuff.

3. You Get Really Creative with Money

Pixabay on Pexels

Pixabay on Pexels

No credit means no financial safety net. So you stretch groceries, DIY fixes, and become a master of repurposing leftovers. You’ll be shocked at what you can do with rice, eggs, and pure determination. It’s budgeting with a splash of survival mode.

4. Emergencies Get Real, Fast

Pixabay on Pexels

Pixabay on Pexels

One flat tire feels like the end of the world. There’s no charging your way out—you have to plan ahead or suffer. Emergency funds stop being optional. They become your new best friend.

5. You Rethink “Needs” vs. “Wants”

Andrea Piacquadio on Pexels

Andrea Piacquadio on Pexels

Suddenly, everything goes through a filter. That cute jacket? Want. Toilet paper? Definite need. You’ll question every cart item like a philosophical debate. Minimalism becomes less of a vibe and more of a necessity.

6. Your Relationship with Debt Changes

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

Without cards, there’s no balance quietly growing in the background. You stop thinking of debt as “normal.” Interest rates become villains, not background noise. Also, paying in full becomes oddly addictive.

7. You Say “No” More—and Mean It

lil artsy on Pexels

lil artsy on Pexels

You can’t afford that weekend getaway? You say it, and people respect it. No more fake smiling through expensive plans you secretly dread. Saying no becomes powerful, not embarrassing. You start building a life that actually fits your wallet, not someone else’s expectations.

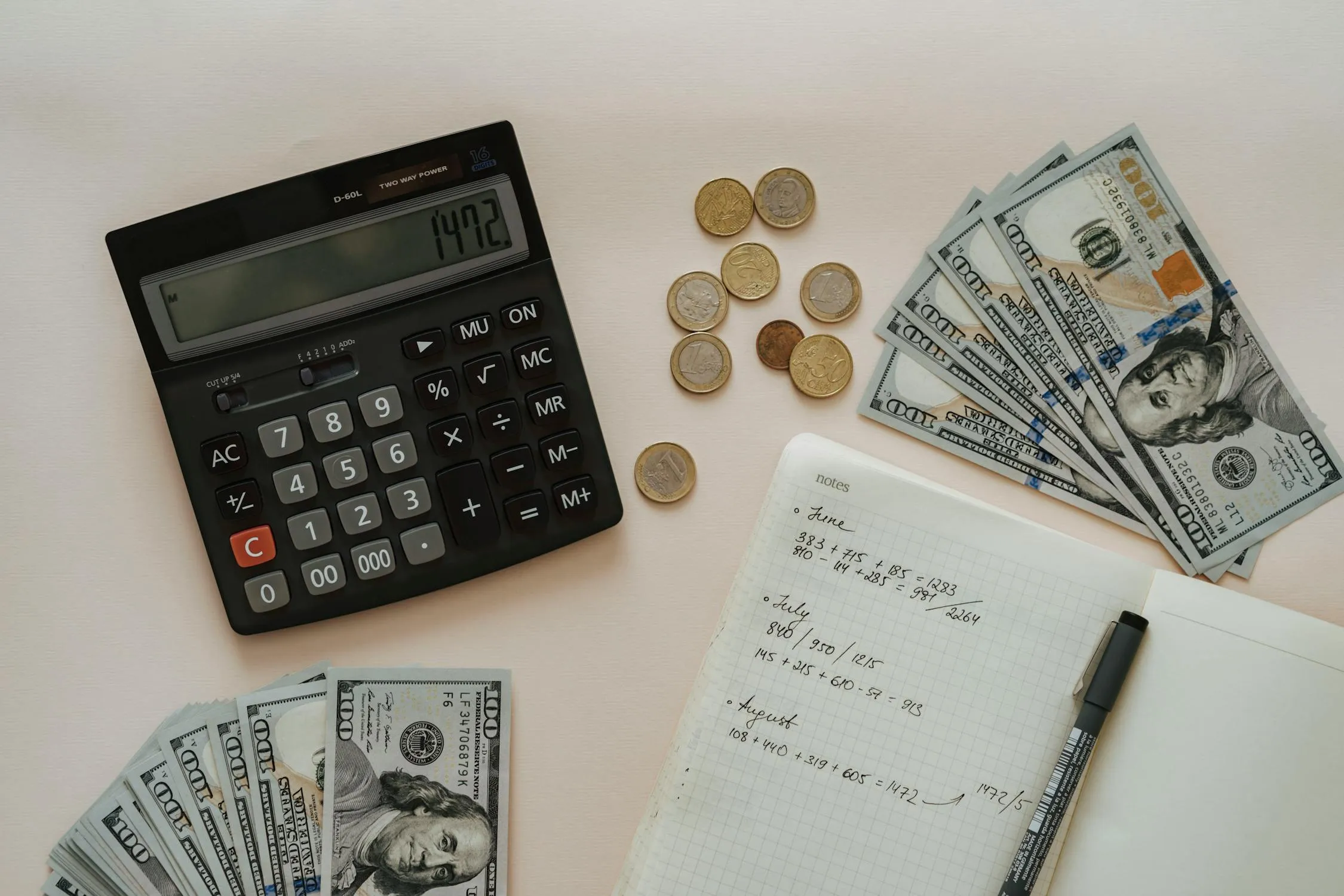

8. You Start Saving by Default

Lukas on Pexels

Lukas on Pexels

No credit card means less spending, which weirdly means more leftover cash. You start tucking it away without even trying. Saving becomes a habit that happens because you’re limited. Also, watching your savings grow hits like a reward. Eventually, you realize you’ve created your own safety net.

9. You Stop Relying on “Future You”

olia danilevich on Pexels

olia danilevich on Pexels

Credit cards let you borrow from your future self. Without them, you only have what you have, so you stop making promises that you can’t keep. Present-you starts making smarter choices, and honestly, the future-you is way less stressed because of it.

10. You Plan Everything

Content Pixie on Pexels

Content Pixie on Pexels

With no financial cushion, winging it stops being an option. Every bill, birthday, and grocery list becomes a spreadsheet moment. You’re basically running your life like a tiny business. You’re the CEO of “Don’t Let This Month Fall Apart.” Planning becomes your secret weapon instead of a chore.

11. You Avoid the Credit Score Obsession

Cup of Couple on Pexels

Cup of Couple on Pexels

No credit cards? No more logging in every week to check your score. You stop chasing a number and start chasing actual stability. It turns out that good financial habits matter more than hitting 800. Peace of mind beats points, and nobody ever clapped for a perfect score anyway.

12. You Build Real Discipline

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Living without credit cards is like financial weightlifting. It’s hard. It takes practice, but it builds real muscle in your mindset. Every smart choice is a little flex. Over time, you realize you’ve got stronger habits than most people with credit.

13. You Realize How Normal Debt Has Become

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Once you step out of the credit card loop, you start noticing how everyone else is in it. Debt is everywhere, and it’s treated like a necessary evil. You don’t judge—but you’re quietly glad you tapped out. It’s like stepping out of a noise-filled room and finally hearing yourself think.

- Tags:

- money

- minimalism

- Budgeting

- Debt

- lifestyle