20 Smart Tax Moves for Real Estate Investors

Real estate investors can get the best returns by making smart tax choices that lower their tax bills and raise their profits. You can save money on taxes and see your portfolio grow faster if you know how to do it right.

- Tricia Quitales

- 7 min read

Taxes are an important part of real estate investing, and using the right strategies can help investors save money and make the most money possible. Smart tax moves can help investors lower their taxable income and increase cash flow. This article talks about 20 important tax moves that real estate investors should make, such as using deductions like depreciation and tax-deferred exchanges. These tips can make a big difference in your finances, no matter how much experience you have as an investor or how new you are to the game.

1. Utilize Depreciation

AS Photography on Pexels

AS Photography on Pexels

With depreciation, you can write off a portion of the cost of an asset over time, which can lower your taxable income by a large amount. This is very helpful for investors who plan to keep their properties for a long time. You can lower your yearly tax bill and keep more profits if you use depreciation to its fullest.

2. Take Advantage of 1031 Exchanges

Artem Podrez on Pexels

Artem Podrez on Pexels

With a 1031 exchange, you don’t have to pay capital gains taxes on an investment property until after you sell it, as long as you buy another similar property. This lets your portfolio grow without having to worry about taxes right away. Using this method, you can grow your money without worrying about taxes cutting into your gains.

3. Use Cost Segregation

Tima Miroshnichenko on Pexels

Tima Miroshnichenko on Pexels

Cost segregation lets investors speed up the loss of value on certain parts of a property, like fixtures and appliances. In the first few years of ownership, this can save you a lot of money on taxes. A cost segregation study can help you figure out which assets can be written off faster, which will lower your tax bill.

4. Deduct Property Management Fees

Pavel Danilyuk on Pexels

Pavel Danilyuk on Pexels

You can write off your property management fees as a business expense. You can write off the money you spend on a property manager or company to watch over your rental properties. This can help you keep your properties in good shape and lower the taxable income.

5. Claim Repairs and Maintenance Costs

James Collington on Pexels

James Collington on Pexels

You can deduct the repairs and maintenance costs, but there is a big difference between repairs and improvements. Repairs bring your property back to its original state, while improvements raise its value or make it last longer. Fixing leaks or getting a new appliance that doesn’t work are fully deductible.

6. Leverage Tax-Advantaged Retirement Accounts

Towfiqu barbhuiya on Pexels

Towfiqu barbhuiya on Pexels

Tax-advantaged accounts, such as a self-directed IRA or a 401(k), can be used to hold real estate investments. Taxes on rental income and capital gains can be put off with these accounts. It’s a smart way to save money on taxes and build up your wealth for retirement.

7. Consider Real Estate Professional Status

Ivan Samkov on Pexels

Ivan Samkov on Pexels

If you are a real estate professional, you can deduct more of the money you lose from renting out your home from your regular income. To keep this status, you have to work in real estate at least 750 hours a year, which is more than half of your working hours. If you are eligible, this status can help you pay less in taxes overall.

8. Deduct Interest on Your Mortgage

RDNE Stock project on Pexels

RDNE Stock project on Pexels

You can write off the interest you pay on a mortgage for a rental property. In the early years of a loan, when most of your payments go toward interest, this can save you a lot of money on taxes. When you can deduct mortgage interest, your taxable rental income goes down.

9. Offset Rental Losses with Passive Activity Losses

Ivan Samkov on Pexels

Ivan Samkov on Pexels

Rental properties are taxed as passive activities, meaning gains from other properties can cancel out losses from one property. If you lose more money on rentals than you make, you can use that extra money to offset other passive income. This plan can help you pay less in taxes overall.

10. Claim Travel Expenses

Alex P on Pexels

Alex P on Pexels

You may be able to deduct the cost of traveling to your properties for management, maintenance, or repairs. This includes the cost of the flight, the hotel, the meals, and the car. Make sure you keep thorough records of these costs so you can use them as proof for tax purposes.

11. Keep Detailed Records of All Expenses

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Keeping good records is important for getting the most tax breaks and following the rules. Keep all of the receipts, contracts, invoices, and other paperwork related to your rental properties. If you get audited, this will help you show that you made the right deductions.

12. Deduct Home Office Expenses

Alpha En on Pexels

Alpha En on Pexels

You can deduct home office costs if you use a certain part of your home to manage your rental properties. Some examples of this are a portion of the rent, mortgage interest, and insurance. Just ensure your home office is only used for real estate work.

13. Utilize the Qualified Business Income Deduction

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

As an investor in real estate, you might be able to take advantage of the Qualified Business Income (QBI) deduction, which lets you write off up to 20% of your rental income. To be eligible, you must be working in the rental business. This deduction can significantly affect how much of your income is taxed.

14. Write Off Depreciation on Your Primary Residence

Zak Chapman on Pexels

Zak Chapman on Pexels

You can’t depreciate your main home, but you can depreciate some of it if you use it for business, like renting a room. This lets you lower your taxable income, even if you don’t always rent out the property. This can help you get tax breaks on a property you own if you keep it in mind.

15. Consider Investing in Opportunity Zones

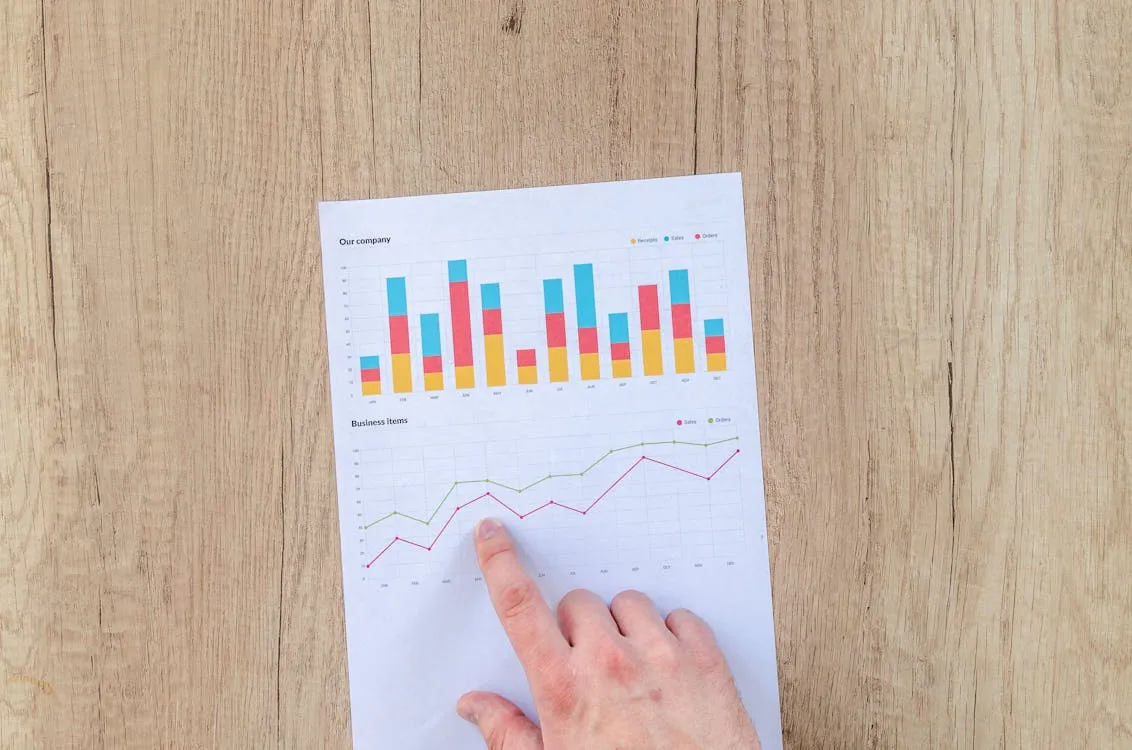

Lukas on Pexels

Lukas on Pexels

Investors who invest in areas that are struggling economically can get tax breaks in “opportunity zones.” Some of these incentives include delaying capital gains taxes and maybe even eliminating taxes on gains from certain investments. Investing in opportunity zones is a way to lower taxes and help communities get back on their feet.

16. Avoid the Alternative Minimum Tax (AMT)

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

The Alternative Minimum Tax (AMT) ensures that people with a lot of money pay at least some tax. Real estate investors can avoid AMT by planning their deductions, like taking advantage of tax credits and putting off income. Keep track of your total income to avoid having to pay this tax.

17. Take Advantage of Tax Credits for Energy Efficiency

Alex P on Pexels

Alex P on Pexels

Investors who make changes to their properties that make them more energy efficient might be able to get tax credits. Some examples are credits for putting in solar panels, appliances that use less energy, or insulation. Tax credits are useful for property owners because they lower the amount of tax you have to pay.

18. Avoid Double Taxation in LLCs

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

If you don’t want to pay taxes twice on your real estate investments, you might want to set up your business as a pass-through entity, such as an LLC or S Corporation. This lets you report business income on your personal tax return instead of paying taxes as a business. In the long run, it can save you cash.

19. Use a Tax Professional

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Real estate taxes can be hard to understand, but working with a tax pro can help you get through them. A professional can ensure you get all the deductions and credits you’re entitled to and keep you from making mistakes that will cost you a lot of money. They know a lot about taxes and can help you save money and do your taxes better.

20. Plan for Capital Gains Taxes

Jakub Zerdzicki on Pexels

Jakub Zerdzicki on Pexels

When you sell a house, you should know the capital gains taxes that apply to the money you make from the sale. You can pay less taxes if you hold on to the property for more than a year and use long-term capital gains rates. When you sell a house, planning can help you pay the least taxes possible.

- Tags:

- Tax

- Moves

- Real Estate

- Investors

- profit