20 Biggest Tax Mistakes That Cost People Thousands

Avoiding these tax mistakes can help you keep more of your hard-earned money.

- Daisy Montero

- 4 min read

Tax season can be stressful, but making the wrong moves can cost you big. Overlooking deductions, misreporting income, and filing late are just a few errors that lead to hefty penalties. Learning how to sidestep these mistakes can save you thousands and keep you on the IRS’s good site.

1. Missing the Tax Filing Deadline

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

Late filing leads to penalties the pile up fast. Even if you cannot pay what you owe right away, filing on time avoids extra fees. Extensions help, but they do not push back payment deadlines.

2. Ignoring Available Deductions

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

Leaving money on the table is never a good idea. Many taxpayers overlook deductions like student loan interest, home office expenses, and medical costs. A little research can lead to big savings.

3. Forgetting to Report Side Income

Tima Miroshnichenko on Pexels

Tima Miroshnichenko on Pexels

The IRS does not forget, even if you do. Income from freelancing, gig work, or rentals must be reported, or penalties could follow. Skipping it might seem harmless, but audits can be costly.

4. Claiming the Wrong Filing Status

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

Filing as single instead of head of household can mean losing valuable tax breaks. Choosing the right status affects deductions, tax rates, and refunds. Double-checking could prevent an expensive mistake.

5. Overlooking Retirement Account Contributions

SHVETS production on Pexels

SHVETS production on Pexels

Contributions to IRAs and 401 (k)s can lower taxable income, yet many taxpayers miss this opportunity. Even last-minute contributions can make a difference. Saving for the future and reducing taxes is a win-win.

6. Miscalculating Estimated Tax Payments

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

Self-employed individuals and freelancers often misjudge quarterly tax payments. Paying too little leads to penalties, while overpaying means lending the IRS money interest-free. A tax professional can help get it right.

7. Not Keeping Proper Tax Records

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Losing receipts or important tax forms can be costly if the IRS comes knocking. Organized records make filing easier and provide backup for deductions. Digital or paper, a good system saves time and stress.

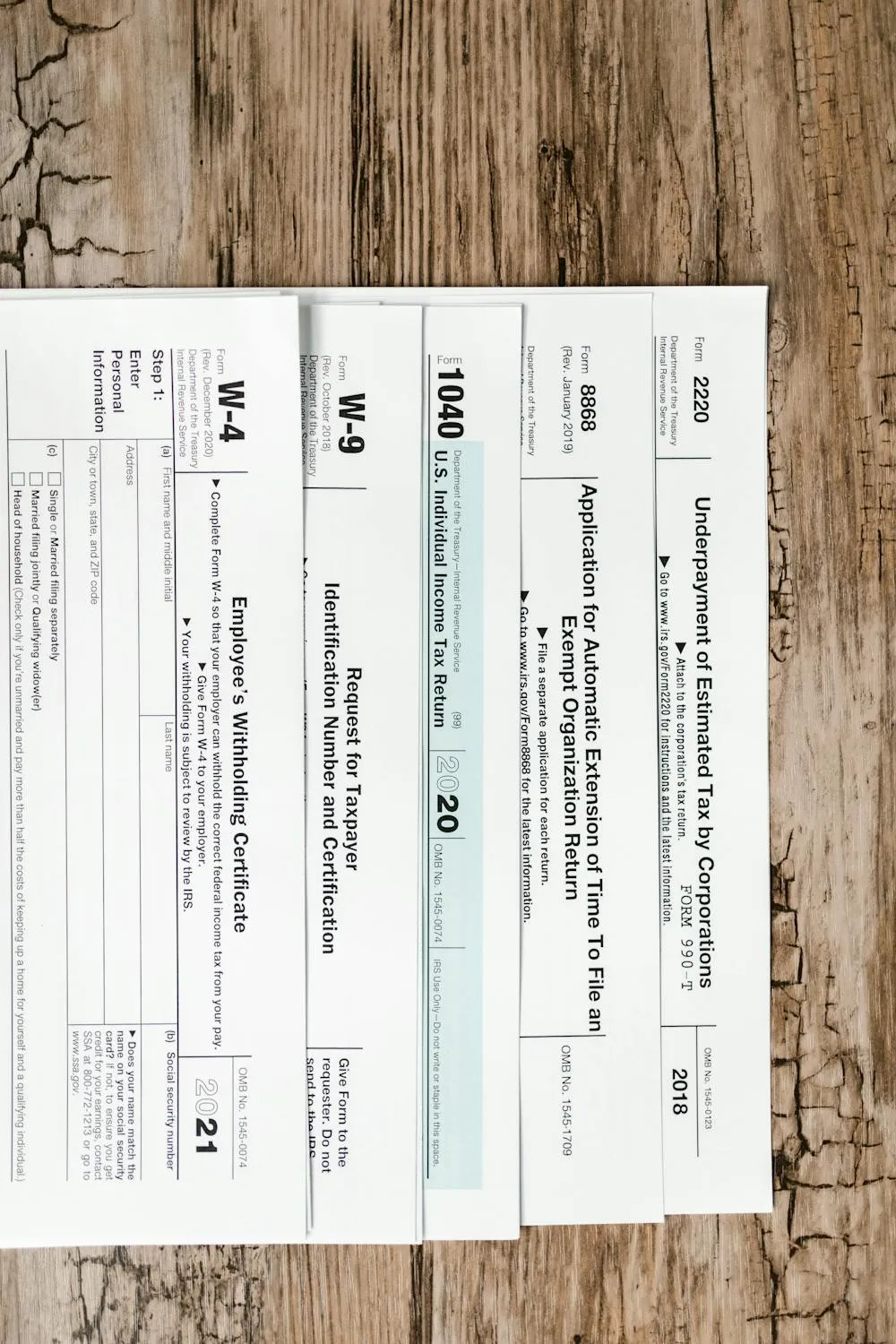

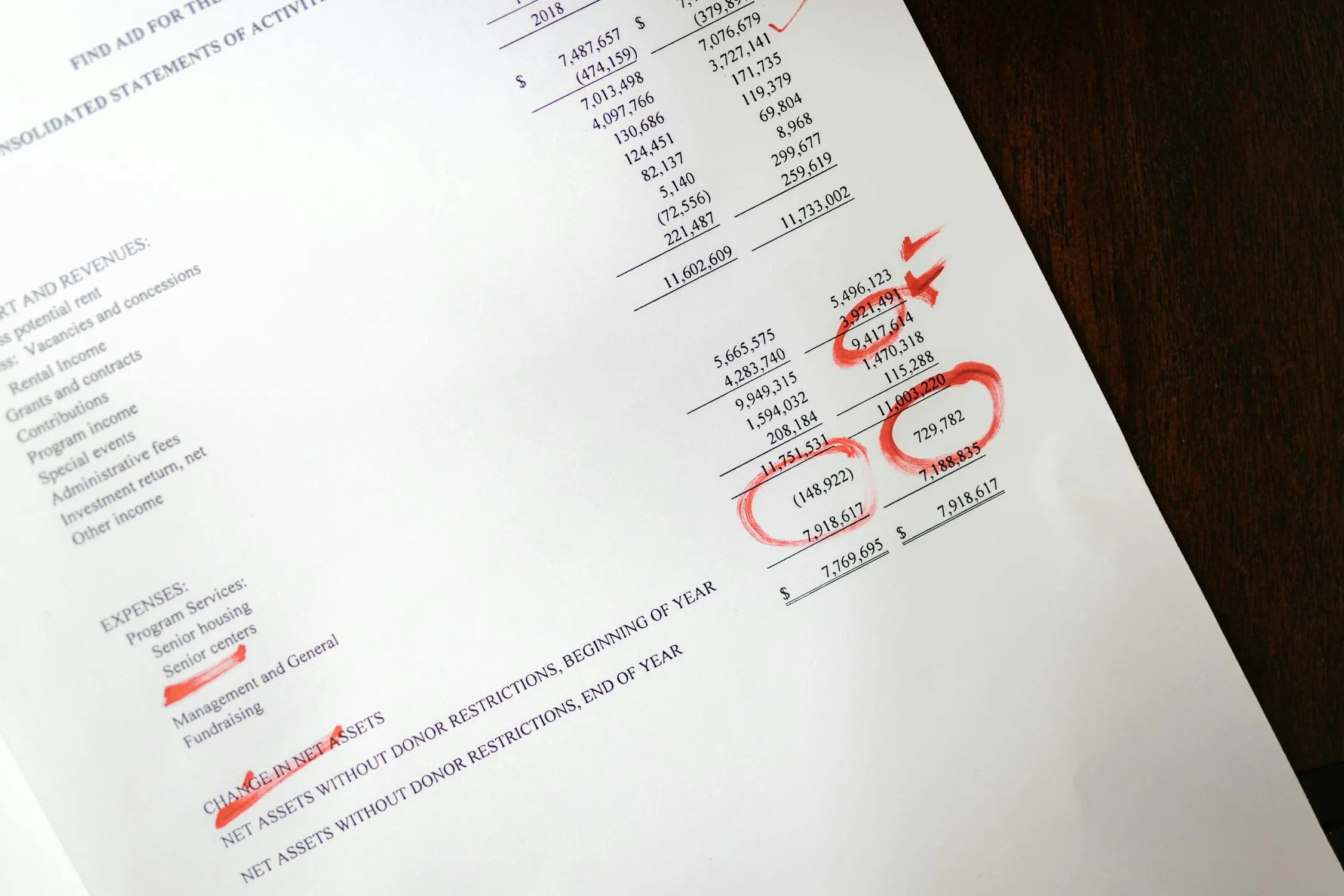

8. Misreporting Income

olia danilevich on Pexels

olia danilevich on Pexels

Even small mistakes on reported income can trigger IRS scrutiny. W-2s, 1099s, and investment earnings must match what the IRS expects. Accuracy prevents costly audits and penalties.

9. Failing to Claim Earned Income Tax Credit (EITC)

Pixabay on Pexels

Pixabay on Pexels

Millions out on this valuable credit each year. The EITC can provide significant refunds for qualifying workers, but eligibility rules are tricky. Checking the requirements could mean extra cash in your pocket.

10. Overlooking State Tax Obligations

Karolina Grabowska on Unsplash

Karolina Grabowska on Unsplash

State taxes are just as important as federal taxes. Moving to a new state or earning income from multiple states adds complexity. Failing to file properly can lead to penalties down the road.

11. Choosing the Wrong Withholding Amount

Karolina Grabowska on Pexels

Karolina Grabowska on Pexels

Under-withholding can lead to a hefty tax bill, while over-withholding means less take-home pay all year. Adjusting your W-4 properly keeps more money in your pocket without surprises.

12. Not Paying Self-Employment Taxes Correctly

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

Freelancers and small business owners must cover Social Security and Medicare taxes on their own. Ignoring these payments leads to fines and headaches. Setting aside funds for taxes avoids last-minute stress.

13. Making Math Errors on Tax Returns

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Simple math mistakes can delay refunds or lead to audits. Even with software, double-checking numbers helps avoid trouble. A quick review saves time and frustration.

14. Failing to File Electronically

Andrea Piacquadio on Pexels

Andrea Piacquadio on Pexels

Paper filing increases the risk of mistakes and slows down refunds. E-filing is faster, more accurate, and provides instant confirmation. Plus, direct deposit gets refunds to your account quickly.

15. Misunderstanding Capital Gains Taxes

energepic.com on Pexels

energepic.com on Pexels

Selling stocks or real estate comes with tax consequences. Short-term gains are taxed higher than long-term ones. Knowing the rules helps maximize profits and minimize taxes.

16. Ignoring Rules for Charitable Donations

Liza Summer on Pexels

Liza Summer on Pexels

Donating to charity can lower your tax bill, but only if done right. Receipts and proper documentation are required. Non-cash donations need extra paperwork to qualify.

17. Misclassifying Workers as Independent Contractors

Tima Miroshnichenko on Pexels

Tima Miroshnichenko on Pexels

Business owners who misclassify employees as contractors can face major fines. The IRS has strict guidelines for determining worker status. Getting it wrong could mean back taxes and penalties.

18. Not Accounting for Life Changes

Arina Krasnikova on Pexels

Arina Krasnikova on Pexels

Marriage, divorce, or having a child can change your tax situation. Adjusting withholdings and knowing what credits apply ensures you do not overpay. Major life events often mean tax benefits—if you claim them.

19. Failing to Track Business Expenses

Photo By: Kaboompics.com on Pexels

Photo By: Kaboompics.com on Pexels

Business deductions lower taxable income, but only if recorded properly. Meals, travel, and office supplies add up fast. Good bookkeeping keeps every deductible dollar in your favor.

20. Not Seeking Professional Help When Needed

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

Taxes are complicated, and DIY approaches can backfire. A tax professional helps catch errors, maximize deductions, and prevent audits. Paying for expert advice often saves more than it costs.