20 Financial Goals Everyone Should Have by 40

Setting financial goals is an important part of growing as a person, especially when a big event like turning 40 approaches. At this point in your life, you should have a clear financial plan to make sure you'll be stable, safe, and able to enjoy the future. This piece talks about 20 financial goals everyone should try to reach by age 40. It also gives useful tips for making a strong base for the years to come.

- Tricia Quitales

- 7 min read

A lot of the time, when we turn 40, we take a moment to think about our money and life goals. One way to help you reach your end goal is to set 20 important financial goals. For example, you could pay off your debt and save for retirement. It’s not hard to reach any of the goals. These steps will help you get closer to being free and having enough money to live on your own. You can make sure you have an easy and stress-free future with these goals, whether you’re just starting out or looking back at where you are now.

1. Build an Emergency Fund

Kaboompics.com on Pexels

Kaboompics.com on Pexels

One important thing to have is an emergency fund in case you need to pay for sudden costs like hospital bills or car repairs. By the time you’re 40, you should have saved enough money to cover your expenses for three to six months. That way, you won’t have to worry about money if something unexpected comes up.

2. Eliminate High-Interest Debt

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

Credit card bills and other types of high-interest debt can quickly get out of hand. Pay it off before you turn 40 to free up money for long-term goals. Get rid of this debt, and your credit score will go up, making it easier and cheaper for you to borrow money in the future.

3. Maximize Retirement Contributions

Towfiqu barbhuiya on Pexels

Towfiqu barbhuiya on Pexels

It is smart to save for retirement in a 401(k) or an IRA so that you can enjoy the next few years. You should put in as much money as you can by the time you are 40. This plan will help you save enough money so that you don’t need to count on Social Security in your later years.

4. Stick With Your Budget

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Making a budget is the first step to having good financial health. It keeps track of your savings and spending, which helps you save more money and stop spending money you don’t need to. By age 40, a realistic budget will help you stay in charge of your money.

5. Pay Off Student Loans

QuinceCreative on Pixabay with graduation cap on top

QuinceCreative on Pixabay with graduation cap on top

Make it a goal to pay off your college loans by age 40 if you still have them. This will make money available for other financial goals and take the stress out of having debt that doesn’t go away. You might be able to lower your interest rates and pay off your loans faster by refinancing.

6. Invest in Real Estate

AS Photography on Pexels

AS Photography on Pexels

One way to build long-term wealth is to own a home or invest in rented properties. Aim to invest in real estate by age 40. It’s a good way to spend your money and can help you plan for your financial future.

7. Build a Strong Credit Score

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

If you have good credit, you can get loans with good rates. Pay your bills on time, get rid of debts as quickly as possible, and don’t use too much of your credit. Aim for a score of 700 or more by age 40.

8. Save for Your Children’s Education

Kaboompics.com on Pexels

Kaboompics.com on Pexels

If you have kids, saving for college can help you avoid worrying about money in the future. Open a 529 plan or a similar account to save for college. By 40, making regular contributions to these funds will help you ensure that your children’s education is paid for without putting your financial goals at risk.

9. Establish a Side Income Stream

Ravi Kant on Pexels

Ravi Kant on Pexels

You can save money and find other ways to make money if you have a side job. You should have a plan if you want to make extra money after 40. One way to do this is to work as a freelancer, make investments, or start a small company. You can get to your long-term goals faster with this extra money.

10. Set Up a Will or Trust

olia danilevich on Pexels

olia danilevich on Pexels

If you make a will or trust, your property will be given to the people you want after you die. To protect your wealth and plan for your family’s future, you need to take this step. You should have a plan that everyone has to follow by age 40.

11. Review Insurance Coverage

Kindel Media on Pexels

Kindel Media on Pexels

As your life changes, so should your insurance. You should often check your life, health, and unemployment insurance to ensure they cover enough. This keeps you and your family from having to pay for medical bills or car fixes out of the blue.

12. Set Up Savings

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Setting up automatic savings will help you regularly save money without thinking about it. Set up monthly transfers to savings or investment accounts that will happen on their own. By the time you’re 40, automation should be a normal part of your money plan.

13. Diversify Your Investments

Tima Miroshnichenko on Pexels

Tima Miroshnichenko on Pexels

It is safer to invest your money in several different things, such as stocks, bonds, and real estate. You should have a wide range of investments by age 40 so that you can handle changes in the market. For your retirement and long-term wealth, this gives you a strong base.

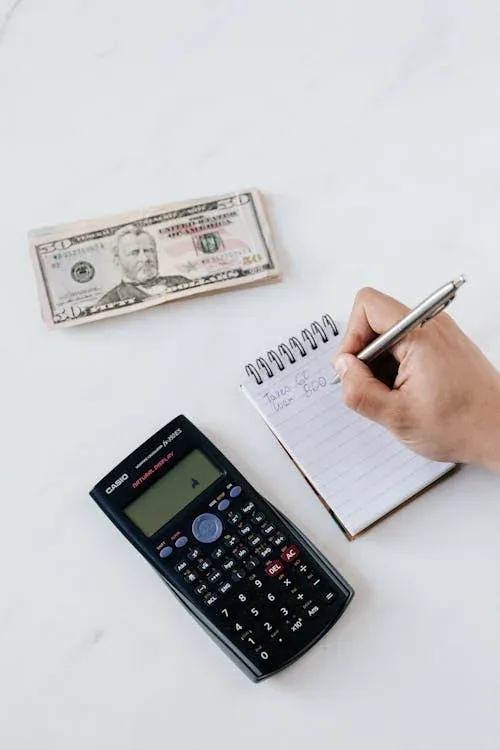

14. Learn About Taxes

Kaboompics.com on Pexels

Kaboompics.com on Pexels

You can make better financial choices if you know how taxes affect your investments and pay. By age 40, you should know how to save on taxes, like tax-deferred savings and deductions. With this information, you can keep more of your salary.

15. Build Financial Independence

George Milton on Pexels

George Milton on Pexels

Being financially independent means having enough assets to live independently without a job. Invest in things that make money for you without you having to do anything and try to become less dependent on a job over time. Should have a clear plan for how to get to this point by the time you are 40.

16. Plan for Major Life Milestones

cottonbro studio on Pexels

cottonbro studio on Pexels

When you buy a house, get married, or start a family, you should plan your finances around those significant events. You won’t be caught off guard if you have a plan for these important dates. Make sure you have saved money for these important events in your life by the time you are 40.

17. Re-evaluate Your Career Path

Yan Krukau on Pexels

Yan Krukau on Pexels

Since your job brings in a lot of money, you should decide by age 40 if it fits your goals. Look for ways to move up, change careers, or learn new skills to help you make more money. Taking charge of your job in this way can help your finances in the future.

18. Prepare for Long-Term Healthcare

Leeloo The First on Pexels

Leeloo The First on Pexels

As you get older, healthcare costs can go up a lot, so it’s smart to plan ahead. By age 40, you should either get long-term care insurance or open a health savings account (HSA). Making a plan for medical costs now can help you keep your money safe later.

19. Build a Financial Support Network

Kindel Media on Pexels

Kindel Media on Pexels

Contact experts like financial advisors, accountants, and teachers who can help you. By age 40, having a network of trusted friends and family helps you make smart choices and stay out of financial trouble. This group can help you keep your money goals on track.

20. Continue Educating Yourself Financially

Alex P on Pexels

Alex P on Pexels

To keep and grow your wealth, you need to know how to handle money. Make it a habit to keep learning about money, saving, and handling your own money. By age 40, make sure you know about new financial trends and tactics that can help you.