20 Investment Mistakes to Avoid After 50

Avoiding common investment mistakes after 50 is the key to turning your golden years into a financial triumph rather than a cautionary tale. Here are 20 investment mistakes to avoid after 50.

- Alyana Aguja

- 5 min read

Reaching 50 is a financial milestone that demands smarter, more deliberate investment decisions to safeguard your future. From understanding healthcare costs to over-relying on Social Security, avoiding critical mistakes can mean the difference between a comfortable retirement and financial strains. By diversifying your portfolio, planning for longevity, and staying proactive financially, you can turn this pivotal decade into the launchpad for a secure and fulfilling retirement.

1. Overlooking Your Time Horizon

Jiyeon Park from Unsplash

Jiyeon Park from Unsplash

Retirement doesn’t mean all investments need to be ultra-conservative. While your principal needs to be protected, inflation can silently erode your purchasing power over time. Achieve a balanced portfolio with growth and stability points that serve your long-term purposes.

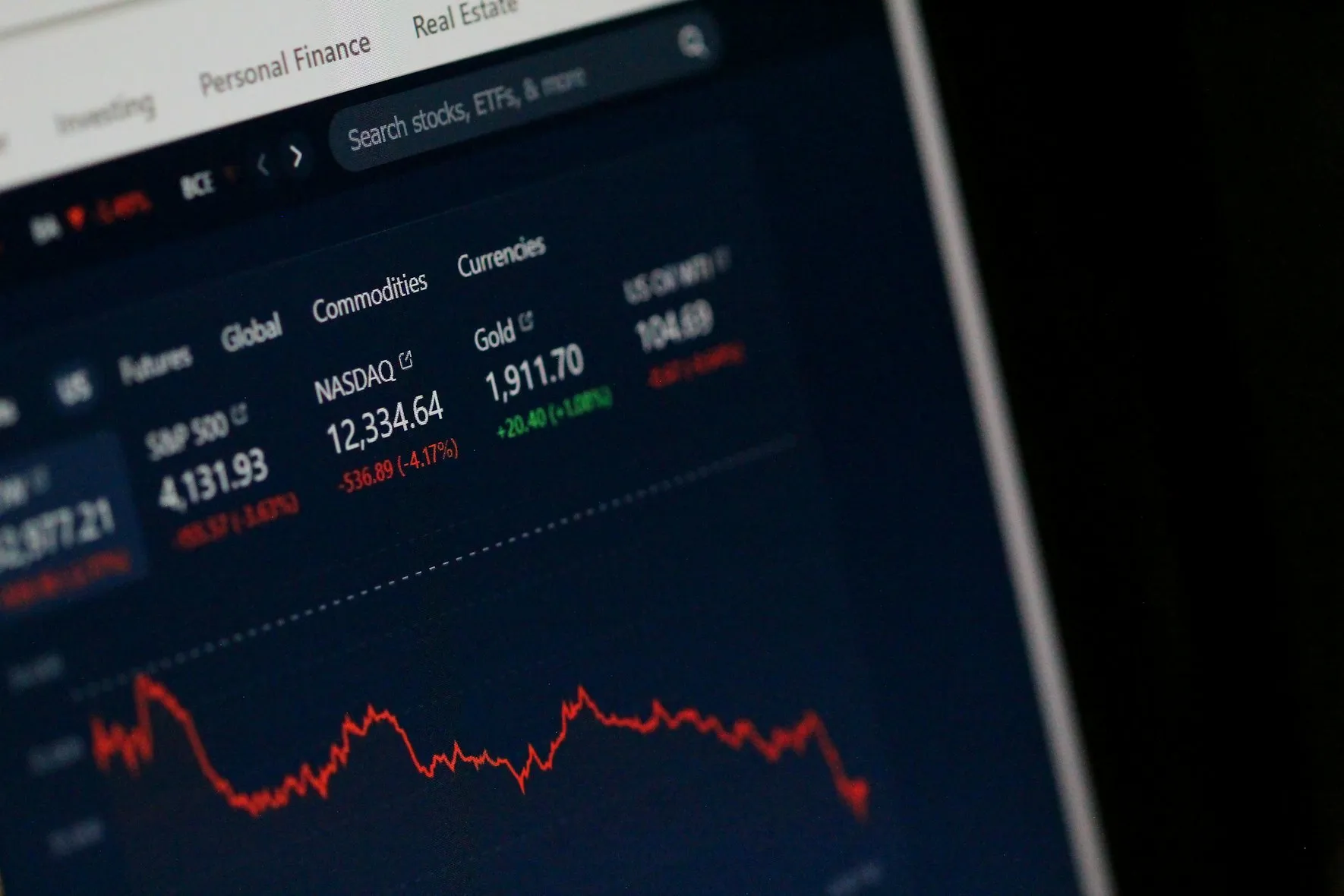

2. Failure to Diversify

Chris Liverani from Unsplash

Chris Liverani from Unsplash

Relying on just a few stocks or asset classes can magnify risk. At 50+, diversification becomes even more important to smooth out market ups and downs. For a balanced approach, spread investments across equities, bonds, real estate, and other vehicles.

3. Overlooking Healthcare Costs

Alexander Grey from Unsplash

Alexander Grey from Unsplash

Healthcare costs tend to jump sharply in retirement, and many underestimate this burden. If these costs are not factored in, an error in a financial plan can soon destroy investments. Long-term care insurance and health savings accounts should be considered.

4. Chasing High Yields

Behnam Norouzi from Unsplash

Behnam Norouzi from Unsplash

A tempting 10% dividend might sound like easy money, but high risks are likely associated with it. High-yield investments may not just underperform in volatile markets but entirely fail. First, consider total returns, which constitute growth and income, to preserve capital.

5. Not Catching Up on Contributions

Alexander Grey from Unsplash

Alexander Grey from Unsplash

At 50+, you can start catching up on retirement accounts through catch-up contributions. Failing to max out your 401(k) or IRA leaves valuable tax-advantaged savings on the table. Contribute more and make up for lost time.

6. Withdrawing Retirement Accounts Early

Money Knack from Unsplash

Money Knack from Unsplash

Dipping into retirement savings before age 59½ invites hefty penalties and taxes. This move interrupts compounding growth, meaning you’ll have less in the later years of your retirement life. To avoid using your retirement funds, an emergency fund should be built.

7. Underestimating Longevity

Peter Gombos from Unsplash

Peter Gombos from Unsplash

People are living longer, so your retirement might extend over decades. Outrunning your money at age 80 or 90 is a realistic possibility if you do not plan. Take conservative withdrawal rates and make sure your investments can sustain long-term needs.

8. Neglecting Estate Planning

Melinda Gimpel from Unsplash

Melinda Gimpel from Unsplash

Failure to make a will, trust, or beneficiary designations often leaves family members in disarray. Assets that might go precisely where you care, to the people or causes you care about, will simply not. Work with an estate attorney to ensure your legacy aligns with your wishes.

9. Giving In to Emotional Investing

Anne Nygård from Unsplash

Anne Nygård from Unsplash

Market drops can be frightening, but panicking to sell tends to lock in losses. When one reaches the age of 50, emotional decisions often have outsized impacts on one’s portfolio. Stick to your well-thought-out plan and consult a financial advisor when things get complicated.

10. Ignoring Inflation Impact

Katharina Kammermann from Unsplash

Katharina Kammermann from Unsplash

Today’s dollar won’t buy as much in 20 years, yet many retirees ignore inflation. Fixed incomes from pensions or bonds can reduce purchasing power over time. Add growth assets to combat inflation’s erosive effects.

11. Over-Reliance on Social Security

Scott Graham from Unsplash

Scott Graham from Unsplash

It’s a good supplement but not enough for all expenses. Banking on it solely as your primary income can leave you in a vulnerable financial position. Build other income streams to support you pleasantly in retirement.

12. Not Reviewing Your Portfolio Regularly

Unseen Studio from Unsplash

Unseen Studio from Unsplash

A “set it and forget it” strategy can leave your portfolio misaligned with your goals. You may need to reduce risk or rebalance allocations as you approach retirement. Regular check-ins ensure your investments stay on track with your changing needs.

13. Not Accounting for Taxes

Kelly Sikkema from Unsplash

Kelly Sikkema from Unsplash

Retirement doesn’t mean you’re free from taxes—withdrawals from traditional IRAs and 401(k)s are taxed as income. Without proper planning, taxes can eat into your nest egg. Consider Roth accounts or tax-efficient withdrawal strategies to minimize your liability.

14. Keeping Too Much in Cash

Giorgio Trovato from Unsplash

Giorgio Trovato from Unsplash

Cash is considered safe, but inflation erodes its value over time. Excess cash in retirement accounts may reduce growth opportunities. Invest wisely, keep the money working for you, and maintain liquidity for emergencies.

15. Unaddressed Debt Management

Towfiqu Barbhuiya from Unsplash

Towfiqu Barbhuiya from Unsplash

High-interest debt is a silent wealth killer if left unchecked at age 50. Paying off credit cards and personal loans or even downsizing your mortgage should become a priority. Reducing debt allows for more cash flow to be available for investments and retirement savings.

16. Not Planning for Market Downturns

Jan Baborák from Unsplash

Jan Baborák from Unsplash

Market volatility is inevitable, especially during decades of retirement. Without preparation for declines, you may sell investments at a loss. It would be best to have a portion of your portfolio in low-risk, liquid assets for such times.

17. Overestimation of Investment Return

Mathieu Stern from Unsplash

Mathieu Stern from Unsplash

A retirement plan that relies on optimistic returns can leave you short. Historical averages are helpful but not guaranteed for any decade. Be conservative in your expectations to avoid nasty surprises.

18. Disregarding Professional Advice

Austin Distel from Unsplash

Austin Distel from Unsplash

While DIY investing is okay for some, sophisticated retirement planning typically requires professional input. Occasional financial advice can result in missed opportunities or costly mistakes. A financial planner can help you customize a strategy around your goals.

19. Misjudging Lifestyle Expenses

Marissa Grootes from Unsplash

Marissa Grootes from Unsplash

Many dream of traveling or doing new hobbies in retirement without considering the price tag. Lifestyle inflation can strain your budget if it’s not accounted for. Create a realistic retirement budget that includes leisure and unexpected costs.

20. Procrastinating Retirement Planning

eberhard 🖐 grossgasteiger from Unsplash

eberhard 🖐 grossgasteiger from Unsplash

You delay optimizing your plan every year, missing compounding opportunities. Time is one of your greatest allies in investing–even after 50. Start today, whether it’s rebalancing your portfolio, increasing savings, or consulting an expert.

- Tags:

- advice

- Finance

- investment