20 Strategies for Paying Off Debt Faster

Paying off debt faster becomes easier with the right strategies, which can help you save money and regain financial control.

- Daisy Montero

- 6 min read

Debt can feel like a heavy burden, constantly pulling your finances in different directions. Paying it off faster is possible with the right approach. Small changes, like making extra payments, cutting unnecessary expenses, and negotiating better terms, can make a huge difference. The sooner you tackle it, the sooner you can enjoy the freedom of being debt-free.

1. Knock Our High-Interest Debt First

Pixabay on Pexels

Pixabay on Pexels

High-interest debt, like credit cards, can drain your wallet faster than you realize. The longer you carry a balance, the more you end up paying in interest. Paying off these debts first frees up money for other financial goals.

2. Pick a Payoff Plan That Works for You

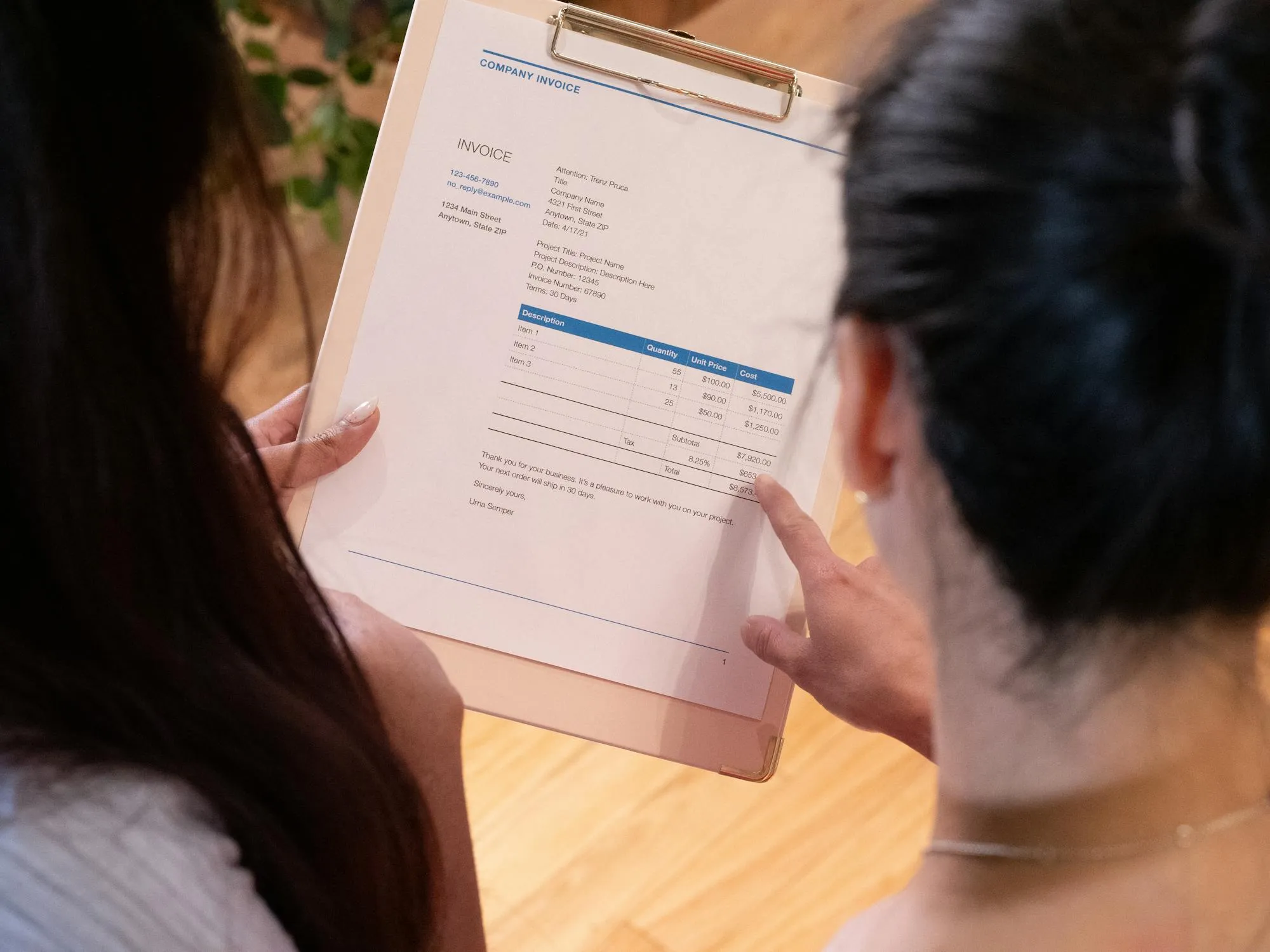

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

The snowball method builds momentum by cleaning small debts first, while the avalanche method saves the most money by tackling high-interest debt. There’s no one-size-fits-all solution; just pick the approach that keeps you motivated. Consistency matters more than the method itself.

3. Split Your Payments in Half

Photo By: Kaboompics.com on Pexels

Photo By: Kaboompics.com on Pexels

Making biweekly payments instead of monthly ones helps you pay off debt faster without feeling the pinch. This strategy results in one extra payment each year, cutting down interest and loan length. It’s a simple trick that makes a big impact over time.

4. Refinance to Get a Better Interest Rate

RDNE Stock project on Pexels

RDNE Stock project on Pexels

A lower interest rate means less money wasted on interest and more going toward your actual debt. Refinancing can be a great option for student loans, car loans, or even mortgages. Just be sure to compare rates and terms before making a move.

5. Ask for a Lower Interest Rate

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Many lenders are willing to lower your rate if you ask, especially if you have a good payment history. A quick phone call could save you hundreds or even thousands over time. It never hurts to negotiate, and the worst they can say is no.

6. Cut Back on Unnecessary Spending

Thirdman on Pexels

Thirdman on Pexels

Every dollar you don’t spend on non-essentials is a dollar you can use to pay off debt. Small changes, like canceling unused subscriptions or eating out less, add up quickly. The key is to find expenses you won’t miss and redirect that money.

7. Bring in Extra Cash to Speed Things Up

Photo By: Kaboompics.com on Pexels

Photo By: Kaboompics.com on Pexels

A side hustle, part-time gig, or even selling things you no longer need can help you make extra payments. Even a little extra money each month makes a difference. The faster you pay off debt, the less you’ll spend on interest.

8. Turn Clutter Into Cash

Photo By: Kaboompics.com on Pexels

Photo By: Kaboompics.com on Pexels

Unused clothes, electronics, and furniture can bring in extra money when sold online or at a yard sale. That cash can go straight to your debt, helping you pay it off faster. Declutter your space and reducing your financial burden at the same time is a win-win.

9. Automate Payments to Stay on Track

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

Setting up automatic payments ensures you never miss a due date. This not only saves you from late fees but also helps you stay consistent. Paying on time also boosts your credit score, which can help with future financial goals.

10. Use Windfalls Wisely

Yan Krukau on Pexels

Yan Krukau on Pexels

Tax refunds, bonuses, or unexpected cash can make a big dent in your debt if you use them wisely. Instead of spending it all, put at least a portion toward what you owe. It’s one of the easiest ways to make progress without changing your budget.

11. Pay More Than the Minimum Payment

Anete Lusina on Pexels

Anete Lusina on Pexels

Only paying the minimum will stretch your debt repayment over a long period and cost you more in interest. Try paying a bit more whenever you can, even if it’s just a few extra dollars. Over time, those extra payments add up and speed up your journey to being debt-free.

12. Cancel or Freeze Unnecessary Credit Cards

Rann Vijay on Pexels

Rann Vijay on Pexels

Credit cards with no balance or high fees can add to your debt without helping you. Consider canceling or freeing these cards to avoid temptation. Keeping fewer cards means less to manage and fewer opportunities for new debt.

13. Look Into Debt Consolidation

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Debt consolidation combines multiple debts into one, often with a lower interest rate. It simplifies payments and can save you money if you can secure a good rate. Be careful with fees, though, and make sure it’s the right choice for your situation.

14. Set Specific Debt Repayment Goals

Towfiqu barbhuiya on Pexels

Towfiqu barbhuiya on Pexels

Setting clear goals, like paying off a specific debt by a certain date, helps keep you motivated. Break your bigger goals into smaller, manageable targets to avoid feeling overwhelmed. Tracking your progress makes the whole process more rewarding.

15. Cut Back on Luxuries for a While

Andrea Piacquadio on Pexels

Andrea Piacquadio on Pexels

Giving up luxuries, like fancy coffee or frequent shopping, can significantly free up extra cash for debt repayment. These small sacrifices may feel difficult at first, but they add up quickly. You’ll be surprised at how fast you can pay off debt when you focus on essentials.

16. Use Your Tax Refund for Debt

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

Tax season is a great opportunity to put your refund toward reducing your debt. It’s money you weren’t expecting, so why not use it to get ahead? It could make a huge difference in paying off your debt faster.

17. Take Advantage of 0% APR Offers

Antoni Shkraba on Pexels

Antoni Shkraba on Pexels

Some credit cards offer 0% APR for an introductory period, which can help you avoid interest on balance transfers. If you can pay off the balance before the interest kicks in, you’ll save a lot of money. Just make sure to pay attention to the terms and avoid missed payments.

18. Get a Financial Accountability Partner

Kindel Media on Pexels

Kindel Media on Pexels

Having someone to hold you accountable can keep you on track with your debt repayment plan. Whether it’s a friend, family member, or financial advisor, having support makes a big difference. It helps you stay motivated and avoid making excuses.

19. Reevaluate Your Budget Regularly

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

Your financial situation can change, so it’s important to adjust your budget accordingly. Reassess your expenses and income every few months to find areas where you can cut back. Small adjustments can add up to faster debt repayment.

20. Celebrate Milestones Along the Way

Miriam Alonso on Pexels

Miriam Alonso on Pexels

Paying off debt can be a long road, so celebrate your progress along the way. Whether it’s paying off a small balance or sticking to your budget for a month, reward yourself for staying committed. Acknowledging milestones keeps you motivated and excited to keep going.