20 Biggest Financial Mistakes to Avoid in Your 30s

Your 30s are crucial for building financial stability, yet many people make costly mistakes that can hinder their future wealth.

- Chris Graciano

- 4 min read

Making wise financial decisions early in life is crucial since financial mistakes made in your 30s can have long-term effects. These errors, which range from excessive spending to ignoring investments, might impede your financial progress. To ensure a profitable future and attain financial independence, steer clear of these 20 typical traps.

1. Living Beyond Your Means

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Spending more than you earn leads to perpetual debt and financial stress. It’s tempting to upgrade your lifestyle, but if your income doesn’t support it, you’re setting yourself up for hardship.

2. Not Saving for Retirement Early

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Delaying retirement contributions means missing out on the power of compound interest. Even small amounts invested now can grow exponentially over time.

3. Ignoring an Emergency Fund

Tima Miroshnichenko on Pexels

Tima Miroshnichenko on Pexels

Life is unpredictable, and unexpected expenses will arise. Aim for at least three to six months’ worth of expenses in a separate account.

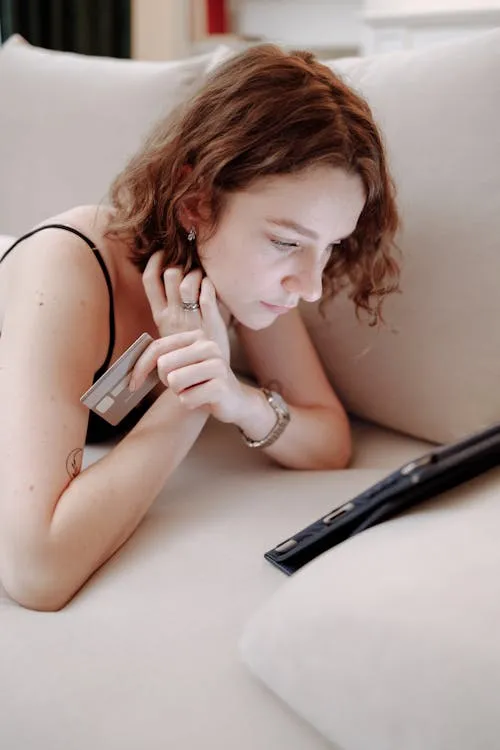

4. Accumulating High-Interest Debt

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Credit card debt and personal loans with steep interest rates can be financial traps. Paying only the minimum prolongs repayment and costs you more in the long run. Always pay off high-interest balances quickly.

5. Not Investing Enough

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Relying solely on savings accounts won’t build long-term wealth. Inflation erodes purchasing power, making investments essential for growth.

6. Neglecting Health Insurance

HVETS production on Pexels

HVETS production on Pexels

Skipping health coverage to save money can backfire if medical emergencies occur. Without adequate insurance, hospital bills can be overwhelming. Choose a plan that balances affordability and coverage.

7. Overspending on Housing

AS Photography on Pexels

AS Photography on Pexels

Buying or renting beyond your budget leaves little room for savings. A large mortgage or rent payment can create financial strain. Aim to keep housing costs within 30% of your income.

8. Not Having Multiple Income Streams

Andrew Neel on Pexels

Andrew Neel on Pexels

Relying on a single source of income is risky in today’s economy. Job loss or an industry downturn can leave you financially vulnerable.

9. Failing to Set Financial Goals

Pixabay on Pexels

Pixabay on Pexels

Without clear financial objectives, money tends to slip through your fingers. Define short-term and long-term goals to keep your finances on track.

10. Not Taking Advantage of Employer Benefits

Andrea Piacquadio on Pexels

Andrea Piacquadio on Pexels

Many companies offer perks like 401(k) matches, stock options, and insurance plans. Ignoring these benefits is leaving free money on the table.

11. Letting Lifestyle Inflation Take Over

Kaboompics.com on Pexels

Kaboompics.com on Pexels

A salary increase doesn’t mean you should spend more. Many people increase expenses as income rises, leaving little room for savings. Keep your lifestyle modest and save the extra earnings instead.

12. Not Prioritizing Debt Repayment

MART PRODUCTION on Pexels

MART PRODUCTION on Pexels

Letting debt linger can cost thousands in interest over time. The longer you delay payments, the more financial pressure you will experience. Pay off debts strategically, starting with high-interest ones first.

13. Skipping Estate Planning

olia danilevich on pexels

olia danilevich on pexels

Thinking you’re too young for a will or estate plan is a mistake. Unexpected events can create legal and financial chaos for loved ones. A simple will, power of attorney, and beneficiary designations can offer peace of mind.

14. Relying Too Much on a Partner’s Income

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

If you depend solely on your partner’s earnings, you risk financial instability if circumstances change. Maintaining your own source of income ensures independence and security. Both partners should contribute to savings and investments.

15. Ignoring Your Credit Score

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

A low credit score can make loans and mortgages more expensive. Late payments, high credit utilization, and neglecting credit reports can damage your score. Monitor it regularly and make responsible financial choices.

16. Not Negotiating Salary and Raises

fauxels on Pexels

fauxels on Pexels

Accepting the first salary offer or skipping negotiations can cost you thousands over time. Employers expect some negotiation, and advocating for yourself can significantly boost earnings. Research industry standards and confidently ask for what you deserve.

17. Making Emotional Financial Decisions

Thirdman on Pexels

Thirdman on Pexels

Impulse purchases and reactionary investments often lead to regret. Emotional spending can drain savings, while panic-selling can lead to losses. Take a rational approach and think long-term before making big financial moves.

18. Overlooking Tax Planning

Thirdman on Pexels

Thirdman on Pexels

Failing to optimize tax deductions and credits means paying more than necessary. Strategic tax planning can help you save money legally. Consult a tax professional to maximize deductions, retirement contributions, and investment strategies.

19. Not Protecting Assets with Insurance

Kindel Media on Pexels

Kindel Media on Pexels

Skipping essential coverage like auto, home, or disability insurance can be costly. A single accident or disaster can wipe out savings. Protect your financial future with the right policies.

20. Waiting Too Long to Start Wealth Building

Pixabay on Pexels

Pixabay on Pexels

The earlier you build wealth, the more time your money has to grow. Procrastination limits your financial potential.