20 Financial Lessons You Should Have Learned in School

The money lessons that would have made managing finances less stressful.

- Daisy Montero

- 5 min read

Money shapes so many decisions, yet it is rarely part of the school curriculum. Learning how to budget, save, and invest early on makes a huge difference down the road. These lessons are the kind that make managing money feel less like a challenge and more like a skill you have mastered.

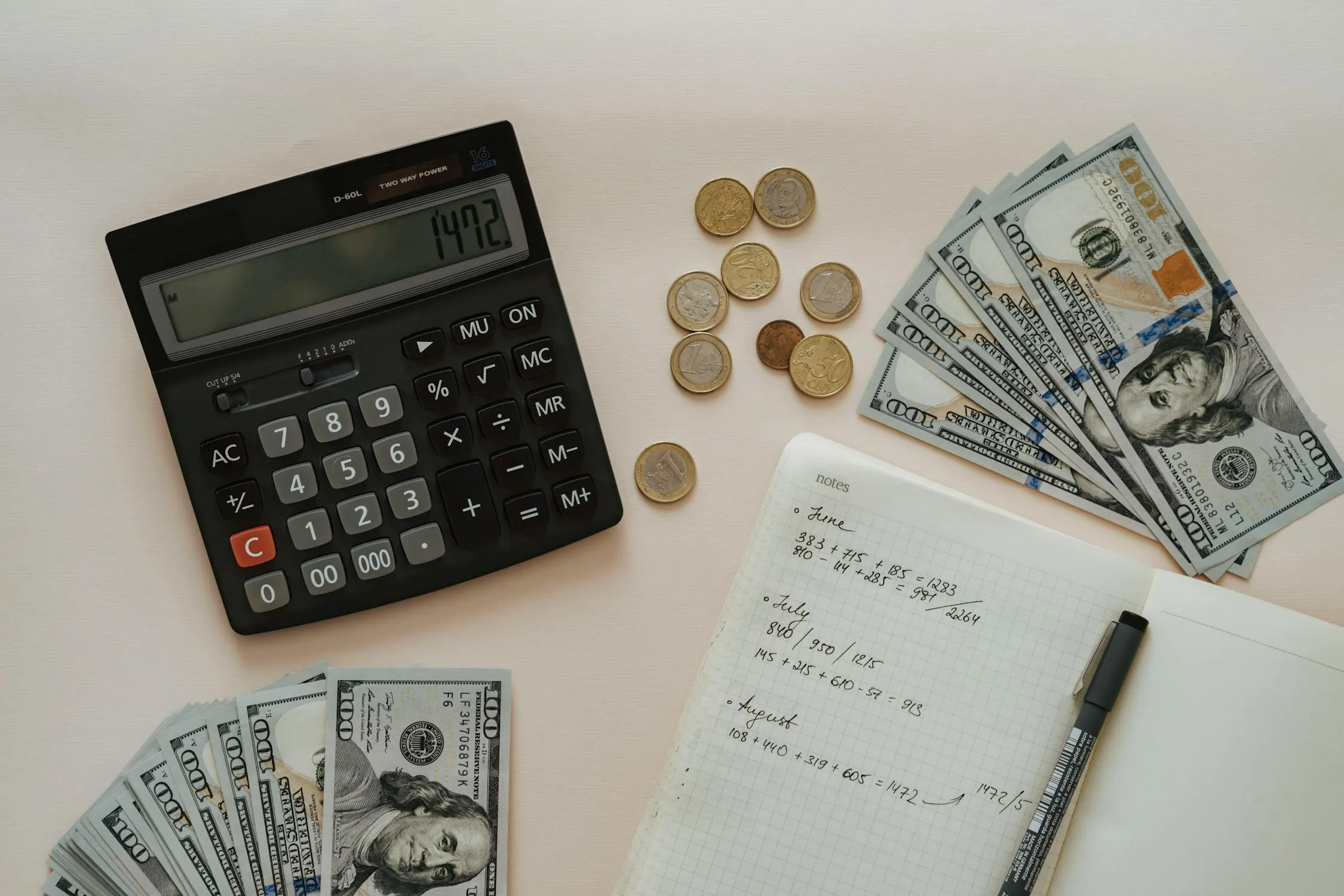

1. Budgeting is a Lifesaver

olia danilevich on Pexels

olia danilevich on Pexels

Knowing where your money goes makes all the difference. A budget helps you prioritize spending, avoid unnecessary expenses, and save for the future.

2. Emergency Funds Are Non-Negotiable

Photo By: Kaboompics.com on Pexels

Photo By: Kaboompics.com on Pexels

Life happens, and you need to be prepared. An emergency fund prevents financial disasters when unexpected expenses arise. Aim for three to six months’ worth of expenses in a separate, easily accessible account.

3. Credit Cards Are Not Free Money

Antoni Shkraba on Pexels

Antoni Shkraba on Pexels

If you do not pay it off, you will regret it later. Credit cards are useful, but high-interest pay off your balance in full to avoid unnecessary interest and financial stress.

4. Compound Interest Can Work for You , or Against You

Planet Volumes on Unsplash

Planet Volumes on Unsplash

The earlier you start, the more you gain. Compound interest makes investments grow over time, but it also makes debt harder to pay off. The sooner you start saying or investing, the more wealth you will build.

5. Living Below Your Mean is the Secret to Wealth

Anna Shvets on Pexels

Anna Shvets on Pexels

Spending less than you earn is the key. Financial stability comes from making smart spending choices. Just because you can afford something does not mean you should buy it.

6. Investing in Not Just for the Wealthy

Anna Tarazevich on Pexels

Anna Tarazevich on Pexels

Start small, and let it grow. Investing early, even with small amounts, builds long-term wealth. Learning about stocks, index funds, and retirement accounts can set you up for financial success.

7. Paying Yourself First is the Smartest Habit

Alexander Mils on Unsplash

Alexander Mils on Unsplash

If you wait until the end of the month, there will be nothing left. Treat savings like a bill and automate transfers to a savings or investment account. This ensures financial growth before lifestyle expenses eat up your paycheck.

8. Financial Goals Give Your Money a Purpose

Bich Tran on Pexel

Bich Tran on Pexel

Without a plan, money disappears fast. Setting short-and long-term financial goals keeps you focused. Whether saving for a car, a house, or retirement, a clear goal helps you stay disciplined.

9. Taxes Are Easier When You Understand Them

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

Filing taxes is not as complicated as it seems. Knowing how taxes work helps you keep more of your hard-earned money. Understanding deductions, credits, and tax brackets makes filing less stressful and ensures you are not overpaying.

10. Lifestyle Creep Can Sneak Up on You

Photo By: Kaboompics.com on Pexels

Photo By: Kaboompics.com on Pexels

Earning more does not mean spending more. Getting a raise feels great, but upgrading everything too quickly can leave you stuck in the same financial spot. Keeping expenses in check lets you enjoy that extra income without feeling like you are always catching up.

11. Negotiating Your Salary Can Change Everything

Tima Miroshnichenko on Pexels

Tima Miroshnichenko on Pexels

Your paycheck is not set in stone. Many people accept the first offer without realizing employers expect negotiations. Asking for more, especially when backed by research, can boost your income for years to come.

12. Student Loans Are a Long-Term Commitment

Min An on Pexels

Min An on Pexels

Borrowing for school is a big decision. Education is an investment, but loans can follow you for decades if not managed wisely. Understanding repayment options and interest rates makes paying them off easier.

13. Credit Scores Open or Close Doors

energepic.com on Pexels

energepic.com on Pexels

Good credit makes life easier. A strong credit score helps with everything from getting a loan to renting an apartment. Paying bills on time and keeping debt low builds a score that works in your favor.

14. Investing in Yourself Pays Off

祝 鹤槐 on Pexels

祝 鹤槐 on Pexels

Skills and knowledge are your best assets. The right training, education, or certifications can lead to better job opportunities and higher earnings. Learning never stops, and investing in yourself brings long-term rewards.

15. Side Hustles Can Build Wealth Faster

KATRIN BOLOVTSOVA on Pexels

KATRIN BOLOVTSOVA on Pexels

A little extra income goes a long way. A side gig can help pay off debt, boost savings, or fund your goals. Turning skills or hobbies into extra cash creates more financial freedom.

16. Financial Independence is More Than Just Retirement

Photo By: Kaboompics.com on Pexels

Photo By: Kaboompics.com on Pexels

Freedom comes from smart money choices. Being financially independent means having enough savings and options for the future.

17. Debt Can Be a Tool, If Used Wisely

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

Not all debt is bad, but it needs a plan. Using credit for education or homeownership can build wealth, but reckless borrowing leads to stress. Understanding interest rates and repayment strategies keeps debt under control.

18. Insurance is Protection, Not an Extra Expense

Kindel Media on Pexels

Kindel Media on Pexels

Future-you will be glad you planned. Health, auto, and home insurance prevent financial disasters. Paying for coverage now saves thousands later in case of an emergency.

19. Knowing Your Money Triggers Helps You Spend Smarter

Ivan Samkov on Pexels

Ivan Samkov on Pexels

Emotions and money are connected. Understanding what makes you overspend—stress, boredom, or social pressure—helps you make better choices. Awareness turns impulse buying into intentional spending.

20. Generational Wealth Starts Today

Andrea Piacquadio on Pexels

Andrea Piacquadio on Pexels

Small steps today create a better future. Building wealth is not just about today, it’s about setting up the next generations for success. Smart financial habits, investments, and estate planning make a lasting impact.