20 Financial Tools Every Small Business Owner Should Use

Small business owners can streamline operations, improve financial management, and maximize profits by leveraging essential financial tools for budgeting, invoicing, payroll, and expense tracking.

- Sophia Zapanta

- 6 min read

Managing finances effectively is crucial for the success of small businesses, and the right financial tools can simplify the process. From automating bookkeeping to optimizing tax planning, these tools help business owners save time, reduce errors, and make data-driven decisions. This article explores 20 must-have financial tools, detailing how each one enhances cash flow, compliance, and overall business efficiency.

1. Accounting Software

Austin Distel on Unsplash

Austin Distel on Unsplash

Accurate bookkeeping is the backbone of any successful business, and accounting software simplifies the process. Tools like QuickBooks or Xero automate transaction tracking, invoicing, and financial reporting. They help business owners maintain up-to-date financial records and prepare tax filings effortlessly. With cloud-based access, users can manage finances from anywhere, ensuring real-time insights into cash flow.

2. Expense Tracking Apps

Jakub Żerdzicki on Unsplash

Jakub Żerdzicki on Unsplash

Keeping track of business expenses prevents financial mismanagement and cash flow issues. Apps like Expensify and Zoho Expense allow users to scan receipts, categorize transactions, and generate expense reports. These tools integrate with accounting software, reducing manual data entry and human errors. Automated tracking ensures that businesses stay within budget and identify unnecessary costs.

3. Payroll Management Software

Tima Miroshnichenko on Pexels

Tima Miroshnichenko on Pexels

Processing payroll manually is time-consuming and prone to errors, making payroll software a vital investment. Tools like Gusto and ADP automate salary calculations, tax withholdings, and direct deposits. They ensure compliance with labor laws and simplify tax filings for employees and contractors. By streamlining payroll operations, businesses can save time and reduce financial risks.

4. Invoice Management Tools

Carlos Muza on Pexels

Carlos Muza on Pexels

Late or missed payments can disrupt cash flow, making invoice management crucial. Platforms like FreshBooks and Wave help businesses effortlessly create, send, and track invoices. Automated reminders prompt clients to pay on time, reducing the chances of unpaid bills. Customizable templates and recurring billing features also improve efficiency for service-based businesses.

5. Tax Preparation Software

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

Navigating tax obligations can be complex, but tax software simplifies the process. Programs like TurboTax Business and TaxSlayer help small businesses file taxes accurately while identifying deductions and credits. They provide step-by-step guidance, reducing the risk of costly tax mistakes. Cloud-based solutions also ensure secure document storage and easy retrieval for audits.

6. Budgeting and Forecasting Tools

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

Financial planning is essential for business growth, and budgeting tools provide structured insights. Software like PlanGuru and Float helps businesses set financial goals, analyze trends, and predict future cash flow. These platforms use historical data to create realistic financial forecasts. A clear budget allows businesses to allocate resources wisely and prepare for unexpected expenses.

7. Business Credit Monitoring Services

Kampus Production on Pexels

Kampus Production on Pexels

Maintaining a strong credit score is critical for securing loans and business credibility. Tools like Nav and Experian Business Monitor track credit scores, alerting owners to potential risks. They provide reports on payment history, outstanding debts, and lender evaluations. By monitoring credit health, businesses can improve borrowing opportunities and negotiate better terms with vendors.

8. Payment Processing Systems

Julio Lopez on Pexels

Julio Lopez on Pexels

Accepting multiple payment methods enhances customer convenience and revenue streams. Platforms like Square, Stripe, and PayPal facilitate secure credit cards, digital wallets, and online payment transactions. These systems integrate with accounting software, ensuring seamless financial tracking. Reliable payment processing minimizes transaction failures and enhances the customer experience.

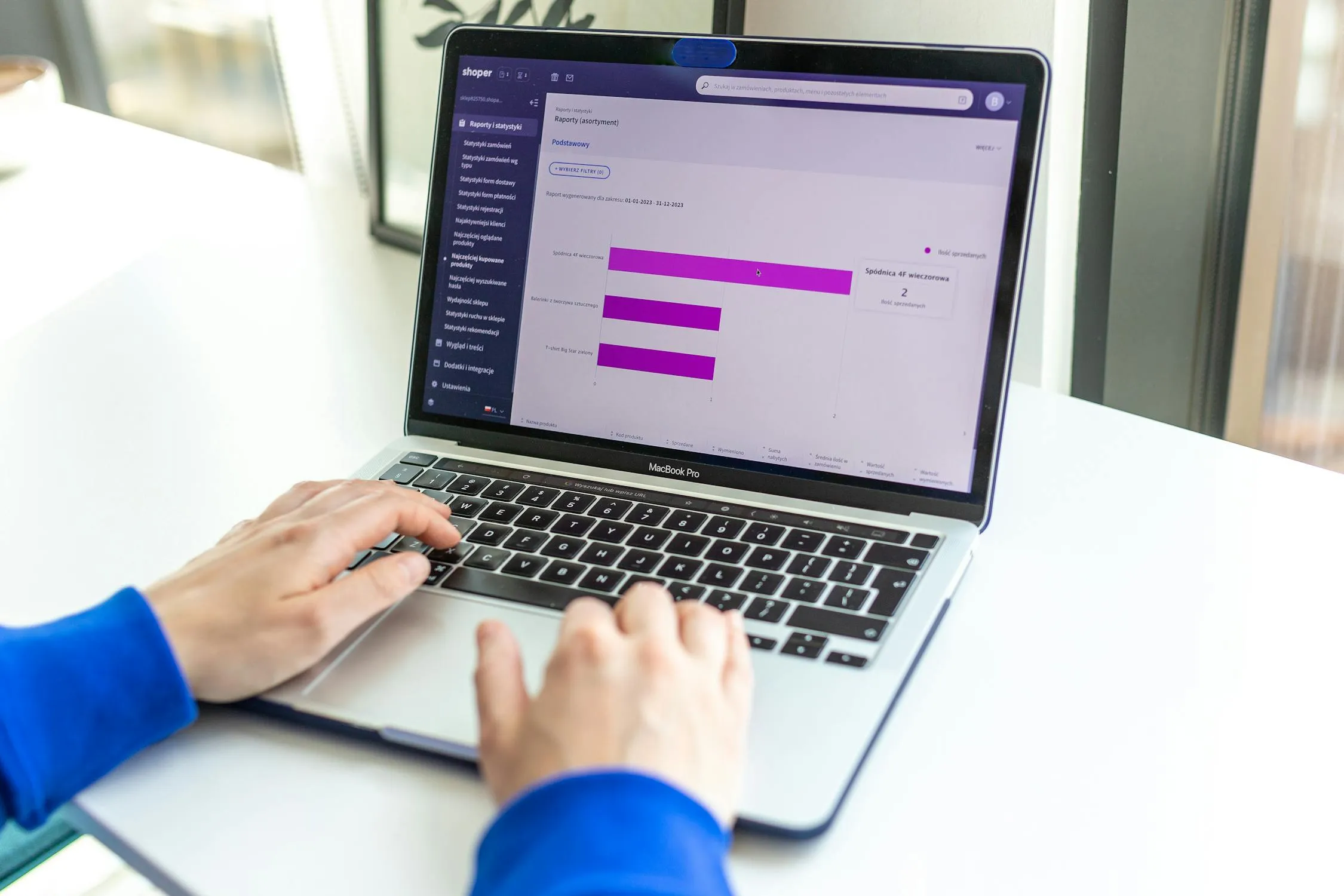

9. Point-of-Sale (POS) Systems

Shoper .pl on Pexels

Shoper .pl on Pexels

For retail and service-based businesses, a robust POS system is essential. Solutions like Shopify POS and Lightspeed streamline sales, track inventory, and manage customer data. These systems generate real-time reports, helping businesses analyze sales trends and optimize pricing strategies. A good POS system enhances operational efficiency and improves customer service.

10. Inventory Management Software

Pixabay on Pexels

Pixabay on Pexels

Efficient inventory tracking prevents stock shortages and overstocking issues. Tools like TradeGecko and Ordoro automate inventory updates, order tracking, and supplier management. They integrate with e-commerce platforms, ensuring accurate stock levels across multiple sales channels. Proper inventory management reduces financial losses and enhances supply chain efficiency.

11. Business Loan and Financing Platforms

Antoni Shkraba on Pexels

Antoni Shkraba on Pexels

Access to funding is crucial for scaling a business, and loan platforms simplify the process. Services like Fundbox and Kabbage offer small businesses fast and flexible financing options. These platforms analyze business performance and credit scores to determine eligibility. Quick loan approvals help businesses manage cash flow gaps and seize growth opportunities.

12. Financial Dashboard Tools

Pavel Danilyuk on Pexels

Pavel Danilyuk on Pexels

A centralized financial dashboard offers real-time insights into business performance. Platforms like LivePlan and Fathom compile financial data from multiple sources into an easy-to-read format. These tools help business owners visualize trends, monitor key metrics, and make informed decisions. Having a clear financial overview enhances strategic planning and goal setting.

13. E-commerce Financial Tools

Julio Lopez on Pexels

Julio Lopez on Pexels

Online businesses require specialized financial tools for seamless transactions. Software like Shopify Payments and Payoneer handles international payments, sales tax calculations, and multi-currency support. These platforms provide analytics to track revenue growth and optimize pricing strategies. Efficient e-commerce financial tools improve profit margins and global scalability.

14. Billing and Subscription Management Software

Syed Qaarif Andrabi on Pexels

Syed Qaarif Andrabi on Pexels

For businesses offering recurring services, managing subscriptions is crucial. Tools like Chargebee and Recurly automate billing, renewals, and cancellations. They help businesses track customer subscriptions, reduce churn rates, and improve retention strategies. Automated invoicing also ensures timely payments and smooth financial operations.

15. Business Insurance Comparison Tools

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Protecting a business from financial risks requires the right insurance coverage. Platforms like CoverWallet and Simply Business compare policies tailored to small businesses. These tools simplify the selection process by highlighting coverage options, costs, and provider ratings. Having the right insurance reduces liability risks and ensures financial security.

16. Debt Management Software

Tima Miroshnichenko on Pexels

Tima Miroshnichenko on Pexels

Managing business loans and debts strategically prevents financial strain. Tools like Tally and Undebt help businesses track loan payments, calculate interest, and develop repayment plans. They provide insights into payoff timelines and recommend strategies to reduce debt faster. Effective debt management ensures long-term financial stability and minimizes interest costs.

17. Grant and Funding Search Tools

Polina Zimmerman on Pexels

Polina Zimmerman on Pexels

Securing grants can provide non-repayable funding for business growth. Websites like Grants.gov and Hello Alice help businesses identify available grants based on industry and eligibility criteria. These platforms streamline the application process and offer guidance on securing funds. Leveraging grant opportunities reduces reliance on traditional loans and improves financial sustainability.

18. Wealth Management and Investment Tools

Tima Miroshnichenko on Pexels

Tima Miroshnichenko on Pexels

Long-term financial planning includes investment strategies for business growth. Apps like Personal Capital and M1 Finance help business owners manage assets, retirement plans, and investments. These platforms provide portfolio analysis, risk assessment, and automated investing options. Smart wealth management secures financial stability and future business expansion.

19. Contract and Financial Agreement Software

Docusign internal Brand & Creative team on Wikimedia Commons

Docusign internal Brand & Creative team on Wikimedia Commons

Legal and financial agreements should be properly documented for business security. Tools like PandaDoc and DocuSign facilitate digital contract creation, electronic signatures, and secure storage. These platforms automate agreement workflows, reducing delays and compliance risks. Digitized contracts ensure transparency, legal protection, and streamlined financial transactions.

20. Fraud Prevention and Security Tools

Jakub Zerdzicki on Pexels

Jakub Zerdzicki on Pexels

Protecting business finances from cyber threats is essential in the digital age. Tools like Kount and Sift use AI-driven fraud detection to prevent unauthorized transactions. They analyze payment behaviors, detect suspicious activities, and provide real-time alerts. Investing in fraud prevention safeguards business revenue and customer trust.

- Tags:

- Finance

- Business

- tools

- money

- Productivity