20 Smart Ways to Invest $1,000 Right Now

Discover 20 smart and exciting ways to invest $1,000 right now, from stocks and crypto to side hustles and real estate, and start building your financial future today!

- Alyana Aguja

- 5 min read

Savvy investing of $1,000 can lead to financial prosperity through stocks, real estate, crypto, or starting a side business. Ranging from conservative choices, such as high-yield savings and bonds to riskier bets like startup investing and digital currencies, there is a strategy for any level of risk tolerance. Through good decision-making and waiting it out, even a modest investment can lead to long-term riches and financial independence.

1. Index Funds for Long-Term Growth

Austin Distel from Unsplash

Austin Distel from Unsplash

Invest in an S&P 500 index fund to get a stake in the market leaders. These funds diversify, minimize risk, and grow steadily in the long term. Most brokerage accounts allow you to begin with a minimum of $100.

2. High-Yield Savings Account

Eduardo Soares from Unsplash

Eduardo Soares from Unsplash

Invest your money in a high-yield savings account for security and guaranteed returns. Certain online banks provide much higher interest rates than the usual banks. It’s a good choice if you require liquidity yet want to earn passive income.

3. Robo-Advisors for Hands-Free Investing

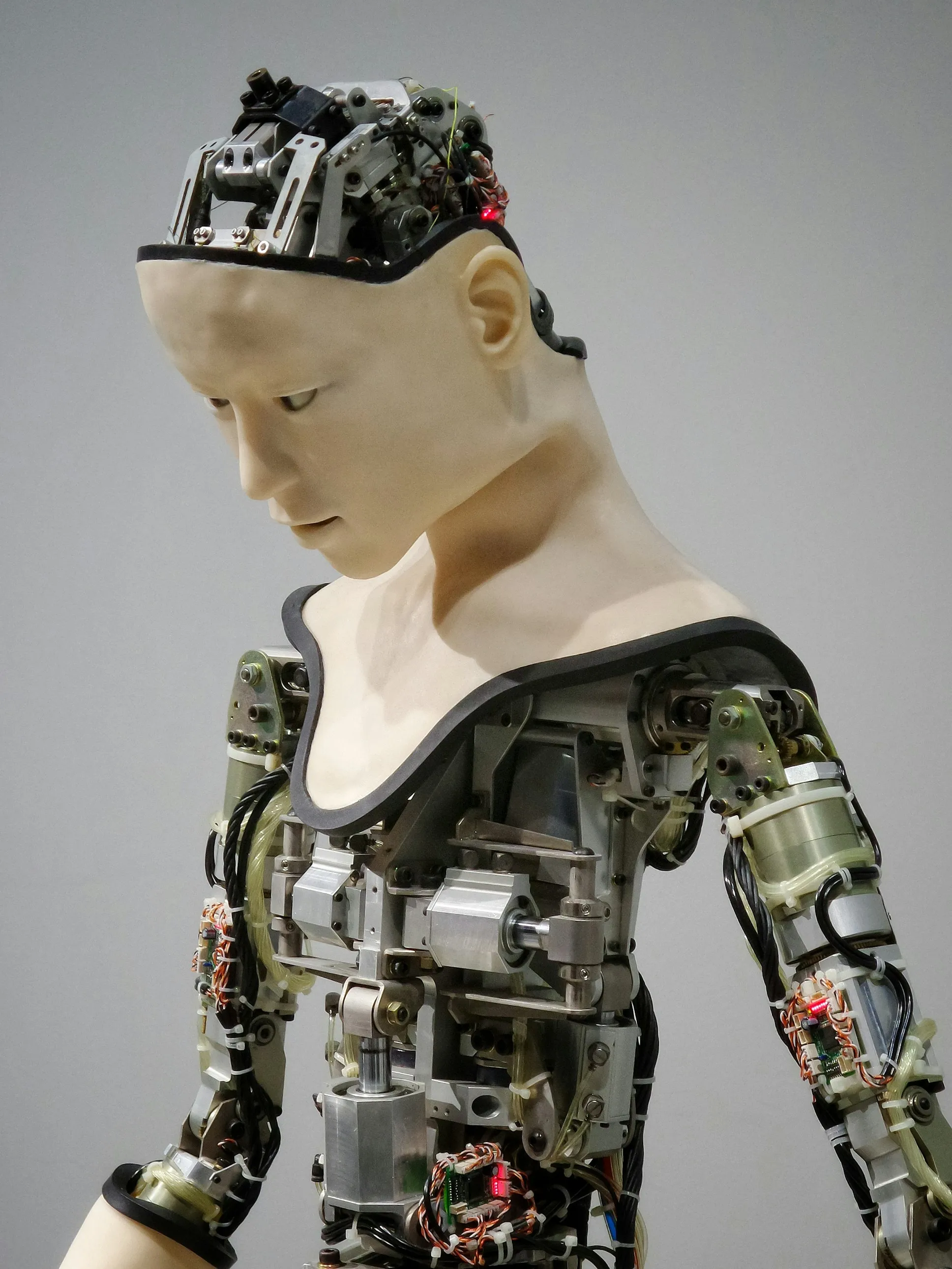

Possessed Photography from Unsplash

Possessed Photography from Unsplash

Robo-advisors such as Wealthfront and Betterment use AI to invest your money automatically. They regularly rebalance portfolios according to market conditions and risk tolerance. This is ideal for beginners who desire intelligent investing without having to lift a finger.

4. Fractional Shares of Blue-Chip Stocks

Joshua Mayo from Unsplash

Joshua Mayo from Unsplash

If you’ve long dreamed of owning Apple, Amazon, or Tesla stock but couldn’t spare a whole share, fractional investing is the solution. Robinhood and M1 Finance are just two apps that allow you to purchase fractions of stocks for as low as $1. This makes it possible to create a diversified portfolio without having thousands of dollars.

5. Cryptocurrency for High-Risk, High-Reward Potential

Thought Catalog from Unsplash

Thought Catalog from Unsplash

Allocate a portion of your $1,000 to Bitcoin, Ethereum, or emerging altcoins. Crypto markets are volatile, but they offer significant growth opportunities over the long term. Just make sure to research and only invest what you’re willing to lose.

6. Peer-to-Peer Lending for Passive Income

Jp Valery from Unsplash

Jp Valery from Unsplash

Sites like Prosper and LendingClub enable you to lend to individuals and companies. You make interest on your loans, typically higher than regular savings accounts. This is a good way to diversify and assist others in gaining access to capital.

7. Start a Side Hustle

Campaign Creators from Unsplash

Campaign Creators from Unsplash

Utilize $1,000 to start an online business through dropshipping, freelancing, or online marketing. Etsy, Shopify, and Fiverr enable easy monetization of your talents. Spending little on tools, software, or ads can translate to huge rewards in the future.

8. Invest in Yourself By Taking Online Courses

Glenn Carstens-Peters from Unsplash

Glenn Carstens-Peters from Unsplash

Knowledge is a sound investment. Websites such as Udemy, Coursera, and LinkedIn Learning offer low-cost courses in coding, marketing, investing, and many other areas. New skills can translate to better-paying jobs or new business ventures.

9. Real Estate Crowdfunding for Passive Property Income

Johnson Johnson from Unsplash

Johnson Johnson from Unsplash

Platforms such as Fundrise and RealtyMogul allow you to invest in real estate developments starting from $10. This means you can reap rental income and appreciation without owning a landlord title. It’s an excellent opportunity to diversify beyond stocks and bonds.

10. Buy and Resell Limited-Edition Sneakers or Collectibles

Jeff Tumale from Unsplash

Jeff Tumale from Unsplash

You can begin flipping popular-demand sneakers, trading cards, or unique collectibles with $1,000. Buying low and selling high is easy using sites like StockX and eBay. If properly done, this side hustle can be turned into a full-time job.

11. Invest in an ETF for Sector-Specific Growth

Yorgos Ntrahas from Unsplash

Yorgos Ntrahas from Unsplash

Exchange-traded funds (ETFs) enable you to invest in particular industries such as tech, healthcare, or clean energy. ETFs provide diversification while focusing on high-growth industries. It’s a good way to have exposure to trends without selecting individual stocks.

12. Self-Publishing an eBook or Online Course

Hannah Olinger from Unsplash

Hannah Olinger from Unsplash

If you are knowledgeable in any topic, monetize it as an eBook or an online course. Amazon Kindle Direct Publishing and sites such as Teachable allow you to sell digital products with little initial investment. This can generate a passive income stream with little upkeep.

13. Buy a Dividend-Paying Stock

Maximilian Bruck from Unsplash

Maximilian Bruck from Unsplash

Invest in solid dividend stocks such as Coca-Cola, Johnson & Johnson, and AT&T. Such companies provide dependable dividend returns. They pay you periodically as your investment grows long-term. Investing in dividend-paying stocks can build your wealth more quickly.

14. Establish a Low-Cost Dropshipping Business

Mediamodifier from Unsplash

Mediamodifier from Unsplash

With $1,000, you can start an e-commerce site without inventory. Shopify and Oberlo allow you to order products from suppliers and send them directly to customers. Target a high-demand niche to ensure maximum success.

15. Micro-Investing Apps for Easy Wealth Building

Priscilla Du Preez from Unsplash

Priscilla Du Preez from Unsplash

Apps such as Acorns and Stash round up your daily purchases and invest the leftover change. That way, you can build wealth passively without thinking about it. It’s ideal for those who want to begin small and build their portfolio without effort.

16. Precious Metals for Inflation Protection

Jingming Pan from Unsplash

Jingming Pan from Unsplash

Gold and silver have been value stores for centuries. Putting a fraction of your money into bullion or precious metal-backed ETFs can help safeguard against economic slumps. It’s a good hedge against inflation and currency devaluation.

17. Start a Print-on-Demand Store

Bank Phrom from Unsplash

Bank Phrom from Unsplash

Utilize platforms such as Printful or Redbubble to sell personalized-designed T-shirts, mugs, and posters. You don’t have to maintain inventory—just upload your designs and earn a commission per sale. With effective marketing, this can become a reliable source of passive income.

18. Invest in Bonds for Low-Risk Returns

金 运 from Unsplash

金 运 from Unsplash

Treasury, municipal, and corporate bonds provide stable, lower-risk returns. They will not get you rich overnight, but they ensure stability, particularly in unstable markets. Bonds are ideal for offsetting a high-risk portfolio in stocks.

19. Buy and Flip Domain Names

Burst from Unsplash

Burst from Unsplash

Similar to property, digital real estate (domains) can prove to be lucrative. Buy cheap domain names and sell them for a markup on platforms like Flippa. Some domain investors have made small amounts of money translate into six-figure sales.

20. Angel Investing in Startups

Annie Spratt from Unsplash

Annie Spratt from Unsplash

Some platforms, such as AngelList and WeFunder, allow you to invest in early-stage businesses. Although risky, successful startups can pay off huge. If you think an innovative concept has merit, getting on board early can be life-changing.