20 Financial Habits That Will Set You Up for Life

Long-term security and success depend on developing good financial practices. These behaviors not only assist with financial management but also set the groundwork for a better future. These ideas will help you avoid financial traps and generate lifetime riches.

- Tricia Quitales

- 5 min read

Financial success is about adopting the correct habits and making wise judgments rather than about getting great pay. From saving consistently to investing smartly and analyzing your expenditures, the following article lists twenty financial behaviors that can equip you for life. These routines help build a strong basis for financial freedom, therefore lowering stress and providing more future control. Little, regular adjustments can help you create a solid financial future that will get you through the ups and downs of life.

1. Automate Your Savings

Sora Shimazaki on Pexels

Sora Shimazaki on Pexels

Automatic payments into a savings account guarantee that you pay yourself first, before devoting any other funds toward something else. As your income increases, you might change the amounts over time. This regularity lets you build riches without work and prevents you from neglecting savings.

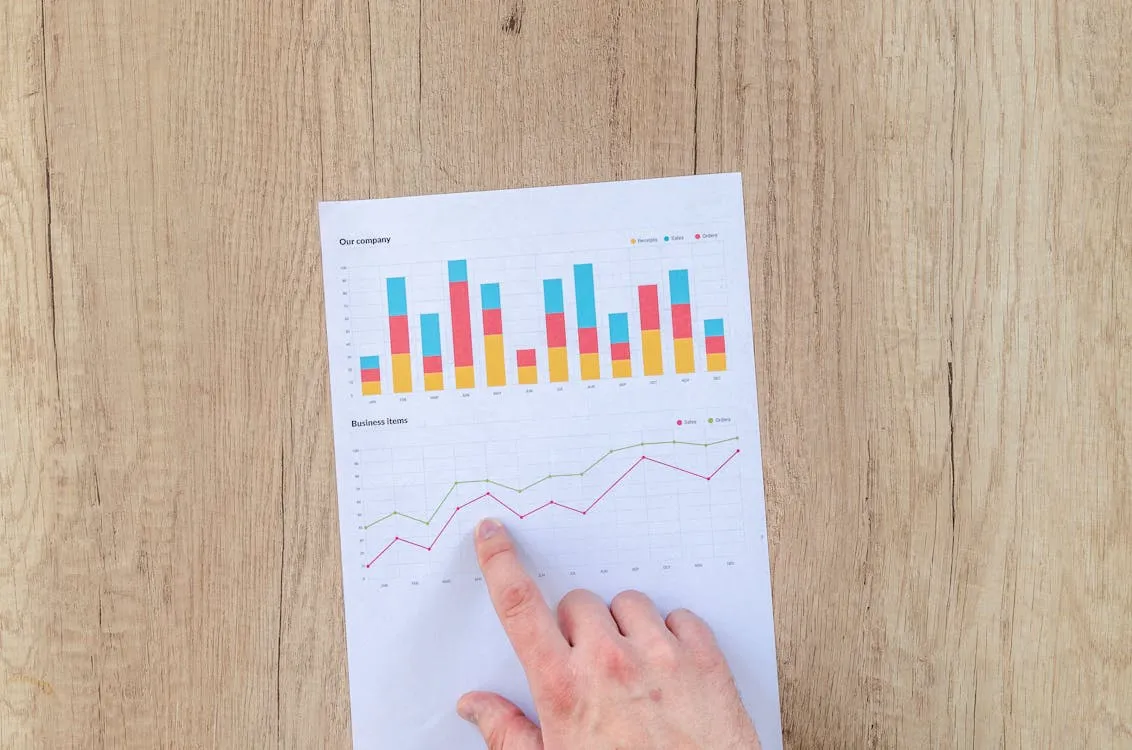

2. Budgeting

Kaboompics.com on Pexels

Kaboompics.com on Pexels

A well-designed budget allows you to precisely see where your money is going. This guarantees you’re living within your means and helps you set priorities for expenditure. Tracking your budget regularly helps you stay motivated and prevent unneeded debt.

3. Track Your Expenses

SHVETS production on Pexels

SHVETS production on Pexels

Monitoring every spending helps you to find places where you might cut back. Small purchases will be visible and limited where they stack up. Monitoring guarantees your continued responsibility for your financial objectives.

4. Prioritize Emergency Fund

ClickerHappy on Pexels

ClickerHappy on Pexels

An emergency fund provides a safety net for unanticipated costs including auto repairs or medical bills. This savings should ideally pay three to six months’ living expenditures. Having it in place shields you from financial losses and brings you a piece of mind.

5. Pay Off Debt

cottonbro studio on Pexels

cottonbro studio on Pexels

You will lose less money to interest the earlier you pay off high-interest debt. To prevent overloading yourself, concentrate on one debt at a time pay-off. Being debt-free lets you focus your income on investments and savings.

6. Avoid Lifestyle Inflation Without Enough Budget

Emil Kalibradov on Pexels

Emil Kalibradov on Pexels

Living below your means means choosing deliberately rather than starving yourself. Eat less than you make to prevent lifestyle inflation. This discipline guarantees that, rather than the other way around, your money is always working for you.

7. Start Investing Early

Burak The Weekender on Pexels

Burak The Weekender on Pexels

Early investments help you benefit from compound interest, which over time can dramatically increase your wealth. Starting requires not a lot of money; even little contributions count. Your money will work for you more aggressively the earlier you start.

8. Diversify Your Investments

Tima Miroshnichenko on Pexels

Tima Miroshnichenko on Pexels

Diversification helps guard your riches against market swings. You lower the chance of losing everything by diversifying your assets among several types. More steady growth can result from a balanced portfolio.

9. Check Your Financial Goals

Lukas on Pexels

Lukas on Pexels

Clearly state your financial goals and go over them often. This keeps you on target and facilitates essential strategy modification. It also enables you to keep inspired and track your development.

10. Avoid Impulse Purchases

Anna Shvets on Pexels

Anna Shvets on Pexels

Impulse purchases might throw off your savings and budget. Make ahead of time purchase plans and question yourself whether you truly need the item. Making a grocery list and keeping to it will help you remain orderly.

11. Save for Retirement

Diva Plavalaguna on Pexels

Diva Plavalaguna on Pexels

Your chances of leading a pleasant life when you’re older are higher the earlier you begin investing for retirement. Think about making contributions to an IRA or 401(k) retirement plan. Over time, even little donations today can cause a notable increase.

12. Understand Your Credit Score

RDNE Stock project on Pexels

RDNE Stock project on Pexels

From loan to insurance rates, your credit score influences numerous financial decisions. Review your score often to learn what variables affect it. Over time, keeping a decent credit score will help you to save money.

13. Set Up Multiple Income Streams

Andrea Piacquadio on Pexels

Andrea Piacquadio on Pexels

Having more than one source of income builds your financial strength. Search for side projects or passive income sources commensurate with your level of ability. The extra money can help pay down debt or increase your savings.

14. Protect Your Income with Insurance

Andrea Piacquadio on Pexels

Andrea Piacquadio on Pexels

Insurance protects your money in case of unanticipated circumstances such as illness or accident. Protection of your earning power depends critically on health, life, disability, and house insurance. Regular review of your insurance guarantees sufficient coverage.

15. Learn to Negotiate

Kampus Production on Pexels

Kampus Production on Pexels

Bargaining for a better price will help you save money on major purchases like houses or vehicles. Take time to investigate and make proposals; don’t settle for the first price quoted. One useful ability that will improve your financial results is learning negotiation techniques.

16. Keep Your Taxes in Mind

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Knowing how taxes affect your investments and income will enable you to save money. Make sure you benefit from credits and tax deductions at your disposal. Speaking with a tax consultant will help you maximize your tax plan.

17. Avoid Bad Financial Advice

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Financial advice that seems too good to be true should be viewed with suspicion. Consult reliable professionals’ recommendations and conduct a study. Steer clear of dangerous plans offering great profits with minimal work or risk.

18. Practice Delayed Gratification

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Delaying purchases and waiting for the best bargain lets you make wiser financial decisions. It teaches patience and helps stop impulse buying as well. This practice guarantees that your funds support more important investments.

19. Keep Learning About Personal Finance

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

You’ll make better choices the more knowledgeable you are about money management. Keep learning constantly on financial subjects including investing, budgeting, and other areas. Books, podcasts, and online courses among other things are readily available.

20. Surround Yourself with Positive Financial Influences

fauxels on Pexels

fauxels on Pexels

Your financial behavior could be much influenced by the individuals in your vicinity. Assemble those who give saving and investing top priority. Strong support may keep you inspired and enable you to hold yourself responsible to reach your objectives.