20 Financial Documents Every Family Needs for Tax Season

Tax time can be stressful, especially for families who have to keep track of a lot of different income and spending sources. If you have the right financial documents, it will be easier to file your taxes, and you won't miss out on any important credits or deductions.

- Tricia Quitales

- 6 min read

Families may find tax season difficult, but having the right paperwork on hand can make the process easier and help them get a bigger refund. If you know what documents you need, you can avoid delays and make sure that no mistakes happen. These 20 financial documents, like income statements and receipts for expenses you can deduct, are very important for making sure you file your taxes correctly and quickly.

1. W-2 Forms

SHVETS production on Pexels

SHVETS production on Pexels

If you have a job, you must keep your W-2 form because it shows how much money you made and how much tax was taken. It’s something your boss gives you at the end of the year. If you have this form, you can accurately report your income and file taxes.

2. 1099 Forms

SHVETS production on Pexels

SHVETS production on Pexels

Freelancers and people who work for themselves will send 1099 forms from clients who paid them. These forms track their income, and they’ll need them to report the money they make from working for themselves. Ensure you keep all of your 1099s, so you don’t report less income than you have.

3. Social Security Numbers (SSNs)

viarami on Pixabay

viarami on Pixabay

You will need the SSNs of everyone living in your home, including children and people who depend on you. This is necessary to get tax credits and deductions for people who depend on you. Double-check that each SSN is correct to keep your return from taking too long to process.

4. Tax Identification Number (TIN)

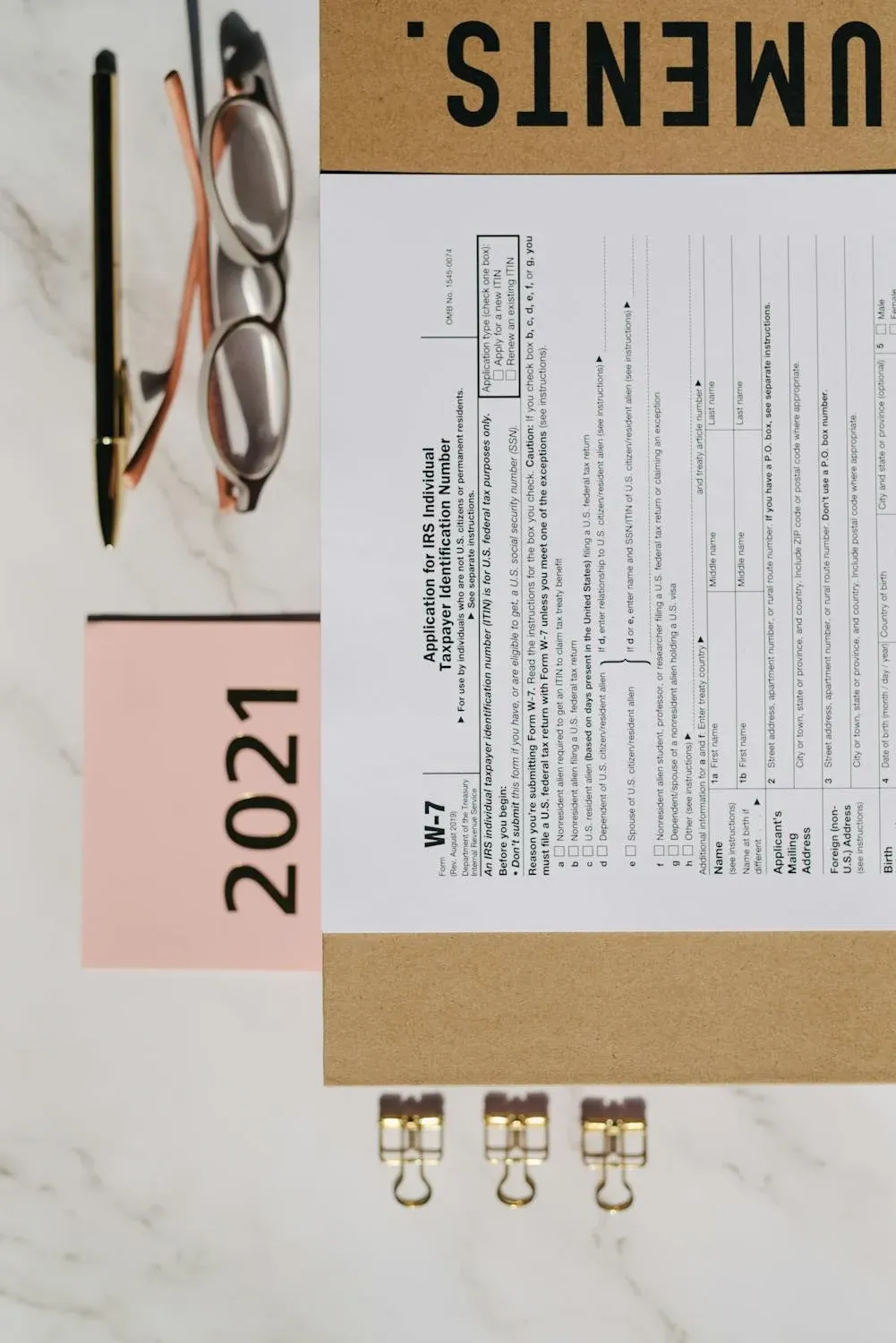

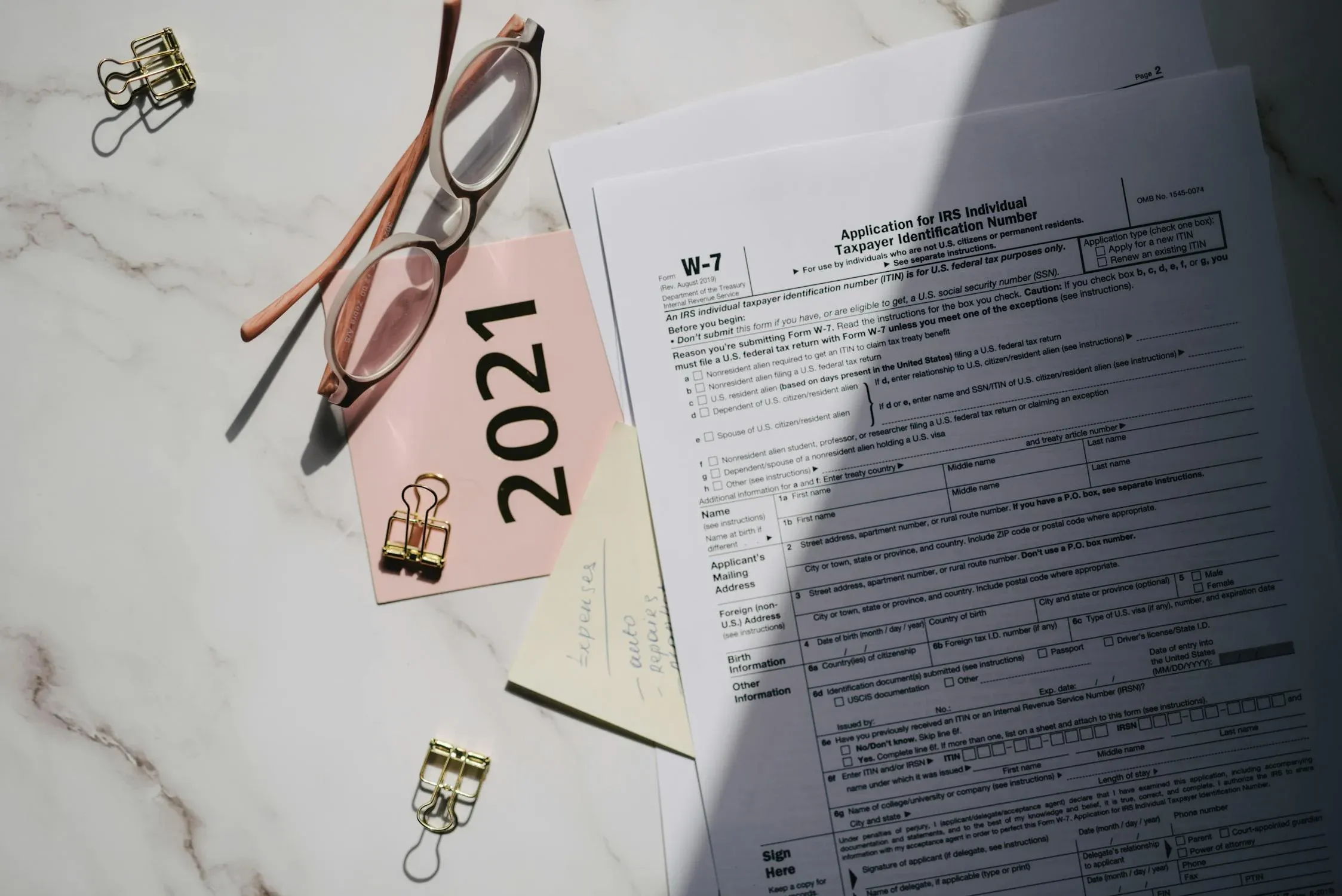

Leeloo The First on Pexels

Leeloo The First on Pexels

People dependent on you but don’t have an SSN may need to give you their Taxpayer Identification Number (TIN). To claim the dependent on your tax return, you need to use this number. If this applies, make sure you have it ready.

5. Proof of Childcare Expenses

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Families who want to claim the Child and Dependent Care Credit must show proof of child care costs. This includes payments for daycare, babysitting, or care after school. Keeping these records in order will help you pay less in taxes.

6. Child Tax Credit Documents

Vidal Balielo Jr. on Pexels

Vidal Balielo Jr. on Pexels

Proof that you live in the country and the child’s birth certificate are two things you’ll need to claim the Child Tax Credit. This credit can help you get a bigger tax refund or pay less in taxes. For tax time, keep these papers in a safe place.

7. Mortgage Interest Statement (Form 1098)

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

In order to get a tax break, homeowners can write off their mortgage interest. Your mortgage lender will give you a 1098 form that shows how much interest you paid over the year. This form can help you lower your taxable income, which is especially helpful if you have a big mortgage payment.

8. Property Tax Documents

Andrea Piacquadio on Pexels

Andrea Piacquadio on Pexels

Most of the time, you can deduct property taxes from your taxable income. Get statements or receipts from your local tax office that show how much property tax you paid each month. This could help you pay less in taxes overall.

9. Health Insurance Information (Form 1095-A, 1095-B, or 1095-C)

Leeloo The First on Pexels

Leeloo The First on Pexels

Families with health insurance will need to show Form 1095, which lists the benefits of your health plan. This is very important if you want to report having health insurance and stay out of trouble with the Affordable Care Act. Get these forms from your insurance company.

10. Medical Expense Records

cottonbro studio on Pexels

cottonbro studio on Pexels

You can deduct qualified medical costs that are more than a certain percentage of your income if you list them on your tax return. Remember to keep track of your insurance payments, doctor’s bills, and prescription receipts. This may help lower the amount of your income that is taxed and raise your refund.

11. Student Loan Interest (Form 1098-E)

Pixabay on Pexels

Pixabay on Pexels

Families with student loans can deduct the interest they pay on those loans up to a certain amount. The lender gives you a Form 1098-E showing how much interest you paid. Get this form to use this deduction and lower your taxable income.

12. Retirement Plan Contributions (Form 5498)

Leeloo The First on Pexels

Leeloo The First on Pexels

Form 5498 will be given to you by the bank if you put money into a retirement plan like an IRA. This form shows how much you gave over the course of the year. Keep this paper so you can possibly get a tax break and make plans for the future.

13. Alimony Payments

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Some people may be able to deduct the money they pay in alimony from their taxable income. Checks or bank statements that show the payments have been made will do. If you can, keep records to lower your tax bill.

14. Charitable Donations Receipts

cottonbro studio on Pexels

cottonbro studio on Pexels

If you itemize your deductions, you can get a tax break for giving to certain charities. Keep records or receipts of gifts you give, whether cash or goods. Making sure you keep track of these donations will help you get the most tax breaks.

15. Self-Employment Income and Expenses

Leeloo The First on Pexels

Leeloo The First on Pexels

If you work for yourself, keep track of all the money your business makes and spends. This includes bank statements, receipts, and bills. Having the right paperwork can help you get deductions and lower your overall tax bill.

16. Education Expenses (Form 1098-T)

Tara Winstead on Pexels

Tara Winstead on Pexels

Families whose children are in college or who are themselves in school may be able to get tax credits related to education. Form 1098-T shows how much tuition and fees were paid. If you want to get a credit like the American Opportunity Credit, keep this form close by.

17. Investment Income Documents (Form 1099-INT, 1099-DIV, 1099-B)

Tima Miroshnichenko on Pexels

Tima Miroshnichenko on Pexels

Your bank will send you forms that show interest, dividends, and capital gains if you have investments. These forms help you report the money you made from investments. Keep all of your 1099 forms to report them correctly and stay out of trouble.

18. Rental Property Income and Expenses

Kaboompics.com on Pexels

Kaboompics.com on Pexels

If you own rental property, you’ll need proof of the rent you earn and the costs you incur, like mortgage interest or repairs. This includes bills, bank statements, and receipts. You need these things to be able to deduct costs related to your rental property on your tax return.

19. Unemployment Income (Form 1099-G)

Nicola Barts on Pexels

Nicola Barts on Pexels

If you have unemployment benefits, you’ll need Form 1099-G, which shows how much money you have in total. You must report this income on your tax return because it is taxed. Keep this form to make sure you correctly report your unemployment benefits.

20. Proof of Social Security Benefits (SSA-1099)

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

Families that get Social Security benefits will need the SSA-1099 form, which shows how much they got in benefits. This form helps you report your Social Security income, which may be taxed if you have other sources of income. Make sure you keep this form so there are no problems.