20 Important Tax Documents for Homeowners

As a homeowner, you have to take care of many things, and one of the most important is keeping your taxes in order. Homeowners can get tax breaks and credits and avoid problems by keeping track of the needed tax documents.

- Tricia Quitales

- 7 min read

Tax deductions and credits are often available to homeowners, but it’s important to keep the right paperwork to take advantage of them. This article discusses 20 important tax papers that every homeowner should keep track of all year. These documents, like mortgage interest statements and receipts for home improvements, can help you pay less in taxes and make sure you file correctly. Homeowners can save money and be ready for tax season by knowing what documents to keep.

1. Mortgage Interest Statement (Form 1098)

Cytonn Photography on Pexels

Cytonn Photography on Pexels

You need to get Form 1098 from your mortgage lender, which shows how much interest you paid on your loan during the year. If you want to get the mortgage interest deduction, which can lower your taxable income, you need this form. Keep this document safe so that you can file your taxes correctly.

2. Property Tax Records

Leeloo The First on Pexels

Leeloo The First on Pexels

A homeowner must have property tax bills or receipts if they want to deduct property taxes on their tax return. These papers show how much property taxes you pay throughout the year. Keeping these papers in order will help you remember about possible tax breaks.

3. Home Improvement Receipts

Kaboompics.com on Pexels

Kaboompics.com on Pexels

You might get tax credits or deductions if you make changes to your home. Keep all your receipts for home improvements, like upgrades that make your home more energy-efficient, in case you need to claim a tax break. You can also use these receipts to track how much your house has lost in value over time.

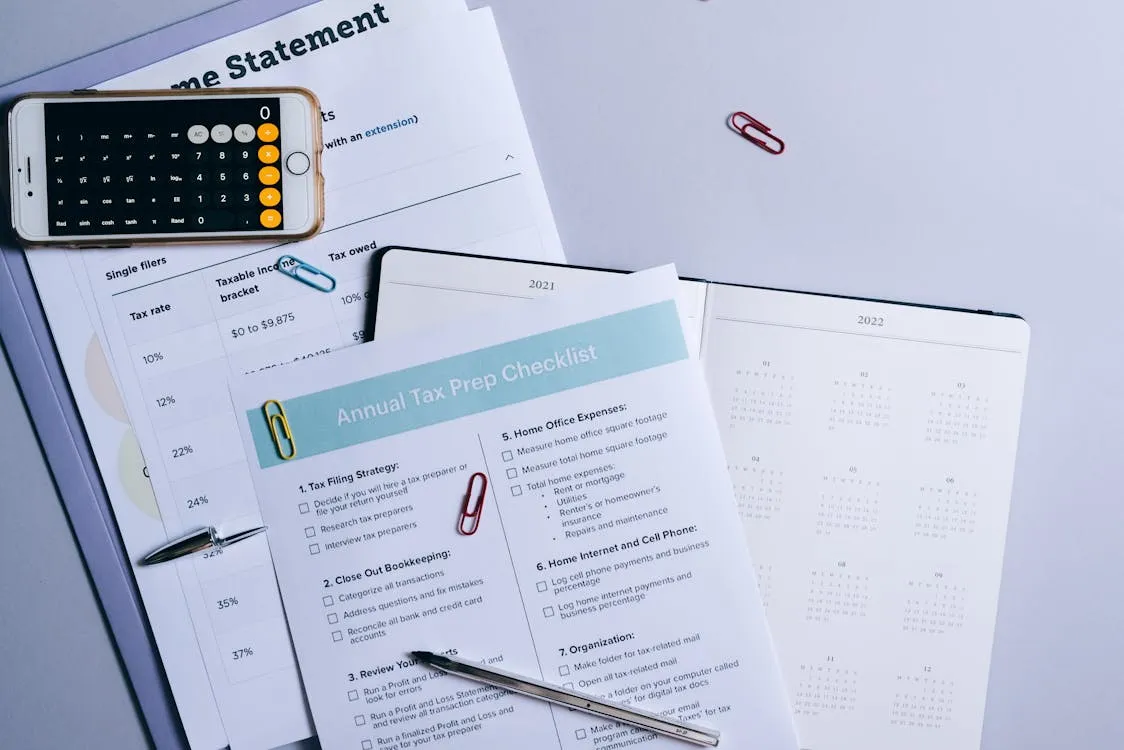

4. Home Office Deduction Documents

Pixabay on Pexels

Pixabay on Pexels

You may get a tax break for your home office if you use part of your home for work. To get this, you must keep detailed records of the space you used for work, such as utility bills, mortgage interest, and home repairs. Having the correct paperwork can help you get the most out of your deduction.

5. Closing Documents (HUD-1 or Closing Disclosure)

energepic.com on Pexels

energepic.com on Pexels

The HUD-1 Settlement Statement or Closing Disclosure is one of the closing documents you’ll get when you buy a house. These papers list all the fees you’ll have to pay to buy a house, like loan origination fees and title insurance. They might be useful when getting tax breaks for things like mortgage points or the cost of buying a house.

6. Insurance Premium Statements

Polina Tankilevitch on Pexels

Polina Tankilevitch on Pexels

You can possibly get a tax break if you keep track of your home insurance premiums if you have homeowners insurance. Homeowners’ insurance premiums aren’t usually tax-deductible, but premiums for rental or business properties can be. Make sure to keep your yearly statements to keep good records.

7. Mortgage Insurance Premiums (PMI)

Polina Tankilevitch on Pexels

Polina Tankilevitch on Pexels

Depending on your income and tax situation, you can deduct your private mortgage insurance (PMI) premiums. Ensure you keep your PMI records so you can use this deduction if you are eligible. This may help you pay less in taxes overall.

8. Energy-Efficiency Improvement Records

cottonbro studio on Pexels

cottonbro studio on Pexels

You might be able to get tax breaks for making changes to your home that are better for the environment, like adding solar panels or energy-efficient windows. Keep the receipts and other proof of any upgrades to see if you are eligible for these incentives. You can save a lot on taxes if you keep these documents.

9. Rent Records (If Renting Out Part of Your Home)

RDNE Stock project on Pexels

RDNE Stock project on Pexels

You have to report rental income if you rent out a part of your home, but you can also deduct some costs related to the rental. Keep track of the money you make from rentals, like rent payments, and the money you spend on repairs or property management fees. These papers ensure you follow the rules and get the most out of your deductions.

10. Proof of Capital Gains Exclusion

MART PRODUCTION on Pexels

MART PRODUCTION on Pexels

If you sell your home and make a profit, you might get a tax break on the extra money you earn. You need to show proof that you have lived in the house for at least two of the last five years. To get a correct estimate of your gain, keep track of the details of your sale, such as the sales price and any changes you made.

11. Charitable Donation Receipts

Kaboompics.com on Pexels

Kaboompics.com on Pexels

If you donate things from your home to charity, like furniture or other things, you can get a tax break for those donations. For tax purposes, keep the charity’s receipts or letters of thanks. These papers are needed to list all of your charitable deductions.

12. Energy-Efficient Tax Credit Forms

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Some tax credits can help homeowners cover the costs of making improvements that use less energy. You might need to fill out certain forms for these tax credits, like IRS Form 5695 for residential energy credits. For your taxes, keep all forms and papers related to energy-efficient products.

13. Tax Forms for Rental Property (Schedule E)

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

To report rental income and costs, you must file Schedule E if you rent out your home. This form helps you get tax breaks for repairs, property management fees, and the value of your home going down over time. Keep accurate records of all the costs related to the rental.

14. Home Sale Records

cottonbro studio on Pexels

cottonbro studio on Pexels

Keeping records of the sale of a home is very important. These records should include the purchase price, the selling price, and any improvements made to the property. When you report the sale, these papers help you determine capital gains or losses. You won’t miss out on exclusions or deductions if you keep good records.

15. Bank Statements

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Keeping track of your money is easier if you keep bank statements that show your mortgage, property tax, and other related payments. You can use these statements to confirm payments and ensure that your deductions are correct. If you need to, keep these papers for at least three years.

16. Records of Home-Related Expenses

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

Keep track of all the money you spend on your home, like repairs, utilities, and upkeep. These costs might be tax-deductible if you rent out part of your home or use your home for business. You can get the most out of your tax breaks with the correct paperwork.

17. 1099 Forms for Contractors

Leeloo The First on Pexels

Leeloo The First on Pexels

Keep the 1099 forms contractors give you if you hire them for work or repairs, like landscaping or maintenance. For tax purposes, you must report any payments of $600 or more to a contractor. These forms keep you in line with IRS rules and help you keep track of your expenses.

18. Loan Statements

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

It’s important to track your mortgage and any home equity loans. These papers show how much interest was paid and how much the principal is still owed. This information can be used to figure out tax breaks or gains from selling a home. They help you keep things in order and prepare to file your taxes.

19. Tax Assessment Notices

Leeloo The First on Pexels

Leeloo The First on Pexels

Property tax assessment notices tell you how much your property is worth. They may be able to help you appeal your property tax assessment if you think it is too high. Keeping these notices can help you ensure your property taxes are correct and may even let you get a tax break.

20. Receipts for Home Repairs (If Renting)

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

If you rent out your home or part of it, you can deduct repairs you make. Keep the receipts for any repairs that need to be done to keep the property rentable. These receipts can help you pay less in rental income tax by showing how much the repairs cost.

- Tags:

- Tax

- documents

- Homeowners

- Deductions