20 Tax Deductions Most People Overlook

Many people don't take advantage of tax breaks that could lower their taxed income and save them money in the long run. Knowing about these often-overlooked tax breaks can make a big difference when it's time to file your taxes. This piece talks about 20 tax deductions that most people don't use, which can help you save the most on your taxes.

- Tricia Quitales

- 6 min read

There’s a lot that can go wrong when you’re not sure what tax benefits you can use. Tax credits are things that many people forget every year that could lower their tax bill and get their money back. A lot of tax breaks are missed, like those for home offices and school bills. This article talks about 20 popular tax deductions that most people forget about. Make sure you don’t miss out on any money when you file your return.

1. Home Office Deduction

Alex Green on Pexels

Alex Green on Pexels

Many think this benefit is only for people who own their businesses full-time, but anyone who regularly works from home can use it. This includes people who work for someone else, run a small business from home, and freelancers. You can deduct some of your rent, bills, and even the amount your house has lost in value over time.

2. Medical Expenses

Henrikas Mackevicius on Pexels

Henrikas Mackevicius on Pexels

You might be able to subtract medical costs that are more than 7.5% of your adjusted gross income. This covers insurance premiums, out-of-pocket expenses, and even medical care-related travel costs. People often forget to keep track of all the small health-related bills that could add up to a big tax break.

3. Charitable Contributions

RDNE Stock project on Pexels

RDNE Stock project on Pexels

You can deduct your cash donations or other items to certain groups, including clothes, household goods, and even cars. It is important to keep track of all gifts and their market value. You can also write off the miles you drive for volunteer work.

4. Student Loan Interest

Yan Krukau on Pexels

Yan Krukau on Pexels

You can deduct up to $2,500 in student loan interest, which many people forget. You can get this benefit even if you don’t list your deductions on your tax return. This is a great way to lower your tax bill. The amount you can claim is based on how much money you make.

5. Retirement Contributions

Towfiqu barbhuiya on Pexels

Towfiqu barbhuiya on Pexels

You may be able to deduct contributions to retirement accounts like IRAs or 401(k)s, which lowers your taxed income. Traditional IRAs and 401(k)s both give tax breaks, but the amounts you can put in each differ. If you start saving for retirement early, you can have more money saved over time.

6. Job Search Expenses

MART PRODUCTION on Pexels

MART PRODUCTION on Pexels

Some of the costs you incur while looking for a new job in the same area can be deducted when filing your taxes. This includes the cost of a resume, fees from a job agency, and travel to interviews. Remember that you can’t use this exemption if you’re changing jobs.

7. Child and Dependent Care Credit

Arina Krasnikova on Pexels

Arina Krasnikova on Pexels

You might be able to get this credit if you pay for child care while you work or look for work. The care has to be given to kids younger than 13 or other people who can’t take care of themselves. The credit may lower your tax bill by a certain amount depending on how much money you make.

8. Tax Preparation Fees

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

If you itemize, you can reduce the cost of having a professional do your taxes or buying tax software. Other expenses may also be included, like fees for financial planning. If you keep track of these prices, you can save even more.

9. Energy-Efficient Home Improvements

Daniele La Rosa Messina on Pexels

Daniele La Rosa Messina on Pexels

You might be able to get a tax return if you make changes to your home that make it more energy-efficient, like putting in solar panels or energy-efficient windows. You can save money and go green at the same time with the credit, which can cover some of the costs. This is a reward meant to get people to live in a more environmentally friendly way.

10. Mortgage Insurance Premiums

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

It’s possible that you can reduce both the interest on your mortgage and the premiums you pay for mortgage insurance. Taxpayers who bought their homes after 2007 and meet certain income requirements can take advantage of this benefit. It can be beneficial for people who own their homes but have less than 20% wealth.

11. Moving Expenses for Work

Somchai Kongkamsri on Pexels

Somchai Kongkamsri on Pexels

Most people can’t deduct moving costs anymore, but some can. There is still a way to deduct moving fees if you are in the military. This covers the cost of getting there, staying there, and even storing your things.

12. Educator Expenses

Max Fischer on Pexels

Max Fischer on Pexels

For school supplies, teachers and educators can deduct up to $250. For married couples filing jointly, this amount goes up to $500. You can get this benefit even if you don’t break down your taxes into separate items. It’s meant to help teachers pay for the personal bills they often have to deal with in the classroom.

13. State Sales Taxes

Kindel Media on Pexels

Kindel Media on Pexels

If you don’t have an income tax in your state, you can reduce your state’s sales tax instead. This can be very helpful if you buy many things or live in a place with high sales tax. You can use the IRS’s tables to get a rough idea of how much you can claim.

14. Adoption Expenses

olia danilevich on Pexels

olia danilevich on Pexels

While adopting a child can be pricey, there is a tax credit that can help make the process more affordable. You can get a big tax credit for adoption fees, court costs, and travel costs that are considered “qualified.” This credit is also available if you adopt a child from a different state.

15. Alimony Payments

Kaboompics.com on Pexels

Kaboompics.com on Pexels

If your divorce was settled before 2019, you can deduct the alimony payments you make. There are certain things you have to do, like sending the money straight to your ex-spouse. To get the right discount, make sure you keep good records of these payments.

16. Business Travel Expenses

Omar Markhieh on Pexels

Omar Markhieh on Pexels

Business travel costs are tax-deductible if you’re self-employed or work from home. This covers the cost of getting there, staying there, eating, and other costs that come up during business trips. Ensure you collect all your tax deductions by keeping careful records and receipts.

17. Unreimbursed Employee Expenses

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

When you’re an employee and your boss doesn’t pay you for work-related costs, you can deduct them. This includes tools, clothes, and other things workers need to do their jobs. If you itemize, you can subtract these things, but only up to 2% of your adjusted gross income.

18. Legal Fees

RDNE Stock project on Pexels

RDNE Stock project on Pexels

You might be able to deduct some legal fees, especially if they have to do with your business or job. For example, lawsuits connected to your job might count. On the other hand, personal attorney fees for things like estate planning are not tax-deductible.

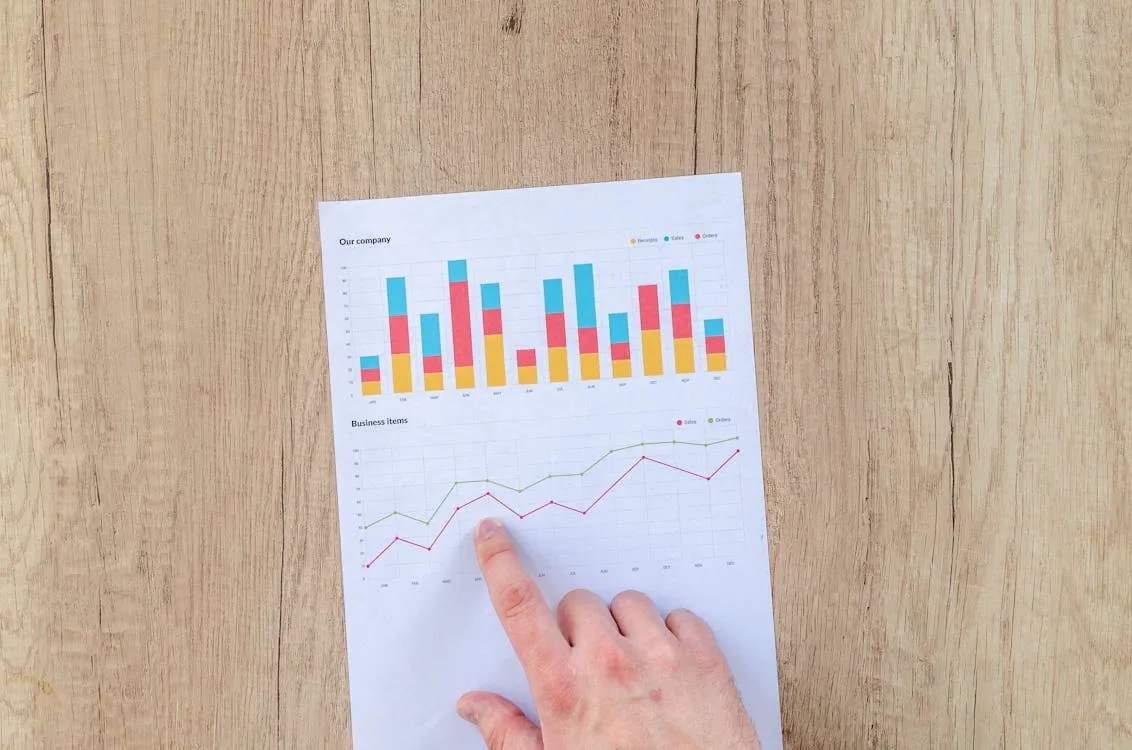

19. Investment Expenses

Lukas on Pexels

Lukas on Pexels

You can deduct expenses related to your investments, like the cost of having your taxes done for investment-related profits. You may also be able to deduct fees for managing investment accounts, brokerage commissions, and other related expenses. However, you can only deduct business costs if you list them all.

20. Casualty and Theft Losses

Tara Winstead on Pexels

Tara Winstead on Pexels

You might be able to recover some of the money you lose due to theft, fire, or other disasters. However, these benefits are limited, such as to $100 per event and 10% of adjusted gross income. Insurance payments must also be removed from the total loss before the discount can be claimed.