14 Old-School Ways of Budgeting That Still Work Better Than Apps

Discover 14 timeless budgeting techniques that continue to be more effective than today's digital tools.

- Daisy Montero

- 4 min read

In an era dominated by budgeting apps and digital finance tools, traditional methods still hold significant value. This listicle explores 14 classic budgeting strategies that have stood the test of time, offering simplicity, control, and effectiveness. Embracing these methods can lead to better financial habits and a deeper understanding of personal spending.

1. Pen and Paper Budgeting

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

Before the digital age, budgeting was a manual process involving pen and paper. This method encourages mindfulness by requiring individuals to write down each expense, fostering a deeper connection to spending habits. It’s a straightforward approach that promotes accountability and awareness.

2. The Envelope System

Photo By: Kaboompics.com on Pexels

Photo By: Kaboompics.com on Pexels

This method involves allocating cash into envelopes designated for specific spending categories. Once an envelope is empty, no more spending occurs in that category, effectively controlling expenses. It’s a tactile system that reinforces spending limits and discipline.

3. Cash Only Spending

Photo By: Kaboompics.com on Pexels

Photo By: Kaboompics.com on Pexels

Using only cash for purchases can significantly reduce overspending. The physical act of handing over money makes transactions more tangible, leading to more thoughtful spending decisions. This method eliminates the detachment often associated with card payments.

4. Maintaining a Check Register

Photo By: Kaboompics.com on Pexels

Photo By: Kaboompics.com on Pexels

Recording every transaction in a check register helps track spending and monitor account balances. This practice ensures that individuals are always aware of their financial standing, preventing overdrafts and fostering responsible money management.

5. Collecting and Reviewing Receipts

Photo By: Kaboompics.com on Pexels

Photo By: Kaboompics.com on Pexels

Saving receipts and reviewing them regularly provides insight into spending patterns. This habit can highlight unnecessary expenses and areas where savings are possible, promoting more conscious financial decisions.

6. Using Spreadsheets for Budgeting

Andrea Piacquadio on Pexels

Andrea Piacquadio on Pexels

Creating a budgeting spreadsheet allows for detailed tracking of income and expenses. This customizable tool can be tailored to individual needs, offering a clear overview of financial health and aiding in goal setting.

7. Zero-Sum Budgeting

Photo By: Kaboompics.com on Pexels

Photo By: Kaboompics.com on Pexels

This approach assigns every dollar of income a specific purpose, ensuring that income minus expenses equals zero. It promotes intentional spending and prioritizes savings and debt repayment, leaving no room for unallocated funds.

8. The 50/30/20 Rule

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

This budgeting rule divides income into three categories: 50% for needs, 30% for wants, and 20% for savings. It’s a simple framework that helps balance essential expenses with personal desires and financial goals.

9. Pay Yourself First

Photo By: Kaboompics.com on Pexels

Photo By: Kaboompics.com on Pexels

This strategy involves allocating a portion of income to savings before addressing other expenses. By prioritizing savings, individuals ensure that they consistently build financial security, treating savings as a non-negotiable expense.

10. Line-Item Budgeting

Kindel Media on Pexels

Kindel Media on Pexels

This method involves detailing every expense category and assigning specific amounts to each. It offers granular control over finances, making it easier to identify areas for cost-cutting and ensuring that spending aligns with financial goals.

11. The 60/40 Budget

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

This budgeting approach allocates 60% of income to expenses and 40% to savings and discretionary spending. It provides a flexible structure that can be adjusted based on individual financial goals and lifestyle needs.

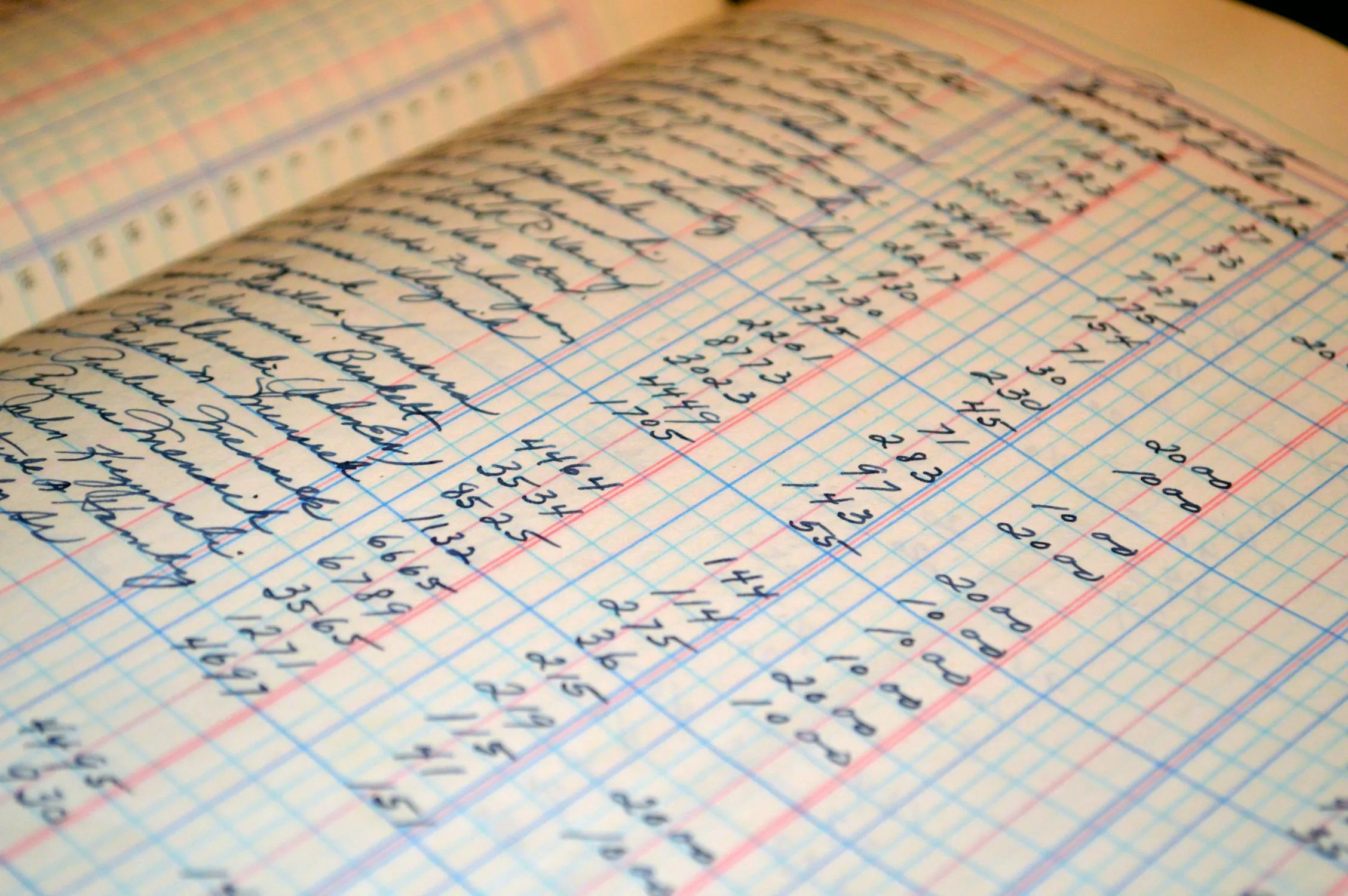

12. Using a Ledger Book

Pixabay on Pexels

Pixabay on Pexels

A ledger book is a traditional tool for recording financial transactions. By manually entering income and expenses, individuals can maintain a clear and organized record of their financial activities, enhancing accountability.

13. Monthly Bill Calendar

Bich Tran on Pexels

Bich Tran on Pexels

A calendar dedicated to bill due dates helps prevent missed payments and late fees. Marking payment days visually reinforces financial responsibility and keeps the budget in check. It is especially helpful for those who prefer structure and routine.

14. Setting Weekly Spending Limits

Photo By: Kaboompics.com on Pexels

Photo By: Kaboompics.com on Pexels

Instead of monthly allocations, this method breaks down spending into weekly caps. It creates a tighter feedback loop, making it easier to adjust habits and stay within budget. Weekly limits can reduce stress and make money feel more manageable.