20 Tax Mistakes That Could Trigger an IRS Audit

Knowing the biggest tax mistakes can help you avoid an IRS audit. One wrong move could put your return under the government's magnifying glass.

- Alyana Aguja

- 6 min read

Preparing your taxes may be simple, but minor errors can land you an IRS audit and cause stress, penalties, and surprise charges. From not reporting your income to taking too many deductions, the IRS is always on the lookout for indications of miscalculations or tax evasion. Knowing these pitfalls and keeping detailed records will allow you to file confidently and avoid the IRS radar.

1. Underreporting Income

Alexander Grey from Unsplash

Alexander Grey from Unsplash

Failing to report all taxable income is a common audit trigger. The IRS gets copies of your W-2s and 1099s, so it raises a red flag if your return doesn’t match what they have. Even minor discrepancies can lead to further scrutiny.

2. Excessive Business Deductions

Microsoft Edge from Unsplash

Microsoft Edge from Unsplash

If your business expenditures are unusually high for your line of business, the IRS is likely to investigate. Deductions for big meals, travel, and home office use require adequate documentation. Writing off an entire house as an office without a reason is a red flag.

3. Inconsistent 1099 or W-2 Forms

Jp Valery from Unsplash

Jp Valery from Unsplash

The IRS computer system cross-matches your reported income with forms submitted by employers. If your figures don’t exactly match, a notice of audit may ensue. Double-check your forms every time before you file.

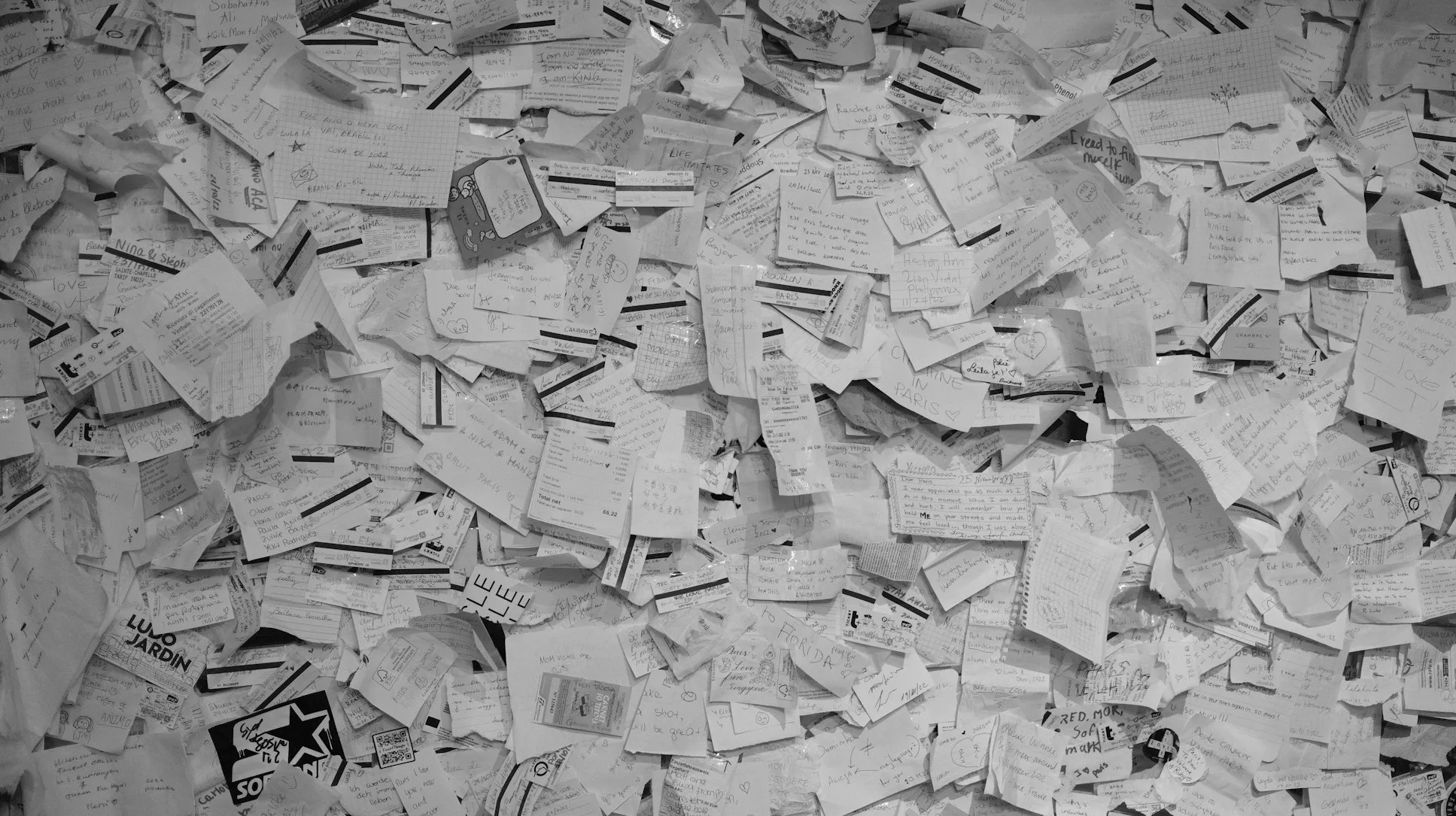

4. Claiming Too Many Charitable Contributions

Joel Muniz from Unsplash

Joel Muniz from Unsplash

If you claim excessively high charitable contributions in relation to your income, the IRS will request substantiation. Exaggerating donations, particularly in non-cash contributions, is a common trigger. Document everything in detail, including receipts and accurate valuations.

5. Claiming a Home Office Deduction Incorrectly

Olena Bohovyk from Unsplash

Olena Bohovyk from Unsplash

Your home office must be exclusively used for business—using it as a guest room, too, invalidates the deduction. The IRS knows the average percentage of home office claims for various professions. If yours seems excessive, they may investigate further.

6. Reporting a Business Loss for Several Years

Xianjuan HU from Unsplash

Xianjuan HU from Unsplash

If your business regularly shows losses, the IRS will suspect it’s really a hobby. The IRS anticipates that a genuine business should demonstrate profit at least three years out of five. Not passing this test can lead to disallowed deductions and back taxes.

7. Too Many Work-Related Expenses as an Employee

Nathan Dumlao from Unsplash

Nathan Dumlao from Unsplash

W-2 workers have limited tax deduction choices for job expenses after 2018 tax law adjustments. If you deduct hefty, unreimbursed expenses that your employer should have paid, the IRS will scrutinize your claim. Have documentation ready to demonstrate necessity and personal payment.

8. Rounding Numbers or Using Too Many Zeroes

Celyn Kang from Unsplash

Celyn Kang from Unsplash

Tax returns with suspiciously neat numbers—such as $5,000 in deductions to the exact dollar—are notable. However, the IRS is aware that actual expenses are never that tidy. Therefore, use precise amounts from receipts rather than estimates.

9. Not Reporting Cryptocurrency Transactions

Thought Catalog from Unsplash

Thought Catalog from Unsplash

Cryptocurrency exchanges now report transactions to the IRS, and leaving them out can trigger alarms. Even small trades or exchanging crypto for cash are taxable events. The IRS has stepped up enforcement in this area in recent years.

10. Overstating Rental Property Losses

Erik Mclean from Unsplash

Erik Mclean from Unsplash

Real estate losses are only allowed unless you are a real estate professional. Most taxpayers errantly claim complete deductions without fulfilling the IRS criteria. The IRS scrutinizes big rental losses above passive activity levels closely.

11. Claiming the Earned Income Tax Credit (EITC) When Ineligible

Giorgio Trovato from Unsplash

Giorgio Trovato from Unsplash

The EITC is designed to help low-to-moderate-income workers, but incorrect claims are a major audit trigger. Common mistakes include claiming children who don’t meet residency or relationship requirements. Due to frequent fraud, the IRS aggressively reviews EITC claims.

12. Making Large Cash Deposits Without Reporting

Mufid Majnun from Unsplash

Mufid Majnun from Unsplash

Sinking more than $10,000 in cash sets off an alert to the IRS. When your reported income doesn’t match up with these deposits, the IRS will wonder about unreported income. Structured deposits near but below the limit can raise an eyebrow, too.

13. Failing to Report Gambling Winnings

Michał Parzuchowski from Unsplash

Michał Parzuchowski from Unsplash

Casinos and gaming halls report winnings of more than $600 to the IRS. If you fail to report your income when attempting to deduct losses, the IRS will catch on. You can only deduct losses to the extent of your reported winnings with proper documentation.

14. Not Filing a Return When Required

Markus Winkler from Unsplash

Markus Winkler from Unsplash

If you made income over the filing limit but don’t file, the IRS can still pursue you. They estimate your tax bill from third-party returns such as W-2s and 1099s. Not filing can lead to high penalties, interest, and even criminal prosecution in severe cases.

15. Large Foreign Bank Account Balances Without Disclosure

John McArthur from Unsplash

John McArthur from Unsplash

American citizens with foreign accounts of more than $10,000 must report them to the IRS through FBAR. The IRS has treaties with most foreign banks and will identify unreported accounts. Failure to report foreign assets will result in enormous fines and prosecution.

16. Deducting Personal Expenses as Business Expenses

Alexander Grey from Unsplash

Alexander Grey from Unsplash

Bleeding personal and business expenses, such as claiming family vacations as business trips, is a big warning sign. The IRS seeks patterns of abuse, particularly with travel, meals, and cars. Maintain separate bank accounts and detailed records to stay out of trouble.

17. Overstating Mileage Deductions

Christina Radevich from Unsplash

Christina Radevich from Unsplash

Self-employed and business owners tend to overstate mileage deductions. Logs, receipts, and a reasonable percentage of business use are what the IRS anticipates. Reporting 100% business use for your car without documentation can lead to an audit.

18. Large Cash Transactions Without Proper Documentation

Alexander Grey from Unsplash

Alexander Grey from Unsplash

If you receive or pay large sums of cash for business or personal transactions, you must report them. The IRS closely watches cash-intensive businesses such as restaurants and construction. Failure to report these transactions can result in tax evasion charges.

19. Sudden Large Income Deductions Without Explanation

Giorgio Trovato from Unsplash

Giorgio Trovato from Unsplash

If your income and deductions change significantly from one year to another without good reason, the IRS will take a closer look. Large medical costs, theft, or casualty losses should be documented well. Any significant decline in taxable income should have a valid, verifiable reason.

20. Taking Early Retirement Withdrawals Without Paying Penalties

Keller Chewning from Unsplash

Keller Chewning from Unsplash

If you take money from your IRA or 401(k) before the age of 59½ without a qualified exception, you owe a 10% penalty. The IRS receives automatic reports on these distributions. It is easy to be audited claiming a penalty exemption when you do not meet qualifications.