14 Financial Products That Were Wildly Popular—and Then Disappeared

These financial products were once household names, but changing trends, tighter regulations, and modern alternatives caused them to vanish from the spotlight quietly.

- Daisy Montero

- 3 min read

Financial products often mirror the economic and technological landscapes of their times. Some gain immense popularity, only to fade away due to innovation, regulation, or scandal. This listicle explores 14 financial products that were once household names but have since disappeared.

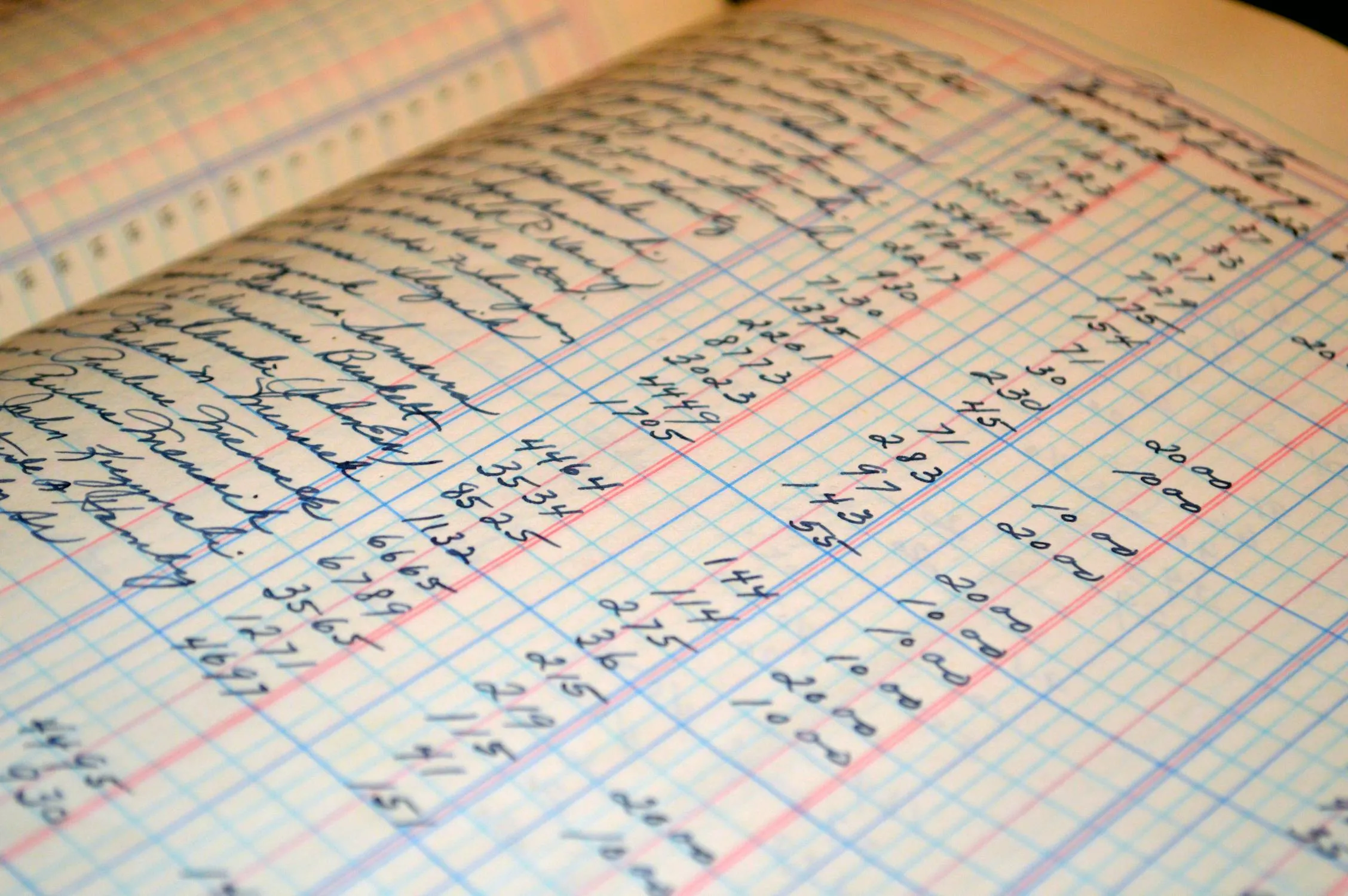

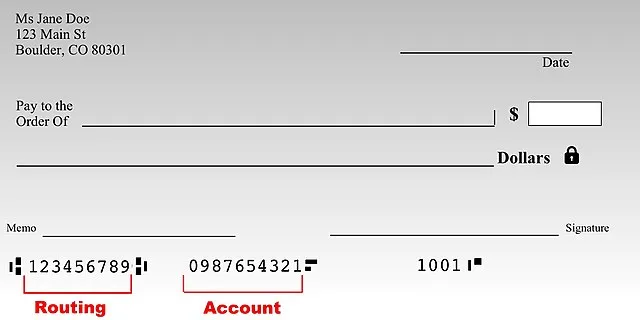

1. Personal Checks

Mario Lurig on Wikimedia Commons

Mario Lurig on Wikimedia Commons

Once a staple in everyday transactions, personal checks have seen a dramatic decline in use. With the advent of digital payments and mobile banking, many retailers no longer accept them, signaling the end of an era for this traditional payment method.

2. Lehman Brothers

David Shankbone on Wikimedia Commons

David Shankbone on Wikimedia Commons

A titan of investment banking, Lehman Brothers’ 2008 collapse was a pivotal moment in the global financial crisis. Its bankruptcy highlighted the risks of excessive leverage and complex financial instruments, leading to significant regulatory reforms.

3. AIG Financial Products

American International Group SVG version by JBarta on Wikimedia Commons

American International Group SVG version by JBarta on Wikimedia Commons

A subsidiary of AIG, this division’s involvement in credit default swaps significantly contributed to the 2008 financial meltdown. Its downfall necessitated a massive government bailout and underscored the dangers of unregulated financial derivatives.

4. Equity Funding Corporation of America

RDNE Stock project on Pexels

RDNE Stock project on Pexels

In the 1970s, this company was embroiled in a massive insurance fraud scandal, involving fake policies and falsified records. Its collapse led to significant changes in auditing practices and regulatory oversight.

5. National Heritage Life Insurance Company

Anonymous / Kaleva on Wikimedia Commons

Anonymous / Kaleva on Wikimedia Commons

Once a trusted insurer, this company collapsed in the 1990s due to a massive fraud scheme. The scandal resulted in significant financial losses for policyholders and highlighted vulnerabilities in the insurance industry’s regulatory framework.

6. Timbercorp

Tara Winstead on Pexels

Tara Winstead on Pexels

An Australian managed investment scheme, Timbercorp’s collapse in 2009 left thousands of investors out of pocket. Its failure prompted a reevaluation of investment regulations and the risks associated with agribusiness ventures.

7. Savings and Loan Associations

Farragutful on Wikimedia Commons

Farragutful on Wikimedia Commons

Once a cornerstone of American home financing, many S&Ls failed during the 1980s crisis due to risky investments and deregulation. The fallout led to significant taxpayer-funded bailouts and stricter financial regulations.

8. Ponzi Schemes

Boston Library (NYT); en.wikipedia.org on Wikimedia Commons

Boston Library (NYT); en.wikipedia.org on Wikimedia Commons

Named after Charles Ponzi, these fraudulent investment scams promise high returns with little risk. While not a product per se, their prevalence has led to increased investor skepticism and regulatory vigilance.

9. MerchantBridge

Expect Best on Pexels

Expect Best on Pexels

MerchantBridge was an investment firm with significant operations in the Middle East. Its activities ceased amid financial controversies, and its story serves as a cautionary tale about the complexities of international finance.

10. Databank Systems

Kampus Production on Pexels

Kampus Production on Pexels

A New Zealand-based financial services company, Databank Systems played a pivotal role in the country’s banking sector before becoming obsolete due to technological advancements and industry consolidation.

11. Interhandel

MART PRODUCTION on Pexels

MART PRODUCTION on Pexels

A Swiss holding company with a complex history, Interhandel was embroiled in legal battles over assets seized during World War II. Its eventual dissolution reflects the intricate interplay between geopolitics and finance.

12. Alpari

Art.Lebedev Studio on Wikimedia Commons

Art.Lebedev Studio on Wikimedia Commons

A prominent forex broker, Alpari’s UK operations ceased in 2015 following the Swiss franc’s unexpected surge. The event underscored the volatility of currency markets and the risks faced by leveraged trading platforms.

13. MyRichUncle

Emily Petit on Pexels

Emily Petit on Pexels

An innovative student loan provider, MyRichUncle offered alternative lending models before succumbing to the 2008 financial crisis. Its demise highlights the challenges faced by fintech startups in turbulent economic times.

14. OppenheimerFunds

oppenheimerfunds on Wikimedia Commons

oppenheimerfunds on Wikimedia Commons

Once a major asset management firm, OppenheimerFunds was acquired and merged into Invesco in 2019. While the name disappeared, its legacy continues through the portfolios it managed and the clients it served. The brand’s retirement marked the end of an era in mutual fund investing.