20 Signs You Need a Professional Tax Advisor for Your Business

If you're making costly tax mistakes, missing deductions, or struggling with complex tax laws, a professional tax advisor can help you save money, keep you compliant, and grow your business.

- Alyana Aguja

- 5 min read

Managing business taxes can be complicated, and expensive errors or lost deductions can cut into your profits. A qualified tax professional keeps you in compliance, saves you more, and minimizes penalties through expert tax planning. If you’re expanding, being audited, or simply wish to legally pay less tax, expert assistance keeps your company financially resilient.

1. You’re Making Costly Tax Mistakes

Jp Valery from Unpslash

Jp Valery from Unpslash

If you’ve ever received a penalty notice from the IRS or your local tax authority, you’re already losing money. Many small business owners unknowingly miscalculate estimated taxes, leading to underpayments. A tax advisor ensures you stay compliant and avoid unnecessary fines.

2. Your Business Structure Might Be Costing You

Andrew Leu from Unpslash

Andrew Leu from Unpslash

Did you begin as a sole proprietorship but currently have increasing revenue? Being in the wrong structure (LLC, S-corp, C-corp) means potentially paying too much in self-employment taxes or leaving deductions on the table. A tax professional can review your case and recommend the most tax-effective structure.

3. You’re Unsure About Deductible Expenses

Jp Valery from Unpslash

Jp Valery from Unpslash

Most entrepreneurs forget deductions such as home expenses, traveling, and depreciation. Others overdo it by claiming personal expenses, which get them audited. A professional guides you on claiming what is permissible while staying off the radar.

4. You’re Expanding to Another State or Country

Patrick T’Kindt from Unpslash

Patrick T’Kindt from Unpslash

If you’re selling goods or services across several states or overseas, tax rules get complex in no time. Each jurisdiction has special sales tax, VAT, and income tax regulations. A tax professional avoids expensive compliance errors before they occur.

5. You’re Getting More 1099s Than W-2s

Windows from Unpslash

Windows from Unpslash

If you’re employing freelancers and contractors rather than employees, you must properly issue 1099s. Worker misclassification can generate IRS penalties and tax arrearages. A tax professional assists you in establishing good payroll practices.

6. You’re Having Difficulty Complying with Sales Tax

Campaign Creators from Unsplash

Campaign Creators from Unsplash

If your company sells online, determining where and how much sales tax to charge can be daunting. California and New York are states that have aggressive enforcement against online sellers. A tax advisor will help you comply with Nexus rules and avoid audits.

7. You’ve Recently Received a Tax Notice

Scott Graham from Unsplash

Scott Graham from Unsplash

Whether it’s a humble info request or a downright audit notice, it’s not something you take on yourself. Most companies end up paying more money because they lack knowledge of what the tax department is asking for. A tax expert can act for you and bargain on your behalf.

8. You’re Not Maximizing Retirement Tax Benefits

Towfiqu barbhuiya from Unsplash

Towfiqu barbhuiya from Unsplash

Business owners can utilize SEP IRAs, Solo 401(k)s, and Defined Benefit Plans to minimize taxable income. Most leave thousands on the table by failing to use these tools optimally. A tax advisor helps you accumulate wealth while reducing your tax liability.

9. You Have High Net Income but Low Cash Flow

Giorgio Trovato from Unsplash

Giorgio Trovato from Unsplash

Your tax planning requires improvement if your profits are good but taxes consume too much. Clever tax planning can legally lower taxable income by releasing cash for expansion. A tax advisor finds opportunities such as depreciation, credits, and planned deferrals.

10. Your Bookkeeper Is Not a Tax Expert

Hannah Olinger from Unsplash

Hannah Olinger from Unsplash

Bookkeepers account for transactions but do not specialize in tax planning. If your bookkeeper is doing your tax planning, you may be leaving money on the table or creating compliance issues. A trained tax professional works with your bookkeeper to maximize your filings.

11. You’re Thinking About Selling Your Business

Sherzod Max from Unsplash

Sherzod Max from Unsplash

An ill-conceived sale can lead to high capital gains taxes. To illustrate, selling assets rather than shares in an S-corp can make a huge difference in tax. A tax professional structures the transaction for the greatest after-tax return.

12. You Have Inventory and Don’t Understand COGS Deductions

Denny Müller from Unsplash

Denny Müller from Unsplash

Companies with tangible products must accurately account for the Cost of Goods Sold (COGS). Most do not maximize deductions for inventory purchases and storage. A tax consultant assists you in efficiently managing inventory tax obligations.

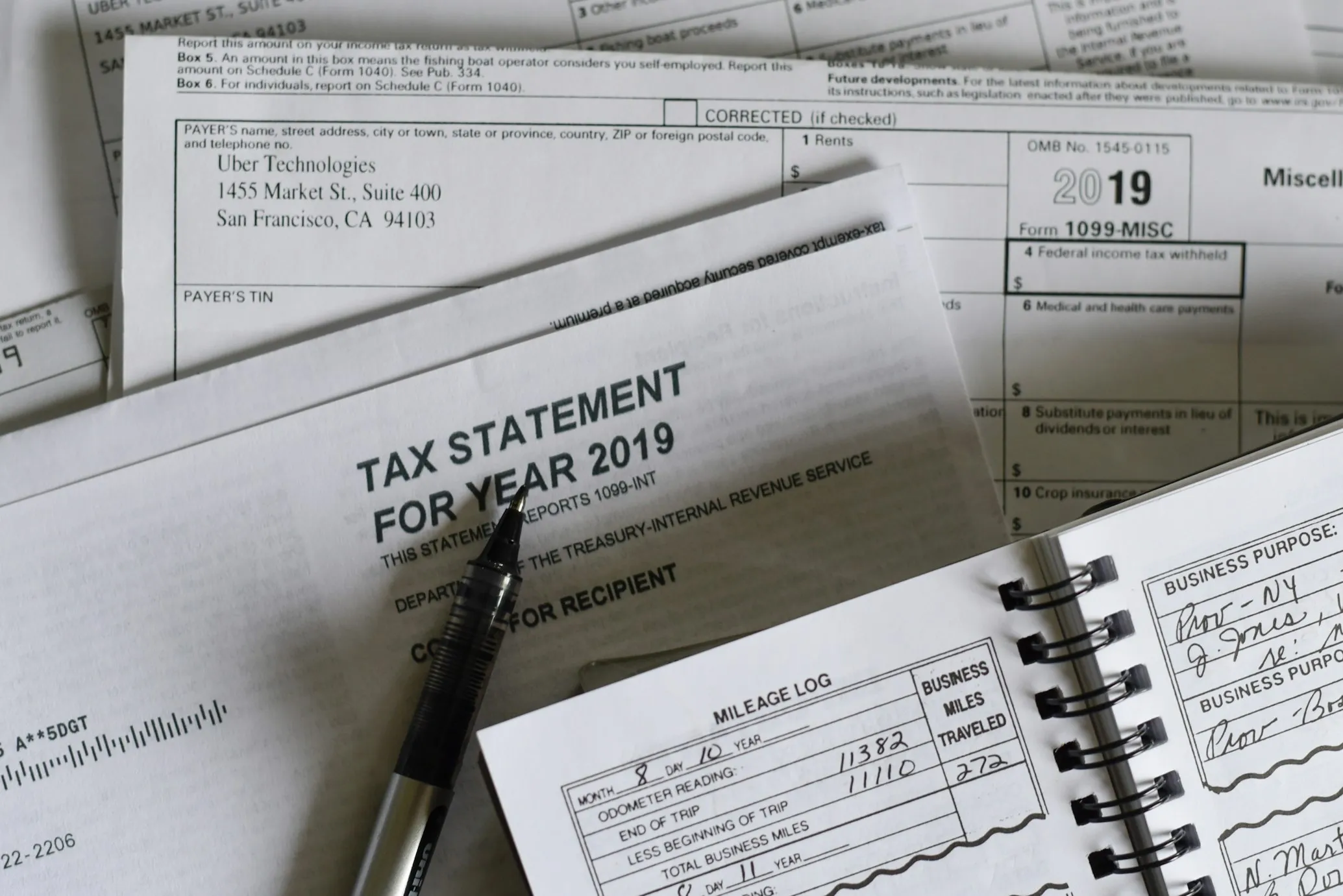

13. You’re Behind on Tax Filings

Kelly Sikkema from Unsplash

Kelly Sikkema from Unsplash

If you’ve missed deadlines, interest and penalties pile up quickly. The IRS and state agencies are more aggressive about collecting overdue taxes than ever before. A tax professional can help negotiate payment plans or penalty abatements.

14. You’re Investing in Real Estate or Equipment

Ronnie George from Unsplash

Ronnie George from Unsplash

Depreciation rules can substantially reduce your taxable income, but they’re complicated. Most businesses overlook Section 179 and bonus depreciation savings. A tax advisor helps you take advantage of these deductions.

15. You’re Not Claiming R&D Tax Credits

Dan Dimmock from Unsplash

Dan Dimmock from Unsplash

Even small businesses are eligible for research & development (R&D) tax credits. If you develop new products, enhance manufacturing processes, or create software, you may qualify. A tax professional makes sure you reap this underutilized credit.

16. You Received an IRS Audit Request

Olga DeLawrence from Unsplash

Olga DeLawrence from Unsplash

Even when you’ve done everything correctly, an audit is stressful and time-consuming. Companies without professional guidance overpay since they don’t know what’s being questioned. A tax consultant defends your interests and deals with the give-and-take.

17. Your Business Has Frequent Large Cash Transactions

Roman Synkevych from Unsplash

Roman Synkevych from Unsplash

If your company handles large volumes of cash, the IRS mandates Form 8300 reporting for transactions exceeding $10,000. Non-reporting can lead to audits and legal penalties. A tax consultant maintains compliance with federal and state reporting regulations.

18. You’re Thinking of Merging or Acquiring Another Company

Damir Kopezhanov from Unsplash

Damir Kopezhanov from Unsplash

Mergers and acquisitions can result in unsuspected tax bills without careful tax planning. Purchasing assets versus stock, deductibility of goodwill, and state tax effects can be expensive if not properly designed. A tax consultant guides you through complicated tax ramifications.

19. You’re Struggling to Keep Up with Tax Law Changes

Tingey Injury Law Firm from Unsplash

Tingey Injury Law Firm from Unsplash

Tax laws change constantly, and missing key updates can cost you money. From new deductions to changes in corporate tax rates, staying informed is difficult. A tax professional keeps your business compliant and tax-efficient.

20. You Want to Pay Less Tax Legally

Kelly Sikkema from Unsplash

Kelly Sikkema from Unsplash

If you just don’t want to pay so much tax, a tax consultant can assist. By restructuring entities, deferring income, and taking advantage of tax credits, most companies can greatly reduce their tax bill. Proper tax planning can save you thousands annually.