15 Ways You Tried to Make a Dollar Stretch in the Past

Making a dollar last used to be a skill and a necessity, especially when money was tight. Whether budgeting carefully or getting creative, people found smart ways to stretch every cent. These methods show the resourcefulness of the past and how far some would go to make a buck count.

- Tricia Quitales

- 4 min read

Saving money wasn’t just about clipping coupons — it was a way of life. In the past, people had to be inventive and mindful of how every dollar was spent. From reusing leftovers to buying in bulk, many old habits were rooted in making limited funds go a long way. This article explores 15 relatable and clever ways people used to stretch their money.

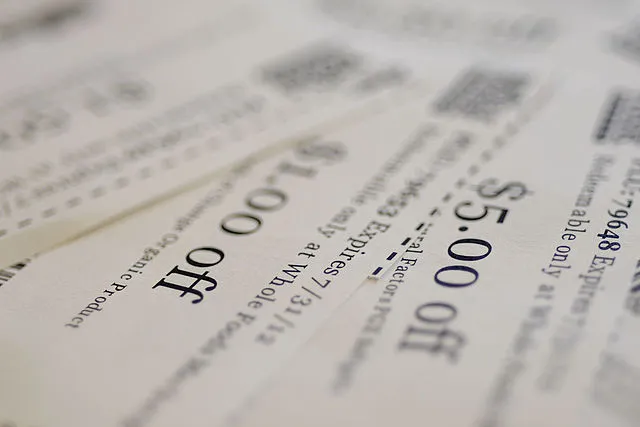

1. Clipping Coupons from the Sunday Paper

Senior Airman Wesley Farnsworth on Wikimedia

Senior Airman Wesley Farnsworth on Wikimedia

Every Sunday meant spreading out the newspaper and cutting out paper coupons by hand. People organized them in envelopes or folders to save a few cents at checkout. Over time, those small savings really added up.

2. Using Every Drop of a Product

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Whether it was shampoo, toothpaste, or ketchup, nothing was thrown away until it was completely empty. Bottles were turned upside down, and tubes were rolled tightly. Waste not, want not was the rule.

3. Reusing Aluminum Foil and Plastic Bags

cottonbro studio on pexels

cottonbro studio on pexels

Instead of tossing foil or sandwich bags after one use, people would wash and reuse them. It might seem odd now, but it was a normal part of frugal kitchen life. A little effort saved a lot over time.

4. Turning Leftovers into New Meals

Clem Onojeghuo on Pexels

Clem Onojeghuo on Pexels

Leftover meatloaf became sandwiches, and last night’s veggies went into soup. Nothing edible was wasted if it could be transformed into something else. Stretching meals meant stretching dollars.

5. Buying Store Brands Instead of Name Brands

Pixabay on Pexels

Pixabay on Pexels

Store-brand products cost less and often worked just as well as the popular labels. People learned that a plain label didn’t mean poor quality. The savings were worth skipping the fancy packaging.

6. Shopping at Thrift Stores and Yard Sales

cottonbro studio on Pexels

cottonbro studio on Pexels

Secondhand shopping was a budget-friendly habit. From clothes to furniture, many treasures were found for a fraction of the cost. A little digging could lead to big savings.

7. Cutting Your Own Hair or Getting a Friend to Do It

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

Haircuts at home weren’t just for kids; they saved money for the whole family. Kitchen scissors and mirrors were all part of the setup. It might not have been perfect, but it kept cash in your pocket.

8. Hanging Clothes to Dry Instead of Using a Dryer

Dziana Hasanbekava on Pexels

Dziana Hasanbekava on Pexels

Dryers used energy, so hanging clothes on a line was the cheaper option. Clothes smelled fresh, and the electric bill stayed low. It was eco-friendly before that was even a trend.

9. Borrowing Instead of Buying

ECBULAT on Pexels

ECBULAT on Pexels

Need a tool, dress, or book? Someone in your circle probably had one you could borrow. Sharing cut down on spending and built a sense of community.

10. Making Gifts by Hand

Yan Krukau on pexels

Yan Krukau on pexels

Homemade crafts, baked goods, or photo albums became heartfelt presents. They cost less but meant more because they took time and thought. Creativity often replaced cash.

11. Walking Instead of Driving

Lukas Rychvalsky on Pexels

Lukas Rychvalsky on Pexels

If the store or school was close enough, walking saved gas money. It was also healthier and cheaper, especially when every mile counted. There was no need to start the car for a short trip.

12. Waiting for Sales and Layaway Plans

Max Fischer on Pexels

Max Fischer on Pexels

Buying on sale or putting items on layaway helped avoid debt. People watched ads and timed their purchases carefully. Patience often paid off with big discounts.

13. Using the Library for Books, Movies, and More

Pixabay on Pexels

Pixabay on Pexels

Instead of buying books or renting movies, the library offered it all for free. Families spent hours browsing the shelves. It was a place for entertainment without spending a dime.

14. Cooking at Home Instead of Eating in Restaurants

Kristina Snowasp on Pexels

Kristina Snowasp on Pexels

Home-cooked meals were cheaper and often healthier than restaurant food. Stretching groceries across multiple meals saved even more. Dining out was saved for special occasions only.

15. Fixing Things Instead of Replacing Them

Ksenia Chernaya on Pexels

Ksenia Chernaya on Pexels

Broken toys, leaky faucets, or worn-out shoes were repaired before being thrown away. Knowing how to fix things was a money-saving superpower. If it could be patched, glued, or sewn, it lived to see another day.

- Tags:

- save

- money

- budget

- hacks

- frugal living