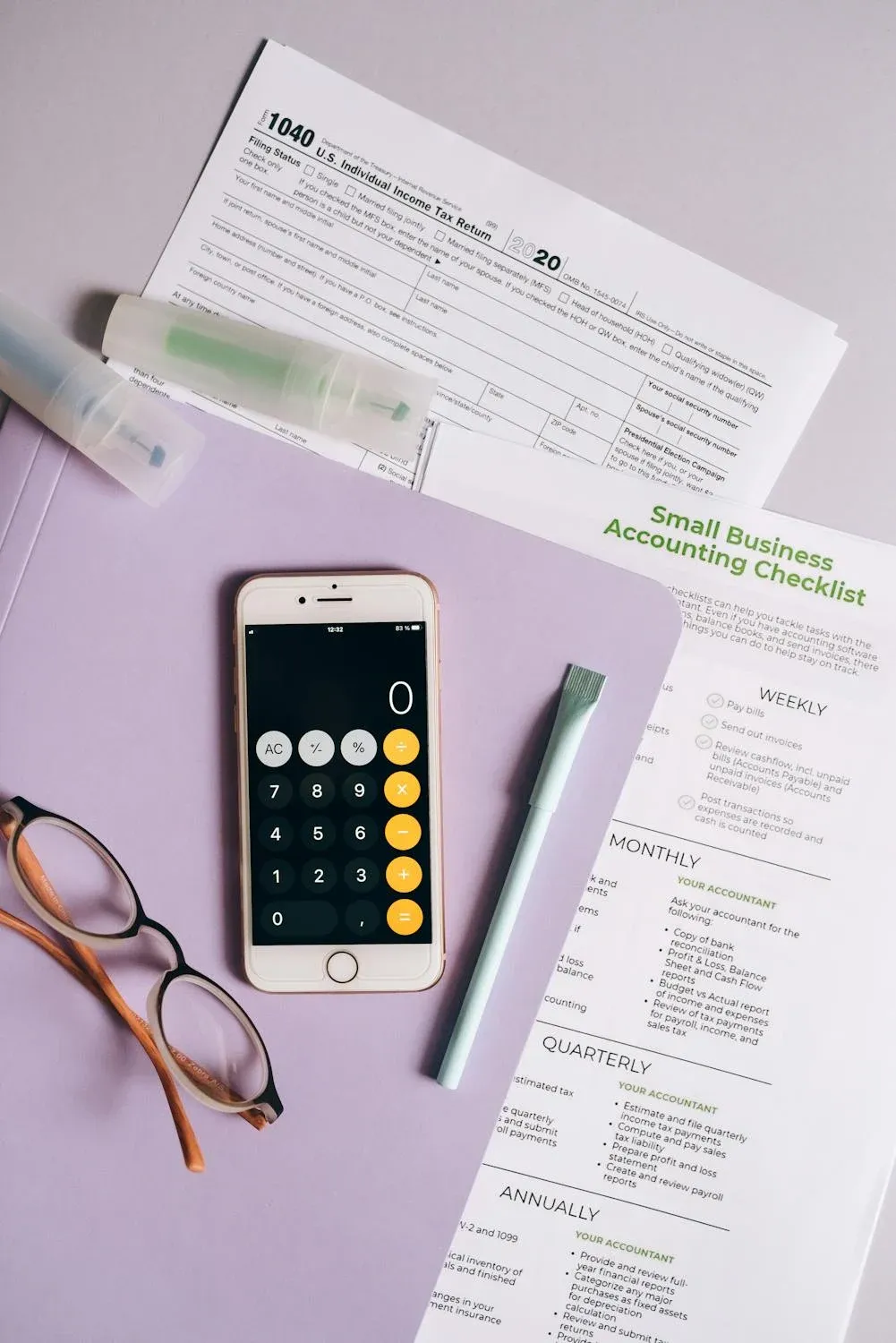

20 Essential Tax Forms for Small Business Owners

For small business owners to stay in compliance with IRS regulations, they must handle several tax forms. Completing these forms is essential to preventing fines and guaranteeing efficient financial operations.

- Tricia Quitales

- 6 min read

Keeping up with taxes is essential for small business owners to preserve their financial stability and legal compliance. There are many forms to be aware of, ranging from payroll to income tax. This article explains the function of 20 crucial tax forms as well as when and why they are required. You can lessen mistakes and make tax season less stressful for your company by becoming familiar with these forms.

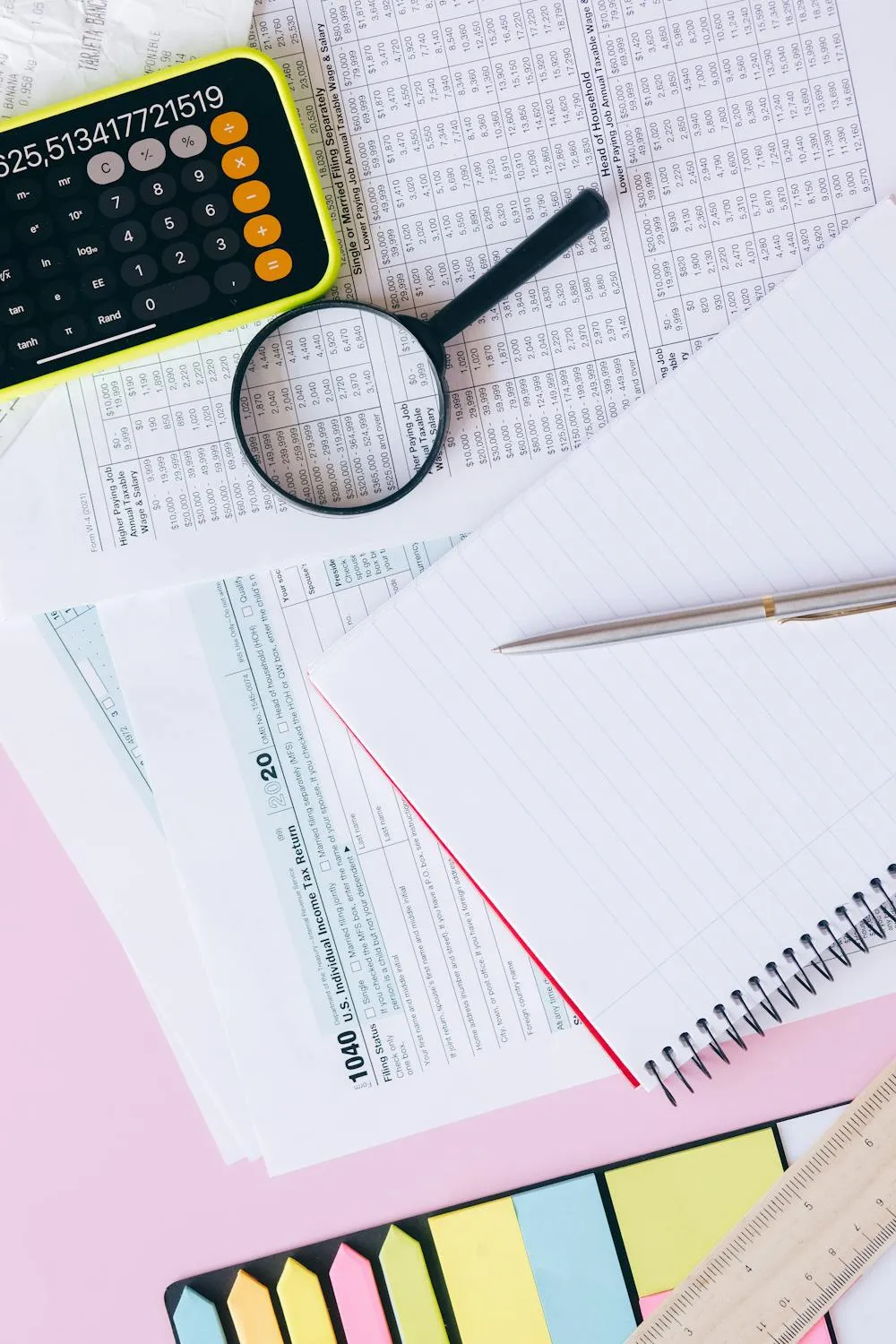

1. Form 1040: U.S. Individual Income Tax Return

Mark Youso on Pexels

Mark Youso on Pexels

Individuals, including sole proprietors and small business owners, use Form 1040 to report their yearly income and determine their tax obligations. Wages, interest, dividends, and other sources of income are all covered. Any small business owner who files taxes as an individual must use this form.

2. Form 1065: U.S. Return of Partnership Income

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Partnerships must report their income, deductions, gains, and losses on Form 1065. This form also specifies how much of the company’s profits and losses go to each partner. To stay compliant, small partnership businesses must submit it once a year.

3. Form 1120: U.S. Corporation Income Tax Return

Leeloo The First on Pexels

Leeloo The First on Pexels

To report their income, deductions, and any tax liabilities, corporations must submit Form 1120. Avoiding penalties for underpayment of taxes can be achieved by ensuring that Form 1120 is accurately reported.

4. Form 1120S: U.S. Income Tax Return for an S Corporation

Polina Tankilevitch on Pexels

Polina Tankilevitch on Pexels

S corporations report their income, credits, and deductions on Form 1120S. Shareholders receive income and deductions, which they then report on their personal tax returns. If this form is filed, the corporation will remain compliant and avoid needless tax penalties.

5. Form 941: Employer’s Quarterly Federal Tax Return

Leeloo The First on Pexels

Leeloo The First on Pexels

Employers report wages paid, taxes withheld, and their portion of Social Security and Medicare taxes on Form 941. To ensure businesses meet their tax obligations, it is filed every quarter. This form must be submitted by small business owners who employ people to report payroll taxes.

6. Form 944: Employer’s Annual Federal Tax Return

Polina Tankilevitch on Pexels

Polina Tankilevitch on Pexels

Form 944 permits smaller businesses to report wages and taxes annually instead of quarterly if their annual payroll tax obligations are $1,000 or less. For companies with a smaller payroll, this form serves as an alternative to Form 941. For small businesses, filing Form 944 can streamline tax reporting.

7. Form W-2: Wage and Tax Statement

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

An employee’s yearly salary and the taxes deducted are reported on Form W-2. By January 31 of the following year, employers are required to submit this form to the IRS and their employees. For the benefit of the employer and the employee, Form W-2 must be filed accurately.

8. Form W-3: Transmittal of Wage and Tax Statements

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

Form W-3 is a summary form sent to the Social Security Administration (SSA) with Form W-2. It adds up all of the W-2s that employees receive during a specific year. This form must be filed to ensure that the IRS and Social Security Administration records correspond.

9. Form 1099-MISC: Miscellaneous Income

Polina Tankilevitch on Pexels

Polina Tankilevitch on Pexels

Payments to freelancers, independent contractors, and anyone not an employee but received $600 or more during the year are reported using Form 1099-MISC. The IRS uses this form to keep track of non-employee income. Small business owners are required to report to the IRS and provide contractors with a Form 1099-MISC.

10. Form 1099-NEC: Nonemployee Compensation

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

Payments to independent contractors and other non-employee compensation are specifically reported using Form 1099-NEC. Starting in 2020, it replaced Form 1099-MISC for this purpose. This form will be used to report the earnings of freelancers or contractors you hire.

11. Form 1096: Annual Summary and Transmittal of U.S. Information Returns

Leeloo The First on Pexels

Leeloo The First on Pexels

The IRS receives a summary of the 1099 series forms on Form 1096. The Form 1096 must be submitted as a cover sheet if you submit more than one 1099 form. This aids the IRS in matching your company’s 1099 filings.

12. Form 8862: Information to Claim Earned Income Credit After Disallowance

RDNE Stock project on Pexels

RDNE Stock project on Pexels

If you want to reapply for your Earned Income Credit (EIC) after it was previously denied, you must submit Form 8862. The IRS uses this form to gather more data to assess eligibility. You must file Form 8862 if your small business is eligible for EIC.

13. Form 4562: Depreciation and Amortization

RDNE Stock project

RDNE Stock project

Deductions for asset amortization and depreciation are claimed on Form 4562. It is frequently submitted when buying a new property or equipment for the company. Taking asset depreciation into account helps business owners lower their taxable income.

14. Form 1065 Schedule K-1: Partner’s Share of Income, Deductions, and Credits

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Each partner’s income and loss shares are shown in Form 1065 Schedule K-1. It is submitted together with the partnership Form 1065. On their individual tax returns, each partner reports their portion of the partnership’s financial activity using the data on Schedule K-1.

15. Form 8832: Entity Classification Election

MART PRODUCTION on Pexels

MART PRODUCTION on Pexels

Businesses can choose how they want to be classified for federal tax purposes by completing Form 8832. A company may decide to be regarded as a disregarded entity, partnership, or corporation. This form aids in defining the business’s taxation.

16. Form 941-X: Adjusted Employer’s Quarterly Federal Tax Return

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

Errors on previously filed Form 941 returns are corrected using Form 941-X. This form lets you correct your filings if you made a mistake on a quarterly return. By guaranteeing accurate payroll tax records, it assists business owners in maintaining compliance.

17. Form 2553: Election by a Small Business Corporation

Leeloo The First on Pexels

Leeloo The First on Pexels

Businesses can choose to be an S corporation by completing Form 2553 for tax purposes. By making this choice, a company can avoid double taxation by passing income directly to its shareholders. Businesses that wish to become S corporations must complete Form 2553.

18. Form 8863: Education Credits

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

People can apply for education credits like the American Opportunity Credit and Lifetime Learning Credit using Form 8863. It is especially helpful for small business owners who are continuing their education or providing employees with educational support. Business owners can save money on taxes if they file this form correctly.

19. Form 720: Quarterly Federal Excise Tax Return

Leeloo The First on Pexels

Leeloo The First on Pexels

Federal excise taxes are reported and paid using Form 720. Businesses that produce or market specific products, such as alcohol or gasoline, usually use it. Small business owners in these sectors must submit this form every quarter.

20. Form 2848: Power of Attorney and Declaration of Representative

Leeloo The First on Pexels

Leeloo The First on Pexels

An individual is authorized to act on your behalf before the IRS by completing Form 2848. If you require a tax expert or accountant to manage your taxes, this can be useful. Using this form is crucial when looking for expert tax help.