20 States Offering the Best Business Tax Incentives

These 20 states are giving business owners big reasons to launch, relocate, or expand with smart tax breaks.

- Daisy Montero

- 6 min read

Some U.S. states are making it easier for entrepreneurs and corporations to thrive by offering powerful tax incentives. Many of them are also fostering innovation, green energy investment, and small business growth through targeted breaks. Here are 20 states where tax incentives are too good for businesses to ignore.

1. Texas Has No Corporate or Personal Income Tax

Tablelegs6 on Wikimedia Commons

Tablelegs6 on Wikimedia Commons

Texas gives business owners a major advantage by eliminating corporate and personal income taxes. The state relies heavily on franchise taxes instead, which can still be lower than other states’ corporate taxes. It is a magnet for entrepreneurs and corporations looking to scale without the tax burden.

2. Florida’s Business Climate Is Warm in More Ways Than One

Florida Department of Transportation on Wikimedia Commons

Florida Department of Transportation on Wikimedia Commons

Florida skips the personal income tax entirely and keeps corporate income taxes relatively low. It also offers strong incentives for manufacturing, research, and tech startups. Many small businesses flourish here thanks to its tax-friendly setup and booming population.

3. Nevada’s Tax Structure Draws Startups and Corporations

Richc80 on Wikimedia Commons

Richc80 on Wikimedia Commons

Nevada does not charge corporate or personal income tax, giving it an edge over other Western states. Businesses also benefit from no franchise tax and minimal reporting requirements. Its growing urban hubs like Las Vegas and Reno are seeing more tech and logistics companies take root.

4. Wyoming Keeps Taxes Low and Freedom High

Wyoming, Illinois on Wikimedia Commons

Wyoming, Illinois on Wikimedia Commons

Wyoming ranks consistently as one of the most business-friendly states thanks to zero corporate or personal income tax. The state also avoids gross receipts or inventory taxes. It is ideal for small businesses and LLCs looking for minimal bureaucracy.

5. South Dakota Supports Businesses at Every Level

Steve Shook from Moscow, Idaho, USA on Wikimedia Commons

Steve Shook from Moscow, Idaho, USA on Wikimedia Commons

South Dakota does not tax corporate income, personal income, or capital gains. The regulatory environment is light, and local governments often provide property tax incentives for job creators. It is a hidden gem for financial firms and small business owners.

6. North Carolina Offers Competitive Tax Credits

JBTHEMILKER on Wikimedia Commons

JBTHEMILKER on Wikimedia Commons

North Carolina keeps its corporate income tax rate among the lowest in the country. The state offers targeted incentives for job creation and infrastructure investment. Its cities like Raleigh and Charlotte have become hotspots for finance and tech.

7. Indiana Encourages Growth With Aggressive Deductions

U.S. Government on Wikimedia Commons

U.S. Government on Wikimedia Commons

Indiana maintains a flat, low corporate tax rate and provides credits for training, R&D, and energy efficiency. The state’s economic development agency actively supports new projects with grants. It is a solid choice for manufacturing and logistics companies.

8. Tennessee Offers Tax Savings and Prime Location

Sixflashphoto on Wikimedia Commons

Sixflashphoto on Wikimedia Commons

Tennessee has no personal income tax and low franchise and excise taxes for businesses. Economic development grants are available for companies relocating or expanding. Its central location makes it ideal for distribution and logistics.

9. Arizona Supports Innovation With Incentives

Skunkcrew on Wikimedia Commons

Skunkcrew on Wikimedia Commons

Arizona offers tax credits for R&D, renewable energy, and small business creation. The state’s low-income tax rates and reduced regulations make it a top pick for tech startups. Phoenix continues to grow as a business and logistics hub.

10. Georgia Invests in Jobs and Tech

DanTD on Wikimedia Commons

DanTD on Wikimedia Commons

Georgia’s Job Tax Credit and Quality Jobs Program reward companies for hiring and staying. The state’s corporate tax is flat, and there are bonuses for development in rural counties. Atlanta has emerged as a major player in film, tech, and distribution.

11. Utah Rewards R&D and Clean Tech

Tablelegs6 on Wikimedia Commons

Tablelegs6 on Wikimedia Commons

Utah offers tax credits for research, clean energy projects, and recycling programs. The corporate income tax rate is low and has remained stable, giving businesses more predictability. Salt Lake City’s growth has made the state more attractive to emerging industries.

12. Ohio Offers Tax Breaks for Job Creation

Miami University Libraries - Digital Collections on Wikimedia Commons

Miami University Libraries - Digital Collections on Wikimedia Commons

Ohio’s Job Creation Tax Credit and R&D incentives make it a top pick for expanding businesses. The Commercial Activity Tax is a flat rate, replacing a traditional corporate income tax structure. Its central location and growing cities help seal the deal.

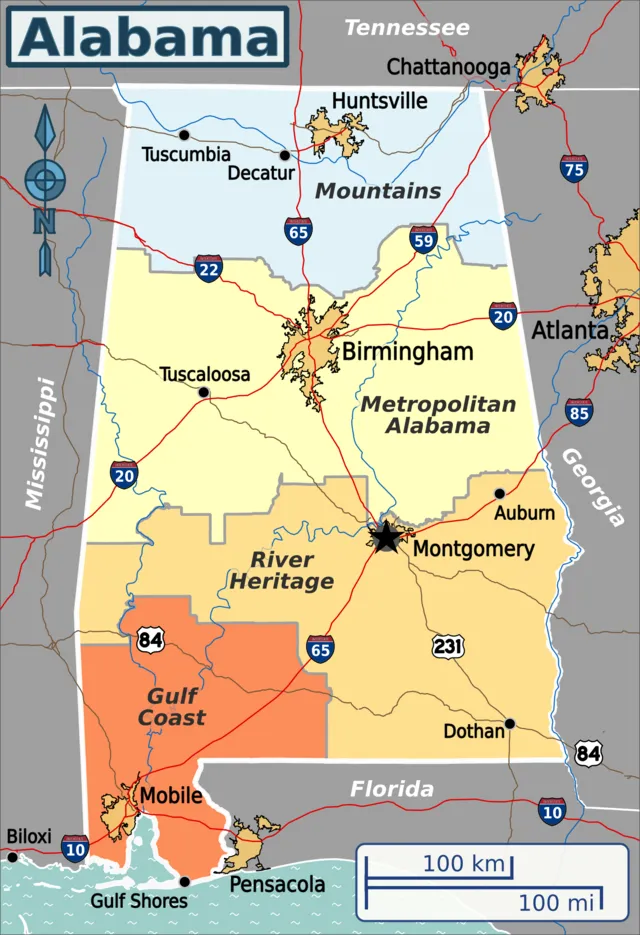

13. Alabama Attracts Manufacturers With Strong Incentives

Shaundd on Wikimedia Commons

Shaundd on Wikimedia Commons

Alabama’s tax incentives target large-scale investments, especially in the manufacturing and auto industries. The state offers credits for capital investment, job creation, and training. Businesses also benefit from property tax abatements in many counties.

14. Colorado Boosts Green Businesses

Steve Shook from Moscow, Idaho, USA on Wikimedia Commons

Steve Shook from Moscow, Idaho, USA on Wikimedia Commons

Colorado offers tax incentives for renewable energy, cleantech, and innovative startups. The state’s Enterprise Zone program provides credits for businesses in designated areas. Denver’s entrepreneurial culture keeps growing with this support.

15. Missouri Helps Businesses Expand in Targeted Zones

Designed by Judge Robert William Wells on Wikimedia Commons

Designed by Judge Robert William Wells on Wikimedia Commons

Missouri’s Enhanced Enterprise Zone program and Missouri Works initiative offer significant tax savings. The state gives property tax abatements and job retention credits. Its location in the Midwest makes it ideal for national distribution networks.

16. Idaho Keeps Operating Costs Low

GNU Free Documentation License on Wikimedia Commons

GNU Free Documentation License on Wikimedia Commons

Idaho offers a low corporate tax rate and tax credits for investment, broadband expansion, and rural development. The state also waives sales tax for certain production-related purchases. Its business climate continues to appeal to agricultural and tech ventures.

17. Wisconsin Supports Manufacturing and Agriculture

Kenneth C. Zirkel on Wikimedia Commons

Kenneth C. Zirkel on Wikimedia Commons

Wisconsin’s Manufacturing and Agriculture Credit cuts down the effective tax rate on qualifying income to nearly zero. There are also credits for job creation and energy efficiency improvements. It is a solid choice for legacy industries and startups alike.

18. Oklahoma Gives Back to Energy and Aerospace Firms

Steve Shook from Moscow, Idaho, USA on Wikimedia Commons

Steve Shook from Moscow, Idaho, USA on Wikimedia Commons

Oklahoma supports aerospace, tech, and energy industries through targeted tax rebates and exemptions. The state also offers Quality Jobs incentives for businesses that bring new employment. Low property and business taxes make it even more appealing.

19. Michigan Invests in Revitalization Projects

Steve Shook from Moscow, Idaho, USA on Wikimedia Commons

Steve Shook from Moscow, Idaho, USA on Wikimedia Commons

Michigan’s economic development programs focus on redeveloping underserved and urban areas. Tax breaks are given for real estate development, technology growth, and job training. Detroit and Grand Rapids have become key hubs for innovation.

20. Pennsylvania Encourages Growth in Tech and Health

Paul Hamilton on Wikimedia Commons

Paul Hamilton on Wikimedia Commons

Pennsylvania offers targeted tax credits for biotech, film, and job creation in underdeveloped areas. Its Keystone Opportunity Zones provide long-term tax relief for businesses willing to invest. The state continues to evolve into a center for research and advanced industries.