20 Tax Benefits for Homeowners You Shouldn’t Miss

A lot of good things happen when you own a house, especially when it comes to taxes. There are several tax breaks that homeowners can use to lower their monthly payments.

- Tricia Quitales

- 6 min read

Not only does owning a home help you build equity, but it can also help your finances in many ways. Homeowners can lower their taxable income in a number of ways, such as by deducting mortgage interest and getting credits for energy-efficient homes. Knowing about these tax breaks can help homeowners lower their tax bills, making it easier for them to buy a home. This article talks about 20 tax benefits that every homeowner should know about to make sure they are getting the most out of their home.

1. Mortgage Interest Deduction

AS Photography on Pexels

AS Photography on Pexels

With the mortgage interest deduction, homeowners can deduct the interest they pay on their mortgage from their taxable income. This is often one of the biggest tax breaks homeowners can get. It works for primary and secondary homes, so people with bigger loans can save a lot on their taxes.

2. Property Tax Deduction

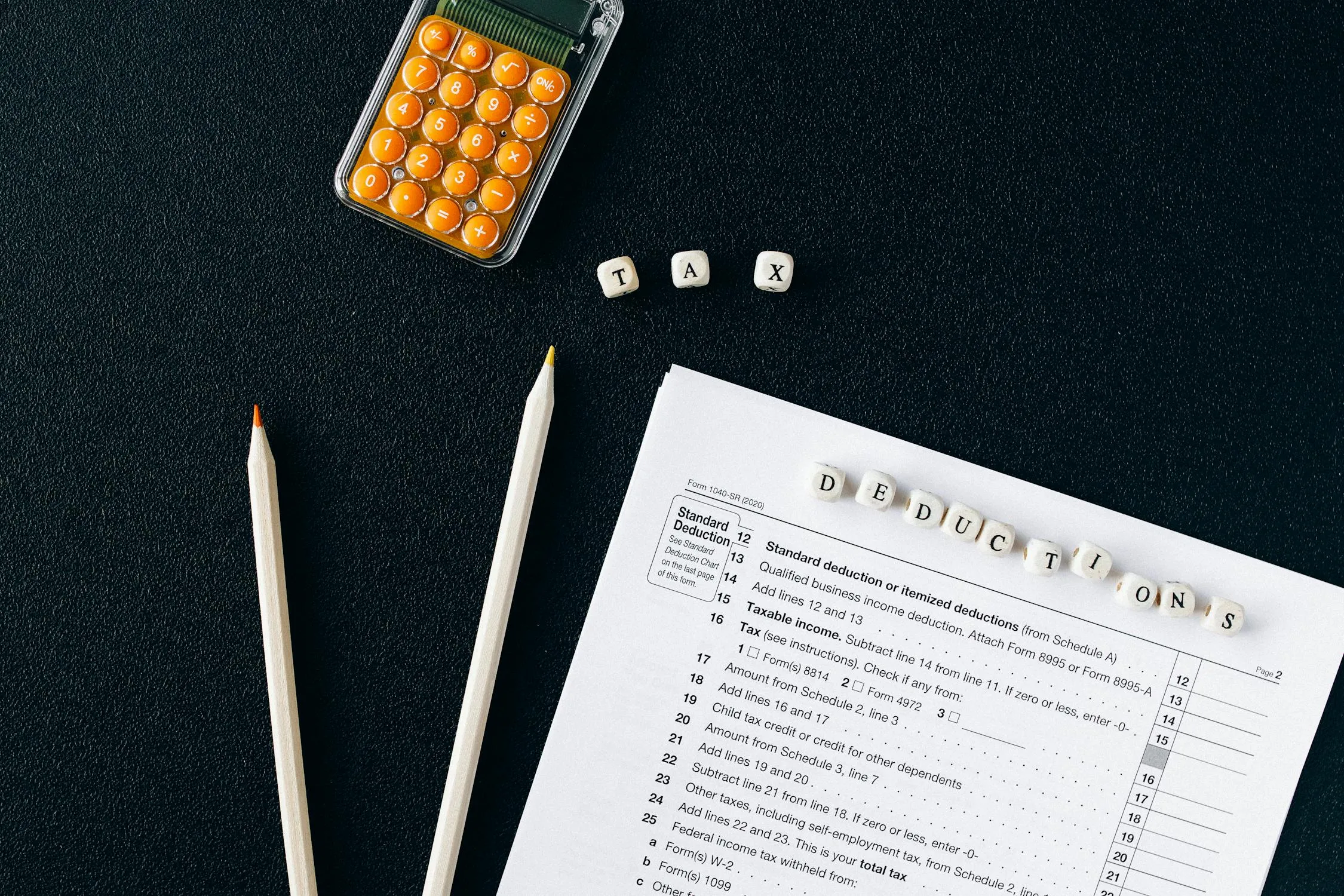

olia danilevich on Pexels

olia danilevich on Pexels

People who own a house can deduct the property taxes they pay on their main home, lowering their taxable income. This tax break helps lower the cost of local government taxes, which can be very helpful for homeowners who live in areas with high taxes.

3. Home Office Deduction

Ken Tomita on Pexels

Ken Tomita on Pexels

Part of your home can be used for business, so you can deduct some of the costs of running your business at home. This includes things like rent, utilities, and even mortgage payments. The IRS lets you get tax breaks based on how much space in your home is used for work.

4. Capital Gains Exclusion

Thirdman on Pexels

Thirdman on Pexels

If you meet certain requirements, you can keep up to $250,000 in capital gains when you sell your home ($500,000 for married couples). This tax break helps you make more money when you sell your home. This is a great way to keep your profit from being taxed when selling your main home.

5. Energy-Efficient Home Credits

Kindel Media on Pexels

Kindel Media on Pexels

Tax credits are available to homeowners who make their homes more energy-efficient, like adding solar panels or better insulation. The amount of tax you owe goes down because of these credits. Green home improvements can save you money from the federal government and many states.

6. Private Mortgage Insurance (PMI) Deduction

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

PMI stands for private mortgage insurance. If your down payment is less than 20%, you may have to pay it. Luckily, there are times when PMI payments can be written off on your taxes. People who bought their home with a small down payment may benefit the most from this deduction.

7. Mortgage Insurance Premiums (MIP) Deduction

Vlad Deep on Pexels

Vlad Deep on Pexels

Mortgage insurance premiums (MIP) paid by people with FHA loans can also be deducted, just like PMI. People who have loans backed by the government may find this deduction helpful. You should check if you can claim this on your tax return.

8. First-Time Homebuyer Credit

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Some homeowners, especially first-time buyers, may be able to get a credit. When you buy your first home, this one-time credit can help you save a lot on taxes. Even though this program isn’t offered right now, you should still look to see if any state-level credits are available.

9. Home Improvement Loan Deduction

Rene Terp on Pexels

Rene Terp on Pexels

If you borrow money to fix your house, you might be able to write off the interest on that loan. This is true for loans used to improve your home that qualify and raise its value. Make sure that the loan is being used for a reason that allows tax breaks.

10. Seller’s Closing Costs

RDNE Stock project on Pexels

RDNE Stock project on Pexels

When you sell your home, you might be able to deduct some of your closing costs. These include fees related to the sale, like the cost of advertising. Deducting these costs can lower your taxable income from the sale.

11. State and Local Tax Deduction (SALT)

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

People who own a house can write off the property taxes and other state and local taxes they pay on their federal tax return. People who live in places with high state or local taxes will benefit the most from this deduction. However, you can only deduct a certain amount, so it’s important to know what those limits are right now.

12. Home Accessibility Improvements Deduction

Marcus Aurelius on Pexels

Marcus Aurelius on Pexels

Making changes to your home so a disabled family member can get around more easily lets you deduct the cost of these changes. This includes putting in ramps or making doorways wider. The deduction helps make it easier to afford to make changes to your home that you need to.

13. Rental Property Deductions

Ivan Samkov on Pexels

Ivan Samkov on Pexels

If you rent out a part of your house, you can deduct some of the costs that come with that. This covers things like repairs, management fees, and some of your mortgage interest. Even though rental income is taxed, these deductions help lower the tax bill.

14. Energy Tax Credits for Home Renovations

Curtis Adams on Pexels

Curtis Adams on Pexels

You might get federal tax credits if you make certain changes to your home that make it more energy efficient, like installing new windows or a more energy-efficient HVAC system. These credits can lower the amount of taxes that need to be paid. To get these credits, keep track of all the changes you make to save energy.

15. Home Equity Loan Interest Deduction

RDNE Stock project on Pexels

RDNE Stock project on Pexels

People who borrow money against their home equity to pay for improvements may be able to write off the interest they pay. This is another way to lower taxable income. However, the loan can only be used for things allowed by IRS rules, like making improvements to the property.

16. Imputed Rental Income Deduction

Muffin Creatives on Pexels

Muffin Creatives on Pexels

Some homeowners who rent out a vacation home or part of their main home can deduct some costs related to the rental income. These include utilities, insurance, and repairs. This deduction may help lower the amount of taxed rental income.

17. Points Deduction on Mortgage

Jakub Zerdzicki on Pexels

Jakub Zerdzicki on Pexels

You might be able to write off the points you pay for a mortgage over the loan’s life. Points are fees you pay upfront that lower your interest rate. By deducting these, you can save money on your mortgage taxes over time.

18. Moving Expenses for Work Deduction

Artem Podrez on Pexels

Artem Podrez on Pexels

Some of your moving costs might be tax-deductible if you have to move for work. This includes the cost of moving personal belongings, traveling, and short-term housing. Remember that you can only get this deduction if your move meets certain criteria.

19. Child and Dependent Care Tax Credit

cottonbro studio on Pexels

cottonbro studio on Pexels

People who own a house and pay for child or dependent care while working might get a tax credit. You can use this credit to pay for daycare or care after school. If you are a working parent, this is a great way to lower your overall tax bill.

20. Selling Costs Deductions

Thirdman on Pexels

Thirdman on Pexels

When you sell your home, you can write off some of the costs, like the commission paid to the real estate agent. Because of these deductions, you can pay less in taxes when you sell your home. You can save the most on your taxes if you know which selling costs are tax-deductible.