15 Money Mistakes from the Past That Are Being Repeated Today

Explore these recurring financial missteps that continue to impact individuals and economies, and learn how to avoid them.

- Daisy Montero

- 3 min read

History often repeats itself, especially when it comes to financial money mistakes from the past that are still prevalent today, from accumulating credit card debt to neglecting emergency savings. Each slide offers insights into these common errors and practical advice on how to steer clear of them.

1. Accumulating Credit Card Debt

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

Despite widespread awareness, many individuals continue to rely heavily on credit cards, leading to mounting debt. High-interest rates can quickly turn manageable balances into financial burdens. It’s crucial to use credit responsibly and pay off balances promptly to avoid long-term consequences.

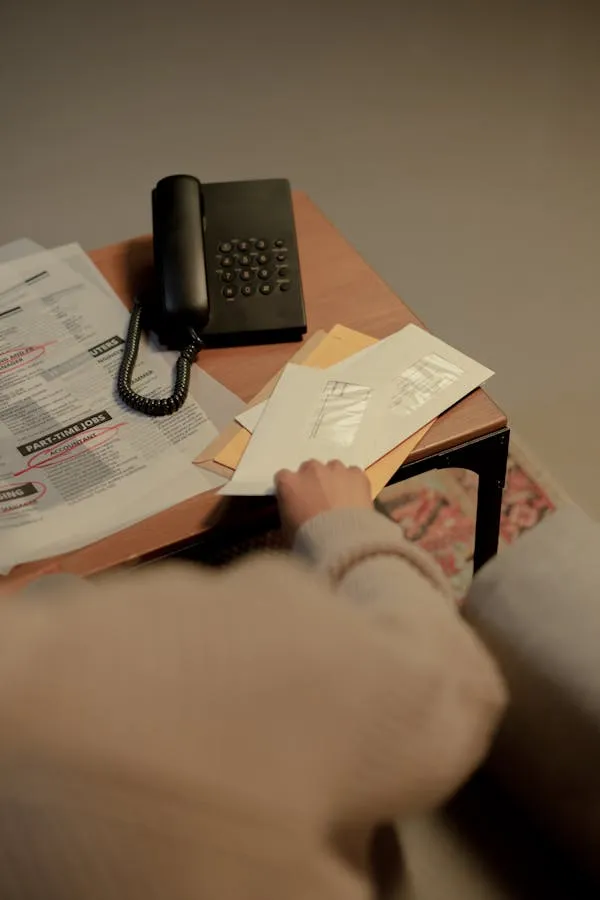

2. Neglecting Emergency Savings

Pavel Danilyuk on Wikimedia Commons

Pavel Danilyuk on Wikimedia Commons

Unexpected expenses are a part of life, yet many neglect to build an emergency fund. Without savings, even minor financial setbacks can lead to significant stress. Establishing a safety net is essential for financial resilience.

3. Impulsive Spending Habits

Sora Shimazaki on Pexels

Sora Shimazaki on Pexels

The ease of online shopping has amplified impulsive buying behaviors. Without mindful spending, individuals risk accumulating unnecessary items and debt. Implementing a waiting period before purchases can curb impulsivity.

4. Chasing Investment Fads

Thirdman on Pexels Grabeh Accot on Pexels

Thirdman on Pexels Grabeh Accot on Pexels

From tulip mania to cryptocurrency surges, history is life with investment bubbles. Jumping on trends without thorough research can lead to significant losses. Diversified, informed investing is key to long-term success.

5. Ignoring Financial Planning

Mohamed hamdi on Wikimedia Commons

Mohamed hamdi on Wikimedia Commons

Without a clear financial plan, it’s easy to drift into debt and miss savings goals. Regularly reviewing and adjusting one’s financial roadmap ensures alignment with long-term objectives.

6. Living Beyond Means

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

The desire to maintain a certain lifestyle can lead to spending more than one earns. This habit often results in debt accumulation and financial instability. Prioritizing needs over wants is essential for sustainable living.

7. Relying Solely on Cash

Photo By: Kaboompics.com on Pexels

Photo By: Kaboompics.com on Pexels

While cash can help control spending, avoiding credit entirely may hinder credit score development. A balanced approach ensures financial flexibility and creditworthiness.

8. Overcommitting to Subscriptions

Ron Lach on Pexels

Ron Lach on Pexels

Monthly subscriptions, while seemingly affordable, can accumulate and strain budgets. Regularly reviewing and canceling unused services can free up funds for essential expenses.

9. Lack of Financial Education

PNW Production on Pexels

PNW Production on Pexels

Many financial mistakes stem from a lack of understanding. Investing time in financial literacy can empower individuals to make informed decisions and avoid common pitfalls.

10. Underestimating Small Expenses

Photo By: Kaboompics.com on Pexels

Photo By: Kaboompics.com on Pexels

Daily small purchases, like coffee or snacks, can add up over time. Tracking these expenses helps in identifying areas to cut back and save more effectively.

11. Panic Selling Investments

Pavel Danilyuk on Wikimedia Commons

Pavel Danilyuk on Wikimedia Commons

Market fluctuations are natural, but reacting emotionally can lead to selling assets at a loss. Maintaining a long-term perspective is crucial for investment success.

12. Not Utilizing Budgeting Tools

Photo By: Kaboompics.com on Pexels

Photo By: Kaboompics.com on Pexels

Modern technology offers numerous tools to track and manage finances. Leveraging these can provide clarity and control over one’s financial situation.

13. Delaying Retirement Planning

Kampus Production on Pexels

Kampus Production on Pexels

Procrastinating on retirement savings can lead to insufficient funds in later years. Starting early allows for compound growth and a more comfortable retirement.

14. Co-signing Loans Without Caution

Alena Darmel on Pexels

Alena Darmel on Pexels

Co-signing makes one equally responsible for the debt. If the primary borrower defaults, the co-signer’s credit and finances are at risk. It’s essential to assess the risks before agreeing.

15. Avoiding Professional Advice

cottonbro studio on Wikimedia Commons

cottonbro studio on Wikimedia Commons

Many avoid seeking financial advice due to cost or pride. However, professionals can provide tailored strategies to improve financial health and avoid common mistakes.