20 Financial Habits That Will Help You Retire Early

Unlock the secrets to financial freedom with these 20 powerful habits that can help you retire early and live life on your terms!

- Alyana Aguja

- 5 min read

Early retirement isn’t a fantasy—a game of shrewd saving, investing, and frugal spending. Through understanding important habits such as automatons for saving, spending less than you make, and accumulating diversified income, you can propel your path towards independence faster. You can overcome the 9-to-5 prison and be able to live life on your own terms long before you had envisioned!

1. Automate Your Savings

Oliur from Unsplash

Oliur from Unsplash

Create automatic transfers to your investment and retirement accounts to be consistent. Since you won’t see the money, you won’t be tempted to spend it. Save like it’s a bill you can’t negotiate with—your future self will appreciate it.

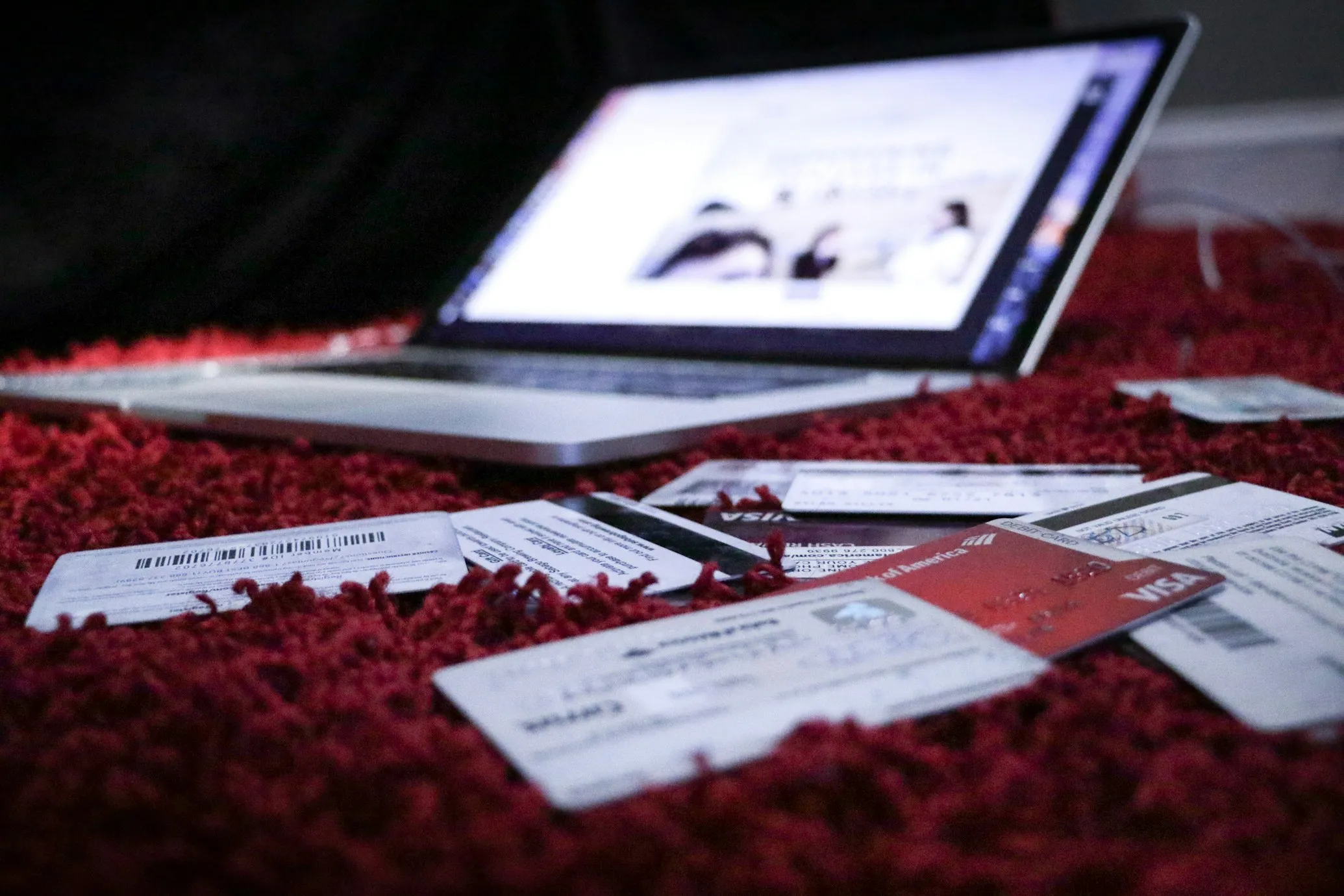

2. Track Every Dollar

Kenny Eliason from Unsplash

Kenny Eliason from Unsplash

Utilize budgeting software or spreadsheets to track your income and expenses. Knowing where your money goes allows you to eliminate wasteful expenditures and allocate money toward wealth creation. Awareness is the path to financial freedom.

3. Spend Below Your Means

Dan Dennis from Unsplash

Dan Dennis from Unsplash

Spending less than you make is the cornerstone of early retirement. Prioritize creating a life you love with minimal expenses. You don’t have to spend money just because you can afford it.

4. Invest Aggressively and Early

Jason Briscoe from Unsplash

Jason Briscoe from Unsplash

The sooner you begin, the longer compound interest has to operate its wonders. Invest in index funds, ETFs, and diversified portfolios to grow steadily. A modest amount of money today can amount to hundreds of thousands years later.

5. Max Out Retirement Accounts

Towfiqu barbhuiya from Unsplash

Towfiqu barbhuiya from Unsplash

Contribute as much as possible to 401(k)s, IRAs, and HSAs for tax benefits. Employer matching contributions are free money—never let it sit on the table. The more you save now, the earlier you can retire.

6. Don’t Let Lifestyle Inflation Get the Best of You

Jacek Dylag from Unsplash

Jacek Dylag from Unsplash

When you get a raise, invest the extra money instead of upgrading your lifestyle. Many people make more but still live paycheck to paycheck because their expenses rise with their income. Stay disciplined and let your investments grow instead.

7. Build Multiple Income Streams

Windows from Unsplash

Windows from Unsplash

Dependence on a single source of income is dangerous and decelerates wealth building. Side hustles, rental income, dividend-paying stocks, or an online business can speed up your financial freedom. Additional income equals additional opportunities to invest.

8. Learn to Love Budgeting

Towfiqu barbhuiya from Unsplash

Towfiqu barbhuiya from Unsplash

A budget is not a limitation—it’s a guide to your financial aspirations. Establish saving, investing, and spending categories to maintain balance. When you’re in charge of your money, you’re in charge of your future.

9. Be Debt-Averse

Dylan Gillis from Unsplash

Dylan Gillis from Unsplash

High-interest debt, particularly credit cards, can ruin wealth-building potential. Pay bad debt off early, and don’t take out unnecessary loans. The less you owe, the more you can invest.

10. Buy Assets, Not Liabilities

Alexander Grey from Unsplash

Alexander Grey from Unsplash

Assets put money in your pocket, while liabilities withdraw it. Invest in purchasing rental houses, stocks, and businesses rather than fancy cars and luxuries. Wealth is created by holding assets that bring in income, not assets that lose value.

11. Master Frugal Living (Without Deprivation)

Towfiqu barbhuiya from Unsplash

Towfiqu barbhuiya from Unsplash

Save without giving up happiness—couponing, home projects, and bill negotiating can save a lot. Eliminate unnecessary subscriptions, dine out less, and purchase quality rather than quantity. Frugality is efficiency, not cost-cutting.

12. Set Clear Financial Goals

Matthew Lancaster from Unsplash

Matthew Lancaster from Unsplash

Early retirement needs a figure—determine what you need to pay for things. Divide it between monthly and annual goals, so you can keep yourself focused. A plan without a goal is merely a desire!

13. Become a Minimalist

Bench Accounting from Unsplash

Bench Accounting from Unsplash

The less you require to be content, the simpler financial independence becomes. Don’t keep up with the Joneses and concentrate on what brings value to your world. Simplicity can bring financial and mental freedom.

14. Master the 4% Rule

Alexander Grey from Unsplash

Alexander Grey from Unsplash

One popular strategy for early retirement is to take 4% of your investment every year. It is essential to save a minimum of 25 times your annual expenditure before retirement. Knowing how much to save is easy once you understand this principle.

15. Leverage Tax Strategies

Scott Graham from Unsplash

Scott Graham from Unsplash

Make the most of tax-advantaged accounts, deductions, and credits to lower your tax bill. The less you pay in taxes, the more you can save and invest. Clever tax planning can get you to financial independence faster.

16. Never Stop Learning About Money

Thought Catalog from Unsplash

Thought Catalog from Unsplash

Financial literacy is an ongoing skill set that can ruin or save your early retirement plan. Read books, listen to finance gurus, and stay updated on investment trends. The more you learn, the more informed your choices will be.

17. Hang Out With Like-Minded Individuals

Headway from Unsplash

Headway from Unsplash

Your financial habits are influenced by those around you. Find a community that values financial independence and smart money choices. Being in the right environment makes sticking to your goals easier.

18. Plan for Healthcare Costs

National Cancer Institute from Unsplash

National Cancer Institute from Unsplash

Medical expenses can derail early retirement if you’re not prepared. Consider HSAs, long-term insurance, and budgeting for out-of-pocket costs. A solid health plan ensures financial stability in retirement.

19. Stay Disciplined During Market Fluctuations

Yorgos Ntrahas from Unsplash

Yorgos Ntrahas from Unsplash

Investing has ups and downs, but panic selling wipes out long-term profits. Stick to your plan, trust your strategy, and don’t make impulsive moves. Time in the market wins over timing the market.

20. Know Your “Why”

Diego PH from Unsplash

Diego PH from Unsplash

Early retirement isn’t so much about avoiding work—it’s about creating the life you desire. Whether that’s travel, time with family, or hobbies, having a purpose keeps you going. A good “why” will keep you on track even when the going gets tough.