20 Tax Rules You Need to Know About Vacation Rentals

Many homeowners are finding vacation rentals to be a good source of income. Before renting out your home, there are particular tax regulations you must know to prevent surprises when filing taxes.

- Tricia Quitales

- 6 min read

Though it’s crucial to negotiate the tax consequences correctly, owning and renting out a holiday home can offer a wonderful chance for extra income. Understanding these tax laws from deductions to reporting obligations can help you avoid fines and optimize your income. This article identifies 20 important tax laws every vacation rental owner should know. These tax tips will keep you informed and financially ready whether you are an experienced rental owner or just beginning.

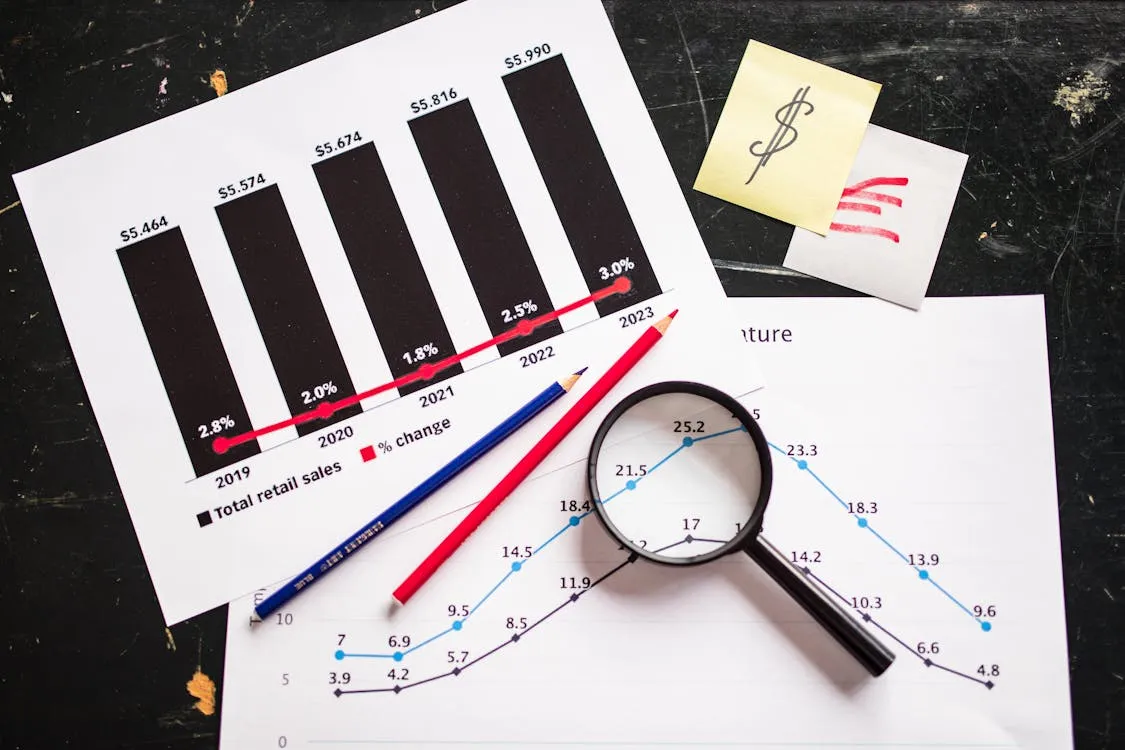

1. Rental Income Must Be Reported

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Whether rented through Airbnb or independently, all income from renting your vacation property must be reported to the IRS. This covers any extra fees or cleaning charges you could charge in addition to the rent you receive. Not declaring this income could result in fines and interest.

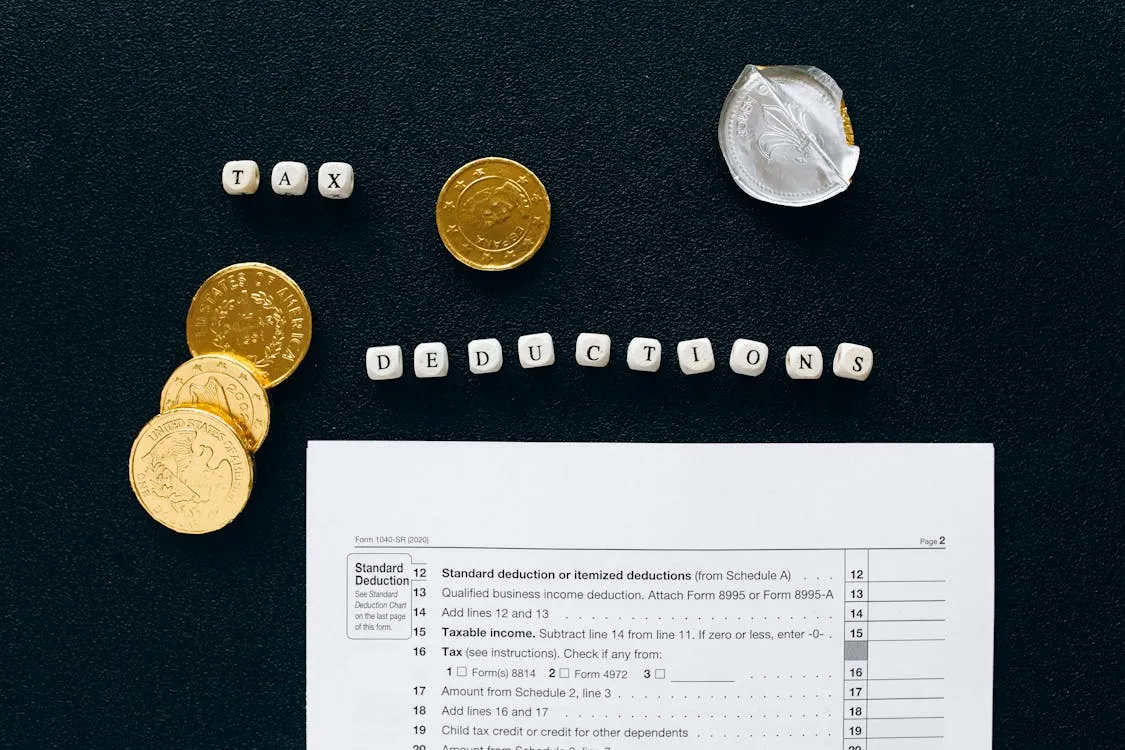

2. Deductions for Rental Expenses

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Expenses connected to your vacation rental, such as property management fees, utilities, advertising, and maintenance, can be deducted. These deductions lower the taxable rental income you declare. Any costs you intend to deduct should be recorded in great detail along with receipts.

3. Use of the Property Affects Deductions

Artem Podrez on Pexels

Artem Podrez on Pexels

You are not permitted to deduct rental costs and do not have to declare the rental income if your property is rented for less than 15 days in a calendar year. However, should you rent for more than 14 days, you have to declare the income, and you may also deduct pertinent costs. Knowing how long you rent your property can greatly change your tax scenario.

4. Personal Use and Rental Use Rules

RDNE Stock project on Pexels

RDNE Stock project on Pexels

You cannot completely deduct rental costs if you personally use the property for more than 14 days or 10% of the days it is rented out (whichever is greater). The IRS will expect you to divide the costs between personal and rental use. This implies that you may only deduct the relevant expense when renting the property out.

5. Depreciation Deduction

Ivan Samkov on Pexels

Ivan Samkov on Pexels

Depreciating your vacation rental property over 27.5 years lets you deduct some of the property’s value yearly. Reducing your taxable income helps to save a lot in this way. To be eligible for depreciation, you must utilize the property for rental reasons.

6. Home Office Deduction

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

Should you run your vacation rental property from a home office, you may be able to write off certain office-related costs. This could cover office supplies, internet, and some of your home’s utilities. Be cautious since tight IRS regulations control what qualifies as a valid home office.

7. Travel Expenses for Rental Management

Meruyert Gonullu on Pexels

Meruyert Gonullu on Pexels

If you go to your holiday rental to oversee or fix it, you could be able to deduct the expenses of that trip. This covers travel expenses, meals, lodging, and airfare. These costs have to be directly tied to the maintenance or management of the rental property.

8. Special Tax Rules for Short-Term Rentals

Ketut Subiyanto on Pexels

Ketut Subiyanto on Pexels

Different tax regulations apply for short-term rentals. The IRS usually regards short-term rentals as a business activity. Thus, you may write off all business-related costs. Knowing these guidelines guarantees your correct deduction claims.

9. Sales and Lodging Taxes

Leeloo The First on Pexels

Leeloo The First on Pexels

Many states and localities treat vacation rentals as taxable under sales, occupancy, or lodging taxes. These taxes differ by site and must be collected from tenants before being sent to the relevant government authorities. Knowing your local tax rules will help you guarantee compliance.

10. Vacation Rental Income Exclusion for Primary Homes

Kaboompics.com on Pexels

Kaboompics.com on Pexels

The IRS lets you omit the rental income from your tax return if your vacation rental is also your main home and you rent it out for 14 days or less per year. This policy applies only if you spend most of the year living in the house. Using this exclusion to its fullest extent will greatly lower your tax obligation.

11. Real Estate Taxes Deduction

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

Like your main house, you may deduct property taxes on your holiday rental. These deductions can reduce your taxable income, which is a significant advantage of having a rental property. However, make sure your property is classified appropriately.

12. Rental Property Losses

Jakub Zerdzicki on Pexels

Jakub Zerdzicki on Pexels

You might qualify for a loss if your rental costs surpass your rental income. Your degree of participation with the property, though, may make this more difficult. The loss might be limited if you are deemed a passive investor; if you are a real estate expert, you could be able to write off the whole loss.

13. Passive Activity Loss Rules

Khwanchai Phanthong on Pexels

Khwanchai Phanthong on Pexels

The IRS considers vacation rentals passive activities, so you can only write off losses from them against other passive income. This policy holds true if you do not manage the rental property significantly. However, should you engage sufficiently in the rental activity, you might be able to offset other kinds of income.

14. Vacation Rental Taxation Based on Use

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

Should you rent your vacation house and use it personally for more than 14 days, the IRS will expect you to divide expenses between rental and personal use. This implies that you can only deduct expenses for the time it is rented; personal use would not qualify. Careful record-keeping guarantees you are not over-deducting.

15. Taxable Gain When Selling the Property

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

Selling your vacation rental could result in capital gains tax on the sale profit. However, you can exclude some or all of the gain should you qualify for the primary residence exclusion. Knowing how much of your rental property’s gain is taxable helps one to qualify.

16. Qualified Business Income Deduction (QBI)

Polina Tankilevitch on Pexels

Polina Tankilevitch on Pexels

Should your holiday rental qualify as a business, you might qualify for the Qualified Business Income deduction. This deduction lets you write off as much as 20% of your rental income. To qualify, you must satisfy particular requirements, including involvement in the property’s management.

17. Vacation Rental Insurance Premiums Deduction

Pixabay on Pexels

Pixabay on Pexels

Premiums paid for insurance connected to your vacation rental property can also be deducted. This could cover any specialized insurance policies for vacation rentals, property insurance, and liability insurance. Insurance prices can mount, so claiming this deduction is a wise approach to cut costs.

18. Expenses for Repairs vs. Improvements

La Miko on Pexels

La Miko on Pexels

Repairs can be completely deducted; improvements must be capitalized and depreciated over time when deducting costs. While improvements could involve remodeling or adding new features, repairs could include fixing leaks, painting, or replacing damaged appliances. Correctly classifying expenses guarantees you optimize your tax advantages.

19. Rental Property Expenses Tracking

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Claiming deductions depends on maintaining precise, thorough records of all vacation rental-related expenses. This covers maintaining invoices for utilities, supplies, repairs, and other associated expenses. If you are subject to an IRS audit, correct records will safeguard you.

20. Tax Considerations for Multiple Vacation Rentals

Tara Winstead on Pexels

Tara Winstead on Pexels

If you own several vacation rental properties, you must monitor the income and expenses individually. Keeping distinct records is crucial since every property could have varied tax consequences. This will enable you to remain organized and follow tax regulations across the properties.