20 Best Practices for Managing Your 401(k)

Securing your financial future depends critically on good management of a 401(k). Following certain best standards will help you to maximize the increase of your retirement funds and reduce possible risks. From account administration to investment decisions to contribution techniques, this article provides 20 basic ideas to help you maximize your 401(k) plan.

- Tricia Quitales

- 6 min read

One of the most effective instruments available for retirement savings is a 401(k), but only if properly handled will its full potential be achieved. The 20 excellent practices in this article enable people to take charge of their 401(k) and make wise decisions on asset allocation, contributions, and other areas. Following these rules will help you increase your retirement savings, prevent frequent errors, and guarantee that your 401(k) is operating as it should. These ideas can provide more financial stability in retirement regardless of your level of experience with investing.

1. Start Contributing Early

cottonbro studio on Pexels

cottonbro studio on Pexels

Your investments have more time to develop the earlier you start contributing to your 401(k). Thanks to compound interest, even modest payments can mount up over time. Start right away to seize this development possibility instead of waiting until later.

2. Contribute at Least Enough to Get the Match

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Many companies match your 401(k) contributions; hence, always try to contribute at least enough to fully utilize this. Your retirement funds would be much enhanced by this practically free money. Ignoring the game is like leaving cash on the counter.

3. Increase Contributions Gradually

Andrea Piacquadio on Pexels

Andrea Piacquadio on Pexels

If you cannot afford to make a sizable upfront donation, consider raising yours little by little over time. Even little annual increases can change your retirement savings. Automating this increase will allow you to keep to your savings targets.

4. Diversify Your Investments

Antoni Shkraba on Pexels

Antoni Shkraba on Pexels

By distributing your funds among several kinds of assets, diversification helps lower your 401k’s risk. This approach can help to flatten market ups and downs. Always ensure your portfolio calls for a mix of stocks, bonds, and other assets.

5. Review Your Asset Allocation Regularly

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

Your risk tolerance may vary as you get closer to retirement and call for changes to your asset allocation. Reviewing your portfolio often guarantees that it still reflects your risk tolerance and goals. Periodically remember to rebalance to keep your intended allocation.

6. Take Advantage of Automatic Increases

Pixabay on Pexels

Pixabay on Pexels

Many 401(k) plans let you automatically raise your contributions yearly. Without thinking about it, this tool will enable you to save more. One easy approach to slowly raise your savings over time is to set up automatic additions.

7. Avoid Early Withdrawals

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Pulling money from your 401(k) before retirement could cause taxes and penalties, drastically lowering your savings. Unless required, try not to touch your 401(k). Maintaining the money invested lets you compound your savings and enable growth.

8. Stay Informed About Fees

Ivan Samkov on Pexels

Ivan Samkov on Pexels

Knowing the costs associated with your plan is vital since fees can reduce your 401(k) profits. Look for affordable investing options; if you can, avoid high-fee funds. Even small fee savings over time could have a big impact.

9. Maximize Your Contributions

Sora Shimazaki on Pexels

Sora Shimazaki on Pexels

If feasible, try to contribute the maximum permitted by law to your 401(k) yearly. This will let you maximize tax incentives and boost your retirement savings. The contribution ceiling for people under 50 as of 2025 is $22,500; for those over 50, it is $30,000.

10. Take Advantage of Catch-Up Contributions

Tima Miroshnichenko on Pexels

Tima Miroshnichenko on Pexels

If you are over 50, you can contribute catch-up to your 401(k) above the usual amount. As you get ready for retirement, this is a fantastic technique to speed up your savings. Use this option fully to increase your savings for a more comfortable retirement.

11. Keep Track of Your Beneficiaries

Caleb Oquendo on Pexels

Caleb Oquendo on Pexels

Review the beneficiaries on your 401(k) often to be sure they represent your present intentions. Changes in your life, such as marriage or divorce, may require changing your beneficiary names. Maintaining this current situation will help avoid future issues for loved ones.

12. Avoid Borrowing From Your 401(k)

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Although some 401(k) plans allow loans, borrowing from your retirement money should be the last option. Should you not repay the loan, it could be seen as a distribution and result in taxes and fines. Generally speaking, you should consider alternative options before relying on your 401(k).

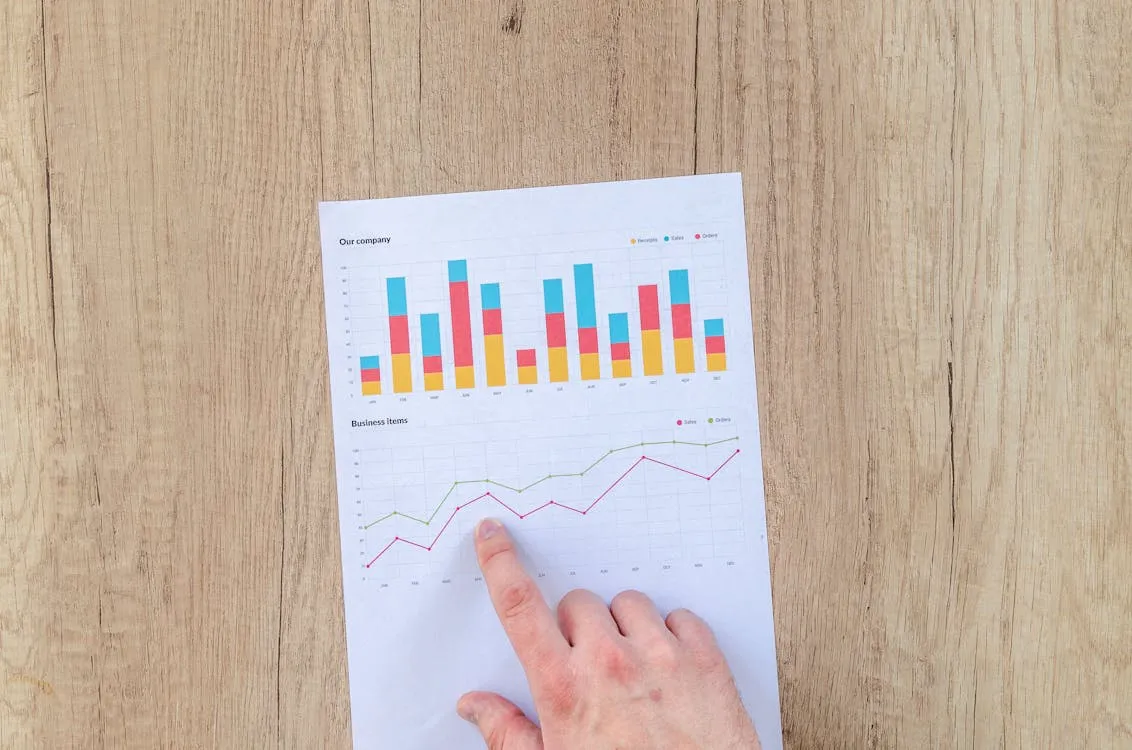

13. Monitor Your Investment Performance

Lukas on Pexels

Lukas on Pexels

Invest some time checking the performance of your 401(k). See if your assets meet your expectations; if not, make the required adjustments. Regular monitoring ensures that you will reach your target retirement age.

14. Stay Consistent with Contributions

Kindel Media on Pexels

Kindel Media on Pexels

Even if you can only contribute a little bit at times, try to be a regular contributor. Whether small or large, consistent contributions help create momentum over the years. Seizing long-term economic prospects depends on consistency.

15. Consider Roth 401(k) Options

cottonbro studio on Pexels

cottonbro studio on Pexels

If your company has a Roth 401(k), consider whether this choice would benefit you, particularly the projected tax rate increases. Although withdrawals in retirement are tax-free, Roth 401(k) contributions are made with after-tax earnings. Younger employees or those with a long investing horizon could find this an excellent option.

16. Avoid Chasing Hot Stocks

energepic.com on Pexels

energepic.com on Pexels

Investing depending on “hot” stocks or the most recent market movements could cause unneeded dangers. Instead, concentrate on a mixed approach that fits your long-term objectives. Keep calm and let your investments increase steadily over time to resist the need to make regular, rash adjustments.

17. Take Required Minimum Distributions (RMDs) When Necessary

Kaboompics.com on Pexels

Kaboompics.com on Pexels

You will have to start drawing necessary minimum distributions (RMDs) from your 401(k) once you turn 73. Ignoring these withdrawals could cost you fines. Make sure you schedule appropriately, knowing when RMDs start.

18. Know Your Plan’s Rules

Markus Winkler on Pexels

Markus Winkler on Pexels

Variations in 401(k) plans apply to things like loans, withdrawals, and vesting timelines. Spend some time reading over the particular guidelines in your plan. Knowing the specifics will enable you to decide how best to allocate your retirement funds.

19. Use Professional Advice When Needed

Antoni Shkraba on Pexels

Antoni Shkraba on Pexels

See a financial adviser if you are unsure how to handle your 401(k). Expert advice can enable you to design a plan fit for your particular financial position. An advisor can also guide you through difficult investment choices.

20. Stay Patient and Long-Term Focused

Anna Nekrashevich on Pexels

Anna Nekrashevich on Pexels

Retirement savings is more of a marathon than a sprint. Keep your long-term objectives clear-cut and avoid emotional decisions motivated by transient market swings. Growing your 401(k) toward a safe retirement calls for patience.

- Tags:

- 401k

- practices

- Savings

- Retirement