20 Tax Benefits of Contributing to a Retirement Account

Putting money into a retirement account can help you save money in the long run, but it can also help your taxes in important ways. Putting money into a 401(k), IRA, or Roth IRA not only protects your future but also lowers the amount of money you have to pay taxes on.

- Tricia Quitales

- 7 min read

Having a retirement account is a great way to save money for the future and get tax breaks right away. Putting money into a 401(k), IRA, or Roth IRA can lower your taxable income, let your money grow tax-free, and even give you tax credits. This article discusses 20 different tax benefits you can get by putting money into retirement accounts, such as deductions and employer matches. By learning about these benefits, you can make the most of your tax return and your retirement savings, securing your financial future.

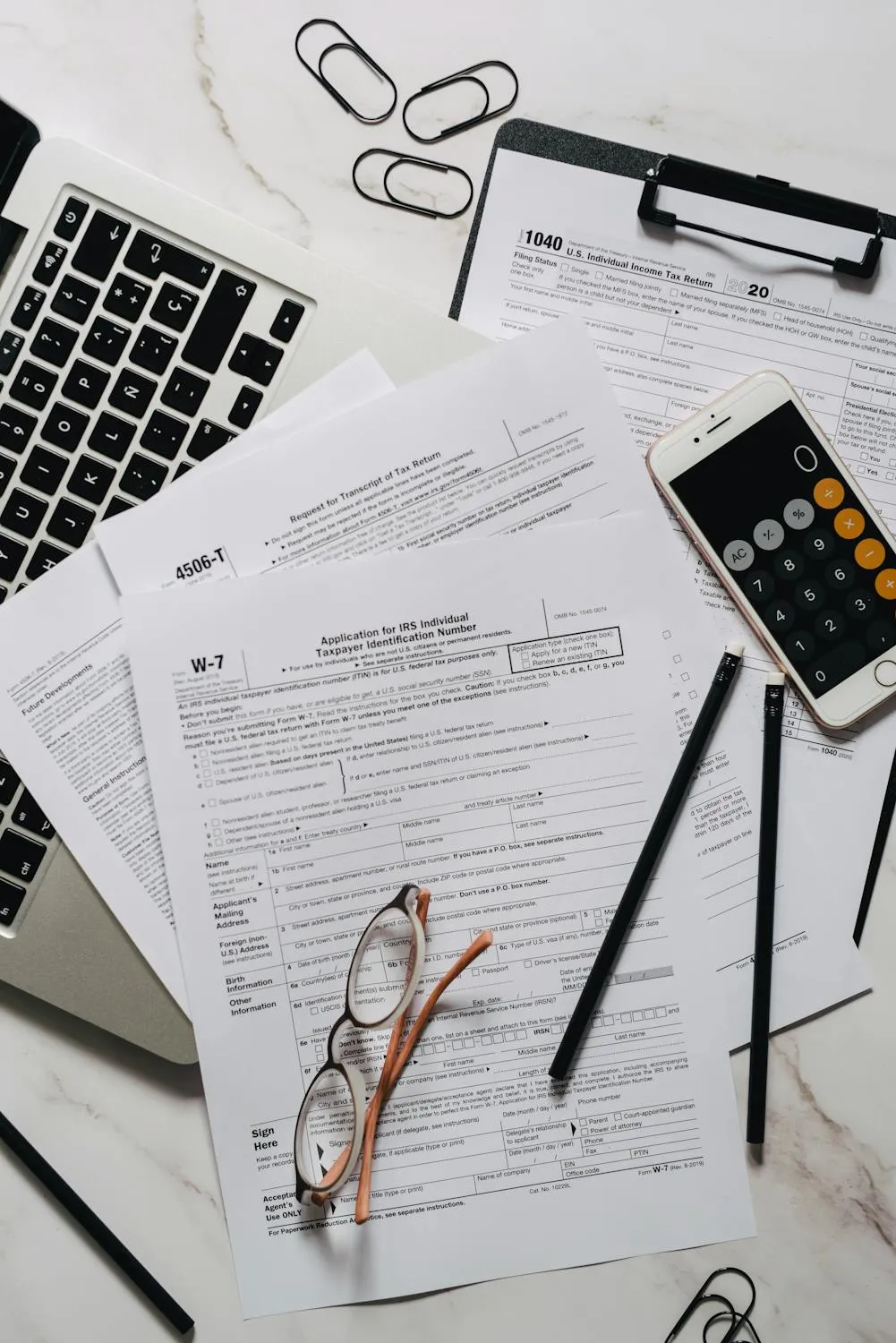

1. Tax Deductions for Traditional IRA Contributions

Leeloo The First on Pexels

Leeloo The First on Pexels

Putting money into a Traditional IRA can lower the amount of taxes you have to pay each year. You might be able to deduct the full amount of your contribution, depending on how much money you make and how you file your taxes. The amount of taxes you owe for the year goes down because of this deduction.

2. Employer 401(k) Match Contributions

Towfiqu barbhuiya on Pexels

Towfiqu barbhuiya on Pexels

Many employers will match the money you put into your 401(k), which is like getting money for free. These contributions from employers are not taxed in the year they are made. You can save more money with the match and pay less in taxes each year.

3. Tax-Deferred Growth in Retirement Accounts

SHVETS production on Pexels

SHVETS production on Pexels

Most retirement accounts grow tax-deferred, meaning you don’t have to pay taxes on the money you earn from investments until you take it out. This means your money will grow over time without being taxed yearly. Moving back your taxes helps your savings grow faster because you don’t have to pay as much in taxes every year.

4. Lower Taxable Income with 401(k) Contributions

Leeloo The First on Pexels

Leeloo The First on Pexels

When you put money into a 401(k), your taxable income goes down. This could mean that you pay less in taxes overall. It is less taxed on your income as you contribute more. If your taxable income is lower, you may get a bigger tax refund or a smaller tax bill.

5. Roth IRA: Tax-Free Withdrawals in Retirement

Tara Winstead on Pexels

Tara Winstead on Pexels

Roth IRA contributions are made with money that has already been taxed, but qualified withdrawals made in retirement are not taxed at all. By this, the money you get from investments over time will not be taxed when you take it out. Roth IRA withdrawals are tax-free, making them a great way to save for retirement.

6. Contribution Limits for Tax Benefits

Leeloo The First on Pexels

Leeloo The First on Pexels

The IRS limits how much you can put into a retirement account each year. Putting in as much as these limits gets you the most tax breaks. The more you put in, the more you can lower your taxable income or save for retirement without paying taxes. To get the most tax breaks, use these limits to their fullest.

7. Catch-Up Contributions for Those 50 and Older

Polina Tankilevitch on Pexels

Polina Tankilevitch on Pexels

If you are 50 or older, you can add money to your retirement accounts afterward. With these extra contributions, you can save more money and get bigger tax breaks. This is very helpful if you’re behind on retirement savings or want to get the most out of tax breaks before retiring.

8. Tax Breaks on Self-Employed Retirement Accounts

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

People who work for themselves can set up retirement accounts like SEP IRAs or Solo 401(k)s that give big tax breaks. Putting money into these accounts helps you save for retirement and lowers the amount of income that is taxed. Freelancers and small business owners can benefit from these accounts.

9. State-Specific Tax Benefits

Leeloo The First on Pexels

Leeloo The First on Pexels

Certain states also grant tax breaks for contributions made to a retirement fund. This can even help reduce your whole tax load. Learning the rules in your state will help you enjoy these additional savings.

10. Tax-Free Growth in a Roth 401(k)

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Like a Roth IRA, a Roth 401(k) lets you grow your money and take it out tax-free, but you can put in more money. You put money into the account after taxes; when you retire, you can take out the earnings tax-free. Because of this, the Roth 401(k) is a great choice for people who want to get tax-free income in retirement.

11. Deduction for Traditional IRA Contributions with Spouse

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

A Traditional IRA may be a better choice if your spouse does not have access to a retirement plan. This is true even if you have 401(k). This can be very helpful for spouses who stay at home. It helps both partners save for retirement and gives them extra tax breaks.

12. Tax Benefits for Contributions to 457 Plans

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

Like 401(k) plans, the 457 plan lets government workers and some nonprofit workers grow their money without paying taxes immediately. Your taxable income decreases when you make contributions, lowering your overall tax bill. These accounts help people working for the government save for retirement while lowering their taxes.

13. No Income Limits for Traditional IRA Deductions

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

You can put money into a traditional IRA no matter how much you make, but you can only deduct certain amounts. No matter how much money you make, you can deduct the full amount you put into a retirement plan if your employer doesn’t offer one. Because of this, IRAs are a great choice for high-income workers who don’t have employer-sponsored plans.

14. Tax-Free Employer Stock in a 401(k)

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Some companies let workers use their 401(k) plans to buy company stocks. Putting stocks in your 401(k) is a good idea because any stock growth is tax-free until you take it out. This can sometimes save you a lot of money on taxes, especially if the value of the company stock goes up.

15. Roth IRA Contributions After Tax Filing Deadline

Leeloo The First on Pexels

Leeloo The First on Pexels

You can still make contributions to a Roth IRA until April 15th of the previous tax year if you didn’t do so before the tax filing deadline. This lets you benefit from tax-free growth and withdrawals while still getting tax breaks. Ensure to contribute before the due date to get tax breaks for the past year.

16. Health Savings Accounts (HSAs) with Retirement Benefits

Marcus Aurelius on Pexels

Marcus Aurelius on Pexels

A Health Savings Account (HSA) is similar to a retirement account because it can help you save money on taxes. You can deduct the money you put into an HSA from your taxes, the money grows tax-free, and withdrawals for certain medical costs are also tax-free. An HSA can be a very useful tool for helping you plan for your retirement.

17. Tax Deductions for Qualified Contributions to SEP IRAs

MART PRODUCTION on Pexels

MART PRODUCTION on Pexels

A SEP IRA is a type of retirement account specifically made for small business owners. It has big tax advantages. You can deduct contributions to a SEP IRA from your taxes, which lowers your taxable income. You can put more money into a SEP IRA than any other retirement plan. This makes them a great way to save money and lower your tax bill.

18. Lower Taxes on Retirement Withdrawals (After Age 59½)

Tara Winstead on Pexels

Tara Winstead on Pexels

You can start taking money out of your retirement accounts when you turn 59½ years old without paying a 10% penalty. Taking money out of a Traditional IRA or 401(k) is taxed as regular income, which lets you get to your money more tax-efficiently. Roth IRAs, on the other hand, let you take money out tax-free when you retire.

19. Avoiding Required Minimum Distributions with Roth IRAs

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

Roth IRAs do not require minimum distributions at age 72. Unlike Traditional IRAs and 401(k)s, this allows you to keep your money in the account longer, where it may grow tax-free. Those who wish more control over their retirement money will find Roth IRAs useful.

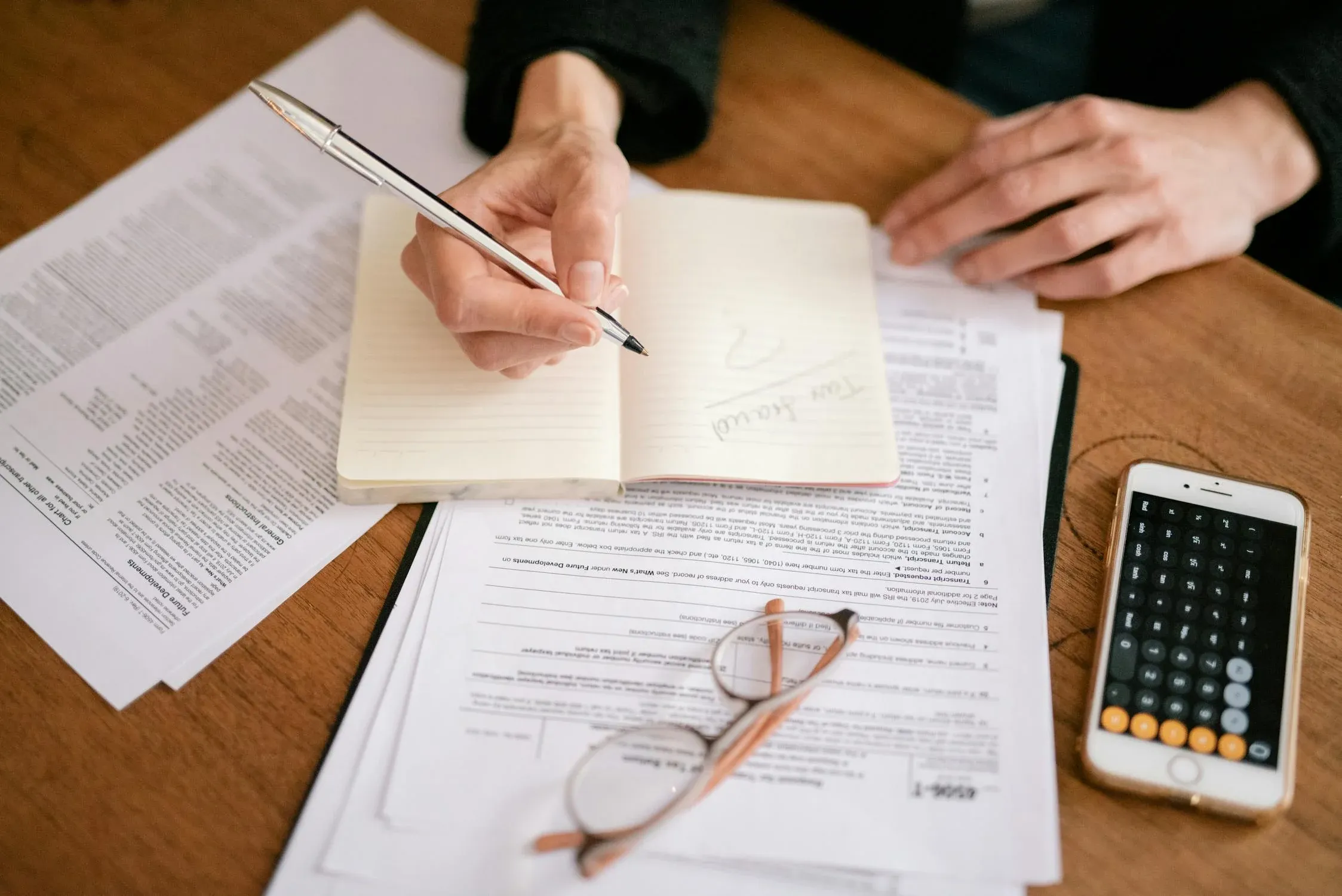

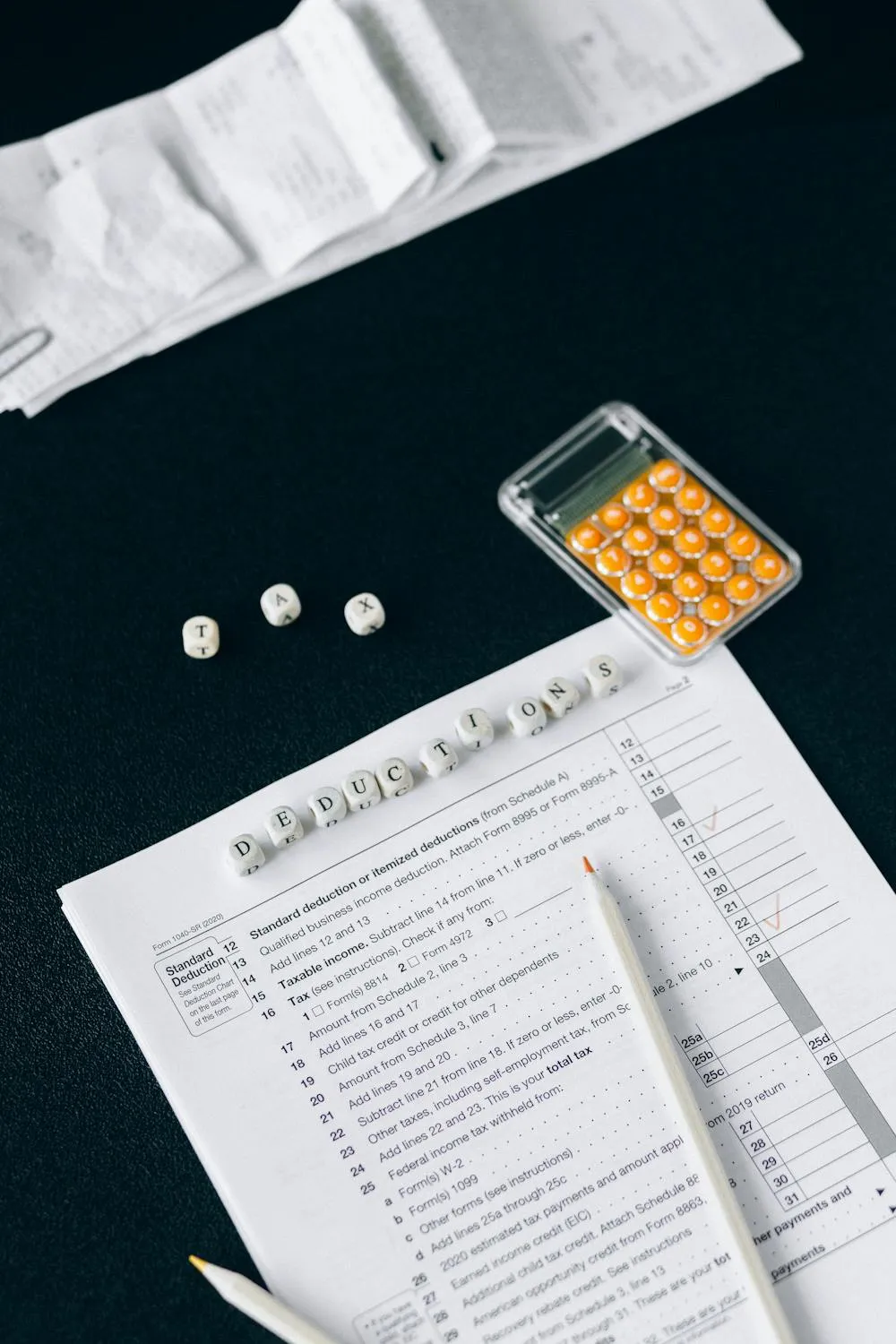

20. Maximizing Your Retirement Savings with Tax Benefits

Tima Miroshnichenko on Pexels

Tima Miroshnichenko on Pexels

By putting money into a retirement account, you not only build wealth for the future but also get tax breaks immediately. Roth IRAs, 401(k)s, and IRAs are all types of retirement accounts that offer many benefits, such as tax breaks and growth that are not taxed. You can save more for retirement and pay less taxes by putting as much money as possible into these accounts.

- Tags:

- IRA

- Retirement

- Tax

- Contribution

- Benefits