15 Money Habits From the ’50s That Could Still Work Today

Explore 15 enduring financial habits from the 1950s that can help you save money and live more sustainably in today's world.

- Daisy Montero

- 4 min read

The 1950s were a time of economic growth, yet many families practiced frugality and resourcefulness, habits shaped by the Great Depression and wartime rationing. Today, revisiting these timeless habits can offer valuable lessons for managing finances, reducing waste, and fostering a more intentional lifestyle.

1. Home Cooking as a Financial Foundation

Elina Fairytale on Pexels

Elina Fairytale on Pexels

In the 1950s, families prioritized home-cooked meals, not only to save money but also to strengthen family bonds. Preparing meals at home reduces food expenses and allows for healthier eating habits. Embracing this practice today can lead to significant savings and improved well-being.

2. Embracing the “Make Do and Mend” Philosophy

Los Muertos Crew on Pexels

Los Muertos Crew on Pexels

Rather than discarding items, 1950s households often repaired clothing and household goods. This mindset promotes sustainability and cost savings. Learning basic repair skills today can extend the life of your belongings and reduce unnecessary expenses.

3. Strategic Shopping Habits

Sam Lion on Pexels

Sam Lion on Pexels

1950s consumers planned their shopping trips meticulously, using lists to avoid impulse purchases. By adopting this approach, modern shoppers can make more intentional purchases, leading to better budgeting and reduced waste.

4. The Cash Envelope Budgeting System

Photo By: Kaboompics.com on Pexels

Photo By: Kaboompics.com on Pexels

Families in the 1950s often used envelopes to allocate cash for specific expenses, which helped them stick to a budget. This practice can still be effective today, fostering discipline and awareness in spending habits.

5. Simplified Transportation

Borta on Pexels

Borta on Pexels

Owning a single vehicle was common in the 1950s, encouraging families to plan trips efficiently. Today, reducing car usage through carpooling, public transport, or biking can lead to substantial savings and environmental benefits.

6. Home Food Production

Andrea Piacquadio on Pexels

Andrea Piacquadio on Pexels

Victory gardens remained popular in the 1950s, providing fresh produce and reducing grocery bills. Starting a home garden today can offer similar benefits, promoting healthier eating and self-sufficiency.

7. Simple, Low-Cost Entertainment

Tima Miroshnichenko on Wikimedia Commons

Tima Miroshnichenko on Wikimedia Commons

Entertainment in the 1950s often involved affordable activities like board games and community events. Embracing similar pastimes today can strengthen relationships and reduce spending on costly entertainment options.

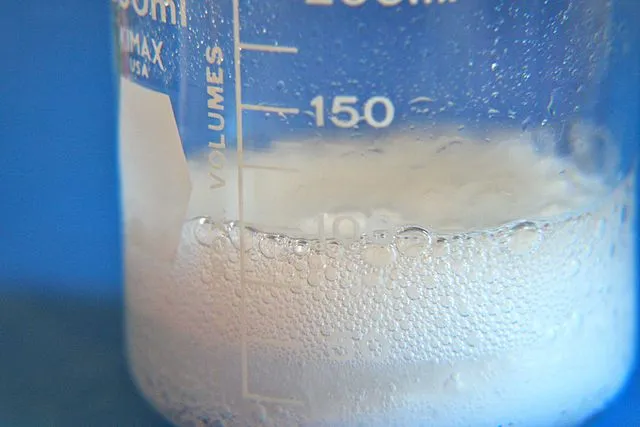

8. Homemade Cleaning Products

katerha on Wikimedia Commons

katerha on Wikimedia Commons

In the 1950s, many households made their own cleaning products using simple ingredients like vinegar and baking soda. This practice is not only cost-effective but also environmentally friendly.

9. Handwritten Budgets

Kelly Sikkema on Unsplash

Kelly Sikkema on Unsplash

Before digital tools, families managed finances with handwritten budgets, fostering a deeper connection to their spending habits. This method can still be effective today, encouraging mindfulness and accounting.

10. Rainwater Harvesting

Nikki Son on Unsplash

Nikki Son on Unsplash

Collecting rainwater was a common practice in the 1950s for watering gardens and other non-potable uses. Implementing rainwater harvesting today can reduce water bills and promote sustainable living.

11. Energy Conversation

Daniil Kondrashin on Pexels

Daniil Kondrashin on Pexels

In the 1950s, energy conservation was a necessity. Practices like line-drying clothes and turning off unused lights saved money and resources. Adopting similar habits today can lead to significant energy savings.

12. Avoiding Debt as a Family Rule

Photo By: Kaboompics.com on Pexels

Photo By: Kaboompics.com on Pexels

Most families in the 1950s paid for items in full and avoided credit whenever possible. This mindset can prevent financial stress and encourage better planning. Living within your means remains a powerful money habit.

13. Creating Homemade Gifts

Pavel Danilyuk on Pexels

Pavel Danilyuk on Pexels

Instead of store-bought gifts, people often gave baked goods or handmade crafts. This practice added a personal touch and saved money. Homemade gifts still feel more thoughtful and cost less than mass-produced ones.

14. Saving Up Before Buying Bid

Photo By: Kaboompics.com on Pexels

Photo By: Kaboompics.com on Pexels

Many families saved for months before buying appliances or furniture. This habit helped avoid debt and made large purchases more rewarding. Waiting also gives time to shop smart and find better deals.

15. Sharing Within the Community

Kampus Production on Pexels

Kampus Production on Pexels

Neighbors often borrowed tools, swapped recipes, or helped with childcare. These exchanges built stronger bonds and kept spending low. Relying on your community is still one of the most underrated money-saving moves.