20 Rental Property Tax Deductions for Landlords

Maximizing your profits and reducing your tax liability as a landlord depend on your knowledge of rental property tax deductions. Many costs connected to running and owning a rental property can be deducted, helping landlords save money.

- Tricia Quitales

- 5 min read

Many landlords are unaware of the several tax deductions available to them regarding their rental properties. This article emphasizes 20 tax deductions landlords should use to reduce their tax burden. From insurance to repairs and property management fees, these deductions let landlords retain more of their rental income. Understanding and using these deductions helps landlords to make better financial choices and strengthen their bottom line.

1. Mortgage Interest

Artful Homes on Pexels

Artful Homes on Pexels

Interest on mortgages and loans used to fund the rental property is completely deductible. This can cover any loan interest assessed as well as the principal. It is a major deduction that can lower the tax on total rental income.

2. Property Taxes

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

You can deduct property taxes paid to local governments on your rental property. This covers any personal property taxes connected to your rental business and real estate taxes. Though they can increase, property taxes can help reduce your taxable rental income.

3. Depreciation

Alesia Kozik on Pexels

Alesia Kozik on Pexels

Rental properties lose value with time, and you can deduct this depreciation to lower your taxable income. Property owners can write off the value of the building—not the land—over 27.5 years under IRS rules. This is a significant deduction that offsets the deterioration of your property.

4. Repairs and Maintenance

Anete Lusina on Pexels

Anete Lusina on Pexels

Expenses connected to repairs and maintenance, such as fixing leaky pipes or repainting walls, are fully deductible. Improvements that raise the property’s value also have to be deducted. Maintaining your property in good shape is not only required but may also lead to major tax savings.

5. Property Management Fees

Jakub Zerdzicki on Pexels

Jakub Zerdzicki on Pexels

Their charges are tax-deductible should you engage a property management firm to manage the daily activities. Maintenance coordination, tenant communication, and rent collecting are included. While offering tax advantages, property management services can help you save time.

6. Insurance Premiums

Kindel Media on Pexels

Kindel Media on Pexels

Landlords may subtract the cost of insurance premiums connected to their rental properties. Included are flood insurance, fire insurance, and landlord liability insurance. Protecting your investment depends on these premiums, which can help to lower your total tax load.

7. Advertising Costs

Jakub Zerdzicki on Pexels

Jakub Zerdzicki on Pexels

Advertising expenses for new tenants such as running ads in newspapers or online—are tax-deductible. This also covers the price of developing and running a website to market your rental property. Advertising fills vacancies, and the related costs could reduce your taxable income.

8. Utilities

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

You can deduct these expenses if you pay for utilities such as water, gas, or electricity for your rental property. This deduction is significant if you pay for tenant utility bills. Tracking these costs helps to reduce your tax liability.

9. Travel Expenses

Tima Miroshnichenko on Pexels

Tima Miroshnichenko on Pexels

You may deduct the travel expenses should you have to travel to manage or maintain your rental property. This covers property-related meals, lodging, airfare, and mileage. Make sure you keep thorough documentation to support these costs.

10. Legal and Professional Fees

Pixabay on Pexels

Pixabay on Pexels

Contracts, conflicts, or eviction procedures generate tax-deductible legal fees. Fees paid to accountants, consultants, or other professionals for rental property-related services also qualify for further deduction. These charges may be subtracted since they are part of the cost of running a company.

11. Home Office Deduction

Pixabay on Pexels

Pixabay on Pexels

If you have a designated area in your house for running your rental properties, you might be eligible for a home office deduction. This might cover your internet expenses, utilities, and mortgage as well. To qualify, the area has to be solely for your rental company.

12. Tenant Screening Costs

Leeloo The First on Pexels

Leeloo The First on Pexels

Background checks and credit reports for prospective tenants are tax-deductible. These expenses are required as part of your company activities to guarantee you choose dependable tenants. Monitoring these costs helps to lower your total tax obligation.

13. Improvements (Capital Expenses)

Alexander F Ungerer on Pexels

Alexander F Ungerer on Pexels

Although changes such as remodeling or adding new features cannot be deducted right away, they can be depreciated over time. This covers significant renovations like changing the roof or adding new countertops. These capital costs can offer long-term tax deductions and help increase the value of your house.

14. HOA Fees

Helena Lopes on Pexels

Helena Lopes on Pexels

You may deduct its fees if your rental property belongs to a Homeowners Association (HOA). These charges pay for the upkeep of shared facilities or areas. These charges are a required company cost for you as a landlord that may lower your taxable income.

15. Security System Costs

cottonbro studio on Pexels

cottonbro studio on Pexels

If you install and monitor a security system to safeguard your rental property, the price of installation and monitoring is tax-deductible. This could include any associated equipment, cameras, or alarm systems. A security system not only safeguards your money but also offers a useful tax deduction.

16. Cleaning and Landscaping Services

Sergei Starostin on Pexels

Sergei Starostin on Pexels

Expenses for maintaining your rental property clean and well-kept, such as cleaning services or landscaping, are deductible. These costs are seen as usual and required to keep the property appealing. Regular maintenance keeps your property in good shape and helps draw renters.

17. Depreciation of Furniture and Appliances

Curtis Adams on Pexels

Curtis Adams on Pexels

Should your rental property have furniture or appliances, these items may also lose value with time. This covers even furniture and items like refrigerators, washers, and dryers. Depreciating these assets could give you more yearly deductions.

18. Bank Fees

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Your rental property’s bank fees, such as account maintenance, wire transfer, or credit card fees, are deductible. These charges are included in managing your rental income. Monitoring these costs could result in a major tax deduction.

19. Lease Cancellation Fees

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Any costs incurred to resolve the lease are deductible should you have to terminate a tenant’s lease early. This covers any legal expenses or tenant compensations. These are corporate costs required to keep operations running smoothly.

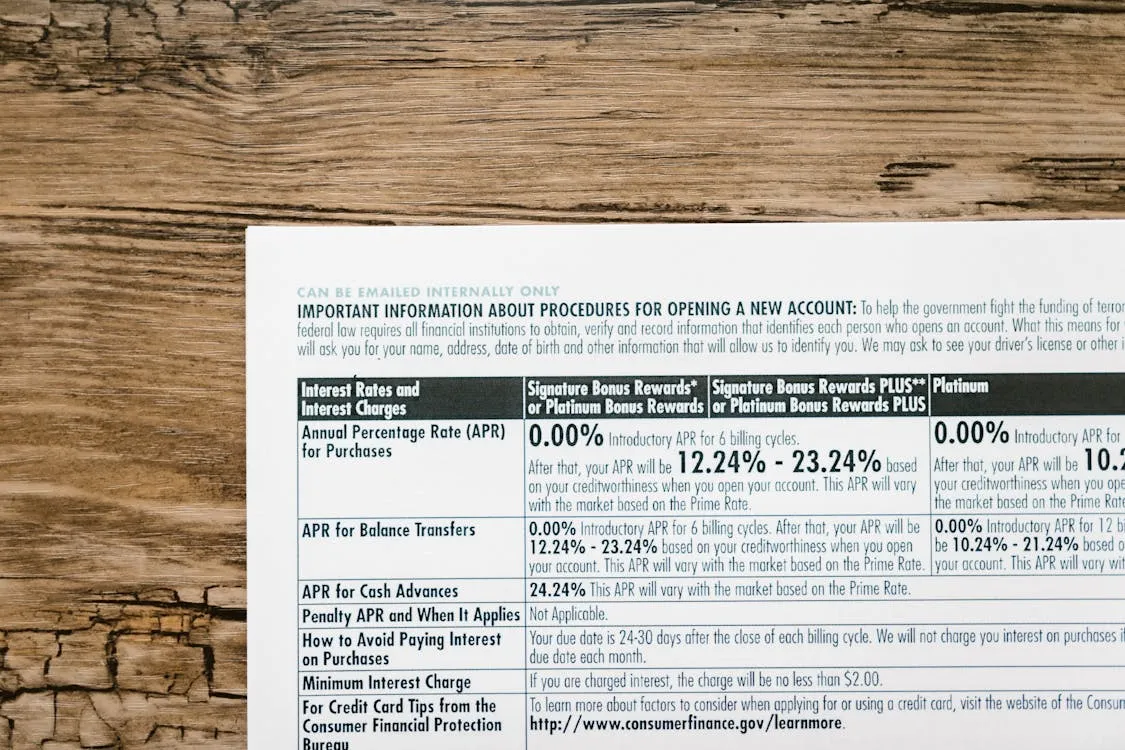

20. Interest on Credit Cards Used for Rental Expenses

RDNE Stock project on Pexels

RDNE Stock project on Pexels

The interest charged on those expenses is deductible if you use a credit card for business expenses connected to your rental property. Any purchases connected to management services, repairs, or other property-related expenses fall under this. Maintain thorough records of these acquisitions for precise deductions.

- Tags:

- Rental

- Tax

- Deductions

- Landlords

- Property