16 Smart Things People Over 50 Are Doing With Their Money

Discover how savvy Americans over 50 are making the most of their money with these 16 smart financial moves.

- Chris Graciano

- 3 min read

As retirement nears, money decisions become more critical than ever. Many Americans over 50 are embracing new strategies to protect and grow their finances. Here are 16 things they do to ensure a secure and comfortable future.

1. Downsizing Their Homes

Ketut Subiyanto

Ketut Subiyanto

Trading a large house for a smaller, more manageable space helps cut property taxes, utility bills, and maintenance costs. It also frees up cash that can be reinvested or saved.

2. Delaying Social Security Benefits

Matthias Zomer on Pexels

Matthias Zomer on Pexels

By waiting until 70 to claim Social Security, retirees can increase their monthly payments significantly. This move can mean thousands more over a lifetime.

3. Diversifying Income Streams

SHVETS production on Pexels

SHVETS production on Pexels

Instead of relying solely on pensions or savings, many are adding income sources like part-time work, online freelancing, or rental properties. This helps hedge against inflation and market volatility.

4. Investing in Health and Wellness

SHVETS production on Pexels

SHVETS production on Pexels

Older adults are spending on gym memberships, healthy food, and preventive care. The idea is to stay healthier longer, reducing future medical expenses.

5. Cutting Back on Unnecessary Subscriptions

Tima Miroshnichenko on Pexels

Tima Miroshnichenko on Pexels

Streaming services, monthly boxes, and forgotten memberships often drain accounts silently. People over 50 are reviewing their expenses and canceling unused services.

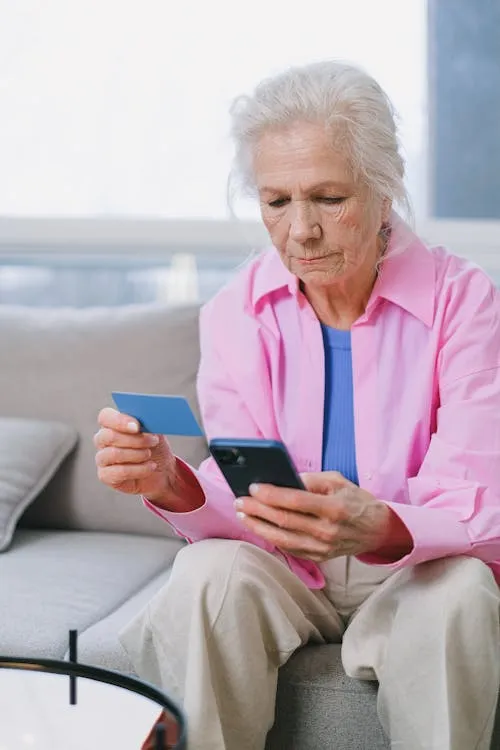

6. Paying Off High-Interest Debt

Kampus Production on Pexels

Kampus Production on Pexels

Eliminating credit card balances and high-interest personal loans has become a priority. It reduces financial stress and improves credit scores.

7. Automating Savings and Bill Payments

Andrea Piacquadio on Pexels

Andrea Piacquadio on Pexels

Setting up automatic transfers to savings accounts and automatic bill payments ensures consistency and avoids late fees. It’s a hassle-free way to stick to financial goals.

8. Rebalancing Investment Portfolios

Andrea Piacquadio on Pexels

Andrea Piacquadio on Pexels

As retirement approaches, many shift from high-risk to more stable investments. Adjusting asset allocation helps protect against big market dips.

9. Using Catch-Up Contributions

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

People over 50 can contribute more to 401(k)s and IRAs thanks to catch-up rules. These additional savings offer both tax advantages and bigger retirement cushions.

10. Considering Long-Term Care Insurance

Andrea Piacquadio on Pexels

Andrea Piacquadio on Pexels

Long-term care costs can be devastating. Savvy seniors are looking into insurance plans to cover nursing homes, assisted living, or in-home care.

11. Starting a Side Hustle

cottonbro studio on Pexels

cottonbro studio on Pexels

Many are turning hobbies into income streams—whether baking, consulting, or selling crafts online. This not only increases their income but also keeps them active and engaged.

12. Refinancing Mortgages

AS Photography on Pexels

AS Photography on Pexels

Lower interest rates present an opportunity to refinance and slash monthly payments. Even a small rate drop can lead to huge savings over time.

13. Setting Up Estate Plans

Pixabay on Pexels

Pixabay on Pexels

Creating wills, powers of attorney, and living trusts ensures assets go where they are intended. It also helps avoid legal problems for loved ones.

14. Supporting Adult Children Wisely

Andrea Piacquadio on Pexels

Andrea Piacquadio on Pexels

Rather than handing out cash, many are offering financial guidance or temporary help. They’re setting boundaries to avoid jeopardizing their own retirement.

15. Embracing Frugal Living

SHVETS production on Pexels

SHVETS production on Pexels

Couponing, shopping second-hand, and embracing minimalism are back in fashion. These habits stretch dollars and align spending with personal values.

16. Traveling During Off-Peak Seasons

Kindel Media on Pexels

Kindel Media on Pexels

To save on airfare and lodging, older adults are taking advantage of flexible schedules. Traveling in shoulder seasons means fewer crowds and better prices.