20 Little-Known Facts About Credit Scores

Many people still don't fully understand how credit scores work, even though they are one of the most important parts of one's finances. We'll look at 20 interesting facts about credit scores that will help you understand how they're created and how they can affect your financial future. These facts will help you better understand the world of credit, whether you want to raise your score or are just interested in how it's calculated.

- Tricia Quitales

- 7 min read

Credit scores are a big part of your financial status because they affect everything from your ability to get loans to the rates of interest you pay. There are, however, a lot of myths and false beliefs about them. This article will talk about 20 interesting facts about credit scores that not many people know. These facts include how your score is generated, what factors affect it, and how small changes can have big effects. You’ll have a better idea of what affects your credit score and how to better handle it so that you can improve your finances by the end.

1. Your Credit Score Isn’t Just One Number

energepic.com on Pexels

energepic.com on Pexels

Many people think they only have one credit score, but there are actually several numbers that are based on different models. There are two main types of credit scores: FICO and VantageScore. They may calculate your score in slightly different ways. Various lenders may use different versions of these models, leading to different scores.

2. Your Credit Score Can Be Affected by Utility Payments

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Most people are aware that paying your bills on time, even if it’s not for credit cards, can hurt your credit score. Certain situations can lower your credit score if you don’t pay your bills on time. However, energy bill payments made on time aren’t usually reported unless there’s a late payment or the account is in collections.

3. Checking Your Own Credit Won’t Hurt Your Score

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

A lot of people are scared to check their credit because they think it will make their credit score go down. There is a mistake here. A “soft inquiry” doesn’t change your credit score in any way.

4. Age of Your Credit History Matters

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

It can help your credit score if you have an extensive credit background. Lenders may trust you more if you have a long credit past that has been taken care of. This shows that you know how to handle finances. Your credit score can still be helped by old credit cards, even if you don’t use them very often.

5. Closing Old Accounts Can Lower Your Score

Ivan Samkov on Pexels

Ivan Samkov on Pexels

Closing old credit accounts to stop possible scams might seem like a good idea, but it can hurt your credit score. When you close an account, the amount of available credit goes down. This can increase your credit utilization ratio. If your percentage is high, it could hurt your score.

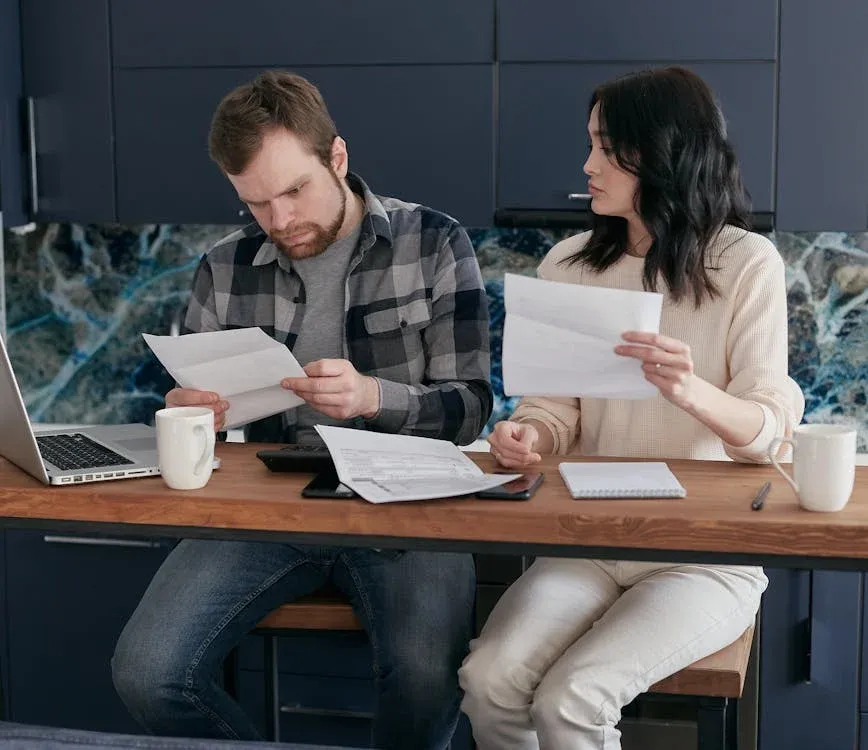

6. Credit Scores Can Be Affected by Your Debt-to-Income Ratio

Kaboompics.com on Pexels

Kaboompics.com on Pexels

There’s more to your credit score than how much you owe compared to your credit limit. It also looks at how much money you make. When choosing whether to give you credit, lenders often look at your debt-to-income ratio (DTI). Lenders may see you as a bigger risk if your DTI is high, which could indirectly affect your score.

7. Credit Scores Don’t Include Your Income

Tima Miroshnichenko on Pexels

Tima Miroshnichenko on Pexels

Your income may affect your credit score indirectly, but it doesn’t directly affect your credit score. Credit numbers are mostly based on things like how well you pay your bills, how much credit you use, and how old your credit is. However, lenders may look at your income to see if you can repay loans; it’s not part of the score formula.

8. Hard Inquiries Can Temporarily Lower Your Score

Antoni Shkraba on Pexels

Antoni Shkraba on Pexels

Lenders will do a “hard inquiry” to check your credit when you ask for a new loan or credit card. A hard inquiry might lower your score for a short time, but it usually doesn’t significantly affect your score in the long run. It can hurt your score even more when you ask for too many credit accounts at once.

9. Your Score Can Be Impacted by Errors in Your Credit Report

Antoni Shkraba on Pexels

Antoni Shkraba on Pexels

If there are mistakes on your credit report, like the wrong account or payment details, they can lower your credit score. If you find a mistake, you should challenge it with the credit bureau to fix it. Checking your credit report often is a good way to make sure there are no errors that could hurt your score.

10. Having No Credit History Isn’t the Same as Having Bad Credit

Pixabay on Pexels

Pixabay on Pexels

Your credit score might be very low or nonexistent if you have no credit history. This can hurt your chances of getting loans or credit cards because lenders won’t be able to tell how creditworthy you are. It’s important to remember that not having any credit is not the same as having bad credit, which means you don’t handle your money well.

11. Late Payments Can Stay on Your Credit Report for Up to Seven Years

Kaboompics.com on Pexels

Kaboompics.com on Pexels

One late payment can hurt your credit score for up to seven years but gets weaker over time. It can hurt your credit score more the longer you wait. One missed payment won’t hurt you as much as you think it will, especially if you get back into good money habits.

12. Paying Off Debt Won’t Immediately Boost Your Score

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Getting rid of debt is a good way to improve your financial situation, but it won’t raise your credit score immediately. How you use your credit affects your score, and it may take a while for the credit companies to update their records. Your credit score will go up over time if you use credit responsibly after you pay off your debts.

13. Student Loans Can Affect Your Credit Score

Sena Shot ® on Pexels

Sena Shot ® on Pexels

A lot of people think of student loans as “good debt,” but they can still hurt your credit score. Your score will go up if you pay on time, but it will go down if you miss or are late on payments. To keep your credit score high, you need to keep track of your student loan payments.

14. Opening Multiple Credit Cards At Once Can Hurt Your Score

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Having more than one credit card isn’t always bad, but asking for many new cards quickly can hurt your score. Each application leads to a hard inquiry, and lenders may think you’re risky if you try to open too many accounts at once. It’s better to send applications more than once.

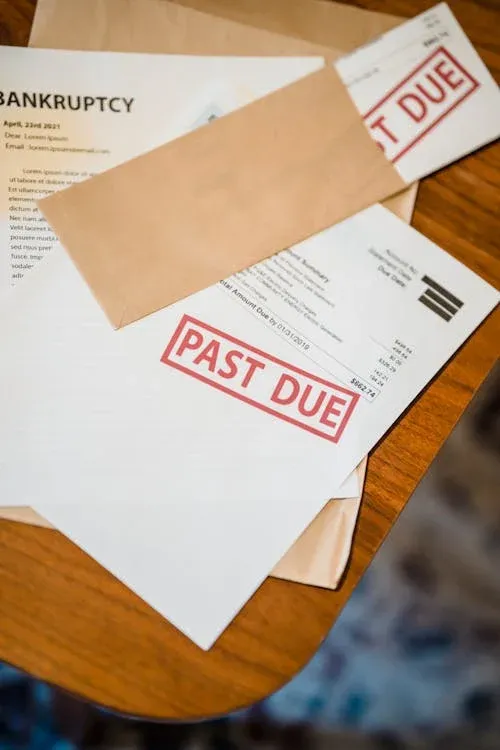

15. Bankruptcy Can Cause a Significant Drop in Your Score

Nicola Barts on Pexels

Nicola Barts on Pexels

If you file for bankruptcy, it can hurt your credit score a lot. You may have to deal with the effects of bankruptcy for up to 10 years, though they will get better over time. Before filing for bankruptcy, it’s important to know the long-term effects.

16. Your Credit Score Can Vary by Industry

nappy on Pexels

nappy on Pexels

Credit scores are calculated in many different ways by different types of businesses. One difference between mortgage lenders and credit card companies may be the form of your FICO score they use. Knowing the exact standards of the job you’re applying for can help you guess your score.

17. Your Credit Score Can Influence Your Insurance Rates

Pixabay on Pexels

Pixabay on Pexels

In some places, your credit score can affect how much your insurance costs. Some insurers look at your credit score to determine how likely you will make a claim. Keeping your credit score high could lower the cost of your home or car insurance.

18. There Are No “Perfect” Credit Scores

Kampus Production on Pexels

Kampus Production on Pexels

Many people try to get a score of 850, but it’s important to know that most lenders consider a score in the mid-700s or better to be great. For most financial goals, you don’t need a perfect score, and a score of 800 or 850 doesn’t make much difference in getting a loan.

19. Credit Score Ranges Vary

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

The ranges that different scoring methods use for scores are not all the same. For example, FICO scores are between 300 and 850, and VantageScores are between 300 and 900. If you want to understand your credit score correctly, you need to know the model’s range.

20. Your Credit Score Can Impact Job Prospects

Tima Miroshnichenko on Pexels

Tima Miroshnichenko on Pexels

Some companies may check your credit score as part of the hiring process. This is especially important for jobs that involve handling money. Even though your score is only one thing employers look at, a low score could affect their choice if the job requires trusting them with money.

- Tags:

- facts

- Credit Score

- Finance

- Payment