20 Hidden Expenses That Are Draining Your Budget

Some costs quietly add up and eat away at your finances without realizing it.

- Daisy Montero

- 5 min read

Do you ever feel like your paycheck disappears faster than expected? Hidden expenses might be the culprit. From sneaky subscription fees to small daily purchases that add up, these costs can drain your budget before you even notice. Cutting them out could free up more money for the things that truly matter.

1. Unused Subscriptions

Kindel Media on Pexels

Kindel Media on Pexels

Those $5 and $10 subscriptions seem harmless until they accumulate. Many people sign up for free trials and forget to cancel or keep paying for services they rarely use. A quick audit of your subscription could save you more money than you think.

2. Bank Fees

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Overdraft fees, ATM charges, and account maintenance fees can quietly drain your bank account. Many banks charge for things like paper statements or using out-of-network ATMs. Switching to a bank with lower or no fees can keep more money in your pocket.

3. Unused Gym Memberships

MART PRODUCTION on Pexels

MART PRODUCTION on Pexels

If your gym membership collects dust instead of sweat, it’s time to cancel. Many people pay monthly fees but rarely step foot inside. Finding alternative workouts at home or choosing pay-per-visit options can be a smarter way to stay fit without wasting money.

4. Impulse Online Shopping

cottonbro studio on Pexels

cottonbro studio on Pexels

Late-night browsing and one-click purchases can be dangerous for your budget. While it’s easy to justify small purchases, they add up over time. Creating a 24-hour rule before buying something can help curb impulse spending.

5. Food Delivery Fees

Norma Mortenson on Pexels

Norma Mortenson on Pexels

Ordering food delivery is convenient, but the fees can be shocking. Between service charges, delivery fees, and tips, your meal costs way more than cooking at home. Picking up your order or limiting how often you rely on delivery can help you save.

6. Bottled Water

mali maeder on Pexels

mali maeder on Pexels

Buying bottled water regularly may not seem expensive, but it adds up over time. A reusable water bottle and a good filter can save you hundreds of dollars annually. It’s also a better choice for the environment.

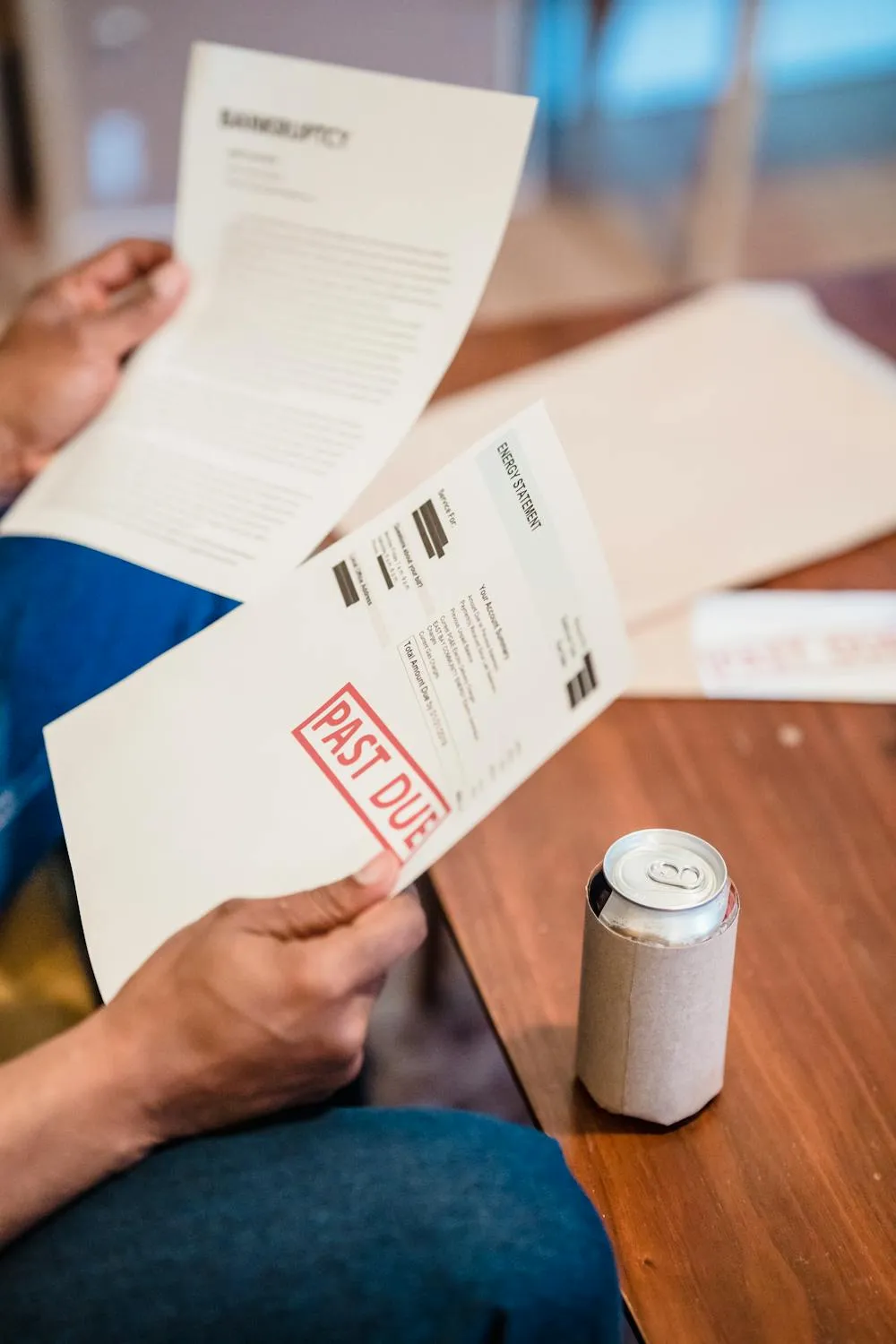

7. Late Fees on Bills

Nicola Barts on Pexels

Nicola Barts on Pexels

Forgetting to pay your bills on time can lead to unnecessary late fees. These charges might seem small at first, but they add up quickly. Setting up automatic payments or reminders can help you avoid them.

8. Extended Warranties

Gabrielle Henderson on Unsplash

Gabrielle Henderson on Unsplash

Many extended warranties aren’t worth the money. Most products don’t break within the extended coverage period, and many credit cards offer built-in protection. Checking your existing warranty policies before buying extra coverage can save you unnecessary expenses.

9. Fancy Coffee Runs

Lina Kivaka on Pexels

Lina Kivaka on Pexels

Grabbing a $5 coffee every morning can add up to hundreds of dollars a year. While it’s a nice treat, making coffee at home is a much cheaper alternative. Investing in a quality coffee maker can help you save without sacrificing your caffeine fix.

10. Credit Card Interest

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

Carrying a balance on your credit card means you’re paying extra in interest every month. The longer you let it sit, the more you end up paying. Paying off your balance in full can help you avoid these unnecessary charges.

11. Subscription Boxes

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

Subscription boxes can be fun, but they often include unnecessary items. The excitement of receiving a monthly surprise fades quickly, leaving you with clutter and wasted money. Canceling unused or unnecessary subscriptions can help free up your budget.

12. Fast Fashion Purchases

Andrea Piacquadio on Pexels

Andrea Piacquadio on Pexels

Cheap, trendy clothes might seem like a good deal, but they don’t last long. Constantly replacing low-quality items adds up over time. Investing in fewer, higher-quality pieces can save you money in the long run.

13. Name-Brand Groceries

Tara Clark on Pexels

Tara Clark on Pexels

Many store-brand products are just as good as name brands but cost much less. Grocery stores often charge extra for branding and packaging. Comparing prices and choosing generics can lead to big savings over time.

14. Unused Gift Cards

Ruliff Andrean on Unsplash

Ruliff Andrean on Unsplash

Unused gift cards are like cash sitting in your drawer. Many people forget about them or never use the full amount. Selling or using them before they expire ensures you don’t waste that value.

15. Premium Gas When You Don’t Need It

Ekaterina Belinskaya on Pexels

Ekaterina Belinskaya on Pexels

Unless your car specifically requires premium gas, you’re wasting money. Despite marketing claims, most vehicles run just fine on regular fuel. Checking your car manual can help you avoid unnecessary fuel costs.

16. In-App Purchases

AS Photography on Pexels

AS Photography on Pexels

Many apps lure you in with free downloads but charge for extras later. Small in-app purchases add up over time, often costing more than a one-time paid version. Keeping track of these expenses can prevent unnecessary spending.

17. Cable TV Packages

Photo By: Kaboompics.com on Pexels

Photo By: Kaboompics.com on Pexels

Cable TV bundles often include channels you never watch. Streaming services or customized plans can provide the same entertainment for a fraction of the cost. Cutting the cord could put extra money back into your budget.

18. High-Interest Loans

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

Payday and high-interest personal loans might seem like a quick fix, but they create long-term financial strain. The high fees and compounding interest make it difficult to pay them off. Looking for lower-interest alternatives can help keep your finances stable.

19. Hotel and Resort Fees

Colon Freld on Pexels

Colon Freld on Pexels

Some hotels charge hidden fees for amenities you don’t use, like Wi-Fi, parking, or gym access. These costs can inflate your travel expenses without you realizing it. Checking for hidden fees before booking can help you budget smarter.

20. Lottery Tickets and Gambling

Erik Mclean on Pexels

Erik Mclean on Pexels

Playing the lottery or gambling might seem harmless fun, but it’s often a losing game. The odds are rarely in your favor, and small bets can quickly add up. Redirecting that money into savings or investments is a much smarter financial move.