20 Apps Changing the Way We Save and Invest

A list of 20 game-changing apps that are helping people make smarter decisions with their money.

- Daisy Montero

- 5 min read

Saving and investing used to feel overwhelming, but these apps are changing the game. They’re designed to make managing your money easier, no matter your financial goals. You’ll find tools that round up spare change, track spending, or offer insights into the stock market. Each app has its own unique way of helping you build a brighter financial furture.

1. Acorns

Pursuit Technology on Wikimedia Commons

Pursuit Technology on Wikimedia Commons

Acorns makes investing so easy you won’t even notice you’re doing it. It rounds up your purchases and invests the spare change in diversified portfolios. It’s an effortless way to grow your money in the background while you go about your day.

2. Robinhood

Robinhood on Wikimedia Commons

Robinhood on Wikimedia Commons

Robinhood lets you trade stocks, EFTs, and cryptocurrencies without commission fees. The app is easy to navigate, offering real-time market data and personalized notifications. It’s a user-friendly choice for beginners and those exploring investment opportunities.

3. E*TRADE

E-Trade on Wikimedia Commons

E-Trade on Wikimedia Commons

E*TRADE offers a user-friendly platform for trading stocks, ETFs, options, and mutual funds. The app includes educational resources to help beginners, while experienced traders can benefit from its advanced tools. It’s a versatile choice for managing investments and building a diverse portfolio.

4. YNAB

YNAB on Wikimedia Commons

YNAB on Wikimedia Commons

You Need A Budget (YNAB) takes a proactive approach to budgeting, assigning every dollar a job. It focuses on helping you break the paycheck-to-paycheck cycle and build long-term savings. The app’s educational resources make financial planning easy to understand and implement.

5. Betterment

Betterment on Wikimedia Commons

Betterment on Wikimedia Commons

Betterment uses a robo-advisor to create personalized investment strategies tailored to your goals. It automatically rebalances your portfolio and optimizes it for taxes. Whether saving for retirement or rainy days, this app simplifies wealth management.

6. Stash

Stash Financial, Inc. on Wikimedia Commons

Stash Financial, Inc. on Wikimedia Commons

Stash allows you to start investing with as little as $1 by offering fractional shares of stocks and EFTs. It provides financial education to help users make informed investment decisions and banking features to manage their finances in one place.

7. Wealthfront

Wealthfront on Wikimedia Commons

Wealthfront on Wikimedia Commons

Wealthfront automates your investments using a robo-advisor that aligns with your risk tolerance and objectives. It also offers financial planning tools for big goals like retirement or college savings. The app simplifies investing while maximizing returns through advanced algorithms.

8. Chime

Chime on Wikimedia Commons

Chime on Wikimedia Commons

Chime helps you save by rounding up your purchases and transferring the difference into a savings account. It also offers early direct deposit and no monthly fees to make saving hassle-free. Chime is a great tool for simplifying your finances while effortlessly building savings.

9. Personal Capital

Personal Capital on Wikimedia Commons

Personal Capital on Wikimedia Commons

Personal Capital consolidates your financial accounts, including investments, to provide a complete overview of your net worth. Its budgeting and retirement planning tools help you make smarter financial decisions. The app also includes a free investment analysis feature for better portfolio management.

10. Fidelity

Prodbot on Wikimedia Commons

Prodbot on Wikimedia Commons

Fidelity offers a comprehensive platform for investing in stocks, EFTs, mutual funds, and retirement plans. The app features easy-to-use tools, personalized advice, and zero-commission trades. It’s a trusted choice for investors looking to grow their wealth and plan for the future.

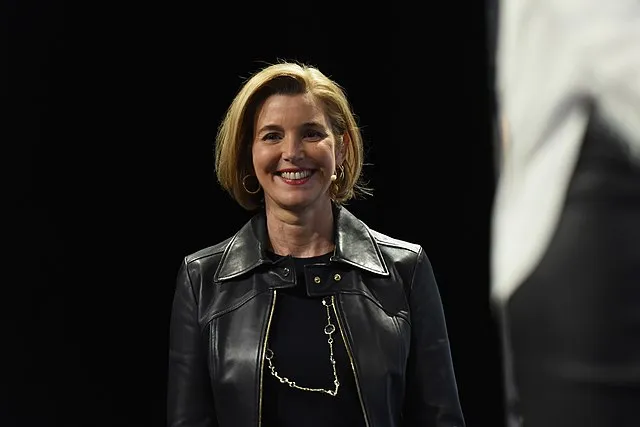

11. Ellevest

TechCrunch on Wikimedia Commons

TechCrunch on Wikimedia Commons

Ellevest focuses on closing the gender investing gap by offering personalized portfolios designed for women’s unique financial needs. It considers factors like pay gaps and career breaks to create tailored investment strategies. This app also includes tools for budgeting, saving, and financial education.

12. SoFi

SoFi on Wikimedia Commons

SoFi on Wikimedia Commons

SoFi combines investing, banking, loans, and financial planning in one app. It offers zero-commission trades, personalized portfolio options, and access to financial advisors—a great choice for those looking to streamline multiple financial tasks.

13. Greenlight

Arcticons Team on Pexels

Arcticons Team on Pexels

Greenlight empowers kids to learn money management with a debit card they can use under parental supervision. Parents can set spending limits, assign chores, and track their kids’ savings goals. It’s a hands-on way to teach financial responsibility from a young age.

14. Wealthsimple

Wealthsimple Inc. on Wikimedia Commons

Wealthsimple Inc. on Wikimedia Commons

Wealthsimple uses a robo-advisor to simplify investing in diversified portfolios tailored to your goals. The app also offers socially responsible investment options for environmentally conscious users. It’s ideal for anyone wanting an easy way to invest while aligning with their values.

15. NerdWallet

NerdWallet on Wikimedia Commons

NerdWallet on Wikimedia Commons

NerdWallet helps you make informed financial decisions by offering advice on credit cards, loans, mortgages, and more. The app provides detailed comparisons and recommendations to help you save money and improve your financial health. It’s an excellent resource for anyone looking to optimize their finances.

16. MyBlock

H&R Block on Wikimedia Commons

H&R Block on Wikimedia Commons

MyBlock by H&R Block makes tax filing easy by guiding you through the step-by-step process. The app offers live support from tax professionals and helps maximize your refund. It’s an excellent solution for straightforward, stress-free tax filing.

17. Credit Karma

Siegel Gale / Credit Karma on Wikimedia Commons

Siegel Gale / Credit Karma on Wikimedia Commons

Credit Karma offers free access to your credit score and reports, helping you stay on top of your financial health. The app provides personalized recommendations for improving your score and helps you track any changes in your credit report. It’s a valuable tool for anyone building or maintaining good credit.

18. Ally Bank

Toomuchcash at en.wikipedia on Wikimedia Commons

Toomuchcash at en.wikipedia on Wikimedia Commons

Ally Bank offers high-yield savings accounts, CDs, and competitive checking account options, all accessible online. The app’s user-friendly interface and no monthly fees make it easy to manage your banking needs. It’s an ideal choice for anyone seeking efficient, fee-free banking.

19. Revolut

Revolut Ltd on Wikimedia Commons

Revolut Ltd on Wikimedia Commons

Revolut offers everything from budgeting and saving to buying crypto and investing in stocks. It’s a versatile financial app that allows you to track spending, send money abroad, and even get cashback on purchases. Whether traveling or managing everyday finances, it has something for everyone.

20. Square

Square, Inc. on Wikimedia Commons

Square, Inc. on Wikimedia Commons

Square is a comprehensive business banking app that helps small business owners manage payments, sales, and finances. The app offers a point-of-sale system, invoicing, and payroll management all in one place. It’s perfect for entrepreneurs who need an easy way to handle business transactions.