20 Tax Breaks for Veterans You Shouldn’t Miss

This list highlights 20 valuable tax breaks that veterans may be eligible for across different states and programs.

- Daisy Montero

- 5 min read

Veterans can qualify for a variety of tax breaks that make a big difference. These include exemptions on property tax, tax-free disability pay, deductions for education, and credits for employers who hire vets. Some benefits depend on your location or disability status. This list makes it easier to know what to look for and how to save.

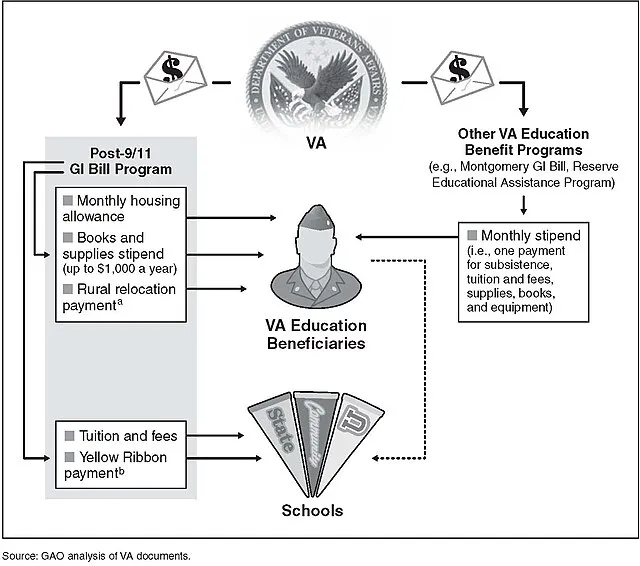

1. Federal VA Disability Pay Is Tax Free

U.S. Government Accountability Office from Washington, DC, United States on Wikimedia Commons

U.S. Government Accountability Office from Washington, DC, United States on Wikimedia Commons

VA disability compensation is not counted as taxable income by the IRS. This means you receive the full amount without any deductions. If you qualify, it can reduce your overall tax burden significantly.

2. Property Tax Exemption for Forever Disabled Vets

Jakub Zerdzicki on Wikimedia Commons

Jakub Zerdzicki on Wikimedia Commons

Many states offer full property tax exemptions to veterans who are permanently and totally disabled. These exemptions can help lower housing costs for life. Some states even allow a surviving spouse to continue receiving the benefit.

3. State-by-State Property Tax Breaks

D Goug on Pexels

D Goug on Pexels

Each state has its own rules for veteran property tax exemptions. Some offer full relief while others give partial deductions. Knowing your state’s benefits can lead to big savings on your annual tax bill.

4. Texas Homestead Tax Cap for Disabled

Munis Asadov on Wikimedia Commons

Munis Asadov on Wikimedia Commons

In Texas, veterans who are 100 percent disabled can qualify for a full exemption on their home’s assessed value. This can wipe out property taxes entirely for qualifying residents. Spouses of deceased veterans may also be eligible.

5. Federal Income Exclusion: Combat Pay and VA Pensions

George Pak on Wikimedia Commons

George Pak on Wikimedia Commons

Combat pay and VA pensions are often excluded from federal income taxes. This helps lower your taxable income without requiring extra forms. It is a valuable benefit for veterans who rely on these sources of income.

6. Work Opportunity Tax Credit for Employers

Anna Tarazevich on Pexels

Anna Tarazevich on Pexels

Employers who hire eligible veterans may qualify for a federal tax credit. The amount depends on the veteran’s status and length of unemployment before being hired. This program can make veterans more attractive job candidates.

7. Hiring Tax Credit Q&A

Sora Shimazaki on Wikimedia Commons

Sora Shimazaki on Wikimedia Commons

To get the Work Opportunity Tax Credit, employers must submit specific forms within a tight timeframe. Veterans must meet certain criteria, such as having a disability or being unemployed for a period of time. Proper documentation is key to receiving the credit.

8. Proposal: Tax Exemption on Veteran Income?

Edmond Dantès on Pexels

Edmond Dantès on Pexels

Lawmakers have proposed expanding tax-free income rules for veterans. Although these changes are not yet law, they may impact future filing seasons. Keeping up with these updates can help you prepare early.

9. No State Income Tax on Military Pensions

Jonathan Borba on Pexels

Jonathan Borba on Pexels

Some states do not tax military retirement pay at all. States like Florida, Texas, and Nevada fall into this category. Moving to one of these states could help maximize your pension income.

10. Military Pay Forms: CRA and PAY Exemptions

U.S. Air Force photo by Senior Airman Jenna Bond on Wikimedia Commons

U.S. Air Force photo by Senior Airman Jenna Bond on Wikimedia Commons

Certain military tax forms, such as the CRA and SCRA, can help delay or reduce taxes. These forms are designed to protect active duty service members and veterans from financial stress. Understanding how they work can save money and time.

11. Claiming Overlooked Deductions

Rachel Parks (USAG Benelux on Wikimedia Commons

Rachel Parks (USAG Benelux on Wikimedia Commons

Veterans can often deduct moving expenses, uniforms, and even certain education costs. These deductions are sometimes missed when filing taxes alone. Taking the time to review your eligibility can lead to unexpected refunds.

12. Military Retirement Exclusions Vary by State

U.S. Army 522dMIBN by Jordan Pearson on Wikimedia Commons

U.S. Army 522dMIBN by Jordan Pearson on Wikimedia Commons

Not every state treats military pensions the same way. Some states offer full exemptions, while others only reduce a portion. Knowing your state’s policy is important when planning where to retire.

13. Homestead Veterans Exemptions

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Some areas allow veterans to deduct a specific amount from the assessed value of their home. This lowers the amount of property tax they owe each year. These exemptions can add up to thousands in savings over time.

14. VA Loan Interest Deduction

Antoni Shkraba Studio on Pexels

Antoni Shkraba Studio on Pexels

If you used a VA loan to buy your home, the interest might be tax-deductible. This can help reduce your federal tax bill each year. It is one more reason VA loans are such a valuable tool for veterans.

15. Education-Related Tax Credits

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

Veterans who go back to school may qualify for the American Opportunity Credit or the Lifetime Learning Credit. These help cover tuition and education expenses. Combining these credits with GI Bill benefits can stretch your funds further.

16. Special License-Plate Fee Waivers

Wouterjan Stikkel on Wikimedia Commons

Wouterjan Stikkel on Wikimedia Commons

Many states waive registration fees for vehicles with veteran plates. Some even offer free parking or toll exemptions. These perks recognize service while helping you save money each year.

17. Local Tax Relief and Ballot Measures

cottonbro studio on Pexels

cottonbro studio on Pexels

Cities and counties sometimes offer additional tax relief to veterans through local ballot measures. These benefits can include extra deductions or lower rates. It is worth checking your local election ballots for veteran-specific savings.

18. Free Tax Prep Assistance

Nataliya Vaitkevich on Wikimedia Commons

Nataliya Vaitkevich on Wikimedia Commons

Veterans can access free tax preparation through the IRS Volunteer Income Tax Assistance program. Many nonprofit groups also offer support. These services help ensure you claim every deduction and credit you are entitled to.

19. Audit Relief for Veterans

George Pak on Wikimedia Commons

George Pak on Wikimedia Commons

Some states limit audits for veterans or offer more lenient procedures. This helps reduce stress during tax season. If selected for an audit, knowing your rights can make the process smoother.

20. Keep Track and Reapply Each Year

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Many veteran tax benefits require you to reapply every year. Missing a deadline could mean losing out on valuable savings. Setting a reminder can help you stay on top of the paperwork.