20 Tax Breaks for First-Time Homebuyers

Buying your first home is a big deal, but it can also be hard on your finances. Fortunately, there are many tax breaks and other incentives available to help first-time homebuyers make the process easier.

- Tricia Quitales

- 7 min read

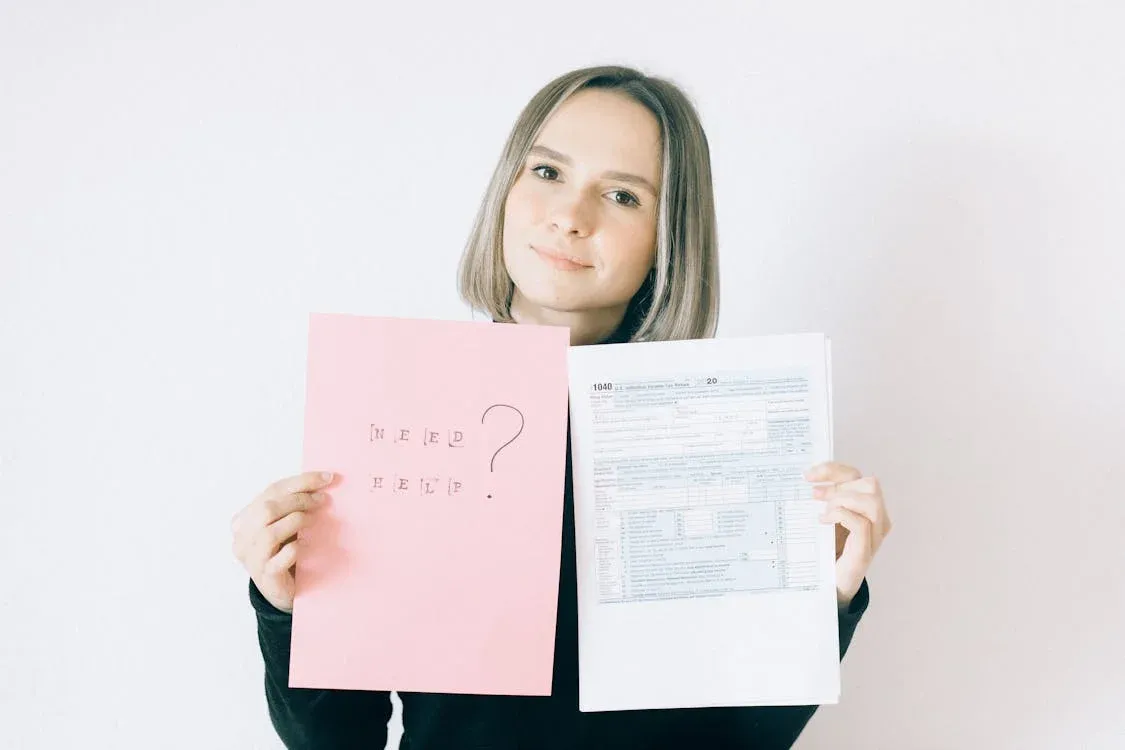

Many people think that buying their first home is a dream come true, but it can also cost much money. First-time homebuyers can save money by taking advantage of different tax breaks and other incentives. These tax breaks, like deductions and credits, can make it cheaper to buy and own a home. This article discusses 20 helpful tax breaks that first-time buyers should know. These breaks can make the process of buying a home easier on your wallet.

1. First-Time Homebuyer Tax Credit

Thirdman on Pexels

Thirdman on Pexels

People who haven’t owned a home in the last three years can get a tax credit through the First-Time Homebuyer Tax Credit. This credit can lower your tax bill by a lot, either by increasing your refund or lowering the amount you owe. It’s a great reason for first-time buyers to enter the market.

2. Mortgage Interest Deduction

RDNE Stock project on Pexels

RDNE Stock project on Pexels

The mortgage interest deduction is one of the most common tax breaks for homeowners. It lets you lower your taxable income by taking away the interest you pay on your mortgage. This tax break can save you a lot of money every year, especially in the first few years of your mortgage. The deduction is more significant if your mortgage is bigger.

3. Property Tax Deduction

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

The cost of owning a home goes down because you can deduct property taxes from your federal income taxes. This is a great benefit that helps you pay less in taxes every year. It’s an easy way to help pay for home ownership.

4. Private Mortgage Insurance (PMI) Deduction

Kindel Media on Pexels

Kindel Media on Pexels

PMI stands for private mortgage insurance. If your down payment is less than 20%, you may have to pay it. Luckily, you may be able to deduct your PMI payments, which will help lower the total cost of buying a home. You can take this deduction if your income is less than a certain amount.

5. Energy-Efficient Home Credit

Kindel Media on Pexels

Kindel Media on Pexels

You might be able to get tax breaks if you make changes to your new home that make it more energy efficient. You can get this credit if you make improvements to your home, such as adding solar panels, energy-efficient windows, or better insulation. You’ll save money on taxes, and your home will also use less energy.

6. First-Time Homebuyer Savings Accounts

Tima Miroshnichenko on Pexels

Tima Miroshnichenko on Pexels

Many states let people buying their first home put money into savings accounts that they can use to save for the big day. You can deduct the money you put into these accounts from your taxes, and the interest you earn is usually tax-free. Now is a great time to save for a down payment and get tax breaks at the same time.

7. State-Specific Tax Breaks

Jakub Zerdzicki on Pexels

Jakub Zerdzicki on Pexels

For first-time homebuyers, many states offer their own tax credits and other incentives, like helping with the down payment or special mortgage programs. These programs are different in each state, but they can make buying a home much easier on your wallet. To get the most out of the benefits your state has to offer, you should find out what they are.

8. IRA Withdrawal for First-Time Homebuyers

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

Individuals buying their first home can take out up to $10,000 tax-free from an IRA to use toward purchasing a home. You can use this money to help pay your down payment or closing costs. You’ll still have to pay taxes on the money you take out, but it’s a great way to get extra cash.

9. First-Time Homebuyer Tax Credit for Veterans

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Veterans who are buying their first home might be able to get special tax breaks or credits. Some of these benefits could be a bigger tax credit for first-time homebuyers or not having to pay certain fees. When veterans buy a home, they should look into all the tax breaks available to them.

10. Capital Gains Tax Exclusion

Pavel Danilyuk on Pexels

Pavel Danilyuk on Pexels

You might get a capital gains tax exclusion if you sell your home in the future. This lets you keep up to $250,000 ($500,000 for married couples) of the profit from your taxable income. If you have lived in the home for at least two of the last five years, you are not subject to this rule. When you sell your home, it’s a great way to save money on taxes.

11. Down Payment Assistance Programs

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

First-time homebuyers can get help with their down payment from some local and state governments. These programs usually help you save money on taxes by lowering your total tax bill or giving you rebates. There are a lot of these programs that can also help with closed costs.

12. Homebuyer Education Tax Credit

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

Many programs encourage people buying their first home to take classes to learn more about the process. You might get a tax credit or rebate if you finish these courses. You might be able to save money on your taxes and make better decisions if you take these classes.

13. First-Time Homebuyer Grant Programs

Sora Shimazaki on Pexels

Sora Shimazaki on Pexels

Some grant programs offer tax-free money to help with closing costs for people buying their first home. These grants don’t usually need to be paid back, but they can help with money immediately. It’s important to find out what programs are available in your area because they change from place to place.

14. Deduction for Home Office Use

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

You might be able to deduct some of the costs that come with your home office if you work from home. These costs could include a portion of your mortgage interest, property taxes, and utilities. This deduction can help you save a lot of money, especially if you use your home office only for work. This tax break is very helpful for self-employed people buying their first home.

15. Mortgage Points Deduction

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

Tax breaks let you write off mortgage points, which are prepaid interest if you pay them to lower your interest rate. If you plan to stay in your home for a few years, this can save you more money in the long run. Mortgage points can help you pay less taxes and lower monthly mortgage payments.

16. Tax Credit for First-Time Homebuyers in Rural Areas

MART PRODUCTION on Pexels

MART PRODUCTION on Pexels

Some rural areas offer tax credits to people who buy their first home. This encourages people to buy homes and helps the local economy grow. These credits can help you pay for a big chunk of your down payment or other costs related to buying a house. If you want to buy a house in the country, see if you can get any tax credits.

17. Tax Exemption for Disabled Homebuyers

Marcus Aurelius on Pexels

Marcus Aurelius on Pexels

People with disabilities who are buying their first home may be able to get tax breaks or credits, such as lower property taxes or help making changes to their home. These tax breaks are meant to help people who need certain home modifications with their finances. Disabled people who want to buy a home should check with local programs to see available benefits.

18. Homebuyer Loan Programs with Tax Benefits

RDNE Stock project on Pexels

RDNE Stock project on Pexels

First-time homebuyers can get extra tax breaks using government-backed loan programs, like FHA, VA, or USDA loans. These benefits could include tax credits, lower interest rates, or fewer fees. For first-time buyers, these loan programs can make buying a home more affordable and possible.

19. Tax Benefits for Refinancing

Antoni Shkraba on Pexels

Antoni Shkraba on Pexels

If you decide to refinance your mortgage, you might get a tax break for some costs, like points and interest. You can lower your mortgage payments by refinancing, and the tax breaks can help you save even more. If you want to refinance in the future, this is an option you might want to look into.

20. Tax Credit for Home Improvements

Blue Bird on Pexels

Blue Bird on Pexels

People who buy their first home and make big changes might get a tax credit. This can include repairs, upgrades that make your home more energy efficient, or even renovations that make your home worth more. Home improvement tax credits can help you pay for improvements to your new home.

- Tags:

- Tax

- Homebuyers

- Incentives

- Deductions