20 Best Tax Filing Tips for First-Time Filers

Filing taxes for the first time can feel overwhelming, but with the right tips, you can avoid mistakes and even save money.

- Sophia Zapanta

- 7 min read

Filing your taxes for the first time doesn’t have to be stressful if you know what to expect. From gathering the right documents to understanding deductions and credits, a little preparation can make tax season a breeze. These 20 tips will help first-time filers avoid costly errors, maximize refunds, and confidently tackle their taxes.

1. Gather All Your Documents Early

Jakub Zerdzicki on Pexels

Jakub Zerdzicki on Pexels

Before you start, ensure you have all the necessary documents, like your W-2, 1099s, and any student loan or investment tax forms. Missing paperwork can delay your filing and even cost you money. If you’re unsure what you need, check with your employer or financial institutions. Staying organized now saves you headaches later.

2. Know Your Filing Status

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Your filing status (Single, Married Filing Jointly, Head of Household, etc.) affects your tax rate and refund. Choosing the wrong one could mean paying more or getting a smaller refund. If you’re unsure, the IRS has an online tool to help. Your status is based on your situation as of December 31st, so choose wisely.

3. Use Free Filing Options

Leeloo The First on Pexels

Leeloo The First on Pexels

If you make less than $73,000, you may qualify for free filing through IRS Free File or tax software providers. Many first-time filers don’t realize they can do their taxes at no cost. Even if you don’t qualify, basic tax software is often cheaper than hiring a pro. Why pay more if you don’t have to?

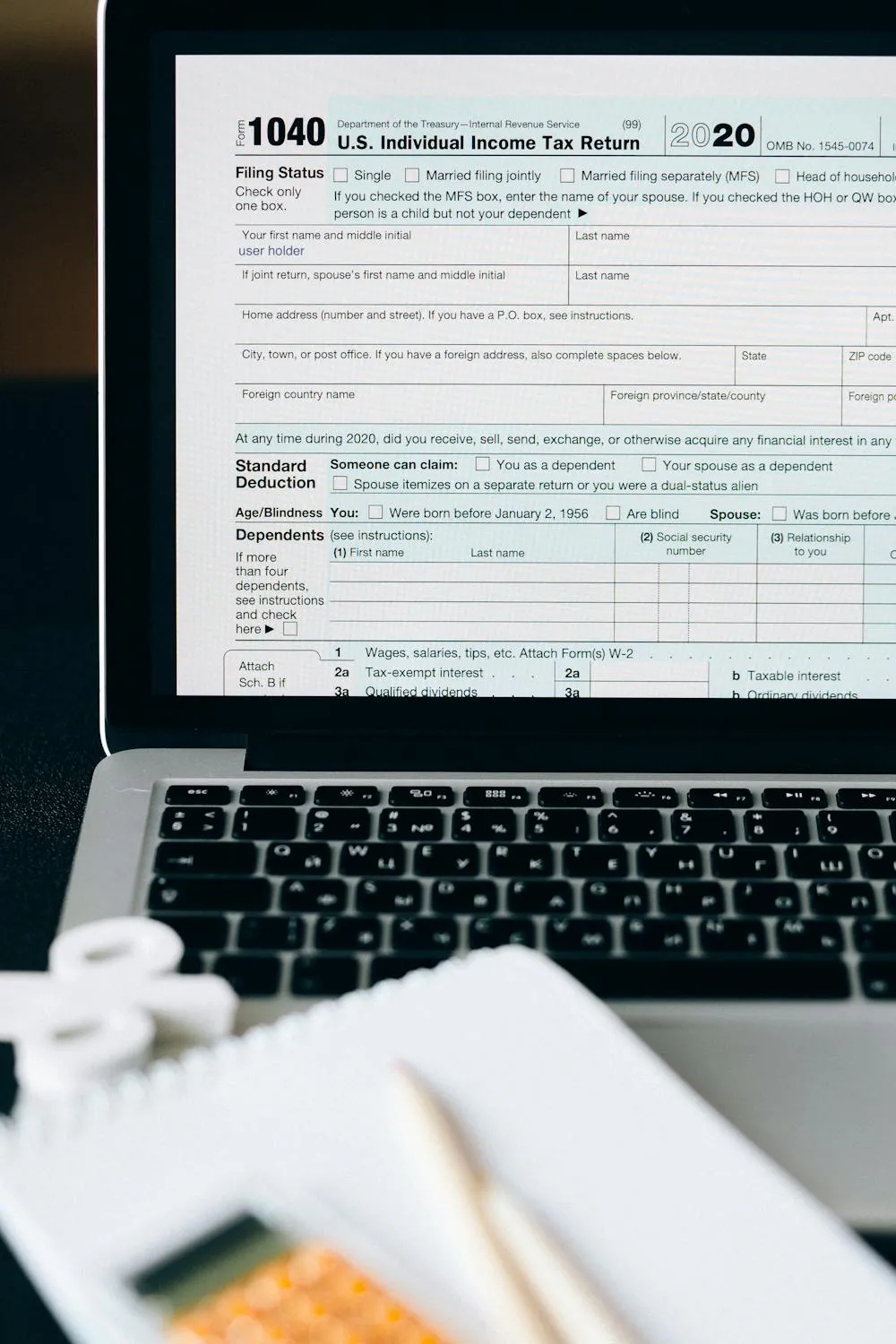

4. Understand the Standard Deduction vs. Itemizing

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

The IRS gives you a choice between taking the standard deduction (a set amount) or itemizing (listing individual expenses like medical costs or mortgage interest). Most first-time filers benefit from the standard deduction since it’s easier and often higher than itemized expenses. However, if you have large deductions, itemizing might save you more. A quick calculation can make all the difference.

5. Take Advantage of Tax Credits

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

Tax credits reduce your tax bill dollar for dollar, which is even better than deductions. Popular ones include the Earned Income Tax Credit (EITC), the Child Tax Credit, and the American Opportunity Tax Credit for students. Many people miss out simply because they don’t know they qualify. Check the IRS website or tax software to see what you’re eligible for.

6. Report All Income, Even Side Hustles

Kaboompics.com on Pexels

Kaboompics.com on Pexels

If you made money from a side gig, freelance work, or selling online, you need to report it. The IRS gets copies of your 1099 forms, so leaving them out can trigger an audit. Even cash jobs or Venmo payments count as taxable income. It’s better to report it now than face penalties later.

7. Check for Student Loan Interest Deductions

Julia M Cameron on Pexels

Julia M Cameron on Pexels

If you’re paying off student loans, you can deduct up to $2,500 in interest. This can lower your taxable income and reduce what you owe. Even if your parents help with payments, you might still qualify. Every little bit helps when tackling student debt.

8. Don’t Forget to File If You Had a Low Income

Nicola Barts on Pexels

Nicola Barts on Pexels

Even if you made very little money, filing can be worth it. You might qualify for a refund due to tax credits like the EITC. Many first-time filers leave money on the table by skipping their return. If you don’t file, you won’t get what you’re owed.

9. Use Direct Deposit for a Faster Refund

Liliana Drew on Pexels

Liliana Drew on Pexels

If you’re expecting a refund, choosing direct deposit can get you your money faster. The IRS processes direct deposit refunds much quicker than mailing paper checks. Plus, it reduces the chance of your refund getting lost or stolen. Faster money is always a good thing.

10. File Electronically to Avoid Errors

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

E-filing is faster, safer, and less prone to mistakes than mailing a paper return. The IRS checks your math and flags potential errors before processing your return. Paper returns take much longer to process, which means slower refunds. Go digital and make your life easier.

11. Understand How Tax Brackets Work

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Your income is taxed in brackets, meaning you don’t pay the same rate on every dollar you earn. For example, if you’re in the 22% bracket, only the portion of your income above the lower bracket threshold is taxed at 22%. Many first-time filers think they lose money by moving into a higher bracket, but that’s not how it works. Understanding this can help you plan better for next year.

12. Watch Out for Tax Scams

Leeloo The First on Pexels

Leeloo The First on Pexels

Scammers love tax season and often impersonate the IRS to steal personal information. The IRS will never call, email, or text you demanding immediate payment. If you get a suspicious message, ignore it and report it to the IRS. Stay alert, and don’t fall for scare tactics.

13. Don’t Rush—But Don’t Wait Until the Last Minute

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

Filing too early without all your documents can lead to mistakes, but waiting until April 15th increases stress. Aim to file as soon as you have everything ready. If you rush, you’re more likely to make errors or forget deductions. Balance is key—give yourself enough time to do it right.

14. Use an HSA or FSA to Lower Taxes

Tima Miroshnichenko on Pexels

Tima Miroshnichenko on Pexels

If you have a Health Savings Account (HSA) or Flexible Spending Account (FSA), contributions are tax-deductible. This lowers your taxable income and can save you money on medical expenses. HSAs even become tax-free if invested. If your job offers these accounts, take advantage of them.

15. Double-Check Your Bank and Personal Info

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Typos in your Social Security number or bank details can delay your refund or even cause your return to be rejected. Before hitting submit, review everything carefully. One wrong digit can cause a massive headache. A few extra minutes of checking can save you weeks of frustration.

16. If You Owe, Set Up a Payment Plan

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

If you end up owing money, don’t panic—you can set up a payment plan with the IRS. They offer installment agreements so you can pay over time without huge penalties. Ignoring the bill will only make things worse. Contact the IRS early to avoid extra fees.

17. Amend Your Return If You Make a Mistake

cottonbro studio on Pexels

cottonbro studio on Pexels

If you realize you forgot something after filing, you can file an amended return. The IRS allows corrections, and sometimes, fixing a mistake can get you a bigger refund. Don’t stress—errors happen, and they’re fixable. Just be sure to file the amendment as soon as possible.

18. Check If Your Parents Are Claiming You

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

If you’re a student or young adult, your parents may still claim you as a dependent. If they do, you can’t claim certain tax benefits yourself. Talk to them before filing to avoid mix-ups. A simple conversation can prevent a rejected return.

19. Save a Copy of Your Tax Return

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

You might need a copy of your tax return for next year’s filing, applying for loans, or verifying income. The IRS recommends keeping records for at least three years. Digital copies are fine, but make sure they’re secure. A lost return can cause major headaches down the road.

20. Plan Ahead for Next Year

Viridiana Rivera on Pexels

Viridiana Rivera on Pexels

Taxes aren’t just a once-a-year thing—keeping track of deductions, expenses, and income throughout the year makes filing easier. Adjust your W-4 at work if you owe a lot or got a big refund this year. A little planning now can save you time and money next tax season.