18 Unexpected Ways People Waste Money Without Realizing It

Many people unintentionally squander money on daily routines and purchases that, at the time, seem little but add up over time. These financial leaks can rapidly drain your savings from purchases you don't need to subscriptions you forgot about.

- Tricia Quitales

- 5 min read

Many times, money is lost through unassuming behaviors, leading to losses greater than one would have imagined. Covering everything from forgotten subscriptions to impulsive purchases, this article explores 18 surprising daily ways people waste money. Recognizing these behaviors helps people to be proactive in reducing unwanted expenses and improving their financial situation.

1. Unused Subscriptions

Junior Teixeira on Pexels

Junior Teixeira on Pexels

Many sign up for subscriptions, like streaming services or exercise apps, and then forget about them. These recurring fees can put a dent in your bank account over time without you using the service at all. Spend time reviewing your subscriptions and deleting the ones you hardly use.

2. Buying Coffee Every Day

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Although buying coffee from cafes daily seems like a small outlay, it soon accumulates. Five dollars a day on coffee costs $1,825 annually! Making your coffee at home could save hundreds or maybe thousands of dollars yearly.

3. Expired Food

Keegan Evans on Pexels

Keegan Evans on Pexels

Food left in your pantry or refrigerator for too long expires and is thrown away. Purchasing things in bulk usually results in waste greater than what you use. Plan your meals and record expiration dates to prevent throwing out perfectly good food.

4. Buying in Bulk Without a Plan

Wallace Chuck on Pexels

Wallace Chuck on Pexels

Purchasing in bulk helps you save money, but only if you can use the goods before they go bad. Many things you might not need or cannot eat fast can be wasted. Only buy in bulk if you have a clear use or storage scheme for the goods.

5. Impulse Buying

energepic.com on Pexels

energepic.com on Pexels

Common ways to waste money are making haphazard purchases on a whim or during a sale. Many times, these are superfluous objects that go unneeded. Stop and consider whether you really need the item before you buy it.

6. Not Using Coupons or Discount Codes

yi lu on Pexels

yi lu on Pexels

Many people ignore using coupons or discount codes while shopping, so they pay more than required. Spend some time looking for specials or discounts before you buy. These little savings taken over time can add up rather dramatically.

7. Overpaying for Brand Name Products

Wendy Wei on Pexels

Wendy Wei on Pexels

Though the quality is the same as generic substitutes, brand names sometimes cost more. Switching to store brands or off-brands will save you a lot for things like food and house goods. Never assume, on autopilot, that a well-known brand is the best.

8. Paying for Convenience

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Many services, including express shipping or food delivery, charge extra for ease. Although they save time, they could be an unnecessary expense. Think about whether substitutes exist and whether the convenience justifies the additional expense.

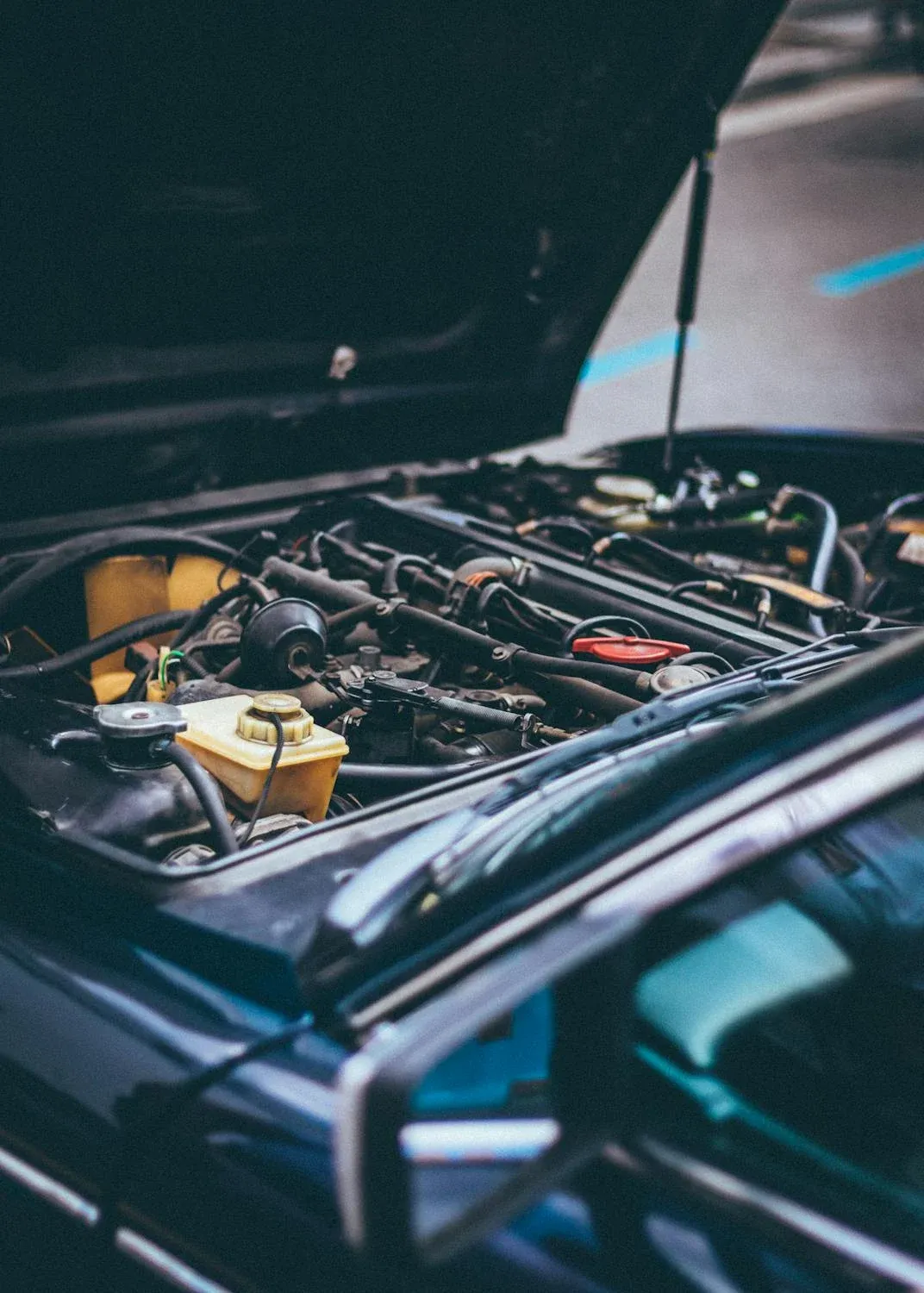

9. Neglecting Maintenance

George Sultan on Pexels

George Sultan on Pexels

Ignoring appliance, home, or car maintenance can result in costly repairs later. Regular maintenance is less expensive than major repairs, which usually require more time and money. Plan regular upkeep to avoid later expensive shocks.

10. Overdraft Fees

Pixabay on Pexels

Pixabay on Pexels

If you often spend more than you have in your account, bank overdraft fees can soon mount up. Set up low-balance alarms or link a savings account for overdraft protection to prevent these needless charges. This is a simple approach to having more cash in your hand.

11. Upgrading Gadgets Too Often

Jakub Zerdzicki on Pexels

Jakub Zerdzicki on Pexels

Continually upgrading your laptop, smartphone, or other device to the newest model results in unnecessary expenses. Many people can hang onto their devices for longer periods of time yet do not fully use their features. As long as your present devices serve well, stick with them to save money.

12. Eating Out Too Often

Marlein Topciu on Pexels

Marlein Topciu on Pexels

Regular restaurant or takeout dining can add up to a sizable monthly expense. Cooking at home is usually far more reasonably priced and healthier. To cut expenses, schedule your meals ahead of time and reduce the frequency of your dining out.

13. Paying for Fitness Memberships You Don’t Use

Pietro Saura on Pexels

Pietro Saura on Pexels

If you are not regularly attending fitness classes or going to the gym, your membership could be wasted. These memberships can cost a lot even if you are not benefiting from them. Look for free or low-cost substitutes, including outdoor activities or home workouts.

14. Not Comparing Prices

Antoni Shkraba on Pexels

Antoni Shkraba on Pexels

Ignoring the need to shop around for the best price on goods could lead to spending more. Many people just grab the first thing they come across without looking at other stores or websites. To be sure you’re getting the best bargain, use comparison tools and shop about.

15. Buying Cheap, Low-Quality Items

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Though they seem like a good bargain at times, cheap items sometimes break or wear out rapidly, which forces more frequent replacement. Over time, spending a little more on better-quality goods will really help you save money. For things you use regularly, invest in quality.

16. Forgetting to Turn Off Utilities

Mark McCammon on Pexels

Mark McCammon on Pexels

Leaving lights, electronics, or heating on too long wastes money and increases utility bills. Make a habit of unplugging appliances you’re not using or turning off lights when leaving a room. Little changes can result in big monthly bill savings.

17. Paying for Unnecessary Warranties

Pixabay on Pexels

Pixabay on Pexels

Particularly for electronics, extended warranties for products sometimes are not worth the expense. Most products come with a basic warranty; many problems can be fixed more affordably without extended coverage. If you can replace the item without extra protection plans, skip them.

18. Not Maximizing Credit Card Rewards

Thirdman on Pexels

Thirdman on Pexels

Although many credit cards provide cashback or rewards, you forfeit these advantages if you misuse them. Ignoring your spending and rewards could mean letting money go unrealized. Use your card for purchases with rewards and pay off the balance to avoid interest charges.