14 Ways People Paid Bills Before the Internet

Paying bills today is often a quick online task, but it used to involve much more time, effort, and patience. Before websites and apps existed, people relied on mail, in-person visits, and telephone calls to stay current on their accounts. These old-school methods required careful organization and often meant planning days or weeks in advance.

- Tricia Quitales

- 5 min read

Life before online banking required a lot more paperwork, stamps, and waiting. People had set routines to make sure their bills were paid on time, and many took great pride in staying organized. Monthly responsibilities like utilities, credit cards, and mortgages were handled through more traditional means. From writing checks to standing in line at payment counters, it was all part of managing a household. These past methods may seem outdated today, but they formed the backbone of everyday financial life for decades.

1. Mailing Checks

Ethan Wilkinson on Pexels

Ethan Wilkinson on Pexels

Most people paid their bills by writing a paper check and mailing it in an envelope. This required buying stamps, knowing the due date, and accounting for delivery time. Many households had a designated day for bill paying to keep track. It was common to double-check the balance in a checkbook register before sending anything. Delays in the mail could lead to late fees, so timing was everything.

2. Paying in Person at Utility Offices

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Utility companies often had local offices where customers could pay their bills directly. People would walk or drive to the location, stand in line, and hand over cash or a check. Many offices had drop boxes for after-hours payments. This method offered a sense of certainty and allowed customers to get a receipt immediately. It also provided a chance to ask questions or resolve billing issues face-to-face.

3. Using the Bank’s Bill Pay Window

Pixabay on Pexels

Pixabay on Pexels

Banks served as payment centers for many services, such as loans or credit cards. Customers would visit during business hours and fill out a form or present a bill stub. A teller processed the payment and gave a confirmation slip. It was a convenient way to handle multiple payments in one stop. Banking hours, however, are limited and require careful planning.

4. Paying with Money Orders

Kelly on Pexels

Kelly on Pexels

For those without checking accounts, money orders were a trusted alternative. These were purchased at post offices, convenience stores, or banks for a small fee. Once bought, they could be mailed to the billing company like a check. Money orders offered security and proof of payment. They were often used for rent, car payments, and other important bills.

5. Dropping Payments in a Night Deposit Box

Brett Sayles on Pexels

Brett Sayles on Pexels

Some businesses provided night deposit boxes for after-hours payments. Customers placed checks or money orders in a sealed envelope and dropped them in the secure box. This allowed payment without waiting in line or rushing before closing time. It was widely used by small businesses and regular customers alike. Trust was essential, as payments sat unattended until the next morning.

6. Automatic Bank Drafts

Eduardo Soares on Pexels

Eduardo Soares on Pexels

Even before online banking, some companies offered automatic drafts from checking accounts. Customers filled out a form authorizing recurring monthly deductions. This method helped avoid missed due dates and eliminated the need to write checks. It was especially popular for loans, mortgages, and insurance. While convenient, it also required trust that the draft would be processed correctly.

7. Paying at the Grocery Store

Tim Samuel on pexels

Tim Samuel on pexels

Many grocery stores acted as bill pay centers for local utilities and phone companies. Customers brought in their bill stubs and paid at the customer service desk. This option was useful because it combined errands and saved a trip. Receipts were given as proof of payment on the spot. It turned a weekly grocery run into a financial task as well.

8. Paying by Phone with a Representative

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Some companies allowed payments over the phone by speaking with a customer service agent. The representative would take credit card or checking information and confirm the payment. Long wait times were common, but it was convenient for last-minute payments. People often called during business hours and made sure to get a confirmation number. This method brought convenience without the need for a computer.

9. Writing Postdated Checks

cottonbro studio on Pexels

cottonbro studio on Pexels

Customers occasionally wrote postdated checks if they expected funds to arrive later. The check was dated ahead to reflect the anticipated payment date. Some businesses honored the date while others processed it immediately. It was a risky method, but it was often used in tight situations. This relied heavily on mutual trust between the customer and the company.

10. Keeping a Ledger or Checkbook Register

Pixabay on Pexels

Pixabay on Pexels

Bill management meant recording every payment by hand in a ledger or checkbook register. People carefully noted amounts, dates, and balances to avoid overdrafts. Reconciling statements each month was an important part of the routine. These records offered a paper trail of financial activity. Accuracy was key, and small math mistakes could cause big issues.

11. Prepaying Bills in Advance

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Some people chose to prepay bills for several months when funds were available. It provided peace of mind and helped avoid late payments during tight periods. Utility companies often accepted advance payments and credited future bills. This strategy required budgeting and foresight. It worked well for those with irregular incomes or upcoming travel plans.

12. Visiting a Payment Kiosk

Liliana Drew on Pexels

Liliana Drew on Pexels

Certain businesses had dedicated kiosks in malls or retail stores for bill payments. These machines accepted cash or checks and provided instant receipts. They were popular for phone bills and other recurring charges. Kiosks offered flexibility outside normal business hours. However, they required a physical visit and often had long lines.

13. Using a Payment Coupon Book

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

Loans and mortgages often came with coupon books that included monthly slips. Each month, the customer tore out the next coupon and mailed it with the payment. It helped keep track of due dates and minimized confusion. The remaining coupons served as a countdown toward the loan’s end. It was a simple, paper-based system that many found reliable.

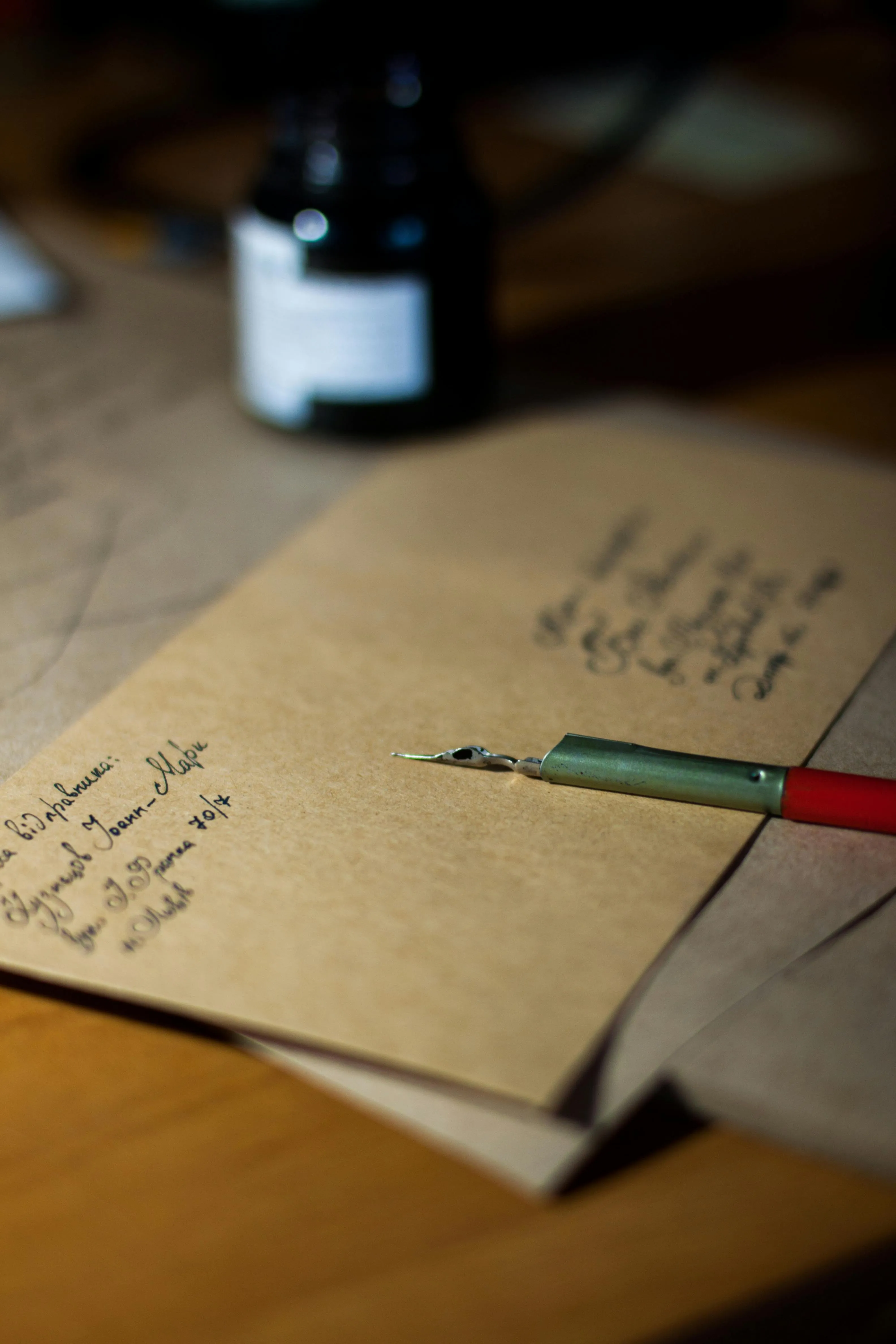

14. Asking for a Bill Extension by Phone or Letter

John-Mark Smith on Pexels

John-Mark Smith on Pexels

When funds were short, people often called or wrote to request more time. Customer service agents could sometimes extend deadlines or waive late fees. Letters had to be clear, polite, and mailed early. While not always granted, extensions were a lifeline during hard times. It showed how communication and honesty played a big role in managing finances.