20 Retirement Planning Strategies To Ensure Success

Retirement planning is the empowering journey of building a secure financial future so that you can embrace your golden years with confidence, freedom, and peace of mind.

- Alyana Aguja

- 5 min read

Retirement planning is the foundation of a financially secure and fulfilling future, where you can live out your golden years on your terms. Setting clear goals, saving diligently, and making wise investment decisions grows your wealth over time. Planning early and staying adaptable will help you build a lifestyle that balances financial freedom with peace of mind despite uncertainty.

1. Start Saving Early

Annie Spratt from Unsplash

Annie Spratt from Unsplash

Time is your best friend when it comes to retirement planning. The sooner you save, the more time compound interest has to do its magic. Even small contributions made consistently over decades can grow into a significant nest egg.

2. Set Clear Retirement Goals

Towfiqu barbhuiya from Unsplash

Towfiqu barbhuiya from Unsplash

Visualize your retirement lifestyle and translate it into financial terms. Determine how much money you’ll need monthly to maintain your desired standard of living. Having specific goals makes it easier to create and stick to a plan.

3. Contribute to an Employer-Sponsored Plan

Kelly Sikkema from Unsplash

Kelly Sikkema from Unsplash

Take full advantage of your employer’s 401(k) or similar plans. Many companies match a percentage of your contributions—essentially free money. Maximizing donations, especially if matched, is a powerful way to grow your retirement savings.

4. Open an IRA

Kelly Sikkema from Unsplash

Kelly Sikkema from Unsplash

With tax advantages, an Individual Retirement Account (IRA) could supercharge your savings. Compare a Traditional IRA, which brings immediate tax benefit, against a Roth IRA, which provides for tax-free withdrawal upon retirement. IRAs are pretty versatile, allowing you to top off employer-sponsored plans.

5. Investment Diversification

Tyler Prahm from Unsplash

Tyler Prahm from Unsplash

Don’t put all your eggs in one basket—spread investments across stocks, bonds, mutual funds, and other assets. Diversification reduces risk and provides a stable growth trajectory. This strategy protects the portfolio from being overly affected by market volatility.

6. Understand Your Risk Tolerance

Jp Valery from Unsplash

Jp Valery from Unsplash

Know how much risk you’re comfortable taking with your investments. Younger investors can afford more risk due to their longer time horizon, while older investors should lean toward stability. Regularly revisit and adjust your portfolio as your tolerance changes.

7. Pay Down Debt

rc.xyz NFT gallery from Unsplash

rc.xyz NFT gallery from Unsplash

Eliminate high-interest debts, like credit cards, before retirement. Reducing your financial obligations ensures more of your income or savings goes toward enjoying your golden years. Debt-free living also provides peace of mind and economic freedom.

8. Build an Emergency Fund

Lucas Law from Unsplash

Lucas Law from Unsplash

A cash reserve means you won’t have to draw down retirement savings for surprise expenses. It would be best if you aimed to have three to six months of living expenses in a liquid account. That way, you can protect your long-term investments during financial emergencies.

9. Maximize Social Security Benefits

Pepi Stojanovski from Unsplash

Pepi Stojanovski from Unsplash

Delay claiming Social Security until you reach your full retirement age or beyond. Every year, you wait past the full retirement age, which boosts the benefit check by about 8%. Choosing a strategic date to begin will make a difference in the overall lifetime income.

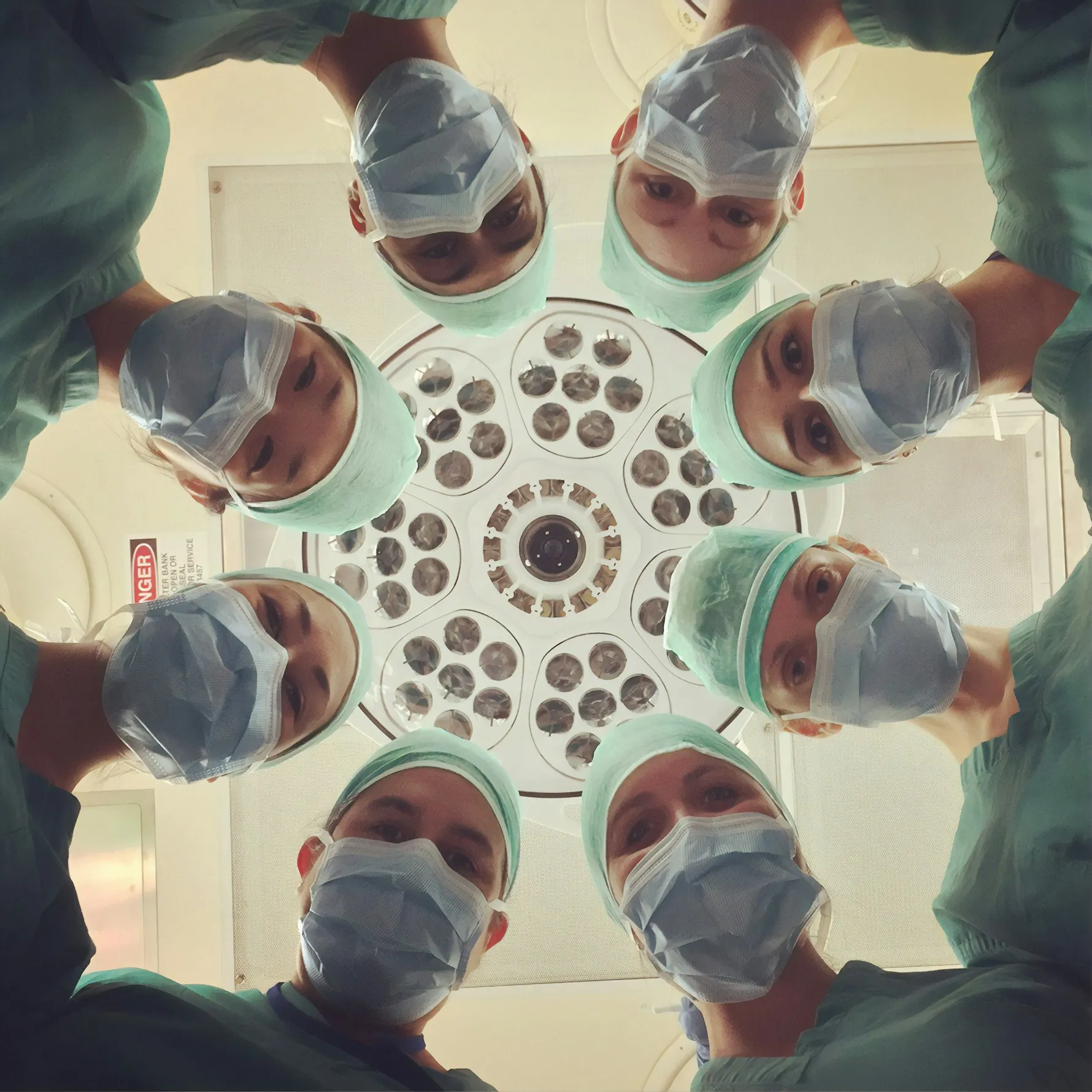

10. Healthcare Costs

National Cancer Institute from Unsplash

National Cancer Institute from Unsplash

Medical expenses increase with age, so factor them into your retirement plan. Explore options like a Health Savings Account (HSA) to save tax-free for medical expenses. Planning for healthcare ensures unexpected costs don’t derail your financial security.

11. Estimate Your Longevity

Ulrich Derboven from Unsplash

Ulrich Derboven from Unsplash

Plan for the possibility of living longer than average. Having some savings that last 25-30 years post-retirement is a safer bet than underestimating one’s lifespan. This guarantees that you are not losing your money.

12. Downsize Your Lifestyle

Vitaly Mazur from Unsplash

Vitaly Mazur from Unsplash

Downsize to a smaller home or reduce expenses. This will save money and make life more manageable in retirement. Eliminating excess can free up funds for travel, hobbies, or investments.

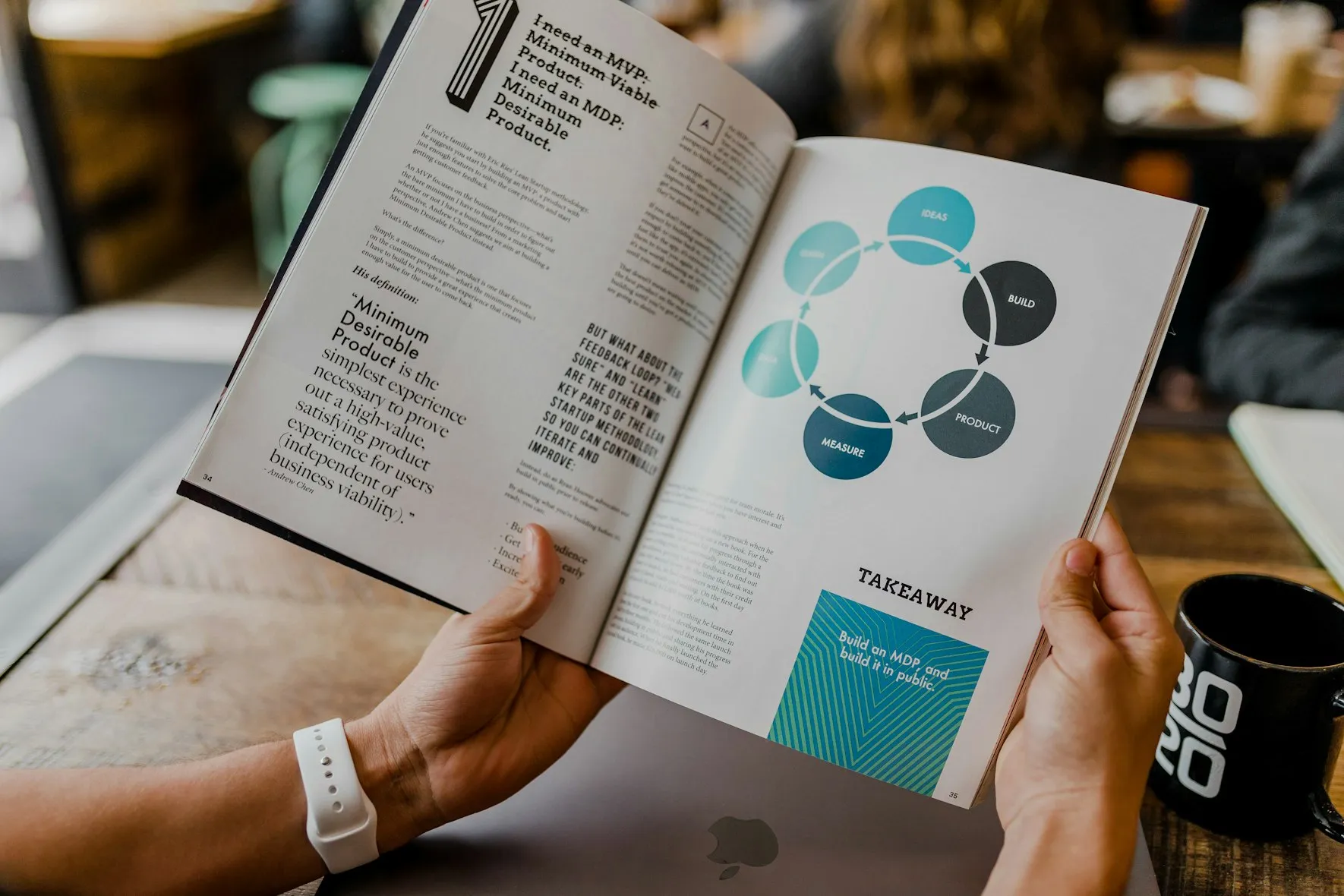

13. Stay Financially Educated

Austin Distel from Unsplash

Austin Distel from Unsplash

Continue to learn about personal finance and investment strategies in retirement. Understanding trends and market shifts and making informed decisions pays off. Financial literacy is an asset that pays off throughout life.

14. Work with a Financial Advisor

Julia Taubitz from Unsplash

Julia Taubitz from Unsplash

Work with a professional to receive customized advice based on your unique needs and goals. A professional can help you optimize investments, manage risks, and plan tax-efficient withdrawals. Regular check-ins ensure that your plan stays on track.

15. Develop a Withdrawal Strategy

Toa Heftiba from Unsplash

Toa Heftiba from Unsplash

Plan how and when to draw down retirement savings to sustain your lifestyle. The 4% rule is a common starting point, but adjust it based on your needs and market conditions. A well-thought-out strategy prevents running out of funds prematurely.

16. Track Inflation

Yassine Khalfalli from Unsplash

Yassine Khalfalli from Unsplash

The cost of living will rise over time, so ensure your savings grow to keep pace. Invest in inflation-protection assets, such as Treasury Inflation-Protected Securities (TIPS). Planning for inflation preserves your purchasing power.

17. Maintain a Side Hustle or Part-Time Work

engin akyurt from Unsplash

engin akyurt from Unsplash

Earning some money in retirement can supplement your savings and keep you engaged. You can turn a hobby into a small business or consult on something you know well. An active lifestyle also gives you a sense of purpose.

18. Keep Your Assets Safe with Insurance

Scott Graham from Unsplash

Scott Graham from Unsplash

Explore options like long-term care, life, and umbrella policies. These can create a safety net against unanticipated events that could deplete your savings. Proper coverage equates to financial stability and peace of mind.

19. Plan for Estate and Legacy Goals

Alexander Grey from Unsplash

Alexander Grey from Unsplash

Determine how you want to pass on wealth to loved ones or causes you care about. Use tools like wills, trusts, and beneficiary designations to make the process easier. Estate planning ensures your wishes are honored and minimizes potential tax burdens.

20. Review and Adjust Your Plan Regularly

Scott Graham from Unsplash

Scott Graham from Unsplash

Life changes, and so should your retirement strategy. Reassess your goals, investments, and savings annually to align with your vision. Flexibility is critical to navigating life’s uncertainties while staying on course.

- Tags:

- Retirement

- Finance

- money

- advice