18 Tax Mistakes That Could Cost You Big—But Are Totally Avoidable

Avoiding these 18 common tax mistakes could save you thousands, keep the IRS off your back, and ensure you get every deduction you deserve!

- Alyana Aguja

- 6 min read

Each year, millions of taxpayers pay dearly for mistakes, such as missing deductions, underreporting income, or filing too early, so they end up facing penalties, audits, and lost refunds. From missed side hustle income to overlooked tax credits, these mistakes are usually simple to prevent with the right information. By avoiding these 18 common tax traps before you file, you can save money and stay out of trouble with the IRS!

1. Forgetting to Report Side Hustle Income

sofatutor from Unsplash

sofatutor from Unsplash

That other money from freelancing, tutoring, or selling on the web? The IRS deems it taxable income, and not reporting it could lead to penalties or an audit. Even if you don’t get a 1099, you’re still on the hook for reporting earnings.

2. Neglecting to Claim All Eligible Deductions

ThisisEngineering from Unsplash

ThisisEngineering from Unsplash

Did you know that educators can write off classroom costs or that employment search expenses in your profession may qualify as deductions? Numerous taxpayers forfeit money without claiming small but legitimate deductions such as interest on student loans or business expenses incurred for self-employment. Always consult the most current rules on deductions before submitting.

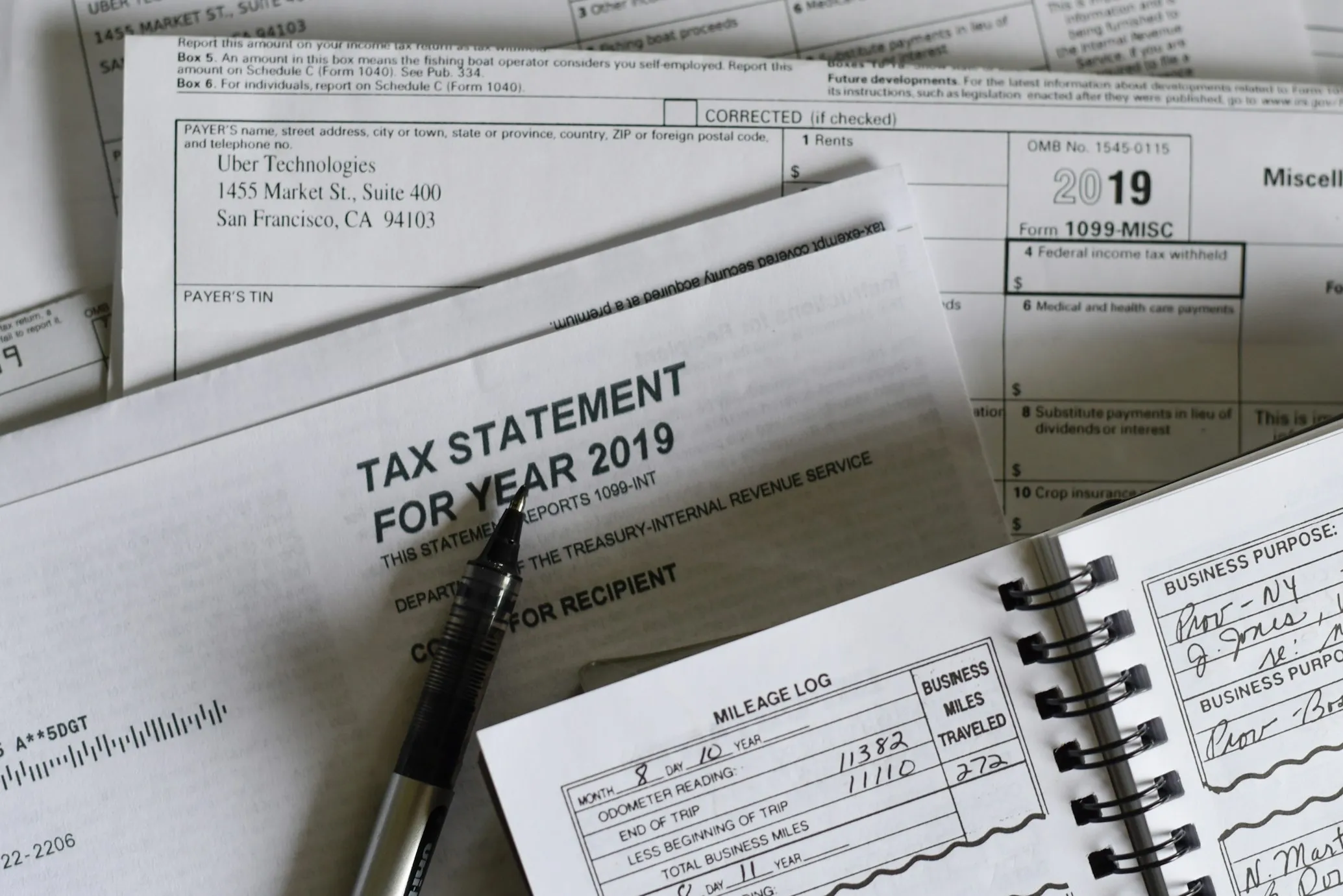

3. Misclassifying Workers as Independent Contractors

Jon Tyson from Unsplash

Jon Tyson from Unsplash

If you bring in help for your business, classifying workers as independent contractors when they are actually employees can result in IRS penalties. Uber and FedEx have both paid dearly for getting this wrong. If you get to dictate how and when the work is performed, they could be legally considered an employee, not a contractor.

4. Filing Too Early and Missing Forms

Kelly Sikkema from Unsplash

Kelly Sikkema from Unsplash

Hastily filing before receiving all your tax papers can result in missing a key W-2, 1099, or investment statement. This can result in underreporting income and having to file an amended return. Always double-check for missing papers before filing.

5. Claiming the Wrong Filing Status

Scott Graham from Unsplash

Scott Graham from Unsplash

Claiming as “Head of Household” when you don’t qualify can initiate an IRS audit. Single parents frequently make this mistake. They believe that custody is sufficient to qualify them for the status. You must pay more than half of the household expenses on a dependent for the IRS to permit you to claim this status.

6. Overlooking the Home Office Deduction (If Applicable)

Windows from Unsplash

Windows from Unsplash

Many telecommuters are reluctant to take the home office deduction, worrying about being audited. However, if you have a dedicated workspace, you’re likely passing up a tax advantage. The simplified method permits you to deduct $5 per square foot, not to exceed 300 square feet.

7. Overstating Charitable Contributions

Wizdan Zacky Fauzan from Unsplash

Wizdan Zacky Fauzan from Unsplash

Claiming charitable contributions without documentation can get you in hot water. In 2018, a taxpayer forfeited a deduction for donating $18,000 worth of household items due to a lack of qualified appraisal. Always maintain receipts and see that non-cash donations exceeding $500 adhere to IRS guidelines.

8. Omitting to Pay Estimated Taxes

Sasun Bughdaryan from Unsplash

Sasun Bughdaryan from Unsplash

Self-employed and gig economy workers frequently do not pay taxes quarterly, resulting in penalties. The IRS wants taxpayers to make tax payments during the year, not only in April. You might be required to make estimated payments if you have more than $1,000 in tax liability.

9. Not Reporting Cryptocurrency Transactions

Thought Catalog from Unsplash

Thought Catalog from Unsplash

Crypto isn’t tax-free—ask the IRS, which has clamped down on unreported activity. It has to be reported whether you sold Bitcoin, traded Ethereum, or accrued staking rewards. Even if you didn’t spend out to USD, taxable events can come into play.

10. Forgetting about Foreign Bank Account Reporting

Ferran Fusalba Roselló from Unsplash

Ferran Fusalba Roselló from Unsplash

If you have over $10,000 in foreign bank accounts, you must file an FBAR (Foreign Bank Account Report). The IRS has penalized taxpayers thousands of dollars for not reporting foreign accounts. Even a simple error could mean steep penalties.

11. Claiming the Wrong Number of Dependents

Robert Collins from Unsplash

Robert Collins from Unsplash

Listing a child who is no longer a dependent or claiming one who has already been declared on another return can result in problems. In the case of divorce, this is a usual error that will result in IRS disagreements. Check dependency status annually to prevent delays.

12. Overlooking the Earned Income Tax Credit (EITC)

Alexander Grey from Unsplash

Alexander Grey from Unsplash

Millions of eligible taxpayers don’t receive the EITC, which may be worth thousands. In 2020, the IRS estimated that 20% of eligible taxpayers didn’t claim it. If you have a low-to-moderate income, check if you qualify—it’s one of the largest tax credits available.

13. Not Making Contributions to Retirement Accounts

James Hose Jr from Unsplash

James Hose Jr from Unsplash

Not participating in an IRA or 401(k) can result in lost tax savings. In 2019, an estimated 45% of workers did not use their retirement savings. Contributions reduce taxable income while allowing you to save for the future.

14. Skipping the Child and Dependent Care Credit

Caleb Woods from Unsplash

Caleb Woods from Unsplash

If you pay for summer camp, after-school care, or daycare, you may be eligible for this credit. One taxpayer lost $2,000, assuming it only counted for traditional daycare centers. The credit can be used as long as the provider reports income.

15. Incorrectly Reporting Investment Gains and Losses

Nick Chong from Unsplash

Nick Chong from Unsplash

Omitting stock sales or incorrect reporting of cost basis will result in IRS adjustments and penalties. Robinhood and other brokerages send you tax documents, but you are responsible for accurately reporting gains. Hiring tax software or a CPA can prevent errors that cost you money.

16. Omitting to Sign and Date Your Return

Cytonn Photography from Unsplash

Cytonn Photography from Unsplash

Believe it or not, the IRS throws out thousands of returns annually because they lack signatures. Even those filing electronically must do it properly according to the verification procedure. Check twice before filing to avoid delays.

17. Not Keeping Tax Records for Long Enough

Towfiqu barbhuiya from Unsplash

Towfiqu barbhuiya from Unsplash

The IRS may audit returns as far back as three years, and in the case of fraud, there is no time limit. One taxpayer lost deductions because he didn’t submit receipts for business expenses four years earlier. Keep receipts, statements, and tax records for at least seven years.

18. Disregarding IRS Notices Until It’s Too Late

Olga DeLawrence from Unsplash

Olga DeLawrence from Unsplash

Most taxpayers are overwhelmed and dismiss IRS notices, which results in more penalties and interest. A man dismissed a $500 tax underpayment notice before it snowballed into thousands of dollars in penalties. Taking action quickly can often resolve matters without severe repercussions.