20 Financial Red Flags in a Partner to Watch For

Don't miss any of these waving red flags.

- Cyra Sanchez

- 5 min read

A partner’s money habits can reveal deeper issues of compatibility and potential future challenges. Red flags such as having a large amount of debt, secretive spending, or a lack of financial responsibility can indicate instability. Talking about money openly from the start builds trust and sets shared financial goals.

1. Reluctance to Discuss Finances

RDNE Stock project on Pexels

RDNE Stock project on Pexels

If your partner treats talking about money like Voldemort—" He-Who-Must-Not-Be-Named"—it’s time to take notice. By avoiding financial topics in a conversation, they may also be hiding debts, insecurity, or a lack of trust. Financial transparency is key to open communication about money in a relationship.

2. Excessive Debt with No Repayment Plan

Photo By: Kaboompics.com on Pexels

Photo By: Kaboompics.com on Pexels

Is your partner’s debt accumulating faster than laundry on a lazy Sunday? Accumulating a lot of debt without a plan to manage it is irresponsible financially. Taking the initiative to manage debt helps maintain long-term financial health and positive relationships.

3. Impulse Spending

Photo By: Kaboompics.com on Pexels

Photo By: Kaboompics.com on Pexels

Is your partner shopping like they’re on a game show bender? Impulsive buying, especially on unnecessary items, can contribute to difficult financial periods. Setting realistic budgets together in a mindful way is very important for achieving financial goals as a couple.

4. Secrecy About Financial Matters

Pavel Danilyuk on Pexels

Pavel Danilyuk on Pexels

If your partner’s finances are as mysterious as a locked diary, beware. Hiding financial information indicates more fundamental trust issues or problems lying beneath the surface. Trust and mutual respect are built on transparency in financial matters.

5. Living Beyond Their Means

Ron Lach on Pexels

Ron Lach on Pexels

Is your partner living a champagne lifestyle on a beer budget? Living consistently beyond their means ultimately leads to debt and the bottom of the financial roller coaster with no one to catch them. It is a foundational skill for fiscal security and long-term stability.

6. Avoiding Long-Term Financial Planning

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Is your significant other planning for the future like it’s light years away? The job description never mentions savings, retirement, or investments could signal short-term thinking. For a beautiful future together, long-term money relationship planning is a must.

7. Frequent Borrowing Without Repayment

Photo By: Kaboompics.com on Pexels

Photo By: Kaboompics.com on Pexels

Does your partner take loans as if it were a hobby? Asking for loans so frequently and not paying them off is irresponsible and loses trust. Financial trust is essential for a smooth collaboration.

8. Refusal to Budget

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

Does your partner see budgeting as a party pooper? Creating or adhering to a budget means that you have financial discipline. Budgeting is one of the key principles of effective financial management.

9. Hiding Large Purchases

Gustavo Fring on Pexels

Gustavo Fring on Pexels

If your partner’s big purchases are as secretive as a surprise party, beware. Hiding large purchases is a bad sign of potentially being dishonest or financial incompatibility. Mutual trust requires honesty about spending.

10. Overreliance on Credit Cards

Andrea Piacquadio on Pexels

Andrea Piacquadio on Pexels

Is your partner using credit cards like they’re magic wands? When people rely on credit cards to fund their everyday expenses, debt accumulation can lead to financial ruin. A lot of credit is necessary for the health of one’s finances.

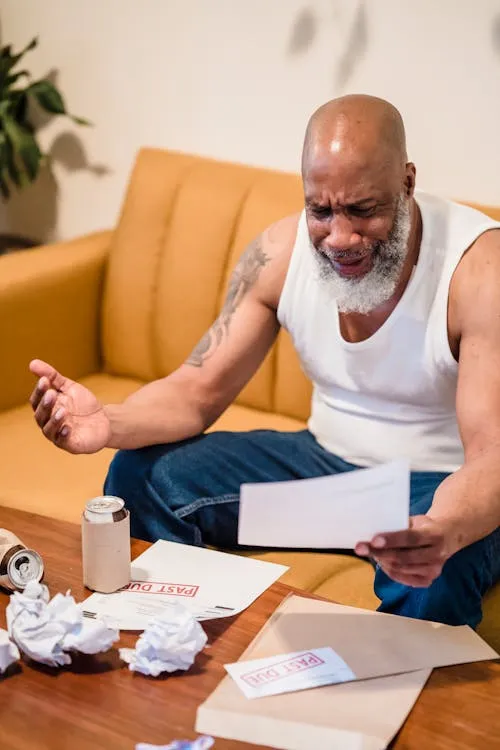

11. Ignoring Bills or Payment Deadlines

Yan Krukau on Pexels

Yan Krukau on Pexels

Are bills in your partner’s less addressed than forgotten houseplants? Missed payments can lower credit scores and reflect bad financial stewardship. Paying the bills on time shows you are responsible and dependable.

12. Blaming Others for Financial Problems

Nicola Barts on Pexels

Nicola Barts on Pexels

Is your partner playing the blame game when it comes to their finances? Avoiding accountability and pointing fingers at the outside world can limit your finances. By that same token, accountability is important in your personal and financial growth.

13. Keeping Secret Bank Accounts

Ayşenaz Bilgin on Pexels

Ayşenaz Bilgin on Pexels

If your partner has secret accounts, they are waving a big red flag. If an individual continues to have undisclosed financial accounts, that implies a lack of honesty. Trust is built upon more than just internally published figures.

14. Resentment Over Financial Success

Felicity Tai on Pexels

Felicity Tai on Pexels

Is your spouse envious of your economic success? When a partner earns more than you, resentment and jealousy of their financial success can lead to disputes. Showcasing each other’s success builds a supportive bond.

15. Prioritizing Wants Over Needs

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Is your partner more about necessity over luxury? Treating discretionary spending as a priority over essentials can be a road to financial ruin. Striking a balance between wants and needs is the keystone for sound financial health.

16. Refusal to Compromise on Financial Decisions

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Does your partner insist on “my way or the highway” with finances? Failure to meet in the middle on financial issues can lead to disputes. This helps prevent some of the stressors that could come out of financial planning.

17. Unwillingness to Seek Financial Help

Kindel Media on Pexels

Kindel Media on Pexels

Does your partner treat financial advisors like lepers? Trying to save money by not seeking the guidance of a professional when you need it will likely cost you over time. Asking for help shows that you are committed to improving your financial health.

18. Frequent Job Changes Without Financial Planning

Thirdman on Pexels

Thirdman on Pexels

Does your partner have a resume longer than War and Peace? Flitting from one job to another without regard for whether you can afford to leave may result in instability. Financial security means having stable employment and prospective planning.

19. Disregard for Financial Agreements

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

Is your partner the kind of person who treats financial agreements as if they were optional suggestions? Breaking agreed financial arrangements is a sign of disrespect. Ensuring consistency with your financial accreditation is vital for trust and partnership.

20. Pressure to Merge Finances Prematurely

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

Are they hurrying to merge finances before the ink dries on your marriage license? It can be a tactic of control or concealment to push to blend financial accounts early. A prudent move is to take some time to understand each other’s financial habits before merging finances.