20 Best Ways to Protect Your Identity from Financial Fraud

Protecting your identity from financial fraud means staying alert, securing your personal information, and knowing the tricks scammers use to steal your money.

- Sophia Zapanta

- 6 min read

Financial fraud is everywhere, and scammers are getting smarter. The good news is that you can outsmart them with a few simple but powerful habits. From securing your passwords to spotting phishing scams, these 20 strategies will help keep your money and identity safe.

1. Use Strong, Unique Passwords for Every Account

Miguel Á. Padriñán on Pexels

Miguel Á. Padriñán on Pexels

Reusing passwords is like giving scammers a master key to all your accounts. Use a mix of letters, numbers, and symbols, and never use easy-to-guess passwords like your birthday or “password123.” A password manager can help you create and store complex passwords. The harder it is to guess, the safer your accounts will be.

2. Enable Two-Factor Authentication (2FA) Everywhere

Pixabay on Pexels

Pixabay on Pexels

Even if someone steals your password, 2FA acts as an extra security layer. It usually involves a code sent to your phone or email, making it harder for hackers to get in. Enable it for banking, email, and shopping accounts. It’s a small step that makes a huge difference.

3. Monitor Your Bank and Credit Card Statements Regularly

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Scammers often start with small test charges to see if they go unnoticed. Check your bank and credit card transactions weekly to spot anything suspicious. If you see charges you don’t recognize, report them immediately. The faster you catch fraud, the easier it is to fix.

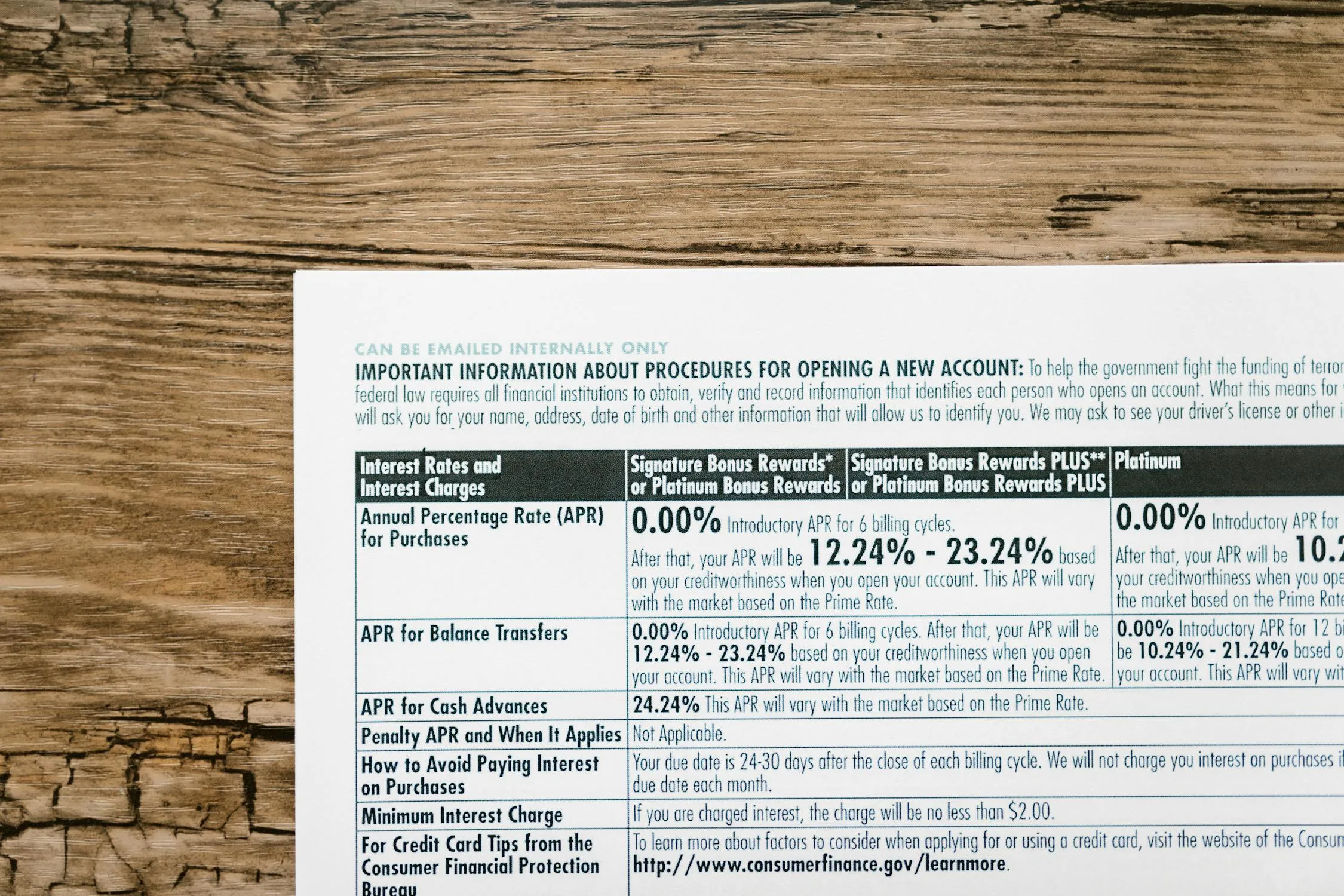

4. Shred Personal Documents Before Throwing Them Away

SAULO LEITE on Pexels

SAULO LEITE on Pexels

Dumpster diving is still a thing, and identity thieves love old bank statements and credit card offers. Shred anything with your personal information before tossing it in the trash. If you don’t have a shredder, rip documents into tiny pieces. It’s a simple way to keep your details safe.

5. Be Cautious with Public Wi-Fi

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Public Wi-Fi at coffee shops and airports is convenient but risky. Hackers can intercept your data and steal passwords or credit card numbers. Use a VPN (Virtual Private Network) to encrypt your connection, or avoid logging into sensitive accounts on public networks. If possible, stick to your mobile data for banking and shopping.

6. Never Share Personal Information Over the Phone

Joshua Mayo on Pexels

Joshua Mayo on Pexels

Scammers often pretend to be from your bank or a government agency, asking for sensitive details. Legitimate companies never ask for your Social Security number, credit card details, or passwords over the phone. If someone pressures you, hang up and call the company directly using a number from their official website.

7. Watch Out for Phishing Emails and Messages

Torsten Dettlaff on Pexels

Torsten Dettlaff on Pexels

Be skeptical if an email or text asks for your personal details or has an urgent, scary language. Phishing scams often look like real messages from your bank or a company you trust. Check the sender’s email address, and never click on suspicious links. When in doubt, contact the company directly.

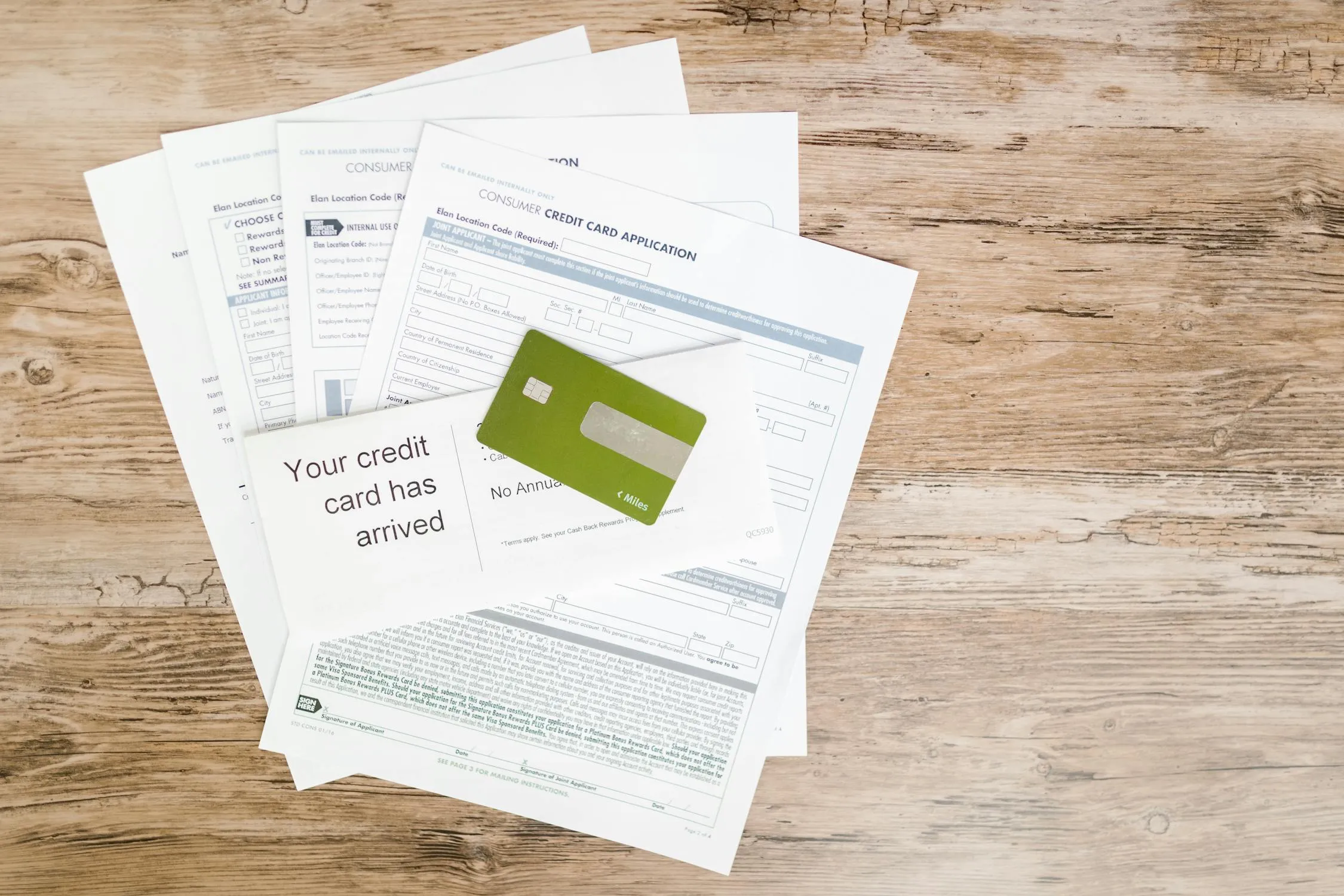

8. Freeze Your Credit if You’re Not Using It

Anete Lusina on Pexels

Anete Lusina on Pexels

A credit freeze prevents scammers from opening accounts in your name. It doesn’t affect your credit score and can be lifted anytime you need to apply for a loan or credit card. Contact credit bureaus like Experian, Equifax, and TransUnion to set it up. It’s one of the strongest protections against identity theft.

9. Be Careful What You Share on Social Media

mikoto.raw Photographer on Pexels

mikoto.raw Photographer on Pexels

Scammers love to collect personal details from social media profiles. Avoid posting your full birthdate, address, or vacation plans, which can be used for fraud. The less personal information you share, the harder it is for criminals to target you. Privacy settings are your friend—use them.

10. Use Secure Payment Methods Online

Kindel Media on Pexels

Kindel Media on Pexels

When shopping online, use credit cards instead of debit cards. Credit cards offer better fraud protection and don’t give scammers direct access to your bank account. Services like PayPal, Apple Pay, or Google Pay add another layer of security. If a website looks shady, don’t enter your payment details.

11. Check Your Credit Report for Unusual Activity

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Your credit report shows if someone has tried to open accounts in your name. You can get a free report once a year from each of the three major credit bureaus. Look for accounts you don’t recognize and report anything suspicious. The sooner you spot identity theft, the less damage it can do.

12. Keep Your Devices Updated

Pixabay on Pexels

Pixabay on Pexels

Outdated software is an easy target for hackers. Enable automatic updates for your phone, computer, and apps to patch security vulnerabilities. Antivirus software adds another layer of protection against malware and keyloggers. Staying updated keeps cybercriminals out.

13. Avoid Clicking on Suspicious Ads and Pop-Ups

Jakub Zerdzicki on Pexels

Jakub Zerdzicki on Pexels

Scam ads and pop-ups often promise prizes, discounts, or warnings about computer viruses. Clicking them can install malware or steal your information. Close suspicious pop-ups immediately, and don’t download anything from untrusted sources. If a deal looks too good to be true, it probably is.

14. Use a Separate Email for Financial Accounts

Burst on Pexels

Burst on Pexels

Having one email for banking and another for everyday use makes it harder for scammers to access your finances. If your personal email gets hacked, your financial accounts stay safe. A dedicated financial email adds an extra layer of security.

15. Set Up Alerts for Bank Transactions

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Most banks let you enable notifications for withdrawals, purchases, or login attempts. These alerts can warn you of fraud immediately. If you see an unauthorized charge, you can take action before more damage is done. Real-time alerts help stop fraud before it gets worse.

16. Be Wary of Fake Customer Support Calls

MART PRODUCTION on Pexels

MART PRODUCTION on Pexels

Scammers pretend to be from tech support, Amazon, or even your bank. They claim there’s a problem with your account and ask for passwords or remote access to your computer. No real company will ever ask for this. Hang up and contact customer support through the official website.

17. Store Sensitive Documents in a Safe Place

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Keep passports, Social Security cards, and important financial papers locked up at home. A fireproof safe or locked drawer prevents identity thieves from accessing them. Don’t carry these documents in your wallet unless necessary. Less exposure means less risk.

18. Be Careful When Donating to Charities

Gustavo Fring on Pexels

Gustavo Fring on Pexels

Fake charities pop up after disasters and tragedies, preying on good-hearted people. Before donating, research the charity on websites like Charity Navigator. Never donate over the phone unless you initiate the call. Scammers count on emotional reactions, so always verify first.

19. Watch Out for Job and Investment Scams

Gustavo Fring on Pexels

Gustavo Fring on Pexels

If a job or investment opportunity sounds too good to be true, it probably is. Scammers ask for money upfront, personal details, or promise guaranteed returns. Research companies thoroughly before handing over sensitive information. A legitimate job or investment won’t pressure you to act immediately.

20. Trust Your Gut and Stay Skeptical

Andrea Piacquadio on Pexels

Andrea Piacquadio on Pexels

If something feels off, it probably is. Scammers rely on fear and urgency to trick people into making quick decisions. Take a moment to think before sharing personal information or clicking links. Being cautious is the best defense against financial fraud.