20 Creative Ways to Save for a Down Payment

While saving for a down payment on a house can be intimidating, it doesn't have to be entirely about substantially cutting back. With some imagination and commitment, you can investigate several strategies for speedier and more intelligent savings building. This post reviews 20 original and practical strategies ranging from side projects to smart budgeting to help you meet your down payment goal.

- Tricia Quitales

- 5 min read

With so many clever and strategic approaches available, saving for a down payment does not have to be daunting. This post offers twenty original suggestions combining basic budgeting advice with side employment and lifestyle changes to help you save quicker without compromising your everyday enjoyment. These ideas will provide you unique approaches to attain your homeownership objective whether your priorities are cutting unneeded expenses, making extra money, or getting somewhat more creative. Staying diligent and applying certain strategies would help you to realize your dream of owning a house in no time.

1. Start a Side Hustle

George Milton on Pexels

George Milton on Pexels

Bring in extra money using your interests or abilities. Every little bit counts—from graphic design to puppy walking to freelance writing. Especially if you have free time, starting a side project could allow you the freedom to earn on your terms.

2. Cut Back on Subscriptions

BiljaST on Pexels

BiljaST on Pexels

Review your subscriptions closely and cancel any you do not need. Gym memberships, magazine subscriptions, and streaming services may soon mount up. To speed up your savings, channel the money into your down payment fund.

3. Sell Unused Items

Leticia Ribeiro on Pexels

Leticia Ribeiro on Pexels

Sort items you no longer use around your house for sale. You can sell furniture, clothing, tools, and outdated technology online or in front of your house. These offers may surprisingly increase your savings, and decluttering can help.

4. Automate Your Savings

Greta Hoffman on Pexels

Greta Hoffman on Pexels

Arrange for an automated transfer from your checking to your savings account every month. This approach guarantees that you are regularly saving without conscious thought. Making it automatic allows you to create your down payment fund with minimum work.

5. Take Advantage of Employer Benefits

Polina Zimmerman on Pexels

Polina Zimmerman on Pexels

Some companies provide matching contributions or homebuyer assistance to help you save for a house. See your HR division to see whether you might be overlooking any resources. This is a basic approach to maximize your money and reach your down payment target.

6. Live Below Your Means

Esra Afşar on Pexels

Esra Afşar on Pexels

Review your way of living and make little changes that add to significant savings. Limit shopping sprees, reduce dining out, or decide on a more frugal living quarter. These adjustments taken over time can pile up and save a lot for your down payment.

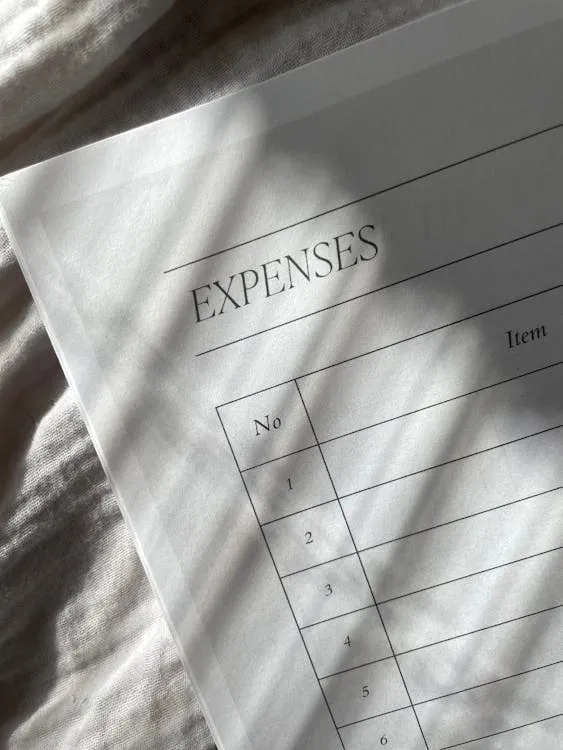

7. Set a Budget

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Plan a thorough monthly budget and follow it. This will help you to see exactly where you might cut back and where your money is going. Maintaining an organization will help you stay on target for regular down payment savings.

8. Get a Roommate

RDNE Stock project on Pexels

RDNE Stock project on Pexels

To further generate money, consider leasing a room in your house. This can help you save more every month and greatly reduce your house expenses. Having a roommate is one simple approach to balancing your living costs as you save.

9. Open a High-Yield Savings Account

Aukid phumsirichat on Pexels

Aukid phumsirichat on Pexels

To maximize interest, place your down payment savings into a high-yield savings account. Although it won’t make you wealthy, it will enable faster growth of your money. Search for accounts with cheap fees and greater interest rates to maximize your results.

10. Cut Transportation Costs

Wender Junior Souza Vieira on Pexels

Wender Junior Souza Vieira on Pexels

Sell your automobile and, if at all possible, carpool, walk to work, or take public transportation. These can cut maintenance, insurance, and gas expenses. You can put the money you save on transportation into your down payment fund.

11. Work Overtime

cottonbro studio on Pexels

cottonbro studio on Pexels

Inquire of your company whether extra shifts or overtime are possible. Working extra hours at your present employment will dramatically raise your salary. Putting in a few more hours per week will help your savings to really increase.

12. Cook at Home More

cottonbro studio on Pexels

cottonbro studio on Pexels

Start cooking more meals at home, as eating out rapidly depletes your income. Meal planning and bulk purchases of ingredients will help you save still more. Reducing eating out will allow you to save that money for your down payment.

13. Use Cashback Apps

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Use websites and cashback apps when looking for daily needs. Apps like Rakuten or Honey allow you to somewhat save on every purchase; over time, the savings mount up. Build your down payment fund with this cash back.

14. Refinance Debt

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

If you already owe money, think about refinancing to cut interest rates. This can cut your monthly payments and free you to save the difference for your house. Reducing debt allows more money for your down purchase.

15. Track Your Spending

Kiersten Williams on Pexels

Kiersten Williams on Pexels

Track your spending patterns and find areas where you might cut back with Mint or YNAB apps. Being aware of your financial situation helps you to decide deliberately where to save. Little spending adjustments over time can result in significant savings.

16. Start a Savings Challenge

Bich Tran on Pexels

Bich Tran on Pexels

Challenge yourself to set aside a particular weekly or monthly sum. You could follow a set target or progressively raise the level. A savings challenge might keep you driven and attentive to your down payment.

17. Earn Referral Bonuses

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Use the referral schemes offered by banks, credit cards, or service providers. Many businesses offer bonuses for referring friends or relatives. With these advantages, adding to your down payment savings can be quick and simple.

18. Utilize Tax Refunds

Leeloo The First on Pexels

Leeloo The First on Pexels

Increase your savings with any tax returns you get. Set the refund straight into your down payment fund rather than spending it. One excellent chance to significantly contribute to your savings goal is tax season.

19. Use Gift Money

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Ask friends and relatives whether they would be willing to give you money for your down payment. Although this could be embarrassing, many people are ready to assist with a significant life objective. Track and report any gifted money for tax needs.

20. Take Advantage of First-Time Homebuyer Programs

MART PRODUCTION on Pexels

MART PRODUCTION on Pexels

Investigate local and federal first-time homebuyer programs with reduced down payment requirements or financial aid. Many initiatives exist to enable those like you to find homeownership more realistic. Use these tools to cut the amount you have to save yourself.

- Tags:

- Down Payment

- Tips

- money

- Expense